Quarterly Report (10-q)

September 27 2021 - 4:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended November

30, 2020

or

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to __________

Commission file number: 000-53556

MINING GLOBAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

|

74-3249571

|

State or Other Jurisdiction of

Incorporation or Organization

|

|

I.R.S. Employer

Identification No.

|

|

224 Datura St.,Suite 1015

West Palm Beach FL

|

|

33401

|

|

Address of Principal Executive Offices

|

|

Zip Code

|

Registrant’s telephone number, including

area code (561) 259-3009

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☐ No ☒

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☒

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of September 27, 2021, the Registrant had

7,225,161,617 shares of common stock outstanding.

Explanatory Note

In accordance with the new 15c211 requirements the company is providing these interim statements until the matter is heard by the Nevada

courts in the custodianship hearing. New 15c211 coming into effect September 28, 2021.

Mining Global Inc.

(Formerly Yaterra Ventures Corp.)

Balance Sheet

As at November 30, 2020 (Unaudited)

|

|

|

Notes

|

|

As at

November 30, 2020 (Unaudited)

|

|

|

|

|

|

|

($)

|

|

|

ASSETS

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

4

|

|

|

17,118

|

|

|

Total Current Assets

|

|

|

|

|

17,118

|

|

|

|

|

|

|

|

|

|

|

Fixed assets

|

|

5

|

|

|

727,384

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

|

|

744,502

|

|

|

|

|

|

|

|

|

|

|

EQUITY & LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

6

|

|

|

303,727

|

|

|

Short term debt

|

|

7

|

|

|

848,123

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

|

|

1,151,850

|

|

|

|

|

|

|

|

|

|

|

Long term debt

|

|

|

|

|

256,000

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

|

|

1,407,850

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock ($0.001 Par Value, 100,000,000 shares authorized, 2,000,000 shares issued

|

|

|

|

|

1,000

|

|

|

Common stock, $0.001 Par Value, 6,710,000,000 shares authorized 6,485,161,617, share issued and outstanding

|

|

8

|

|

|

6,485,162

|

|

|

Additional paid in capital

|

|

|

|

|

872,269

|

|

|

Accumulated deficit

|

|

|

|

|

(8,021,779

|

)

|

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

|

|

|

(663,348

|

)

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity

|

|

|

|

|

744,502

|

|

Mining Global Inc.

(Formerly Yaterra Ventures Corp.)

Statement of Profit and loss

For the quarter ended November 30, 2020

|

|

|

Notes

|

|

For the quarter ended

November 30, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Amount in $)

|

|

|

|

|

|

|

|

|

|

Gold Sales

|

|

|

|

|

38,077

|

|

|

Cost of sales

|

|

10

|

|

|

–

|

|

|

Gross profit

|

|

|

|

|

38,077

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expense

|

|

10

|

|

|

(63,526

|

)

|

|

|

|

|

|

|

|

|

|

Income / (Loss) from operations

|

|

|

|

|

(25,449

|

)

|

|

|

|

|

|

|

|

|

|

Other Income / (expense)

|

|

|

|

|

|

|

|

Interest expense

|

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

Net Profit / (loss) before provision for Income taxes

|

|

|

|

|

(25,449

|

)

|

|

Provision for income tax

|

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

Net Profit / (loss)

|

|

|

|

|

(25,449

|

)

|

Mining Global Inc.

(Formerly Yaterra Ventures Corp.)

Statement of Shareholders' Equity

As at November 30, 2020 (Unaudited)

|

|

|

Common Stock

|

|

|

Preferred Stock

|

|

|

Additional

Paid in

capital

|

|

|

Accumulated

Profit / (Deficit)

|

|

|

Total

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount is $

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at August 31, 2020 (Unaudited)

|

|

|

6,485,161,617

|

|

|

|

6,485,162

|

|

|

|

10,000,000

|

|

|

|

1,000

|

|

|

|

872,269

|

|

|

|

(7,996,330

|

)

|

|

|

(637,899

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit / (loss) for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(25,449

|

)

|

|

|

(25,449

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at November 30, 2020 (Unaudited)

|

|

|

6,485,161,617

|

|

|

|

6,485,162

|

|

|

|

10,000,000

|

|

|

|

1,000

|

|

|

|

872,269

|

|

|

|

(8,021,779

|

)

|

|

|

(663,348

|

)

|

Mining Global Inc.

(Formerly Yaterra Ventures Corp.)

Statement of Cash Flows

As at November 30, 2020 (Unaudited)

|

|

|

2020

|

|

|

Cash flow from operating activities

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / profit before income tax

|

|

|

(25,449

|

)

|

|

|

|

|

|

|

|

Adjustment for non cash charges and other items:

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation / amortization

|

|

|

–

|

|

|

Unrealized exchange loss / (gain)

|

|

|

–

|

|

|

|

|

|

(25,449

|

)

|

|

Changes in working capital

|

|

|

|

|

|

|

|

|

|

|

|

(Decrease) / increase in convertible debt

|

|

|

–

|

|

|

(Decrease) / increase in accrued wages

|

|

|

27,888

|

|

|

(Decrease) / increase in trade and other payables

|

|

|

(5,883

|

)

|

|

|

|

|

22,005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from operating activities

|

|

|

(3,444

|

)

|

|

|

|

|

|

|

|

Cash flow from investing activities

|

|

|

|

|

|

|

|

|

|

|

|

Additions in intangibles assets

|

|

|

–

|

|

|

|

|

|

|

|

|

Cash flow from / (used) in investing activities

|

|

|

–

|

|

|

|

|

|

|

|

|

Cash flow from financing activities

|

|

|

|

|

|

|

|

|

|

|

|

Borrowings during the year

|

|

|

–

|

|

|

Dividends paid

|

|

|

–

|

|

|

|

|

|

|

|

|

Cash flow from financing activities

|

|

|

–

|

|

|

|

|

|

|

|

|

Increase / (decrease) in cash and cash equivalents

|

|

|

(3,444

|

)

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of the year

|

|

|

20,562

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of the year

|

|

|

17,118

|

|

Mining Global Inc.

(Formerly Yaterra Ventures Corp.)

Notes to the Financial Statements

For the quarter ended November 30, 2020

|

1.

|

LEGAL STATUS AND OPERATIONS

|

|

|

|

|

|

Mining Global Inc. was incorporated as Yaterra Ventures Corp. ("the Company") under the laws of state of Nevada on November 20, 2006.

|

|

|

|

|

|

The Company is "exploration stage company" and is primarily engaged in the acquisition, exploration and development of mineral properties. The company holds several mineral properties and is currently focusing its resources in assessing the mineral deposits of lead, zinc, copper, silver, gold or uranium capable of commercial extraction.

|

|

|

|

|

2.

|

BASIS OF PREPARATION

|

|

|

|

|

2.1

|

Statement of compliance

|

|

|

|

|

|

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America and pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") on a going concern.

|

|

|

|

|

2.2

|

Accounting Convention

|

|

|

|

|

|

These financial statements have been prepared on the basis of 'historical cost convention using accrual basis of accounting except as otherwise stated in the respective accounting policies notes.

|

|

|

|

|

|

Going concern

|

|

|

|

|

|

The Company had accumulated losses and had a negative cash flow from operations for the reporting period. Further, the accumulated (deficit) has raised at that date, which raises substantial doubt about its ability to continue as a going concern. The future of the Company is dependent upon its ability to obtain financing and upon future profitable operations from development of its natural properties. Management has plans to seek additional capital through private placement and public offering of its common stock. The financial statements don’t contain any adjustments relating to recoverability and classification of its recorded assets, or the amounts of and classification of its liabilities that might be necessary in the event the Company cannot continue to exist.

|

|

|

|

|

2.3

|

Critical accounting estimates and judgments

|

|

|

|

|

|

The preparation of financial statements in conformity with the approved accounting standards require management to make judgments, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making the judgments about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

|

|

|

|

|

|

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimates are revised if the revision affects only that period, or in the period of the revision and future periods.

|

|

|

The areas involving higher degree of judgment and complexity, or areas where assumptions and estimates made by the management are significant to the financial statements are as follows:

|

|

|

i)

|

Equipment - estimated useful life of equipment (note - 3.8)

|

|

|

ii)

|

Exploration and evaluation cost (note - 3.5)

|

|

|

iii)

|

Provision for doubtful debts (note - 3.4)

|

|

|

iv)

|

Provision for income tax (note - 3.1)

|

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

|

|

|

|

3.1

|

Income tax

|

|

|

|

|

|

The tax expense for the year comprises of income tax, and is recognized in the statement of earnings. The income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the balance sheet date. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation and establishes provisions where appropriate on the basis of amounts expected to be paid to the tax authorities.

|

|

|

|

|

|

Deferred income tax is accounted for using the balance sheet liability method in respect of all temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax bases used in the computation of taxable profit. Deferred income tax liabilities are recognised for all taxable temporary differences and deferred income tax assets are recognised to the extent that it is probable that taxable profits will be available against which the deductible temporary differences and unused tax losses can be utilized. Deferred income tax is calculated at the rates that are expected to apply to the period when the differences are expected to be reversed.

|

|

|

|

|

3.2

|

Trade and other payables

|

|

|

|

|

|

Liabilities for trade and other amounts payable are carried at cost, which is the fair value of the consideration to be paid in future for goods and services received, whether or not billed to the Company.

|

|

|

|

|

3.3

|

Provisions

|

|

|

|

|

|

A provision is recognized in the financial statements when the Company has a legal or constructive obligation as a result of past events and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of obligation.

|

|

|

|

|

3.4

|

Accounts Receivable

|

|

|

|

|

|

Accounts receivable are non-interest bearing obligations due under normal course of business. The management reviews accounts receivable on a monthly basis to determine if any receivables will be potentially uncollectible. Historical bad debts and current economic trends are used in evaluating the allowance for doubtful accounts. The Company includes any accounts receivable balances that are determined to be uncollectible in its overall allowance for doubtful accounts. After all attempts to collect a receivable have failed, the receivable is written off against the allowance. Based on the information available, the Company believes its allowance for doubtful accounts as of period ended is adequate.

|

|

|

|

|

3.5

|

Exploration and evaluation cost

|

|

|

|

|

|

The Company accounts for costs incurred in accordance with applicable accounting standards. These standards require that all exploration and evaluation expenditures are accounted for using the ‘successful efforts’ method of accounting. Costs are accumulated on a field-by-field basis. Geological and geophysical costs are expensed as incurred. Costs directly associated with an exploration well, and exploration and property leasehold acquisition costs, are capitalised until the determination of reserves is evaluated. If it is determined that commercial discovery has not been achieved, these costs are charged to expense.

|

|

|

Capitalisation is made within property, plant and equipment or intangible

assets according to the nature of the expenditure.

|

|

|

|

|

|

Once commercial reserves are found, exploration and evaluation assets are tested for impairment and transferred to development tangible and intangible assets. No depreciation and/or amortisation is charged during the exploration and evaluation phase.

|

|

|

|

|

3.6

|

Contingent liabilities

|

|

|

|

|

|

A contingent liability is disclosed when the Company has a possible obligation as a result of past events, the existence of which will be confirmed only by the occurrence or non-occurrence, of one or more uncertain future events, not wholly within the control of the Company; or when the Company has a present legal or constructive obligation, that arises from past events, but it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation, or the amount of the obligation cannot be measured with sufficient reliability.

|

|

|

|

|

3.7

|

Financial liabilities

|

|

|

|

|

|

Financial liabilities are recognized when the Company becomes party to the contractual provision of the instruments and the Company loses control of the contractual right that comprise the financial liability when the obligation specified in the contract is discharged, cancelled or expired. The Company classifies its financial liabilities in two categories: at fair value through profit or loss and financial liabilities measured at amortized cost. The classification depends on the purpose for which the financial liabilities were incurred. Management determines the classification of its financial liabilities at initial recognition.

|

|

|

(a)

|

Financial liabilities at fair value through profit or loss

|

|

|

|

|

|

|

|

Financial liabilities at fair value through profit or loss are financial liabilities held for trading. A financial liability is classified in this category if incurred principally for the purpose of trading or payment in the short-term. Derivatives (if any) are also categorized as held for trading unless they are designated as hedges.

|

|

|

|

|

|

|

(b)

|

Financial liabilities measured at amortized cost

|

|

|

|

|

|

|

|

These are non-derivative financial liabilities with fixed or determinable payments that are not quoted in an active market. These are recognized initially at fair value, net of transaction costs incurred and are subsequently stated at amortized cost; any difference between the proceeds (net of transaction costs) and the redemption value is recognized in the profit and loss account.

|

|

3.8

|

Property, plant and equipment

|

|

|

|

|

|

All equipments are stated at cost less accumulated depreciation and impairment loss. The cost of fixed assets includes its purchase price, import duties and non-refundable purchase taxes and any directly attributable costs of bringing the asset to its working condition and location for its intended use.

|

|

|

|

|

|

Depreciation on additions to property, plant and equipment is charged, using straight line method, on pro rata basis from the month in which the relevant asset is acquired or capitalized, upto the month in which the asset is disposed off. Impairment loss, if any, or its reversal, is also charged to income for the year. Where an impairment loss is recognized, the depreciation charge is adjusted in future periods to allocate the asset’s revised carrying amount, less its residual value, over its estimated useful life.

|

|

|

|

|

|

Maintenance and normal repair costs are expensed out as and when incurred. Major renewals and improvements are capitalized and assets so replaced, if any are retired.

|

|

|

|

|

|

Gains and losses on disposal of fixed assets, if any, are recognized in statement of profit and loss.

|

|

3.9

|

Cash and cash equivalents

|

|

|

|

|

|

Cash and cash equivalents include cash in hand and deposits held at call with banks. For the purpose of the statement of cash flows, cash and cash equivalents bank balances and short term highly liquid investments subject to an insignificant risk of changes in value and with maturities of less than three months.

|

|

|

|

|

3.10

|

Revenue recognition

|

|

|

|

|

|

Revenue is recognised to the extent it is probable that the economic benefits will flow to the Company and the revenue can be measured reliably. Revenue is measured at the fair value of the consideration received or receivable for goods sold or services rendered, net of discounts and sales tax and is recognised when significant risks and rewards are transferred.

|

|

|

|

|

3.11

|

Functional and presentation currency

|

|

|

|

|

|

Items included in the financial statements are measured using the currency of the primary economic environment in which the Company operates. The financial statements are presented in US (Dollars) which is the Company's presentation currency. All financial information presented in US Dollars has been rounded to the nearest dollar unless otherwise stated.

|

|

|

|

|

3.12

|

Foreign currency transactions

|

|

|

|

|

|

Foreign currency transactions are translated into the functional currency using the exchange rate prevailing on the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are translated into functional currency using the exchange rate prevailing at the statement of financial position date. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at year-end exchange rates are recognized in the profit and loss account.

|

|

|

|

|

3.13

|

Contingencies

|

|

|

|

|

|

The assessment of the contingencies inherently involves the exercise of significant judgment as the outcome of the future events cannot be predicted with certainty. The Company, based on the availability of the latest information, estimates the value of contingent assets and liabilities, which may differ on the occurrence / non-occurrence of the uncertain future event(s).

|

|

|

|

|

4.

|

Cash

|

|

|

|

|

|

This represent cash in hand and cash deposited in bank accounts (current) by the Company.

|

|

|

|

|

5.

|

Fixed assets

|

|

|

|

Amount in $

|

|

|

|

|

|

|

|

Fixed assets

|

|

727,384

|

|

|

6.

|

Accounts payable and accrued expenses

|

|

Opening balance

|

|

309,610

|

|

|

Net movement in liabilities during the period

|

|

(5,883

|

)

|

|

|

|

303,727

|

|

|

Opening balance

|

|

820,235

|

|

|

Net movement in liabilities during the period

|

|

27,888

|

|

|

|

|

848,123

|

|

|

8.

|

Share Capital

|

|

|

|

|

|

This represents ordinary share capital issued by the Company at the par value.The shares issued by the company, if any, during the period are represented in statement of changes in equity.

|

|

|

|

Amount in $

|

|

|

|

|

|

|

|

Entertainment

|

|

|

20,033

|

|

|

Travel and conveyance

|

|

|

8,644

|

|

|

Office and general

|

|

|

7,369

|

|

|

Repairs and maintenance

|

|

|

4,736

|

|

|

Bank charges and interest

|

|

|

3,922

|

|

|

Professional fees

|

|

|

18,822

|

|

|

|

|

|

|

|

|

|

|

|

63,526

|

|

|

10.

|

Contingencies and Commitments

|

|

|

|

|

|

The company has no contingency and commitment as at the end of reporting period.

|

|

11.

|

Other Information

|

|

|

|

|

|

i) Evaluation of Disclosure Controls and Procedures

|

|

|

|

|

|

Management of the Company has evaluated, with the participation of the Chief Executive Officer and Chief Financial Officer of the Company, the effectiveness of the Company's disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) promulgated by the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act")) as of the end of the period covered by this Quarterly Report on Form 10-Q. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer of the Company had concluded that the Company's disclosure controls and procedures as of the period covered by this Quarterly Report on Form 10-Q were effective.

|

|

|

|

|

|

ii) Changes in internal control over financial reporting .

|

|

|

|

|

|

Management of the Company has also evaluated, with the participation of the Chief Executive Officer of the Company, any change in the Company’s internal control over financial reporting that occurred during the period covered by this Quarterly Report on Form 10-Q and determined that there was no change in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

MINING GLOBAL, INC.

|

|

|

|

|

|

By:

|

/s/ Tom Ilic

|

|

|

|

Tom Ilic

Chief Executive Officer

|

Date: September

27, 2021

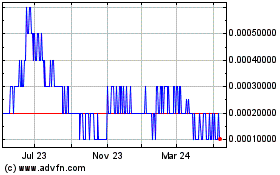

Mining Global (PK) (USOTC:MNGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

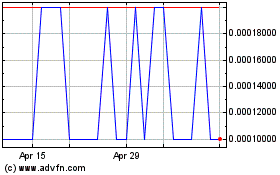

Mining Global (PK) (USOTC:MNGG)

Historical Stock Chart

From Apr 2023 to Apr 2024