TIDMCPP

RNS Number : 6728U

CPPGroup Plc

27 November 2023

27 November 2023

CPPGroup Plc

("the Group"; or "the Company")

Globiva Divestment

CPP Group (AIM: CPP), a provider of real-time assistance

products and resolution services which reduce disruptions to

everyday life for millions of customers across the world, has

entered into an agreement (the "Agreement") with the founders of

Globiva Services Private Ltd ("Globiva") for the disposal of the

Group's majority interest in Globiva for an aggregate consideration

of approximately GBP5.1 million(1) (the "Transaction"). Globiva is

non-core to the Group following the announcement of its revised

strategy and Change Management Programme ("CMP") in October 2022 to

transform the Group to an InsurTech business, led by Blink

Parametric ("Blink").

Background

The Group holds a 51% majority interest in Globiva, a Business

Processes Management company incorporated in India, with the other

49% of the shares beneficially owned by the three founders of

Globiva, Navneet Gupta, Vikram Singh Nathawat, and Ashish Goyal,

who continue to manage the business (the "Globiva Founders").

Under amended arrangements entered into on 20 July 2022, the

Globiva Founders had the option to buy back 10% of the ordinary

shares in Globiva, from the Group, for a pre-agreed price of

approximately GBP0.9 million. This was subject to Globiva meeting

certain performance targets, which it is on track to achieve.

However, in the normal course of business, it was further agreed

that this could not be triggered until 1 January 2026 at the

earliest. This Agreement supersedes the previous arrangements.

Transaction Rationale

-- The Transaction is consistent with the Group's stated

strategy to transform the Group to an InsurTech business led by

Blink and supported by India and Turkey.

-- The Group is currently a "trapped" investor in Globiva with

limited options to realise value. In addition, the Group was likely

to become a minority shareholder (January 2026) and consequently

would have lost majority voting rights on key strategic decisions.

The Transaction provides an exit path for the Group at an

acceptable return.

-- The Transaction provides cash flow, not previously forecast,

over a three-year period to support the Group's CMP.

Transaction Structure

-- The sale and transfer of ownership will be conducted over a

three-year period concluding in Q1 2027.

-- The total aggregate consideration of approximately GBP5.1

million(1) (515 million Indian rupees) represents a blended 7.1x

multiple on forecast EBITDA for the 2023, 2024 and 2025 calendar

years. Final consideration will be based on audited EBITDA and

subject to a maximum adjustment of plus or minus ten percent.

-- The Group's shareholding in Globiva, currently 51%, will

reduce to approximately 35% in Q1 2025; 13% in Q1 2026; and zero

percent in Q1 2027.

-- Cash, subject to any EBITDA performance adjustment (noted

above) will be received by the Group as follows: approximately

GBP1.2 million in 2024; GBP1.3 million in 2025; GBP1.2 million in

2026; and GBP1.4 million in 2027.

For the 2022 financial year, Globiva contributed EBITDA of

GBP2.4 million to the Group's overall EBITDA from continuing

operations of GBP6.9 million, albeit the Group's shareholders only

ultimately benefit from 51% of Globiva's results. As at 30 June

2023, Globiva had net assets of GBP3.6 million.

The Transaction constitutes a related party transaction,

pursuant to Rule 13 of the AIM Rules for Companies, as the Globiva

Founders are Directors of Globiva. The Group's Directors consider,

having consulted with the Company's nominated adviser, Liberum

Capital Limited, that the terms of the Transaction are fair and

reasonable insofar as the Company's shareholders are concerned.

Simon Pyper, Group CEO, commented:

"The agreement we have reached with Globiva is consistent with

our stated strategy and provides a positive outcome for both

parties. This is another forward step as we simplify the Group and

transform to an InsurTech business."

(1) Approximate, as subject to currency exchange movements.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019. Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Enquiries:

CPP Group plc

Simon Pyper, Chief Executive Officer Tel: +44 (0)7917 795601

David Bowling, Chief Financial Officer

Liberum Capital Limited

(Nominated Adviser and Sole Broker) Tel: +44 (0)20 3100 2000

Richard Lindley

Lauren Kettle

About CPP Group:

CPP Group is a technology-driven assistance company that creates

embedded and ancillary real-time assistance products and resolution

services that reduce disruption to everyday life for millions of

people across the world, at the time and place they are needed, CPP

Group is listed on AIM, operated by the London Stock Exchange.

For more information on CPP visit

https://corporate.cppgroup.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRBFBLTMTTTBLJ

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

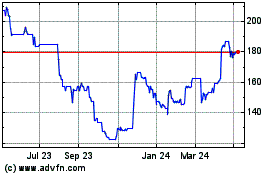

Cppgroup (LSE:CPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

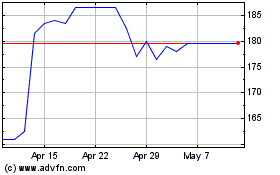

Cppgroup (LSE:CPP)

Historical Stock Chart

From Apr 2023 to Apr 2024