Gran Tierra Energy Inc. Announces Results Of Offer To Purchase All Of Its Issued And Outstanding 5.00% Convertible Senior Not...

July 12 2019 - 5:01PM

UK Regulatory

TIDMGTE

CALGARY, Alberta, July 12, 2019 (GLOBE NEWSWIRE) -- Gran Tierra Energy

Inc. ("Gran Tierra" or the "Company") (NYSE American:

GTE)(TSX:GTE)(LSE:GTE) today announced the final results of its

previously announced issuer bid (the "Offer") to purchase for

cancellation all of the issued and outstanding 5.00% Convertible Senior

Notes due 2021 (being US$115 million aggregate principal amount) of Gran

Tierra (the "Convertible Notes"), which expired at 2:00 p.m. (Calgary

time) on July 12, 2019.

An aggregate of US$114,997,000 principal amount of Convertible Notes was

deposited under the Offer. The Company has taken up and accepted for

purchase and cancellation all such deposited Convertible Notes at a

purchase price of US$1,075 in cash (subject to applicable withholding

taxes, if any) per US$1,000 principal amount of Convertible Notes, plus

a cash payment in respect of all accrued and unpaid interest on such

Convertible Notes up to and including July 11, 2019. Payment to the

depositary, Computershare Investor Services Inc., for such Convertible

Notes taken up and cancelled by the Company under the Offer will be made

promptly and in accordance with the terms and conditions of the Offer as

detailed in the formal offer to purchase, the accompanying issuer bid

circular and the related letter of transmittal.

About Gran Tierra Energy Inc.

Gran Tierra Energy Inc., together with its subsidiaries, is an

independent international energy company focused on oil and natural gas

exploration and production in Colombia and Ecuador. The Company is

focused on its existing portfolio of assets in Colombia and Ecuador and

will pursue new growth opportunities throughout Colombia and Ecuador,

leveraging its financial strength. The Company's shares of common stock

trade on the NYSE American, the Toronto Stock Exchange and the London

Stock Exchange under the ticker symbol GTE. Additional information

concerning Gran Tierra is available at www.grantierra.com. Information

on the Company's website does not constitute a part of this press

release.

Gran Tierra's filings with the U.S. Securities and Exchange Commission

(the "SEC") are available on the SEC website at www.sec.gov and on SEDAR

at www.sedar.com and UK regulatory filings are available on the National

Storage Mechanism website at www.morningstar.co.uk/uk/nsm.

Forward-Looking Statements and Advisories

This press release contains statements about future events that

constitute forward-looking statements within the meaning of the United

States Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and forward looking

information within the meaning of applicable Canadian securities laws

(collectively, "forward-looking statements"). Such forward-looking

statements include, but are not limited to, statements with respect to

the timing of the payment for the Convertible Notes taken up under the

Offer.

The forward-looking statements contained in this press release are

subject to risks, uncertainties and other factors that could cause

actual results or outcomes to differ materially from those contemplated

by the forward-looking statements, including, among others: unexpected

changes in general market and economic conditions. Accordingly, readers

should not place undue reliance on the forward-looking statements

contained herein. Further information on potential factors that could

affect Gran Tierra are included in risks detailed from time to time in

Gran Tierra's reports filed with the SEC, including, without limitation,

under the caption "Risk Factors" in Gran Tierra's Annual Report on Form

10-K filed February 27, 2019 and its subsequent Quarterly Reports on

Form 10-Q. These filings are available on a website maintained by the

SEC at www.sec.gov and on SEDAR at www.sedar.com.

All forward-looking statements are made as of the date of this press

release and the fact that this press release remains available does not

constitute a representation by Gran Tierra that Gran Tierra believes

these forward-looking statements continue to be true as of any

subsequent date. Actual results may vary materially from the expected

results expressed in forward-looking statements. Gran Tierra disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise, except as expressly required by applicable securities laws.

Gran Tierra's forward-looking statements are expressly qualified in

their entirety by this cautionary statement.

Contact Information:

For investor and media inquiries please contact:

Gary Guidry, Chief Executive Officer

Ryan Ellson, Executive Vice President & Chief Financial Officer

Rodger Trimble, Vice President, Investor Relations

+1-403-265-3221

info@grantierra.com

https://www.globenewswire.com/Tracker?data=r0-hfLttajw98n022HJ-73zN1KfSGrVWUENqeruB-SeKBz6w6xAKVB2uxsiJ1MCIj58sBX066ve2sknekNTousAaYdckXP-l8_TBoQJxSek=

(END) Dow Jones Newswires

July 12, 2019 17:01 ET (21:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

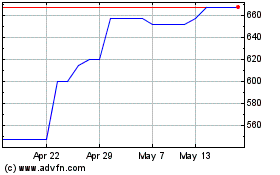

Gran Tierra Energy (LSE:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

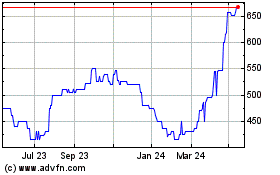

Gran Tierra Energy (LSE:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024