Imperial Brands Sees 1st Half Profit Around Flat on Year; On Track to Meet Full-Year Guidance

April 13 2023 - 2:58AM

Dow Jones News

By Kyle Morris

Imperial Brands PLC said Thursday that it is on track to meet

full-year guidance and that first-half adjusted group operating

profit should be similar on year on a constant-currency basis.

The tobacco group said that, excluding the impact of its exit

from Russia, first-half group net revenue is seen at a similar

level to the prior-year period at constant currency, with strong

combustible pricing offset by volume declines as the prior period

benefited from Covid-19-related changes in buying patterns. It sees

a stronger net revenue performance in the second half, driven by

normalization of volume trends.

For the full year, it sees low single-digit constant currency

net revenue growth, in line with expectations.

First-half group adjusted operating profit is expected to be at

a similar level to last year on a constant currency basis.

Aggregate share in its top-five markets at the half year is

anticipated at a similar level to the prior period. The U.S., Spain

and Australia are anticipated to show growing or stable market

share, offsetting declines in Germany and the U.K.

First-half next generation products revenue is expected ahead of

the prior period, driven by strong growth in Europe.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

April 13, 2023 02:43 ET (06:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

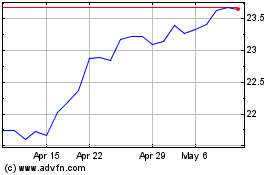

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Apr 2023 to Apr 2024