TIDMASAI

RNS Number : 6471F

ASA International Group PLC

18 November 2020

ASA International Group plc October 2020 business update

Amsterdam, 18 November 2020 - ASA International, ("ASA

International", the "Company" or the "Group"), one of the world's

largest international microfinance institutions, today provides the

following update of the impact of COVID-19 on its business

operations as at 31 October 2020.

-- The immediate health impact of COVID-19 on the Company's operations remains low.

-- Liquidity continues to remain high with approximately USD

112m of unrestricted cash and cash equivalents across the Group on

31 October 2020.

-- The pipeline of funding deals under negotiation totalled approximately USD 183.5m.

-- Collection efficiency remained high with 8 out of 13

operating countries showing percentage rates in the mid to high

nineties.

-- Kenya and Uganda significantly improved collections reaching 91% and 78%, respectively.

-- The Philippines continued to struggle with collections

reducing from 74% to 69% as result of the imposition by the

government of a 60-days grace period for the repayment of loan

instalments until the end of December which many clients availed,

the ongoing disruption caused by limited, regional lockdowns in

certain parts of the country as well as the three major typhoons

which hit the Philippines in quick succession recently.

-- Collections also were adversely affected by the institution

of regional lockdowns affecting 56 branches in Myanmar and the

temporary suspension of operations in up to 50 branches in Sri

Lanka due to a rapid increase in COVID-19 infections.

-- Disbursements as percentage of collections exceeded 100% in

many countries with the exception of India, Myanmar, the

Philippines, Uganda, Rwanda and Zambia.

-- As a result, the number of clients and Gross OLP continued to

gradually increase reaching approximately 2.3m and USD 428m,

respectively, across the Group.

-- The Moratoriums granted for October amounted to USD 7.1m and

primarily stemmed from (i) the 60-day grace period for the

repayment of loan instalments in the Philippines, (ii) the regional

lockdowns for up to two months in Myanmar, and (iii) the temporary

suspension of operations in Sri Lanka.

Health impact of COVID-19 on our communities

-- The immediate health impact of COVID-19 on the Company's

operations remain ed low with 81 of our over 12,500 staff members

confirmed as infected , but with no deaths . The number of

confirmed infections amongst our 2.3m clients increased from 419 at

end of September to 1,192 as at 31 October 2020, resulting in 21

deaths.

Funding

-- Unrestricted cash and cash equivalents remained high at approximately USD 112m.

-- The Company secured approximately USD 22.7m of new loans from

local and international lenders in October 2020.

-- The majority of the Company's USD 183.5 pipeline of future

wholesale loans are supported by (agreed) term sheets and/or draft

loan documentation. The terms and conditions of the remaining loans

are being negotiated with lenders.

Collection efficiency until 31 October 2020 (1)

Country 01-07 08-14 15-22 23-29 30 Aug-05 06-12 13-19 20-30 01-15 16-31

Aug Aug Aug Aug Sep Sep Sep Sep Oct Oct

------ ------ ------ ------ ---------- ------ ------ ------ ------

India 41% 49% 53% 58% 60% 68% 78% 74% 77% 76%

Pakistan 96% 96% 96% 94% 96% 96% 96% 97% 97% 97%

Sri Lanka 93% 92% 95% 95% 94% 91% 96% 99% 90% 83%

Myanmar 96% 96% 97% 97% 95% 93% 91% 78% 65% 75%

The Philippines 70% 65% 65% 67% 67% 68% 69% 74% 65% 68%

Ghana 101% 100% 99% 99% 99% 99% 99% 100% 99% 100%

Nigeria 90% 94% 90% 90% 91% 91% 91% 93% 93% 94%

Sierra Leone 94% 96% 96% 97% 94% 97% 96% 99% 99% 99%

Kenya 69% 73% 70% 74% 76% 76% 77% 81% 84% 91%

Tanzania 100% 98% 98% 98% 98% 98% 99% 99% 99% 99%

Uganda 57% 63% 63% 63% 65% 67% 72% 73% 72% 78%

Rwanda 88% 89% 86% 82% 85% 84% 88% 87% 86% 91%

Zambia 99% 99% 99% 99% 100% 100% 100% 100% 99% 99%

----------------- ------ ------ ------ ------ ---------- ------ ------ ------ ------ ------

(1) Collection efficiency refers to actual collections from

clients divided by expected collections for the period; since

any moratorium on the repayment of loans are only granted to

clients after the end of the month, the collection efficiency

is not affected by the grant of such moratorium;

-- Collection efficiency across the Group remained high with 8

out of 13 operating countries showing percentage rates in the mid

to high nineties.

-- Kenya and Uganda significantly improved collections reaching 91% and 78%, respectively.

-- The government imposed a 60-day grace period for the

repayment of loans adversely affected collections in the

Philippines.

-- Collections were also affected by the institution of a

temporary lockdowns in Yangon and parts of Bago Division in Myanmar

and the partial suspension of operations in Sri Lanka due to

increased COVID-19 infections.

Disbursements vs collections of loans until 31 October 2020

(2)

-- With the business environment gradually improving in many

countries, disbursements of fresh loans continued to increase in

amount and as a percentage of weekly collections in many countries

in October.

Country 01-07 08-14 15-22 23-29 30 Aug-05 06-12 13-19 20-30 01-15 16-31

Aug Aug Aug Aug Sep Sep Sep Sep Oct Oct

------ ------ ------ ------ ---------- ------ ------ ------ ------

India 54% 70% 78% 74% 75% 79% 78% 91% 91% 68%

Pakistan 72% 85% 90% 91% 95% 89% 93% 99% 99% 99%

Sri Lanka 8% 74% 128% 145% 64% 118% 122% 144% 17% 135%

Myanmar 73% 101% 114% 122% 97% 104% 103% 63% 24% 44%

The Philippines 57% 51% 70% 79% 77% 80% 90% 111% 74% 96%

Ghana 120% 120% 112% 117% 113% 115% 123% 119% 116% 95%

Nigeria 67% 96% 104% 104% 87% 115% 129% 139% 152% 136%

Sierra Leone 110% 131% 139% 97% 105% 117% 115% 123% 123% 116%

Kenya 85% 87% 99% 101% 93% 95% 101% 108% 92% 103%

Tanzania 104% 121% 116% 112% 97% 107% 111% 119% 101% 106%

Uganda 42% 75% 78% 69% 65% 68% 69% 66% 88% 95%

Rwanda 88% 93% 79% 87% 81% 79% 84% 81% 83% 87%

Zambia 136% 184% 181% 188% 129% 178% 151% 85% 93% 86%

----------------- ------ ------ ------ ------ ---------- ------ ------ ------ ------ ------

(2) Disbursements vs collections refers to actual loan disbursements

made to clients divided by total loans collected from clients in

the period

Development of Clients and Outstanding Loan Portfolio

-- With disbursements gradually increasing in many operating

countries , Gross OLP (3) increased to USD 428m (up 1%) in October

2020 compared to the previous month.

Gross OLP (in

Clients (in thousands) Delta USDm) Delta

-------------------------

Dec-Oct Dec-Oct Sep-Oct

Countries Dec/19 Sep/20 Oct/20 Dec-Oct Sep-Oct Dec/19 Sep/20 Oct/20 USD CC USD

India 732 709 713 -3% 1% 183.0 168.3 166.3 -9% -5% -1%

Pakistan 439 417 409 -7% -2% 62.9 54.4 58.4 -7% -4% 7%

Sri Lanka 63 57 56 -11% -1% 10.1 9.1 9.0 -11% -10% -1%

Myanmar 152 134 128 -16% -4% 31.7 31.9 30.4 -4% -17% -5%

The

Philippines 340 262 278 -18% 6% 53.2 47.0 47.2 -11% -15% 0%

Ghana 165 145 151 -9% 4% 41.7 39.8 40.6 -3% 0% 2%

Nigeria 260 222 228 -12% 3% 33.5 25.4 28.1 -16% -12% 11%

Sierra

Leone 34 32 35 3% 8% 2.9 3.9 4.2 45% 46% 8%

Kenya 101 81 86 -15% 5% 17.7 12.5 12.8 -28% -22% 2%

Tanzania 123 104 108 -12% 4% 20.5 19.3 20.5 0% 1% 6%

Uganda 101 83 81 -20% -2% 10.4 7.7 7.9 -24% -23% 3%

Rwanda 21 19 19 -11% 0% 3.0 2.6 2.6 -14% -11% -1%

Zambia 2 4 5 146% 14% 0.2 0.4 0.4 116% 216% -3%

Total 2,533 2,269 2,297 -9% 1% 471 422 428 -12% -7% 1%

(3) Loan portfolio including the off-book BC and DA model,

excluding interest receivable and before deducting the ECL

provision and modification loss

Selected moratorium (4) on loan repayments

As %

Clients under moratorium of

Total

Countries Mar Apr May Jun Jul Aug Sep Oct Clients

India 0 0 0 182,318 181,878 165,618 0 0 0%

Pakistan 0 0 0 0 0 0 0 0 0%

Sri Lanka 0 0 0 37,891 9,002 78 116 23,430 42%

Myanmar 2,307 2,101 35,056 12,394 7,876 15,308 32,118 64,501 50%

The Philippines 1,297 0 57,130 145,086 65,405 59,626 100,427 95,241 34%

Ghana 0 0 0 0 0 0 0 0 0%

Nigeria 0 0 4,042 10,523 9,763 0 0 0 0%

Sierra Leone 0 91 1,225 1,336 1,178 0 0 0 0%

Kenya 20,453 17,366 9,660 7,778 26,697 0 0 0 0%

Tanzania 0 194 5,323 4,162 0 0 0 0 0%

Uganda 8,269 0 0 75,360 59,563 49,897 3,557 0 0%

Rwanda 436 0 7,746 7,886 4,703 2,800 0 0 0%

Zambia 0 0 0 0 0 0 0 0 0%

Total 32,762 19,752 120,182 484,734 366,065 293,327 136,218 183,172 8.0%

October

Moratorium amounts (in USD thousands) moratoriums

---------------------------------------------------------------------

As % of

as % of Total

Countries Mar Apr May Jun Jul Aug Sep Oct Total OLP Moratoriums

India 0 0 0 5,831 5,332 3,633 0 0 14,796 0% 28%

Pakistan 0 0 0 0 0 0 0 0 0 0% 0%

Sri Lanka 0 0 0 1,160 250 2 24 264 1,699 3% 3%

Myanmar 42 43 732 347 253 408 877 1,973 4,677 6% 9%

The Philippines 16 0 927 6,247 2,110 2,253 3,928 4,902 20,382 10% 39%

Ghana 0 0 0 0 0 0 0 0 0 0% 0%

Nigeria 0 0 137 465 431 0 0 0 1,033 0% 2%

Sierra

Leone 0 1 10 19 21 0 0 0 51 0% 0%

Kenya 675 432 2,146 730 807 0 0 0 4,790 0% 9%

Tanzania 0 5 147 115 0 0 0 0 266 0% 1%

Uganda 76 0 0 1,698 1,536 1,156 155 0 4,620 0% 9%

Rwanda 5 0 161 218 125 75 0 0 584 0% 1%

Zambia 0 0 0 0 0 0 0 0 0 0% 0%

Total 813 482 4,260 16,831 10,863 7,528 4,984 7,139 52,900 1.7% 100.0%

(4) Moratoriums relate to clients who have received an extension

for the payment of one or more loan instalments during the

month.

-- In October 2020, the moratorium on loan repayments granted to

clients amounted to USD 7.1m, which represents 1.7 % of the Group's

Gross OLP.

-- Moratoriums were granted to clients in the Philippines, Myanmar and Sri Lanka.

-- In the Philippines, the new government directive for

financial institutions to offer clients a 60-day grace period for

the payment of loan instalments was availed by many clients. The

country also experienced three major typhoons hitting Luzon Island

in recent weeks, which caused substantial disruption to our

clients' businesses on top of the existing disruption already

caused by COVID-19.

-- In Myanmar, the institution of regional lockdowns caused the

temporary closure of 56 branches in Yangon and parts of Bago Region

for a period of up to two months.

-- Due to the rapidly increasing number of COVID-19 infections

in Sri Lanka, operations were temporarily suspended in more than 50

branches.

Enquiries:

ASA International Group plc

Investor Relations +31 6 2030 0139

Véronique Schyns vschyns@asa-international.com

About ASA International Group plc

ASA International is one of the world's largest international

microfinance institutions, with a strong commitment to financial

inclusion and socioeconomic progress. The company provides small,

socially responsible loans to low-income, financially underserved

entrepreneurs, predominantly women, across South Asia, South East

Asia, West and East Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFZMMMLNFGGZM

(END) Dow Jones Newswires

November 18, 2020 02:00 ET (07:00 GMT)

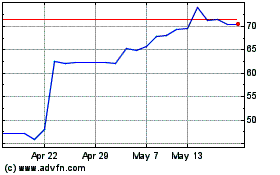

Asa (LSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asa (LSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024