Brexit Deal Optimism Drives Pound, UK Bank Stocks Higher

October 11 2019 - 8:29AM

Dow Jones News

By Anna Isaac and Caitlin Ostroff

Signs of optimism that the U.K. could reach a divorce deal with

the European Union drove the pound and U.K bank stocks sharply

higher Friday.

Sterling climbed as much as 1.7% against the U.S. dollar on talk

of a breakthrough between the two sides after months of worsening

relations, causing investors to review their bets on the currency

losing further value. U.K. bank stocks rallied hard with shares in

Royal Bank of Scotland Group PLC (RBS.LN) and Lloyds Banking Group

PLC (LLOY.LN) rising more than 10% and Barclays PLC (BARC.LN)

gaining 5%.

Investors attributed the sharp rise to positive remarks from

Donald Tusk, European Council President. He said that the Irish

taoiseach and the UK prime minister "saw for the first time a

pathway to a deal."

"I have received promising signals from the taoiseach that a

deal is still possible," Mr. Tusk said Friday.

Analysts agreed that there were still hurdles to be overcome in

the Brexit process in order for a deal to be sealed prior to the

Oct. 31 deadline. However, "something meaningful" had clearly been

accomplished in the meeting between Leo Varadkar and Boris Johnson,

Derek Halfpenny, head of research global markets at MUFG Bank

said.

A deal is more likely to be passed by parliament than previous

attempts because key euroskeptic groups of lawmakers believe Mr.

Johnson could pursue a looser long-term relationship with the EU

than his predecessor Theresa May.

However, while the pound climbed 1% on the signs of the

breakthrough, it is still unlikely to return to pre-referendum

strength. The currency has still lost close to 17% of its value

against the U.S. dollar since the vote, and the greenback has

gained in strength in recent years, analysts said.

"Looking at the longer-term picture, we are still very much in

the range for sterling that we've been in for the three-year

period," John Wraith, head of U.K. rates strategy at UBS Group AG,

said. UBS still expects the value of the pound to be in a range of

$1.05 to $1.50 in scenarios ranging from a hard Brexit to a new

referendum and the U.K. remaining in the EU.

"Most likely is this what we're calling the middle ground where

we sort of limp around with one extension after the other or we

then get a deal that sees the U.K. go into transition," he

said.

UBS has started recommending that clients stay light on risk for

the pound and put options--a type of insurance against sudden

changes in price moves--against the euro or dollar as it expects

that to react to Brexit headwinds in the future.

Write to Anna Isaac at anna.isaac@wsj.com and Caitlin Ostroff at

caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

October 11, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

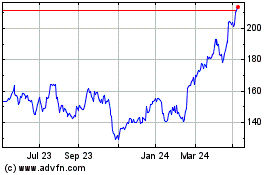

Barclays (LSE:BARC)

Historical Stock Chart

From Aug 2024 to Sep 2024

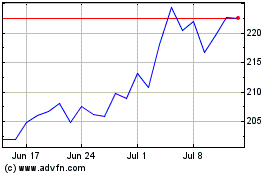

Barclays (LSE:BARC)

Historical Stock Chart

From Sep 2023 to Sep 2024