TIDMBBSN

RNS Number : 5309A

Brave Bison Group PLC

23 January 2024

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended. Upon

the publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

23 January 2024

Brave Bison Group plc

("Brave Bison" or the "Company", together with its subsidiaries

"the Group")

Trading Update

Results ahead of market expectations

Third consecutive year of growth in net revenue, EBITDA

and EBITDA per share

Brave Bison, the digital advertising and technology services

company, is pleased to provide the following trading update for the

year ending 31 December 2023 ("FY23").

The Board expects to report audited FY23 results in April

2024.

Financial Highlights

FY23 (1) FY22A Change

Turnover / Billings (2) GBP35.5m GBP31.7m +12%

Net Revenue / Gross Profit GBP20.8m GBP16.9m +23%

Adj. EBITDA (3) GBP4.3m GBP3.0m +43%

--------- --------- -------

Adj. Profit Before Tax (4) GBP3.6m GBP2.6m +38%

--------- --------- -------

Adj. PBT per Share 0.28p 0.24p +17%

Net Cash GBP6.8m GBP6.2m +10%

--------- --------- -------

-- Net Revenue / Gross Profit of not less than GBP20.8m (FY22:

GBP16.9m), growth of 23% year-on-year and ahead of market

expectations

-- Adj. EBITDA of not less than GBP4.3m (FY22: GBP3.0m), growth

of 43% year-on-year , and Adj. Profit Before Tax of not less than

GBP3.6m (FY22: GBP2.6m), growth of 38% year-on-year, both results

ahead of market expectations

-- Net cash ahead of market expectations at GBP6.8m, an increase

of GBP2.5m from 30 June 2023 (H1 23: GBP4.3m) and an increase of

GBP0.6m year-on-year (FY22: GBP6.2m). Revolving credit facility of

GBP3m remains undrawn, providing further liquidity

-- New clients won in 2023 include Pinterest, Purina, John Lewis

Partnership, Holland & Barrett, ProCook, Monday.com, Patreon,

The Army, Warner Bros., Aer Lingus, Markel Group, Asda, Team GB,

Winparts , Fiskars and Molson Coors

-- Third consecutive year of growth in Net Revenue / Gross

Profit, Adj. EBITDA and Adj. EBITDA per Share. Net Revenue / Gross

Profit has quintupled since 2020 and Adj. EBITDA per Share has

doubled since 2021

FY20 FY21 FY22 FY23 (1)

--------------------- -------- -------- --------- ---------

Net Revenue / Gross GBP4.0m GBP7.8m GBP16.9m GBP20.8m

Profit

YoY Growth n/a +95% +117% +23%

--------------------- -------- -------- --------- ---------

Adj. EBITDA (3) GBP0.1m GBP1.8m GBP3.0m GBP4.3m

YoY Growth n/a +1,700% +67% +43%

--------------------- -------- -------- --------- ---------

Adj. EBITDA per

Share 0.02p 0.17p 0.28p 0.33p

YoY Growth n/a +921% +67% +20%

--------------------- -------- -------- --------- ---------

Net Cash GBP2.7m GBP4.7m GBP6.2m GBP6.8m

YoY Growth n/a +74% +32% +10%

--------------------- -------- -------- --------- ---------

(1) Unaudited, not less than results.

(2) Turnover / Billings includes pass-through costs such as

media spend and revenue share from platforms and partner

channels.

(3) Adj. EBITDA is defined as earnings before interest,

taxation, depreciation and amortisation, and after adding back

acquisition costs, restructuring costs and share-based payments.

Under IFRS16 most of the costs associated with property leases are

classified as depreciation and interest, therefore Adj. EBITDA is

stated before deducting these costs.

(4) Adj. Profit Before Tax is stated after adding back

acquisition costs, restructuring costs, impairments, amortisation

of acquired intangibles and share-based payments, and is after the

deduction of costs associated with property leases.

Oliver Green, Chairman, commented:

"We are pleased to report another year of good progress at Brave

Bison. We have grown profits, EBITDA per share and net cash for the

third consecutive year. Our mission to become a market-leading

digital advertising and technology services company has advanced

notably with the acquisition of SocialChain and we are optimistic

for further growth in 2024."

For further information please contact:

Brave Bison Group plc

Oliver Green, Chairman via Cavendish

Theo Green, Chief Growth Officer

Philippa Norridge, Chief Financial Officer

Cavendish Capital Markets Limited Tel: +44 (0) 20 7220 0500

Nominated Adviser & Broker

Ben Jeynes

Dan Hodkinson

About Brave Bison

Brave Bison (AIM: BBSN) is a digital advertising and technology

services company, headquartered in London with a globally

distributed workforce in over ten countries. The Company provides

services to global brand advertisers through four business

units.

Brave Bison Performance is a paid and organic media practice. It

plans and buys digital media on platforms like Google, Meta,

TikTok, Amazon and YouTube, as well as providing search engine

optimisation and digital PR services. Customers include New

Balance, Curry's and Asus.

SocialChain is a social media advertising practice. It creates

content for social media platforms, and works with influencers to

create and distribute content. This creative approach ensures that

content is more native to the platform it is on, leading to higher

engagements from its audience. Customers include Holland &

Barrett, The Army and General Mills.

Brave Bison Commerce is a digital commerce practice. It creates,

improves and maintains transactional websites and manages the

customer experience in a digital environment. This practice builds

ecommerce systems in a composable way - whereby different functions

of a website are provided by different software from different

vendors. Customers include Furniture Village, Fiskars and

Winparts.

Brave Bison Media Network is a portfolio of channels across

YouTube, Facebook, Snapchat, TikTok and Instagram. These channels

generate over 1 billion monthly views, and the advertising

inventory from each channel is sold through online advertising

exchanges. Popular channels include The Hook, PGA Tour, US Open and

Link Up TV.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEMESEELSEDF

(END) Dow Jones Newswires

January 23, 2024 02:00 ET (07:00 GMT)

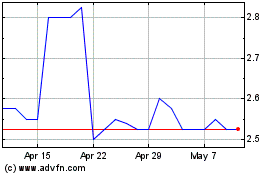

Brave Bison (LSE:BBSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brave Bison (LSE:BBSN)

Historical Stock Chart

From Apr 2023 to Apr 2024