KKR to Buy 20% Stake in Singtel's Data Centre Business for S$1.1 Billion

September 17 2023 - 8:18PM

Dow Jones News

By P.R. Venkat

Private-equity firm KKR has agreed to buy a 20% stake in the

regional data center business of Singapore Telecommunications for

1.1 billion Singapore dollars (US$800.0 million).

The telecom company said Monday that the investment to be made

by a fund managed by KKR puts the enterprise value of Singtel's

overall regional data center business at S$5.5 billion.

Singtel said that KKR could increase its stake to 25% by 2027 at

a pre-agreed valuation.

Singtel will use proceeds from the sale to expand its regional

data center business across Asean markets, including Singapore,

Indonesia, and Thailand, while exploring markets like Malaysia and

others.

"This will widen the business' strategic choices, giving a

variety of options to monetise in the future," Singtel said.

The transaction is expected to be completed by the fourth

quarter of this year, subject to regulatory approvals.

"With more than S$6 billion being unlocked since we embarked on

our strategic reset two years ago, we continue to focus on

unlocking value for our shareholders," Singtel Chief Financial

Officer Arthur Lang said.

KKR is making this investment as part of its Asia infrastructure

strategy.

Some of its past investments include Pinnacle Towers, a digital

infrastructure platform in Asia with a strong focus on the

Philippines; First Gen, a provider of clean and renewable power in

the Philippines; and Aster Renewable Energy, a platform that

develops, builds, and operates solar, wind, and energy storage

projects in the Asian region.

Write to P.R. Venkat at venkat.pr@wsj.com

(END) Dow Jones Newswires

September 17, 2023 20:03 ET (00:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

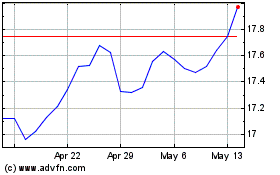

Singapore Telecommunicat... (PK) (USOTC:SGAPY)

Historical Stock Chart

From Apr 2024 to May 2024

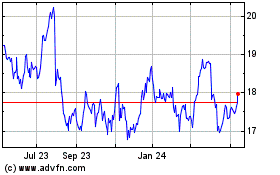

Singapore Telecommunicat... (PK) (USOTC:SGAPY)

Historical Stock Chart

From May 2023 to May 2024