TIDMASL

Aberforth Smaller Companies Trust plc

Audited Annual Results for the year to 31 December 2021

The following is an extract from the Company's Annual Report and Financial

Statements for the year to 31 December 2021. The Annual Report is expected to

be posted to shareholders by 7 February 2022. Members of the public may obtain

copies from Aberforth Partners LLP, 14 Melville Street, Edinburgh EH3 7NS or

from its website: www.aberforth.co.uk. A copy will also shortly be available

for inspection at the National Storage Mechanism at: https://data.fca.org.uk/#/

nsm/nationalstoragemechanism.

FINANCIAL HIGHLIGHTS

Net Asset Value per Ordinary Share Total +32.5%

Return

Numis Smaller Companies Index (excluding Investment Companies) Total +21.9%

Return

Ordinary Share Price Total +20.3%

Return

Total ordinary dividends of 35.2p per share for 2021 represent a 5.7%

increment when compared with 2020's 33.3p.

INVESTMENT OBJECTIVE

The investment objective of Aberforth Smaller Companies Trust plc (ASCoT) is to

achieve a net asset value total return (with dividends reinvested) greater than

that of the Numis Smaller Companies Index (excluding Investment Companies)

("NSCI (XIC)" or "benchmark") over the long term.

CHAIRMAN'S STATEMENT TO SHAREHOLDERS

Review of performance

It is pleasing to report on a good year for performance in 2021, one that

contrasts sharply with the difficulties of 2020. ASCoT's net asset value total

return was 32.5%. The share price total return was lower at 20.3%, which

reflects the widening of the discount from 3.4% to 12.6% over the course of

2021.

ASCoT's net asset value performance compared well with that of the investment

benchmark. The total return of the Numis Smaller Companies Index (excluding

Investment Companies) (NSCI (XIC)) was 21.9%. The share prices of large

companies also rose, though to a lesser extent with the FTSE All-Share up by

18.3% in total return terms.

The contrast between 2020 and 2021 was due among other things to the arrival of

the vaccines, which gave confidence to markets that the pandemic could be

controlled without reliance on lockdowns. The on-going uncertainties pertaining

to the Omicron variant show that the effects of the coronavirus linger and it

continues to extract a regrettable toll in terms of lives lost. However, from

the investment perspective, it does feel that the issue at hand is the pace of

recovery rather than recovery itself. In this context, it is encouraging that

the resilience shown by ASCoT's investee companies in 2020 allowed them to

benefit from the first stages of economic recovery in 2021. In turn, as the

Managers' Report describes in detail, profits and dividends are rebounding

well. The improvement in trading conditions is convincing, though it is

necessary to recognise the challenges from inflation and supply chain problems

that became increasingly evident through the latter part of the year.

Dividends

The recovery in the profits of small UK quoted companies is amply demonstrated

by ASCoT's Income Statement. A large increase in investment income through 2021

was always likely, given how far it had declined in 2020, which was the worst

year for UK dividend income in the post war period. However, the degree of the

pick-up has been greater than the Board had previously expected. Some of this

is due to two special dividends received by the Company during the year, but

the heavy lifting was done by numerous investee companies returning promptly to

pay dividends having passed them amid 2020's lockdown. This outcome is to the

credit of the resilience and stewardship of the companies in which ASCoT

invests.

The growth in investment income fed through to a 177% increase in the revenue

return per Ordinary Share to 36.76p, which has allowed the Board the

flexibility to propose a final dividend of 24.25p per Ordinary Share. This,

together with the interim dividend of 10.95 pence, would give a total dividend

of 35.20p per Ordinary Share in respect of the year to 31 December 2021. Growth

of 5.7% is consistent with the Board's aim to increase dividends in real terms.

Notably, the 35.20p total dividend is funded entirely from the year's revenue

return - there has been no need to use revenue reserves, which is a better

outcome than I had envisaged when I wrote my interim update.

Inflation running at its current elevated rate may prove a more demanding

hurdle for the Board's progressive dividend policy if the investee companies

struggle in the near term to pass on higher costs. However, the Board takes

encouragement from ASCoT's revenue reserves, which were 59.0p per Ordinary

Share at 31 December 2021 assuming approval of the final dividend.

Additionally, the Managers' dividend estimates for the portfolio plot a path

for ASCoT's investment income to exceed 2019's pre-pandemic levels over the

next couple of years.

Gearing

Throughout ASCoT's life, it has been the Board's policy to deploy gearing in a

tactical fashion. Decisions to gear are motivated by periods of stress in

equity markets. The pandemic and lockdown in 2020 produced such an episode,

which allowed ASCoT to gear for the fourth time in its 31 year history. The £

130m debt facility to enable this is provided by The Royal Bank of Scotland

International. It has a term running to June 2023, which is designed to align

with the three-yearly continuation vote cycle.

Gearing, which is the ratio of net debt to Shareholders' Funds, was 5.6% at 31

December 2021, down slightly from 6.1% at the start of the year. This reduction

in gearing reflects the increase in share prices and therefore in Shareholders'

Funds through the year. Despite this recovery, the Board and Managers consider

that continued use of the debt facility is appropriate. As the Managers' Report

explains, the portfolio's companies continue to make sound progress, while

valuations remain attractive.

Share buy-back

The Company seeks authority to buy back up to 14.99% of its Ordinary Shares at

the Annual General Meeting. The authority was renewed in March 2021. In the

year to 31 December 2021, 874,800 shares were bought back and cancelled. The

total value of these repurchases was £12.9m, on an average discount of 11.2%.

The Board continues to believe that, at the margin, buy-backs provide an

increase in liquidity for those Shareholders wishing to crystallise their

investment and, at the same time, deliver an economic uplift for those

Shareholders wishing to remain invested in the Company. Accordingly, the Board

will be seeking to renew the buy-back authority at the Annual General Meeting

on 3 March 2022.

Stewardship

In November, COP26 reinforced the increasing importance of environmental,

social and governance issues for economies and financial markets. As part of

its stewardship responsibilities, the Board regularly reviews the Managers'

approach to these issues, which is described in additional detail elsewhere in

this annual report. The Board endorses the Managers' stewardship policy, which

is set out in their submission as a signatory to the UK Stewardship Code 2020.

This, together with examples relating to voting and engagement with investee

companies, can be found in the literature library of the Managers' recently

refreshed and updated website at www.aberforth.co.uk.

Board changes

The Board regularly reviews its composition and structure in line with

corporate governance requirements. As part of the Board's succession planning,

Paula Hay-Plumb, who has been a Director for eight years, will not stand for

re-election at the forthcoming Annual General Meeting. Paula has made a

valuable contribution to the Board's deliberations and we wish her well for the

future.

A recruitment process for a new Director, being run by the Board, is well

advanced.

Annual General Meeting ("AGM")

The AGM will be held at 14 Melville Street, Edinburgh EH3 7NS at 2.30 pm on 3

March 2022. Details of the resolutions to be considered by Shareholders are set

out in the Notice of the Meeting on page 56. Shareholders are encouraged to

submit their vote by proxy in advance of the meeting in case restrictions

related to the Covid-19 pandemic apply and it is therefore not possible for

shareholders to attend in person. The Company will issue a regulatory news

announcement, which will also be posted on the website, if the only attendees

permitted will be those required to allow the business of the meeting to be

conducted. The Board welcomes questions from Shareholders and invites them to

be submitted by email to enquiries@aberforth.co.uk before the meeting, in case

attendance is not allowed. Questions will be considered by the Board and

responses provided. In light of these circumstances a brief update on

performance and the portfolio will be available on the Managers' website

following the meeting. In accordance with normal practice, the results of the

AGM will be issued in a regulatory news announcement and also posted on the

website.

Conclusion

The enduring fascination of financial markets is that they never cease to

surprise. Had I been told at the start of 2021 that ten year government bond

yields would finish the year still below their pre-pandemic levels, I would

have concluded that nascent inflationary pressures had given way to the

disinflationary conditions with which we have become familiar since the global

financial crisis. And yet the year ended with inflation running at its highest

rates for decades. The Managers' Report explores this conundrum in more detail,

but, with the rhetoric from the central banks evolving, it does appear likely

that the coming year will bring some form of resolution.

The nature of the resolution will have important implications for the direction

of equities as a whole, for the Managers' value investment style and for

ASCoT's returns. I would note that financial markets ended 2021 in a familiar

manner - bond yields were low and growth stocks had resumed leadership within

equity markets. At the risk of being confounded again, I would venture to

suggest that the burden of proof does not sit with the value investor.

The second order effects of the pandemic, in the form of inflation and supply

chain challenges, threaten to hamper the profit recovery in 2022, but a year of

progress nevertheless seems likely. Political developments in many parts of the

world remain unpredictable and affect equity valuations. At home, it is

remarkable how rapidly political uncertainty has re-emerged after the decisive

general election result at the end of 2019. This has no doubt contributed to

the valuation of UK equities remaining below their global peers. It is notable,

however, that these valuations are attracting the attention of other companies

and private equity as M&A activity recovers to levels last seen before the EU

referendum.

While politics and economics will be important influences on ASCoT's near term

returns, the more important contribution over time is the fortunes of the

investee companies. I am struck by how well these businesses have fared through

the great challenges of the past two years. Their resilience is brought out in

the Managers' Report through analyses of balance sheet strength, good returns

on equity and growing dividends. Such characteristics may be considered to sit

oddly with a portfolio managed under a value investment philosophy. My

interpretation is that this is another instance of the financial markets'

ability to surprise and highlights the opportunity for ASCoT's shareholders

Finally, my fellow Directors and I very much welcome the views of Shareholders

and are available to talk to you directly.

My email address is noted below.

Richard Davidson

Chairman

28 January 2022

richard.davidson@aberforth.co.uk

MANAGERS' REPORT

Introduction

Equity markets performed well in 2021. In the UK, the total return of large

companies, represented by the FTSE All-Share, was 18.3%. This was surpassed by

the 21.9% return of the NSCI (XIC), which defines ASCoT's investment universe

of small UK quoted companies. The net asset value total return of ASCoT itself

was 32.5%, while the share price total return was 20.3%.

Following the negative returns of 2020, these numbers depict a welcome reversal

of fortunes for UK equity markets. However, it would be remiss to pass over the

contrast between this improvement and the development of the pandemic - the

world is likely to have seen more deaths associated with the coronavirus in

2021 than in 2020. The disparity between investment returns is explained by the

remarkably rapid development of the vaccines, which were announced towards the

end of 2020. These spurred a powerful rally in share prices and allowed equity

markets to fulfil their function by discounting a future in which the pandemic

can be controlled and economic activity can normalise. In due course, the

rollout of the vaccines allowed demand to begin its recovery, boosted by high

household savings, loose monetary policy and fiscal support. Corporate profits

followed, thus starting to justify the rebound in share prices.

The economic recovery progressed more or less as hoped through 2021. Support

measures, such as the UK's Job Retention Scheme, have been gradually phased out

without, as yet, a significant impact on activity. However, it is notable that

share prices struggled through the second half of the year. This reflects

uncertainties that stem both from the continuing effects of the coronavirus

itself and from the unintended consequences of the stimulus measures deployed

in 2020 to mitigate the economic damage of the pandemic. Three particular

issues stand out for their effects on equity valuations: variants of the virus,

supply chain constraints and inflation.

. Despite the success of the vaccines, the prospect of further

lockdowns has lingered owing to the emergence of new variants that might prove

more infectious, virulent or resistant to the vaccines. Through 2021 the Delta

and Omicron variants highlighted this risk and buffeted sentiment to companies

that were benefiting from the return to normal economic activity. This is a

factor that is likely to remain relevant until levels of immunity around the

world are high enough to compromise the virus's ability to evolve.

. Supply chains have been put under severe stress as demand has

surged and as the impact of 2020's lockdowns on industrial production and

investment plays out. Employment has also been a challenge: with indications

that elements of the labour force have been slow to re-engage after the

lockdowns, wage growth is accelerating. In the UK, Brexit is an additional

complication, though it is difficult to disentangle from the effects of the

pandemic. These issues have combined with rising energy prices to exert

pressure on households and on corporate profitability, which is being reflected

in the trading updates of companies around the world, including several of the

portfolio's holdings. In 2021, this factor has tended merely to take the gloss

off results that have been boosted by the demand recovery. However, the effect

on profits in 2022 is likely to be greater.

. Supply chain constraints, rising wages and energy prices have

combined to produce some of the highest rates of inflation in decades. In the

UK, the CPI rose by 5.1% year-on-year in December 2021, while the rate in the

US was 7.0%. As the effects of lockdown in 2020 washed through the data, it

became clear that this rise in inflation is not as transitory as was widely

expected at the start of the year. This is relevant to the performance of the

portfolio since there is evidence that the value investment style, as followed

by the Managers, fares relatively well when government bond yields rise, which

they often do in response to higher inflation. However, in the latter part of

2021, there was little evidence of that relationship. It would seem that equity

markets were focused on the possible responses from central banks, fearing that

tighter monetary conditions might lower both inflation and real economic

growth.

While the effect of these issues on ASCoT's portfolio will become clearer

through 2022, reassurance can be taken from the experience of the past two

years. The sensitivity of the portfolio companies to economic conditions was

clearly displayed both on the way down in 2020 and in the recovery phase in

2021. The resilience of ASCoT's holdings comes with attractive valuations,

despite the strong returns achieved in 2021.

Analysis of performance

To recap, ASCoT's net asset value total return in 2021 was 32.5%, which

exceeded the NSCI (XIC)'s return of 21.9%. The table below and following

paragraphs explain this performance and provide additional detail about the

portfolio.

Performance for the 12 months ended 31 December Basis points

2021

Attributable to the portfolio of investments, 928

based on mid prices

(after transaction costs of 20 basis points)

Movement in mid to bid price spread 10

Cash/gearing 202

Purchase of ordinary shares 15

Management fee (87)

Other expenses (7)

Total attribution based on bid prices 1,061

Note: 100 basis points = 1%. Total Attribution is the difference between

the total return of the NAV and the Benchmark Index (i.e. NAV = 32.53%;

Benchmark Index = 21.92%; difference is 10.61% being 1,061 basis points).

Style

After the adverse experience of 2020, the value investment style in equity

markets around the world benefited from the vaccine rally. This boosted ASCoT's

performance over 2021 as a whole, though its influence waned in the second half

in response to the three challenges to equity valuations described above.

According to the London Business School, which analyses style effects within

the NSCI (XIC) using price to book ratios, value stocks out-performed growth

stocks by just under 10% in 2021. This quantification of the style factor is a

useful but imprecise gauge of the Managers' approach to value investment. The

Managers have always used a broader range of valuation metrics - notably EV/

EBITA, the price earnings ratio, free cash flow yield and dividend yield - to

determine the price targets for ASCoT's holdings. Moreover, their investment

cases are based on more than a statistically low valuation, additionally taking

into account factors such as the development of profits, market position,

pricing power and track record. Consideration is also given to risks and

opportunities emerging from environmental, social and governance (ESG) issues.

Size

The following comments focus on the size effect within the NSCI (XIC), rather

than on comparing the performances of large companies and small companies. The

NSCI (XIC) is defined as the bottom ten percent by value of the total UK

stockmarket. This means that the largest constituent's market capitalisation is

around £1.6bn and that roughly two thirds of the NSCI (XIC)'s value is

represented by companies that are also members of the FTSE 250. For several

years, the Managers have chosen to invest the portfolio in the index's "smaller

small" constituents, which can be thought of as non-FTSE 250 companies. The

motivation for this was that the "smaller smalls" enjoyed much more attractive

valuations, without having to compromise in terms of profit growth, returns on

equity or leverage. For most of the period since the global financial crisis,

this positioning was unhelpful to ASCoT's returns as general concerns about

liquidity overshadowed the opportunity. However, the advent of the vaccines

appears to have been a catalyst for a re-evaluation of the "smaller smalls". A

gauge of this is the relative performance of the FTSE SmallCap, representative

of "smaller smalls", against the FTSE 250. After a strong end to 2020, the

former went on to out-perform the latter by 13% in 2021, which is the best

calendar year relative performance since 1999. Size was therefore beneficial to

ASCoT's performance in 2021.

Geography

The EU referendum in 2016 and the subsequent weakness in sterling led to a

phase of share price under-performance by companies with greater exposure to

the UK's domestic economy. Just as greater political clarity seemed forthcoming

at the end of 2019, domestically oriented businesses were put under renewed

pressure by 2020's lockdown, which was particularly troublesome for businesses

in the retail, travel and leisure sectors. Moving into 2021, geographical

exposure remained relevant, with the share prices of domestically oriented

businesses rebounding more powerfully amid the vaccine rally, before giving up

some of that out-performance through the middle of the year. Notably, the

fourth quarter witnessed under-performance by the overseas oriented companies,

which reflects their greater exposure, at least in the near term, to the supply

chain issues described in the opening paragraphs. Over 2021 as a whole, the

share prices of domestic businesses out-performed those of overseas businesses

by 8%. This was helpful to ASCoT's performance, since the portfolio has a

weighting of 58% in the domestics, higher than the NSCI (XIC)'s 51%.

Dividends

The swings in the income experience of the portfolio and of small UK quoted

companies in general have reflected their capital performance over the past two

years. The London Business School calculated that NSCI (XIC) dividends fell by

52% in 2020, the worst outcome in the post war era. In 2021, dividends

rebounded by 70%. ASCoT has benefited: the proposed total dividends in respect

of 2021 are funded entirely by the year's earnings. Even at the time of the

interim results, the Managers had estimated that it would be necessary to draw

on revenue reserves, albeit to a lesser extent than in 2020.

Behind this improvement was a better than expected underlying dividend

experience, supplemented by two special dividends paid by investee companies to

ASCoT. The dividend experience is portrayed in the following table, which

categorises the portfolio's 77 holdings at 31 December 2021 by their most

recent dividend action.

Nil Payer Cutter Unchanged Increased Payer Returner Other*

Payer

24 5 5 16 25 2

* Other denotes companies paying dividends for the first time

The important categories are Returners and Nil Payers. The former captures

those holdings that did not pay a dividend in 2020 but that have resumed

distributions in 2021. There are more of these than the Managers had expected

at the start of 2021, which is testament to the resilience and good stewardship

of the investee companies in extremely challenging circumstances. These have

provided a significant boost to ASCoT's Income Statement. The Nil Payers

category hints at the scope for further impetus. The Managers estimate that 14

of the Nil Payers will make dividend payments in the next two years. The other

Nil Payers, which may be thought of as structural Nil Payers, are likely to

take longer as their cash flows are prioritised for investment or debt

repayment.

Balance sheets

The strong dividend performance described above is influenced by the resilience

of balance sheets both within the portfolio and among small companies in

general. The table below sets out the weight of the portfolio and the tracked

universe in four leverage categories. Using the Managers' estimates, it also

shows those weights both at the end of 2021 and at the end of 2023. The tracked

universe is those companies in the NSCI (XIC) that the Managers follow closely

and represents 97% by value of the NSCI (XIC).

Weight in companies Net cash Net debt/ Net debt/ Other*

with: EBITDA < 2x EBITDA > 2x

Portfolio: 2021 32% 47% 11% 10%

Portfolio: 2023 43% 43% 7% 7%

Tracked universe: 29% 34% 24% 13%

2021

Tracked universe: 41% 32% 20% 7%

2023

*Includes loss-makers and lenders

The resilience of small companies is evident from the table. Both the portfolio

and the tracked universe are emerging from the pandemic with a skew to

companies boasting strong balance sheets. Some of that resilience is due to

equity issues in 2020, though these were fewer than the Managers had expected.

The more important influences were the control of costs, recovering demand and

a focus on free cash generation. It is also notable that, if anything, the

portfolio's companies look more conservatively financed than does the tracked

universe. The latter has a higher exposure to more highly leveraged companies

with net debt / EBITDA ratios above 2x.

The likely strengthening of balance sheets in the wake of the pandemic is

consistent with the experience of the global financial crisis. Company boards

are naturally slower to utilise their balance sheet strength in the aftermath

of such events. Such caution is understandable, but it can be taken too far. A

lack of investment is detrimental to the longer term prospects of individual

companies and, by extension, to the economy as a whole. Furthermore, in the

absence of attractive investment opportunities, excess cash can be returned to

shareholders, as long as it does not jeopardise the underlying business's

viability.

Return on equity

There is a widespread view that companies in the value cohort of an index

should generate much lower returns on equity (RoE) than do the growth cohort.

This makes sense since, if the stockmarket is pricing efficiently, companies

with high returns on equity should be on higher valuations, all else being

equal. In turn, value investors would tend to find more opportunities among

companies whose returns on equity and valuations are depressed by some issue

but can revert to more normal levels once the issue is addressed.

Weight in "Loss makers" "Laggards" "Value "Stars"

companies creators"

with:

RoE < 0% RoE 0-10% RoE 10-20% RoE > 20%

2019 2020 2019 2020 2019 2020 2019 2020

Portfolio 6% 25% 24% 37% 40% 19% 29% 19%

Tracked 11% 21% 22% 30% 36% 22% 31% 26%

universe

The table shows the exposure of the portfolio and of the tracked universe to

companies categorised by their RoE. The impact of 2020's lockdown-induced

recession is clear, with weightings in "loss makers" and "laggards" rising as

profits declined. A more useful picture is painted by the data for relatively

normal conditions of 2019. In that year, the portfolio's exposures to the four

categories compare well with those of the tracked universe. This contradicts

the widespread view that value investors are condemned to owning less

profitable companies. The explanation for this counterintuitive but encouraging

finding lies in the portfolio's relatively high exposure to the more

attractively valued smaller small companies, which is addressed in more detail

in the commentary on valuations below.

Corporate activity

The international appeal of UK assets diminished with 2016's EU referendum.

This was reflected in sterling weakness, in a widening of the valuation

discount between UK and global equities and in a decline in takeover activity

within the NSCI (XIC). However, the past year has seen some appetite return. UK

equities have continued to under-perform their global peers, but sterling is

above pre pandemic levels and ten percent above the nadir in the wake of the

referendum. Of more direct relevance to the portfolio, the incidence of M&A

within the NSCI (XIC) was at its highest level in 2021 since 2015. Private

equity and other companies, both domestically based and overseas, have been

keen to take advantage of the considerable value available within the UK equity

market.

Nineteen constituents of the NSCI (XIC) were acquired last year, with offers

for another six still outstanding at 31 December 2021. Of these 25 companies,

the portfolio had holdings in six. In addition, there were public approaches

for two holdings that were rejected by shareholders and other approaches that

the Managers helped rebuff before disclosure was required. It remains the case

that the stockmarket valuations for many investee companies are so low that the

typical 20-30% premium for control does not get close enough to the Managers'

target prices.

ASCoT's interim report described an upsurge in IPO activity in the first half

of 2021, with most of the companies brought to the market on high valuations

and with more appeal to the growth investor. There were few IPOs in the second

half, but the year as a whole saw 23 companies float with current market

capitalisations that brought them into the NSCI (XIC) on its 2022 rebalancing.

The net effect of this rebalancing increased the number of constituents in the

NSCI (XIC) from 334 at 1 January 2021 to 337 at 1 January 2022. The largest

constituent in the 2022 vintage at 1 January 2022 had a market capitalisation

of £1,645m.

Portfolio Turnover

Portfolio turnover is defined as the lower of purchases and sales divided by

average portfolio value. Over the twelve months to 31 December 2021, the rate

was 26%. This is in the middle of the range since the financial crisis, with

turnover as low as the mid teens and as high as around 40%. There is often a

relationship between ASCoT's turnover and the relative performance of the

portfolio. If the share prices of holdings rise close to the Managers' targets,

there is the opportunity to realise value and redeploy the proceeds in other

companies with higher upsides. The Managers term this the "value roll". On the

other hand, weaker performance implies that the gaps between share prices and

the Managers' targets prices are widening and so, all else being equal, there

is less incentive to change the portfolio.

Active share

Active share is a measure of how different a portfolio is from an index. It is

calculated as half of the sum of the absolute differences between each stock's

weighting in an index and its weighting in the portfolio. The higher a

portfolio's active share, the higher its chance of either out or

under-performing the index. At 31 December 2021, the portfolio's active share

was 76% relative to the NSCI (XIC), which was well above the Managers' target

ratio of at least 70%.

Valuations

Before examining the valuations of the portfolio, it is worth noting that UK

equities remain lowly valued in the global context. Research by JP Morgan shows

that UK equities have under-performed their US peers by 50% and their European

peers by 25% since the EU referendum in 2016. This has left UK valuations

relative to global equities over two standard deviations below their long term

averages. A significant valuation discount persists even when valuations are

adjusted for the UK stockmarket's heavy exposure to the financials and

commodities sectors. Though less exposed to these sectors, ASCoT's investment

universe and portfolio would appear to bear a UK discount.

Portfolio characteristics 31 December 2021 31 December 2020

ASCoT NSCI (XIC) ASCoT NSCI (XIC)

Number of companies 77 337 80 334

Weighted average market £624m £934m £587m £866m

capitalisation

Price earnings (PE) ratio 13.3x 16.6x 7.3x 10.8x

(historical)

Dividend yield (historical) 1.9% 2.1% 2.2% 1.5%

Dividend cover 4.0x 2.9x 6.1x 6.2x

The historical PE ratios of the portfolio and of the NSCI (XIC) rose through

2021. This was driven both by the recovery in share prices through the year and

by companies reporting lower earnings in respect of the recession year of 2020.

The long term average PE for the portfolio is 11.6x, while that of the NSCI

(XIC) is 13.4x. At 31 December 2021, therefore, both the portfolio and index

are more highly rated than usual. This reflects the fact that recovery in

earnings has further to go - the Managers anticipate that pre-pandemic levels

of profitability will be reached again in 2023. In relative terms, the

portfolio PE is 20% lower than that of the NSCI (XIC) at 31 December 2021. This

compares with an average discount over the long term of 13%.

Turning to dividend yields, the portfolio's 1.9% is lower than the 3.2% long

term average. While dividends recovered more quickly than expected through

2021, they remain below their pre-pandemic levels. Again, those levels are

likely to be seen again in 2023. Consistent with this, the Managers' estimates

suggest a portfolio yield two years out of 3.1%. As dividends grow again, the

presently high dividend cover of 4.0x should reduce closer to the long term

average of 2.7x.

The table below sets out the forward valuations of the portfolio, the tracked

universe and certain subdivisions of the tracked universe. The metric displayed

is enterprise value to earnings before interest, tax and amortisation (EV/

EBITA), which the Managers use most often in valuing companies. The estimates

underlying the ratios are the Managers'. There follows a series of observations

about the table.

EV/EBITA 2020 2021 2022 2023

ASCoT 12.4x 9.4x 8.1x 7.2x

Tracked Universe (245 15.0x 12.9x 10.9x 9.2x

stocks)

* 46 growth stocks 21.9x 21.2x 20.2x 18.2x

* 199 other stocks 13.5x 11.6x 9.7x 8.0x

* 105 stocks > £600m 14.6x 13.4x 11.5x 9.6x

market cap

* 140 stocks < £600m 16.1x 11.5x 9.5x 8.3x

market cap

. The decline in ASCoT's EV/EBITA from 2020 to 2023 is driven by

recovering profits and by a reduction in EV as free cash flow is generated to

reduce debt. The 7.2x multiple in 2023 is based on profits that are expected to

be back roughly to 2019 levels.

. Consistent with the Managers' value investment philosophy, the

portfolio is more attractively rated than the tracked universe, with a discount

of 17% in 2020 expanding to 22% in 2023.

. The valuation stretch among small companies is shown in the EV/

EBITA difference between the growth stocks and the rest of the tracked

universe. It is in this latter cohort that the Managers focus their attention,

though growth stocks do encounter trading issues and can offer opportunities as

well.

. The bottom two rows demonstrate the present importance of size.

Stocks with market capitalisations above £600m are an approximate match for

those NSCI (XIC) constituents that are also members of the FTSE 250. Those with

market capitalisations below £600m are the "smaller smalls". Despite their

better share price performance in 2021, these remain more attractively valued

than their mid cap peers, but they are not inferior in terms of their growth

potential, balance sheets and returns on equity. Since the global financial

crisis, the stockmarket has penalised these companies for their small size and

relative illiquidity. Through its diversified portfolio ASCoT has taken

advantage of this and has a meaningfully higher exposure than does the index to

the "smaller smalls".

. Turning back to M&A within the NSCI (XIC), the average 2021 EV/

EBITA multiple of the takeover targets (excluding property companies) was 17x.

This is markedly higher than the 2021 valuation multiples of both the tracked

universe and the portfolio, which illustrates the value available among small

companies.

The EV/EBITA multiples usefully demonstrate the attractive valuations within

the portfolio, but they are not the only element of the Managers' investment

cases. Each holding is ascribed a target price, which is usually based upon an

estimate of normalised profits to which a multiple is applied. The emphasis of

the investment process is assessment of the appropriate multiple, taking into

account factors such as the company's market position, its record, ESG risks

and opportunities, management and longer term prospects. The ranking by upside

to price targets allows the Managers to circulate capital from companies whose

share prices are near their calculated values to those with a larger gap

between the two. Over time this "value roll" can make a meaningful contribution

to investment returns. It is the full investment cases of the holdings that is

the main influence on the Managers' consideration of ASCoT's tactical gearing

facility. Since attractive valuations continue to unpin significant estimated

upside, it is appropriate that the portfolio remains geared.

Outlook and Conclusion

Equity returns are determined by the progress of corporate profits and the

rating ascribed to those profits by investors. Inflation and monetary policy

are important influences on the latter since they affect the discount rates

used to value financial assets. One of the curiosities of 2021 is that the

highest rates of inflation for decades have not had a greater impact on the

pricing of financial assets. Government bond yields in both the UK and US are

still below their pre-pandemic levels, while growth stocks returned to the fore

after weaker relative performance amidst the vaccine rally. So far, therefore,

the markets appear to be anticipating economic and financial conditions little

changed from those that have pervaded since the global financial crisis: low

real economic growth, low inflation, low interest rates and low bond yields.

It is not clear that today's inflationary pressures will be short-lived and

easily controlled. The supply chain problems will be sorted in time, but there

may be more intractable influences. Under-investment in oil and gas development

projects in recent years could keep energy prices high. Meanwhile, there is

concern that the supply of labour has been affected by issues stemming from the

pandemic and, in the UK at least, by Brexit. Macro-economic data and anecdotes

from companies indicate that wages are accelerating.

Inflation raises the stakes. While its recent resurgence clearly does not

prevent a return to the disinflationary conditions of the past dozen years, it

is perplexing that the financial markets do not yet harbour more doubt. The

chance that bond yields prove too low and that growth stocks are too highly

valued is higher today than before the pandemic, but that is not reflected in

current valuations. Were more doubt to creep into valuations, ASCoT's value

investment style should benefit in terms of relative performance. However, we

should be careful what we wish for - equities struggle when monetary policy

belatedly plays catch-up and relative gains might be achieved against the

backdrop of lower share prices.

Turning back to corporate profits, the outlook is encouraging as economic

activity normalises and demand continues its rebound from the 2020 recession.

Such recovery remains a common theme from the Managers' recent engagement with

ASCoT's investee companies. There are, though, risks. First, the pandemic is

still with us and may elicit further measures by governments. However, the

efficacy of the vaccines means that such measures should affect the pace of

recovery rather than threaten the recovery itself. Second, there are the supply

chain problems, which are another recurring feature of company trading updates

and will take time to resolve. Indeed, energy and labour costs may put

sustained pressure on corporate margins, with demand also threatened by the

impact of energy costs on consumer spending. Third, there is the chance that

central bankers tighten monetary policy to control inflation and thus bring

about economic slowdown. At this stage, this risk is more speculative since

monetary tightening, such as the Bank of England's 0.15% increase in interest

rates in December, has so far been modest - in most western economies interest

rates remain deeply negative in real terms.

So, from the strategic perspective, 2022 feels like a pivotal year as the

inflation debate comes to a head. Equity valuations will be affected, including

those of small UK quoted companies. In such uncertain circumstances, the

records of these companies offer reassurance. They have coped with the global

financial crisis, the Eurozone crisis, Brexit and the pandemic. Despite their

cyclicality they have displayed great resilience through each episode. ASCoT

itself benefits from a diversified portfolio of companies, with wide ranging

activities and geographical exposures. These companies boast strong balance

sheets and generate returns on equity that point to profitable and growing

underlying businesses. Remarkably, these characteristics are available to the

Managers without having to compromise on the value investment philosophy.

Why should that be? Many aspects of ASCoT's investment policy and strategy -

investment in small UK quoted companies with a value philosophy - have been out

of favour for several years.

. Since the financial crisis, smallness has come with concerns

about low liquidity. These have trumped the longer term associations of smaller

size with faster growth and higher total returns.

. Since the EU referendum, UK assets have been out of favour and

remain lowly valued in the global context. This is despite the recent upsurge

in M&A, which recognises the deep valuation discounts.

. Quoted companies are increasingly being seen as outmoded, with

private equity meanwhile lauded for long termism and its ability to use more

leverage. However, as mainstream funds increasingly look to take stakes in

private businesses, it is notable that the private equity firms themselves are

seeking stock exchange listings. Moreover, it is notable that illiquidity is

not a concern when it comes to private equity.

. Finally, value investment has been challenged by the environment

of low inflation and low interest rates since the global financial crisis. But

a continuation of these conditions is not a given, especially in view of

current inflationary pressures.

A reversal of one or more of these headwinds could supplement the progress of

the underlying businesses in which the portfolio invests to boost returns for

ASCoT's shareholders. This optionality, in combination with the resilience of

the investee companies, underlines the relevance of ASCoT's investment

proposition. These attributes and the upside they suggest are good reason for

ASCoT to retain the tactical gearing of the portfolio, which has been in place

since June 2020. They have also motivated the Managers to add further to their

individual shareholdings in ASCoT.

Aberforth Partners

Managers

28 January 2022

DIRECTORS' RESPONSIBILITY STATEMENT

Each of the Directors confirms to the best of their knowledge that:

(a) the financial statements, which have been prepared in accordance with

applicable accounting standards, give a true and fair view of the assets,

liabilities, financial position and profit or loss of the Company;

(b) the Strategic Report includes a fair review of the development and

performance of the business and the position of the Company, together with a

description of the principal risks and uncertainties that it faces; and

(c) the Annual Report, taken as a whole, is fair, balanced and understandable

and provides information necessary for Shareholders to assess the Company's

position and performance, business model and strategy.

On behalf of the Board

Richard Davidson

Chairman

28 January 2022

PRINCIPAL RISKS

The Board carefully considers the risks faced by the Company and seeks to

manage these risks through continual review, evaluation, mitigating controls

and action as necessary. A risk matrix for the Company is maintained. It groups

actual and emerging risks into the following categories: portfolio management;

investor relations; regulatory and legal; and financial reporting. Further

information regarding the Board's governance oversight of risk, its review

process and the context for risks such as conflicts of interest and ESG can be

found in the Corporate Governance Report. The Audit Committee Report (pages 30

to 32 of the Annual Report) details matters considered and actions taken on

internal controls and risks during the year. The Company outsources all the

main operational activities to recognised, well-established firms and the Board

receives internal control reports from these firms, where available, to review

the effectiveness of their control frameworks. Since the Covid-19 pandemic,

these firms have deployed alternative operational practices, including staff

working remotely, to ensure continued business service.

Emerging risks are those that could have a future impact on the Company. The

Board regularly reviews them and, during the year, it added to the risk matrix

potential economic risks arising from inflation, reversal of quantitative

easing and supply chain constraints. This risk was grouped under the principal

risk category of market risk, as described below. The Board regularly monitors

how the Managers integrate such risks into the investment decision making.

Principal risks are those risks derived from the matrix that have the highest

risk ratings. They tend to be relatively consistent from year to year given the

nature of the Company and its business. The principal risks faced by the

Company, together with the approach taken by the Board towards them, are

summarised below. To indicate the level of monitoring required during this year

each principal risk has been categorised as either dynamic risk, requiring

detailed monitoring as it can change regularly, or stable risk, requiring less

monitoring.

(i) Investment policy/performance risk - The Company's investment policy and

strategy exposes the portfolio to share price movements. The performance of the

investment portfolio typically differs from the performance of the benchmark

and is influenced by stock selection, liquidity and market risk (see (ii) below

and Note 19 to the financial statements for further details). Investment in

small companies is generally perceived to carry more risk than investment in

large companies. While this is reasonable when comparing individual companies,

it is much less so when comparing the risks inherent in diversified portfolios

of small and large companies. The Board monitors performance against the

investment objective over the long term by ensuring the investment portfolio is

managed appropriately, in accordance with the investment policy and strategy.

The Board has outsourced portfolio management to experienced investment

managers with a clearly defined investment philosophy and investment

process. The Board receives regular and detailed reports on investment

performance including detailed portfolio analysis, risk profile and

attribution analysis. Senior representatives of Aberforth Partners attend each

Board meeting. Peer group performance is also regularly monitored by the

Board. This remains a dynamic risk, with detailed consideration during the

year. The Managers' Report contains information on portfolio investment

performance and risk.

(ii) Market risk - Investment performance is affected by external market risk

factors, including those creating uncertainty about future price movements of

investments. The Board delegates consideration of market risk to the Managers

to be carried out as part of the investment process. The Managers regularly

assess the exposure to market risk when making investment decisions and the

Board monitors the results via the Managers' quarterly and other reporting. The

Board and Managers closely monitor significant economic and political

developments and, in particular, are mindful of the continued uncertainty

following the departure of the UK from the EU, the impacts of the Covid-19

pandemic and government responses, and the potential effects of climate change.

This remained a dynamic risk during the year, in which the Managers reported on

market risks including inflation and supply-chain pressures and other

geo-political issues as referred to in the Managers' Report.

(iii) Share price discount - Investment trust shares tend to trade at discounts

to their underlying net asset values, but a significant share price discount,

or related volatility, could reduce shareholder returns and confidence. The

Board and the Managers monitor the discount daily, both in absolute terms and

relative to ASCoT's peers. In this context, the Board intends to continue to

use the buy-back authority as described in the Directors' Report. This is

considered a dynamic risk as the discount moves daily.

(iv) Gearing risk - In rising markets, gearing enhances returns, but in falling

markets it reduces returns to Shareholders. The Board and the Managers have

specifically considered the gearing strategy and associated risks during the

year. At present this is a dynamic risk as the Company's tactical gearing

facility is partially deployed.

(v) Reputational risk - The reputation of the Company is important in

maintaining the confidence of shareholders. The Board and the Managers monitor

factors that may affect the reputation of the Company and/or of its main

service providers and take action if appropriate. The Board reviews relevant

internal control reporting for critical outsourced service providers. This has

been monitored as a stable risk.

(vi) Regulatory risk - Failure to comply with applicable legal and regulatory

requirements could lead to suspension of the Company's share price listing,

financial penalties or a qualified audit report. A breach of Section 1158 of

the Corporation Tax Act 2010 could lead to the Company losing investment trust

status and, as a consequence, any capital gains would then be subject to

capital gains tax. The Board receives quarterly compliance reports from the

Secretaries to evidence compliance with rules and regulations, together with

information on future developments. This is a stable risk.

Going Concern

The Audit Committee has undertaken and documented an assessment of whether the

Company is a going concern for the period of at least 12 months from the date

of approval of the financial statements. This assessment included the impact on

the Company of Covid-19. The Committee reported the results of its assessment

to the Board.

The Company's business activities, capital structure and borrowing facilities,

together with the factors likely to affect its development and performance, are

set out in the Strategic Report in the Annual Report. In addition, the Annual

Report includes the Company's objectives, policies and processes for managing

its capital and financial risk, along with details of its financial instruments

and its exposures to credit risk and liquidity risk. The Company's assets

comprise mainly readily realisable equity securities and funding flexibility

can typically be achieved through the use of the borrowing facilities which are

described in notes 12 and 13 to the financial statements. The Company has

adequate financial resources to enable it to meet its day-to-day working

capital requirements.

In summary and taking into consideration all available information, the

Directors have concluded it is appropriate to continue to prepare the financial

statements on a going concern basis.

The Income Statement, Balance Sheet, Reconciliation of Movements in

Shareholders' Funds and summary Cash Flow Statement are set out below.

INCOME STATEMENT

For the year ended 31 December 2021

(audited)

For the year ended For the year ended

31 December 2021 31 December 2020

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Net gains/(losses) on - 344,608 344,608 - (223,279) (223,279)

investments

Investment income 37,331 - 37,331 15,656 - 15,656

Other income 125 - 125 - - -

Investment management fee (3,752) (6,253) (10,005) (2,717) (4,529) (7,246)

Portfolio transaction costs - (2,790) (2,790) - (2,747) (2,747)

Other expenses (811) - (811) (731) - (731)

-------- -------- -------- -------- -------- --------

Net return before finance 32,893 335,565 368,458 12,208 (230,555) (218,347)

costs

and tax

Finance costs (349) (583) (932) (301) (502) (803)

-------- -------- -------- -------- -------- --------

Return on ordinary 32,544 334,982 367,526 11,907 (231,057) (219,150)

activities

before tax

Tax on ordinary activities - - - (48) - (48)

-------- -------- -------- -------- -------- --------

Return attributable to

equity shareholders 32,544 334,982 367,526 11,859 (231,057) (219,198)

====== ======= ======= ====== ======= =======

Returns per Ordinary Share 36.76p 378.43p 415.19p 13.28p (258.78)p (245.50)p

(Note 4)

The Board declared on 28 January 2022 a final dividend of 24.25p per Ordinary

Share. The Board declared on 27 July 2021 an interim dividend of 10.95p per

Ordinary Share.

The total column of this statement is the profit and loss account of the

Company. All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued in the year.

A Statement of Comprehensive Income is not required as all gains and losses of

the Company have been reflected in the above statement.

RECONCILIATION OF MOVEMENTS IN SHAREHOLDERS' FUNDS

For the year ended 31 December 2021

(audited)

Capital

Share redemption Special Capital Revenue

Capital reserve reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000 £'000

Balance as at 31 December 2020 888 100 96,663 979,563 70,716 1,147,930

Return on ordinary activities - - - 334,982 32,544 367,526

after taxation

Equity dividends paid (Note 3) - - - - (30,005) (30,005)

Purchase of Ordinary Shares (9) 9 (12,886) - - (12,886)

-------- -------- -------- -------- -------- --------

Balance as at 31 December 2021 879 109 83,777 1,314,545 73,255 1,472,565

====== ====== ====== ====== ====== ======

For the year ended 31 December 2020

(audited)

Capital

Share redemption Special Capital Revenue

Capital reserve reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000 £'000

Balance as at 31 December 2019 895 93 102,753 1,210,620 91,439 1,405,800

Return on ordinary activities - - - (231,057) 11,859 (219,198)

after taxation

Equity dividends paid (Note 3) - - - - (32,582) (32,582)

Purchase of Ordinary Shares (7) 7 (6,090) - - (6,090)

-------- -------- -------- -------- -------- --------

Balance as at 31 December 2020 888 100 96,663 979,563 70,716 1,147,930

====== ====== ====== ====== ====== ======

BALANCE SHEET

As at 31 December 2021

(audited)

31 December 31 December

2021 2020

£'000 £'000

Fixed assets

Investments at fair value through profit or 1,554,585 1,218,073

loss (Note 5)

---------- ----------

Current assets

Debtors 1,875 968

Cash at bank 3,418 2,963

---------- ----------

5,293 3,931

Creditors (amounts falling due within one (905) (1,231)

year)

---------- ----------

Net current assets 4,388 2,700

---------- ----------

Total Assets less Current Liabilities 1,558,973 1,220,773

Creditors (amounts falling due after more (86,408) (72,843)

than one year)

---------- ----------

Total Net Assets 1,472,565 1,147,930

======= =======

Capital and reserves: equity interests

Called up share capital 879 888

Capital redemption reserve 109 100

Special reserve 83,777 96,663

Capital reserve 1,314,545 979,563

Revenue reserve 73,255 70,716

---------- ----------

Total Shareholders' Funds 1,472,565 1,147,930

======= =======

Net Asset Value per Ordinary Share (Note 6) 1,674.35p 1,292.38p

CASH FLOW STATEMENT

For the year ended 31 December 2021

(audited)

31 December 2021 31 December 2020

£'000 £'000

Operating activities

Net revenue before finance costs and tax 32,893 12,208

Scrip dividends received

- (904)

Taxation - (48)

Investment management fee charged to (6,253) (4,529)

capital

(Increase)/Decrease in debtors (812) 1,841

Decrease in other creditors 37 -

-------- --------

Net cash inflow from operating activities 25,865 8,568

===== =====

Investing activities

Purchases of investments (381,045) (341,319)

Sales of investments 385,146 315,913

-------- --------

Cash Inflow / (outflow) from investment 4,101 (25,406)

activities

===== =====

Financing activities

Purchases of Ordinary Shares (12,156) (6,090)

Equity dividends paid (Note 3) (30,005) (32,582)

Interest and fees paid (850) (964)

Gross drawdowns of bank debt facilities (before any 134,000 182,250

costs)

Gross repayments of bank debt facilities (120,500) (123,000)

(before any costs)

-------- --------

Cash (outflow) / inflow from financing (29,511) 19,614

activities

===== =====

Change in cash during the period 455 2,776

===== =====

Cash at the start of the period 2,963 187

Cash at the end of the period 3,418 2,963

====== ======

SUMMARY NOTES TO THE FINANCIAL STATEMENTS

1. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been presented under Financial Reporting Standard

102 ("FRS 102") and under the AIC's Statement of Recommended Practice

"Financial Statements of Investment Trust Companies and Venture Capital Trusts"

("SORP") issued in 2021. The financial statements have been prepared on a going

concern basis under the historical cost convention, modified to include the

revaluation of the Company's investments as described below. The Directors'

assessment of the basis of going concern is described above. The functional and

presentation currency is pounds sterling, which is the currency of the

environment in which the Company operates. The Board confirms that no critical

accounting judgements or significant sources of estimation uncertainty have

been applied to the financial statements and therefore there is not a

significant risk of a material adjustment to the carrying amounts of assets and

liabilities within the next financial year.

2. INVESTMENT MANAGEMENT FEE

The Managers, Aberforth Partners LLP, receive an annual management fee, payable

quarterly in advance, equal to 0.75% of net assets up to £1 billion, and 0.65%

thereafter. The investment management fee has been allocated 62.5% to capital

reserve and 37.5% to revenue reserve, in line with the Board's expected long

term split of returns, in the form of capital gains and income respectively,

from the investment portfolio of the Company.

3.

DIVIDS

Year to 31 December Year to 31

2021 December 2020

£'000 £'000

Amounts recognised as distributions to equity holders in the period:

Final dividend for the year ended 31 20,318 19,697

December 2020 of 22.90p (2019: 22.00p)

paid on 9 March 2021

Special dividend for the year ended 31 - 3,581

December 2020 of nil (2019: 4.00p)

Interim dividend for the year ended 31 9,687 9,304

December 2021 of 10.95p (2020: 10.40p)

paid on 5 August 2021

------------ ------------

30,005 32,582

------------ ------------

The final dividend for the year ended 31 December 2021 of 24.25p (2020: 22.90p)

will be paid, subject to shareholder approval, on 8 March 2022. These dividends

for 2021 and 2020 have not been included as a liability in the financial

statements.

4. RETURNS PER ORDINARY

SHARE

Year to 31 Year to 31

December 2021 December 2020

The returns per Ordinary Share are based

on: £ £(219,198,000)

Returns attributable to Ordinary 367,526,000

Shareholders

Weighted average number of shares in issue 88,519,932 89,285,989

during the year

Return per Ordinary 415.19p (245.50)p

Share

There are no dilutive or potentially dilutive shares in issue.

5. INVESTMENTS AT FAIR VALUE

In accordance with FRS 102 fair value measurements have been classified using

the fair value hierarchy:

Level 1 - using unadjusted quoted prices for identical instruments in an active

market;

Level 2 - using inputs, other than quoted prices included within Level 1, that

are directly or indirectly observable (based on market data); and

Level 3 - using inputs that are unobservable (for which market data is

unavailable).

Investments held as fair value through profit or loss

Level 1 Level 2 Level 3 Total

As at 31 December 2021 £'000 £'000 £'000 £'000

Listed equities 1,554,585 - - 1,554,585

Unlisted equities - - - -

------------ ------------ ------------ ------------

Total financial asset 1,554,585 - - 1,554,585

investments

------------ ------------ ------------ ------------

During the year, an investment, Lookers, with a book cost of £16,538,000, was

transferred back from Level 3 to Level 1 when its shares relisted on 29 January

2021.

Level 1 Level 2 Level 3 Total

As at 31 December £'000 £'000 £'000 £'000

2020

Listed equities 1,214,140 - 3,933 1,218,073

Unlisted equities - - - -

------------ ------------ ------------ ------------

Total financial asset 1,214,140 - 3,933 1,218,073

investments

------------ ------------ ------------ ------------

6. NET ASSET VALUES

The Net Asset Value per share and the net assets attributable to the Ordinary

Shares at the year end are calculated in accordance with their entitlements in

the Articles of Association and were as

follows.

31 December 2021 31 December 2020

Net assets attributable £ £

1,472,565,000 1,147,930,000

Ordinary Shares in issue at the end 87,948,266 88,823,066

of the year

Net Asset Value per Ordinary Share 1,674.35p 1,292.38p

7. SHARE CAPITAL

During the year, the Company bought back and cancelled 874,800 shares (2020:

710,000) at a total cost of £12,886,000 (2020: £6,090,000). During the period 1

January to 28 January 2022, 220,000 shares have been bought back for

cancellation.

8. RELATED PARTY TRANSACTIONS

The Directors have been identified as related parties and their fees and

shareholdings are detailed in the Directors' Remuneration Report on pages 34

and 35 of the Annual Report. During the year no Director was interested in any

contract or other matter requiring disclosure under section 412 of the

Companies Act 2006.

9. INDEPENT AUDITOR

During the year an audit tender process was conducted by the Audit Committee

and the Board has agreed to appoint Johnston Carmichael LLP as auditor for the

financial year ending 31 December 2022. In view of its length of tenure to

date, Deloitte LLP was not invited to tender. Deloitte LLP remains in office as

auditor until the forthcoming Annual General Meeting at which a resolution for

the appointment of Johnston Carmichael LLP will be proposed.

10. FURTHER INFORMATION

The foregoing do not constitute statutory accounts (as defined in section 434

(3) of the Companies Act 2006) of the Company. The statutory accounts for the

year ended 31 December 2020 which contained an unqualified Report of the

Auditors, have been lodged with the Registrar of Companies and did not contain

a statement required under section 498(2) or (3) of the Companies Act 2006.

Certain statements in this announcement are forward looking statements. By

their nature, forward looking statements involve a number of risks,

uncertainties or assumptions that could cause actual results or events to

differ materially from those expressed or implied by those statements. Forward

looking statements regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the future.

Accordingly, undue reliance should not be placed on forward looking statements.

The Annual Report is expected to be posted to shareholders by 7 February 2022.

Members of the public may obtain copies from Aberforth Partners LLP, 14

Melville Street, Edinburgh EH3 7NS or from its website: www.aberforth.co.uk.

CONTACT: Euan Macdonald or Jeremy Hall, Aberforth Partners LLP, 0131 220 0733

Aberforth Partners LLP, Secretaries - 28 January 2022

ANNOUNCEMENT ENDS

END

(END) Dow Jones Newswires

January 28, 2022 10:04 ET (15:04 GMT)

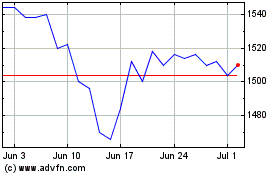

Aberforth Smaller Compan... (LSE:ASL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Aberforth Smaller Compan... (LSE:ASL)

Historical Stock Chart

From Sep 2023 to Sep 2024