false

0001763925

0001763925

2024-01-10

2024-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 10, 2024

(Exact Name of Registrant as Specified in

Charter)

| Virginia |

333-257331 |

46-1892622 |

| (State or Other Jurisdiction of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

|

|

| |

3033 Wilson Boulevard

Suite E-605

Arlington, Virginia 22201 |

|

| (Address of Principal Executive Offices) |

| Registrant’s telephone number, including area code: |

(703) 216-8606 |

|

N/A |

| (Former Name of Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

| Securities registered pursuant to Section 12(b) of the Act: |

| |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

None |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Reference is made to the disclosure set

forth under Item 5.02 below, which disclosure is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

Reference is made to the disclosure set

forth under Item 5.02 below, which disclosure is incorporated herein by reference.

The shares of the Company’s common

stock, $0.01 par value per share (the “Common Stock”), issued to William R. Downs are exempt from registration under

Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), as a transaction by an issuer not

involving a public offering.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective as of January 10, 2024, Wm.

Barrett Wellman resigned from his positions as Chief Financial Officer and Secretary of CoJax Oil and Gas Corporation, a Virginia

corporation (the “Company”). As a result of Mr. Wellman’s resignation as the Company’s Chief Financial

Officer, he relinquished his role as the Company’s “Principal Financial and Accounting Officer” for Securities

and Exchange Commission (“SEC”) reporting purposes. In connection with his resignation, on January 10, 2024, the employment

agreement between the Company and Mr. Wellman, dated March 20, 2023, as amended, was terminated.

On January 10, 2024, Mr. Guzy resigned

from Chief Executive Officer, President and Chairman of the Board positions. As a result of Mr. Guzy’s resignation

as the Company’s Chief Executive Officer, he relinquished his role as the Company’s “Principal Executive Officer”

for SEC reporting purposes.

Effective immediately upon Mr. Wellman’s

resignation, the board of directors of the Company (the “Board”) appointed Jeffrey J. Guzy as the Company’s Chief

Financial Officer, Secretary and Treasurer. In addition, for SEC reporting purposes, Mr. Guzy was designated as the Company’s

“Principal Financial and Accounting Officer.”

In addition to serving as Chief Financial

Officer, Secretary and Treasurer upon this appointment to these offices, Mr. Guzy will continue serving as a member of the Board.

In connection with Mr. Guzy’s appointment as Chief Financial Officer, on January 10, 2024, the Company and Mr. Guzy entered

into a new employment agreement (the “Guzy 2024 Employment Agreement”), and the existing employment agreement between

the Company and Mr. Guzy dated February 14, 2023 (the “Guzy 2023 Employment Agreement”) related to his services as

Chief Executive Officer and Chairman of the Board was terminated. The Guzy 2024 Employment Agreement has a three (3) year term

unless terminated earlier, under the provisions stated in the Guzy 2024 Employment Agreement.

Pursuant to the Guzy 2024 Employment Agreement,

Mr. Guzy will be paid a base salary of $100,000 per annum, which salary will accrue and can either be paid in total when the Company

is adequately funded or, alternatively, the accrued unpaid base salary can be converted into shares of the Company’s common

stock at the lower conversion price of the initial public offering price of $2.00 or current market price at the time of conversion

by Mr. Guzy. Mr. Guzy may participate in any incentive compensation and other benefit plans; may be granted bonus performance bonus

payments to be paid in cash, stock, or both. In addition, the Guzy 2024 Employment Agreement includes provisions for paid vacation

time and expense reimbursement.

The Guzy 2024 Employment Agreement may

be terminated (i) immediately upon Mr. Guzy’s death or Disability; (ii) by the Company for Cause; (iii) by Mr. Guzy for Good

Reason upon thirty (30) days prior written notice of termination; (iv) for Business Failure (as all these terms are defined in

the Guzy 2024 Employment Agreement) or (v) other than for Cause or Good Reason, by Mr. Guzy or the Company upon sixty (60) days

prior written notice of termination. If Mr. Guzy terminates the employment for a Good Reason, then he would be entitled to:

a cash payment, payable in equal installments over a six (6) month period after Mr. Guzy terminates employment, equal to the sum

of the following: (a) subject to the payment of the following sums not causing the insolvency of the Company, the equivalent

of the greater of (i) twenty-four (24) months of Mr. Guzy’s then-current base salary or (ii) the remainder of the term of

the Guzy 2024 Employment Agreement; plus (b) any previously earned but unpaid salary through Mr. Guzy’s final date

of employment, being Mr. Guzy’s termination of employment.

On January 10, 2024, the Board increased

its size from two directors to three directors pursuant to the Bylaws of the Company and appointed William R. Downs to fill this

new directorship, effective immediately.

In addition, effective immediately upon

Mr. Guzy’s resignation from positions as Chief Executive Officer, Chairman of the Board and President, the Board appointed

William R. Downs as Chief Executive Officer, President, and Chairman. In addition, for SEC reporting purposes, Mr. Downs was designated

as the Company’s “Principal Executive Officer.”

William R. Downs, age 64, has more than

42 years of experience in Oil and Gas Industry, specifically in generating, evaluating and managing oil and gas exploration, development

and acquisition projects of private independent and public companies in the area of North and South Louisiana, East Texas, South

Arkansas, Mississippi, Oklahoma, Alabama and Montana. He also owned and managed several oilfield service companies.

Prior to joining CoJax, between February

2022 and October 2023, Mr. Downs served as Executive Vice President and Chief Operating Officer of Topcat Companies, an oilfield

service company, where he was responsible for the management of the workover rigs, saltwater transportation and disposal, drilling

fluids disposal, financial and safety oversight, oversight of individual vice presidents and their team management. Between August

2020 and October 2023, Mr. Downs served as Executive Vice President and Chief Operating Officer of Topcat Waste Management Facility

and was responsible for managing of the drilling fluids and solids waste disposal site in Waskom, Texas, saltwater disposal and

transportation and workover rigs.

In August 2017, Mr. Downs founded Downs

Energy Acquisitions and Downs Operating Company, an oil and gas production acquisition and operating company, which he managed

and owned between August 2017 and December 2020. This company operated three gas fields in East Texas and North Louisiana, and

Mr. Downs managed the operational, financial and personnel activities of the Company. In December 2020, Mr. Downs divested his

ownership in this company.

Mr. Downs is a Certified Petroleum Geologist,

a member of American Association of Petroleum Geologists; a former Convention Chairman and President of the GCAGS and a member

of Division of Professional Affairs. Mr. Downs earned his Bachelor of Science in Geology in 1981 from Centenary College of Louisiana.

The Board believes that based on his extensive

experience in the oil and gas industry, Mr. Downs will be a valuable member of the Board.

There are no arrangements or understandings

between Mr. Downs and any other person pursuant to which he was appointed as director and officer of the Company. In addition,

there are no family relationships between Mr. Downs and any of the Company’s other executive officers or directors.

In consideration for his services as Chief

Executive Officer, on January 10, 2024, the Company entered into an employment agreement with Mr. Downs (the “Downs Employment

Agreement”) with a three-year term, unless terminated earlier pursuant to the terms of the Downs Employment Agreement. Pursuant

to the Downs Employment Agreement, the Company will pay Mr. Downs a base annual salary in the amount of $150,000 per annum; such

salary is payable semi-monthly in equal installments and in accordance with Company’s payroll cycle and practices, provided

that if the Company is unable to pay Mr. Downs his base annual salary without impairing Company’s ability to pay Company’s

current operational debts and obligations, his salary will be accrued and such accrued base salary can either be paid in total

when Company is adequately funded or, alternatively, can be converted into shares of the Company’s Common Stock at the lower

conversion price of the initial public offering price of $2.00 or current market price at time of conversion by Mr. Downs. The

Downs Employment Agreement provides that Mr. Downs will be eligible for annual compensation increases, determined by the Board;

that he may participate in any incentive compensation and other benefit plans of the Company to the extent that he is eligible

to do so, may be granted bonus performance bonus payments to be paid in cash, stock, or both. In addition, the Downs Employment

Agreement includes provisions for paid vacation time and expense reimbursement.

Pursuant to the Downs Employment Agreement,

upon execution of the Downs Employment Agreement, the Company granted and issued Mr. Downs 100,000 shares of the Company’s

Common Stock under the Company’s current equity incentive plan.

The Downs Employment Agreement may be terminated

(i) immediately upon Mr. Downs death or Disability; (ii) by the Company for Cause; (iii) by Mr. Downs for Good Reason upon thirty

(30) days prior written notice of termination; (iv) for Business Failure (as all these terms are defined in the Downs Employment

Agreement) or (v) other than for Cause or Good Reason, by Mr. Downs or the Company upon not less than sixty (60) days prior written

notice of termination. If Mr. Downs terminates the employment for a Good Reason, then he would be entitled to: a cash payment,

payable in equal installments over a six (6) month period after the date of termination, equal to the sum of the following:

(a) subject to the payment of the following sums not causing the insolvency of the Company, the equivalent of the greater

of (i) twenty-four (24) months of Mr. Downs’ then-current base salary or (ii) the remainder of the term of the Downs Employment

Agreement; plus (b) any previously earned but unpaid salary through Mr. Downs’ final date of employment.

The foregoing summaries of the above-referenced

Guzy 2024 Employment Agreement and Downs Employment Agreement do not purport to be complete description of all terms, provisions

and covenants contained in these agreements and are qualified in their entirety by reference to those agreements, copies of which

are attached as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 16, 2024

COJAX OIL AND GAS CORPORATION

| By: |

/s/ William R. Downs |

|

William R. Downs

Chief Executive Officer |

|

Exhibit 10.1

Page I

EXECUTIVE EMPLOYMENT AGREEMENT

This

Executive Employment Agreement (this “Agreement”) is made as of the 10th day of January 10, 2024 by and between CoJax

Oil and Gas Corporation, a Virginia corporation (the “Company”), and William R. Downs, a natural person, residing in

the State of Louisiana (“Executive”). Executive and Company may also be referred to individually as a “party”

and collectively as the “parties.”

RECITALS:

WHEREAS, the Company wishes

to employ Executive as its Executive Chairman and Chief Executive Officer of the Company and the Executive wishes to accept such

employment; and

WHEREAS,

the Company and Executive wish to set forth the terms of Executive’s employment and certain additional agreements between Executive

and the Company.

NOW, THEREFORE, in consideration

of the foregoing recitals and the representations, covenants and terms contained herein, the parties agree as follows:

The

Company will employ Executive, and Executive will serve the Company, as Executive Chairman and Chief Executive Officer of the Company

and do so in accordance with the terms of this Agreement and reasonable directives of the Board for the period commencing on January

10, 2024 (the “Commencement Date”) and ending at 7:00 p.m., EST, on January 10, 2027. “Employment Period”

means the aforementioned three year term of this Agreement or, if this Agreement is terminated sooner in accordance with its terms

and conditions, then Employment Period means the shorter period for which this Agreement is in full force and effect. Except as

expressly stated otherwise below, each party’s obligation under this Agreement ends upon the expiration or termination of

the Employment Period.

The

Company hereby engages Executive as its Executive Chairman and Chief Executive Officer of the Company on the terms and conditions

set forth in this Agreement. Executive agrees to devote the Executive’s main business time, attention and energies to the business

and interests of the Company during the Employment Period. During the Employment Period, Executive shall report directly to the

Board of Directors of the Company (the “Board”) and shall exercise such authority, perform such executive functions and

discharge such responsibilities as are reasonably associated with or required Executive’s positions, commensurate with the authority

vested in Executive pursuant to this Agreement and consistent with the governing documents of the Company. The Company understands

that Executive is engaged in other Advisory and Board Duties of other private companies and Executive will minimize their impact

on Executive’s Company duties and avoid all conflicts of interest arising from those other advisory and board duties.

Executive’s

duties include:

| 1. | Strategic planning for Company in business development, marketing

and sales, and strategic planning; |

| 2. | Liaison for Company to shareholder groups, securities firms,

investment bankers, lenders, outside legal counsel and public auditors of Company, regulatory agencies, media and business partners

of Company; |

| 3. | Executive oversight of other senior officers of Company; |

| 4. | Negotiate significant business, financial and other corporate

transactions for Company; |

| 5. | Appoint senior officers of Company with Board’s review

and consent; |

| 6. | Report to the Board on matters under Executive’s control

and do so on a quarterly basis; |

| 7. | Direct business development and merger-and-acquisition efforts

of Company; |

| 8. | Direct media and public/investor relations for Company; |

| 9. | Perform administrative and related duties necessary to above

duties. |

| 3. | Compensation and Benefits |

(a) Salary: The Company shall pay to Executive, as full and fair compensation for the performance of his duties and obligations

under this Agreement and required for his position as Executive Chairman and Chief Executive Officer, a base annual salary (salary)

of $150,000 (one hundred fifty thousand dollars) per annum, payable semi-monthly in equal installments and in accordance

with Company’s payroll cycle and practices. The Executive will be eligible for annual compensation increases, determined

by the Board. In the event that the Company is unable to pay Executive the base annual salary without impairing Company’s

ability to pay Company’s current operational debts and obligations, the Executive’s salary will be accrued. The Executive’s

accrued base salary can either be paid in total when Company is adequately funded or, alternatively, the accrued unpaid base salary

can be converted into shares of the Company’s Common Stock at the lower conversion price of the initial public offering price

of $2.00 or current market price at time of conversion by the Executive. Company agrees to consider Executive’s base annual

salary a priority obligation and make every reasonable effort to meet its payroll obligations. Any conversion of unpaid base annual

salary must comply with all applicable laws and regulations, including insider trading laws and Section 16 and Rule 144 of Securities

Exchange Act of 1934, as amended, and any other pertinent underlying rules.

(b) Executive may participate in any incentive compensation and other benefit plans to the extent that he is eligible to do

so.

(c) During the Employment Period, Executive may be granted ad hoc, performance bonus payments to be paid in cash, stock or both

and on terms that are declared by the Board. Granting of any bonus will be at sole discretion of the Board.

(d) Incentive Stock Options. The Executive shall have the right to participate in the Company’s Stock Option Plan

(“Plan”), subject to eligibility under Plan terms and as determined in accordance with the Plan.

(e) Upon execution of this Agreement, Executive shall receive 100,000 (one hundred thousand) shares of Company Common

Stock, distributed according to Company Stock Plan.

(f) Upon uplist of Company to a senior stock exchange, Executive shall receive 150,000 (one hundred fifty thousand) shares

of Company Common Stock in accordance with the Company Stock Plan.

(g) Other Benefits. Executive shall be entitled to participate in all of the employee benefit plans, programs and arrangements

of the Company in effect during the Employment Period and that are generally available to senior executives of the Company, subject

to and on a basis consistent with the terms, conditions and overall administration of such plans, programs and arrangements. In

addition, and subject to eligibility, during the Employment Period, Executive shall be entitled to fringe benefits and perquisites

comparable to those of other senior executives of the Company, including, but not limited to, the following: (i) paid holidays

observed by Company; (2) twenty (20) days of paid vacation; and (iii) five (5) days of paid sick/personal leave. All vacation leave

must be approved in advance by the Board, which approval will not be unreasonably withheld, and which vacation leave may be taken

during any audit or review of Company financial statements. All leave is subject to Company’s published policies.

(h) Business Expenses. The Company shall promptly reimburse Executive for all appropriately documented, reasonable business

expenses incurred by Executive in the performance of and necessary to the performance of his duties under this Agreement, including

business telecommunications expenses and travel expenses. All expenses are reimbursed for cost without markup.

| 4. | Termination of Employment |

| (a) | Termination for Cause. The Company may terminate Executive’s employment

hereunder for Cause (defined below). For purposes of this Agreement and subject to Executive’s opportunity to cure as provided

in Section 4(c) hereof, the Company shall have Cause to terminate Executive’s employment hereunder if such termination shall be

the result of: |

| (i) | a material breach of fiduciary duty or material breach of the terms of this

Agreement or any other agreement between Executive and the Company (including without limitation any agreements regarding confidentiality,

inventions assignment and non-competition); |

| (ii) | the commission by Executive of any act of embezzlement, fraud, larceny or

theft on or from the Company; |

| (iii) | substantial and continuing neglect or inattention by Executive of the duties

of his employment or the willful misconduct or gross negligence of Executive in connection with the performance of his duties hereunder,

including insubordination, which willful misconduct or gross negligence or insubordination remains uncured for a period of fifteen

(15) days following the receipt date of written notice from the Board specifying the nature of the alleged breach; |

| (iv) | the commission by and indictment of Executive of any crime involving moral

turpitude or a felony; and |

| (v) | Executive’s performance or omission of any act which, in the judgment of

the Board, if known to the customers, clients, stockholders or any regulators of the Company, would have a material and adverse

impact on the business or public reputation of the Company. |

| (b) | Termination for Good Reason. Executive shall have the right at any

time to terminate his employment and this Agreement with the Company upon not less than thirty (30) days prior written notice of

termination for Good Reason (defined below). For purposes of this Agreement and subject to the Company’ s opportunity to cure as

provided in Section 4(c) hereof, Executive shall have Good Reason to terminate his employment hereunder if such termination shall

be the result of: |

| (i) | the Company’ s material breach of this Agreement; or |

| (ii) | A requirement by the Company that Executive perform any act or refrain from

performing any act that would be in violation of any applicable law. |

(c) Notice and Opportunity to Cure. Notwithstanding the foregoing provisions of this Section 4, it shall be a condition

precedent to the Company’s right to terminate Executive’ s employment for Cause and Executive’s right to terminate for Good Reason

that (i) the party seeking termination shall first have given the other party written notice stating with specificity the reason

for the termination (“breach”) and (ii) if such breach is susceptible of cure or remedy, a period of fifteen (15) days

from and after the date of the giving of such notice shall have elapsed without the breaching party having effectively cured or

remedied such breach during such 15-day period, unless such breach cannot be cured or remedied within fifteen (15) days, in which

case the period for remedy or cure shall be extended for a reasonable time (not to exceed an additional thirty (30) days) provided

the breaching party has made and continues to make a diligent and good faith effort to effect such remedy or cure.

(d) Voluntary Termination. Executive, at his election, may terminate his employment and this Agreement upon not less

than sixty (60) days prior written notice of termination other than for Good Reason and without cause.

(e) Termination Upon Death or Permanent and Total Disability. The Employment Period shall be terminated by and as of

the death of Executive. The Employment Period may be terminated by the Board if Executive shall be rendered incapable of performing

his executive duties to the Company by reason of any medically determined physical or mental impairment that can be reasonably

expected to result in death or that can be reasonably be expected to last for a period of either (i) six (6) or more consecutive

months from the first date of Executive’s absence due to the disability or (ii) nine (9) months during any twelve-month period

(a “Permanent and Total Disability”). If the Employment Period is terminated by reason of a Permanent and Total Disability

of Executive, the Company shall give thirty (30) days’ advance written notice to that effect to Executive.

(f) Termination at the Election of the Company. At the election of the Company, otherwise than for Cause as set forth

in Section 4(a) above, upon not less than sixty (60) days prior written notice of termination.

(g) Termination for Business Failure. Anything contained herein to the contrary notwithstanding, in the event the Company’s

business is discontinued by Board resolution and because continuation is rendered impracticable by substantial financial losses,

lack of funding, legal decisions , administrative rulings, declaration of war, dissolution, national or local economic depression

or crisis or any reasons beyond the control of the Company, then this Agreement shall terminate as of the day the Company determines

to cease operation by Board resolution with the same force and effect as if such day of the month were originally set as the termination

date hereof.

| 5. | Consequences of Termination |

(a) By Executive for Good Reason or the Company Without Cause. In the event of a termination of Executive’s employment

during the Employment Period by Executive for Good Reason pursuant to Section 4(b) or the Company without Cause pursuant to Section

4(f) the Company shall pay Executive (or his estate) and provide him with the following, provided that Executive enter into a release

of claims agreement agreeable to the Company and Executive:

(i) Cash Payment. A cash payment, payable in equal installments over a six (6) month period after Executive’s termination of employment, equal to the sum of the following:

(A) Base Annual Salary. Subject to the payment of the following sums in this subsection(i)(A) not causing the

insolvency of the Company, the equivalent of the greater of (i) twenty-four (24) months of Executive’ s then-current base

salary or (ii) the remainder of the term of this Agreement (the “Severance Period”); plus

(B) Earned but Unpaid Amounts. Any previously earned but unpaid salary through Executive’s final date of employment with the Company, and any previously earned but unpaid bonus amounts prior to the date of Executive’s termination of employment.

(C) Equity. All Options vested at time of termination shall be retained by Executive and all Options that are

not vested shall be accelerated and be deemed vested for purposes of this Section 5, unless vesting is prohibited by the Plan or

applicable laws or regulations.

(ii) Other Benefits. The Company shall provide continued coverage for the Severance Period under all health, life,

disability and similar employee benefit plans and programs of the Company on the same basis as Executive was entitled to participate

immediately prior to such termination, provided that Executive’ s continued participation is possible under the general terms and

provisions of such plans and programs. In the event that Executive’s participation in any such plan or program is barred, the Company

shall use its commercially reasonable efforts to provide Executive with benefits substantially similar (including all tax effects)

to those which Executive would otherwise have been entitled to receive under such plans and programs from which his continued participation

is barred. In the event that Executive is covered under substitute benefit plans of another employer prior to the expiration of

the Severance Period, the Company will no longer be obligated to continue the coverages provided for in this Section 5(a)(ii).

| (b) | Other Termination of Employment. In the event that Executive’s employment

with the Company is terminated during the Employment Period by the Company for Cause (as provided for in Section 4(a) hereof) or

by Executive other than for Good Reason (as provided for in Section 4(b) hereof), the Company shall pay or grant Executive any

earned but unpaid salary, bonus, and Options through Executive’s final date of employment with the Company, and the Company shall

have no further obligations to Executive. |

| (c) | Withholding of Taxes. All payments required to be made by the Company

to Executive under this Agreement shall be subject only to the required withholdings of such amounts, if any, relating to tax,

excise tax and other payroll deductions as may be required by law or regulation. |

| (d) | No Other Obligations. The benefits payable to Executive under this

Agreement are not in lieu of any benefits payable under any employee benefit plan, program or arrangement of the Company, except

as specifically provided herein, and Executive will receive such benefits or payments, if any, as he may be entitled to receive

pursuant to the terms of such plans, programs and arrangements. Except for the obligations of the Company provided by the foregoing

and this Section 5, the Company shall have no further obligations to Executive upon his termination of employment. |

| (e) | Mitigation or Offset. Executive shall not be required to mitigate

the damages provided by this Section 5 by seeking substitute employment or otherwise and there shall not be an offset of the payments

or benefits set forth in this Section 5, unless permitted by court order or applicable laws and regulations. |

This

Agreement and the rights and obligations of the parties hereto shall be construed in accordance with the laws of the Commonwealth

of Virginia, without giving effect to the principles of conflict of laws.

| 7. | Indemnity and Insurance |

The

Company shall indemnify and save harmless Executive for any liability incurred by reason of any act or omission performed by Executive

while acting in good faith on behalf of the Company and within the scope of the authority of Executive pursuant to this Agreement

and to the fullest extent provided under the Bylaws, the Articles of Incorporation and the Stock Corporation Act of Virginia, except

that Executive must have in good faith believed that such action was in, or not opposed to, the best interests of the Company,

and, with respect to any criminal action or proceeding, had no reasonable cause to believe that such conduct was unlawful. No indemnification

barred by regulations or policies of the Securities and Exchange Commission (“SEC”) or in clear violation of public

policy will be permitted under this Section 7 or otherwise.

If

the Executive is eligible under the insurance policy’s terms and conditions, then the Company shall provide that Executive

is covered by Directors and Officers insurance, if any, that the Company provides to other senior executives and/or Board members.

| 8. | Cooperation with the Company After Termination of Employment |

Following

termination of Executive’ s employment for any reason, Executive shall fully cooperate with the Company in all matters relating

to the winding up of Executive’ s pending work on behalf of the Company including, but not limited to, any litigation in which

the Company is involved, and the orderly transfer of any such pending work to other employees of the Company as may be designated

by the Company. Following any notice of termination of employment by either the Company or Executive, the Company shall be entitled

to such full time or part time services of Executive as the Company may reasonably require during all or any part of the sixty

(60)-day period following any notice of termination, provided that Executive shall be compensated for such services at the same

rate as in effect immediately before the notice of termination .

All

notices, requests and other communications pursuant to this Agreement shall be sent by overnight mail of by fax with proof of transmission

to the following addresses:

If to Executive:

William R. Downs

2025 Woodberry Ave.

Shreveport, LA 71106

Phone: (318) 465-1302

Email: will.downs@cojaxoilandgas.com

If to the Company:

CoJax Oil and Gas Corporation

Attn: William R. Downs, Chairman &

CEO

3033 Wilson Blvd, Suite E-605

Arlington, Virginia 22201

Phone: (703) 216-2606

Email: will.downs@cojaxoilandgas.com

| 10. | Non-Disclosure of Trade Secrets, Customer Lists and Other Proprietary Information |

(a) Confidentiality. For term of employment and one year thereafter, the Executive agrees not to use, disclose or communicate,

in any manner, proprietary information about the Company, its operations, clientele, or any other proprietary information, that

relate to the business of Company. This includes, but is not limited to, the names of Company’s customers, its marketing

strategies, operations, or any other information of any kind which would be deemed confidential or proprietary information of Company.

To the extent Executive feels that they need to disclose confidential information, they may do so only after being authorized to

so do in writing by the Company.

(b) Non-Solicitation

Covenant. Executive agrees that for a period of term of employment and one year following termination of employment, for any

reason whatsoever, Executive will not solicit customers or clients of Company. By agreeing to this covenant, Executive acknowledges

that their contributions to Company are unique to Company’s success and that they have significant access to Company’s

trade secrets and other confidential or proprietary information regarding Company’s customers or clients.

(c) Non-Recruit

Covenant. Executive agrees not to recruit any of Company’s employees for the purpose of any outside business either during

or for a period of one year after Executive’s tenure of employment with Company. Executive agrees that such effort at recruitment

also constitutes a violation of the non-solicitation covenant set forth above.

(d) Adherence to

Company’s Policies, Procedures, Rules and Regulations. Executive agrees to adhere by all of the policies, procedures,

rules and regulations set forth by the Company. These policies, procedures, rules and regulations include, but are not limited

to, those set forth within any Company employee manual, any summary benefit plan descriptions, or any other personnel practices

or policies or Company. To the extent that Company’s policies, procedures, rules and regulations conflict with the terms

of this Agreement, the specific terms of this Agreement will control.

Any

waiver of any breach of this Agreement shall not be construed to be a continuing waiver or consent to any subsequent breach on

the part of either Executive or of the Company.

| 12. | Non-Assignment; Successors |

Neither

party may assign his/her or its rights or delegate his/hers or its duties under this Agreement without the prior written consent

of the other party; provided, however, that (i) this Agreement shall inure to the benefit of and be binding upon the successors

and assigns of the Company upon any sale or all or substantially all of the Company’s assets, or upon any merger, consolidation

or reorganization of the Company with or into any other corporation, all as though such successors and assigns of the Company and

their respective successors and assigns were the Company; and (ii) this Agreement shall inure to the benefit of and be binding

upon the heirs, assigns or designees of Executive to the extent of any payments due to them hereunder. As used in this Agreement,

the term “Company’· shall be deemed to refer to any such successor or assign of the Company referred to in the preceding

sentence.

To the extent any provision

of this Agreement or portion thereof shall be invalid or unenforceable, it shall be considered deleted therefrom and the remainder

of such provision and of this Agreement shall be unaffected and shall continue in full force and effect. The restrictive covenants

and promises of the Executive contained in this Agreement will survive any termination or rescission of this Agreement, unless

the Company executes a written agreement specifically releasing the Executive from those restrictive covenants or any specified

restrictive covenants.

This Agreement

may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together will constitute

one and the same instrument.

Executive

and the Company shall submit to mandatory and exclusive binding arbitration, any controversy or claim arising out of, or relating

to, this Agreement or any breach hereof where the amount in dispute is greater than or equal to $75,000 (excluding attorney’s

fees and proceeding costs), provided, however, that the parties retain their right to, and shall not

be

prohibited , limited or in any other way restricted from, seeking or obtaining equitable relief from a court having jurisdiction

over the parties. In the event the amount of any controversy or claim arising out of, or relating to, this Agreement, or any breach

hereof, is less than $75,000 (excluding attorney’s fees and proceeding costs), the parties hereby agree to submit such claim

to mediation. Such arbitration shall be governed by the Federal Arbitration Act and conducted through the American Arbitration

Association (“AAA”) in Arlington County, Virginia before a single neutral arbitrator, in accordance with the National

Rules for the Resolution of Employment Disputes of the American Arbitration Association in effect at that time. The parties may

conduct only essential discovery prior to the hearing, as defined by the AAA arbitrator. The arbitrator shall issue a written decision

which contains the essential findings and conclusions on which the decision is based. Mediation shall be governed by, and conducted

through, the AAA. Judgment upon the determination or award rendered by the arbitrator may be entered in any court having jurisdiction

thereof.

This

Agreement and all exhibits, schedules and other attachments hereto and expressly referenced in this Agreement will constitute the

entire agreement by the Company and Executive with respect to the subject matter hereof and, except as specifically provided herein,

supersedes any and all prior agreements or understandings between Executive and the Company with respect to the subject matter

hereof, whether written or oral. This Agreement may be amended or modified only by a written instrument executed by Executive and

the Company. Any exhibits, attachments and schedules referenced herein are incorporated herein by reference.

IN WITNESS WHEREOF, the parties have executed this Agreement

as of the first date above.

CoJax Oil & Gas Corporation, a Virginia corporation

| By: |

/s/ Jeffrey J. Guzy |

|

| Name: Jeffrey J. Guzy |

|

| Title: Chief Financial Officer |

|

Accepted

| By: |

/s/ William R. Downs |

|

William R. Downs

Chief Executive Officer |

|

Exhibit 10.2

Page I

EXECUTIVE EMPLOYMENT AGREEMENT

This

Executive Employment Agreement (this “Agreement”) is made as of the 10th day of January, 2024 by and between

CoJax Oil and Gas Corporation, a Virginia corporation (the “Company”), and Jeffrey J. Guzy, a natural person, residing

in the Commonwealth of Virginia (“Executive”). Executive and Company may also be referred to individually as a “party”

and collectively as the “parties.”

RECITALS:

WHEREAS,

the Company wishes to employ Executive as its Chief Financial Officer and Secretary of the Company and the Executive wishes to

accept such employment; and

WHEREAS,

the Company and Executive wish to set forth the terms of Executive’s employment and certain additional agreements between

Executive and the Company.

NOW, THEREFORE, in consideration

of the foregoing recitals and the representations, covenants and terms contained herein, the parties agree as follows:

The

Company will employ Executive, and Executive will serve the Company, as Chief Financial Officer of the Company and do so in accordance

with the terms of this Agreement and reasonable directives of the Board for the period commencing on January 10, 2024 (the “Commencement

Date”) and ending at 7:00 p.m., EST, on January 10, 2027. “Employment Period” means the aforementioned three

year term of this Agreement or, if this Agreement is terminated sooner in accordance with its terms and conditions, then Employment

Period means the shorter period for which this Agreement is in full force and effect. Except as expressly stated otherwise below,

each party’s obligation under this Agreement end upon the expiration or termination of the Employment Period.

The Company hereby engages

Executive as its Chief Financial Officer and Secretary of the Company on the terms and conditions set forth in this Agreement.

Executive agrees to devote the Executive’s main business time, attention and energies to the business and interests of the

Company during the Employment Period. During the Employment Period, Executive shall report directly to the Board of Directors of

the Company (the”Board”) and shall exercise such authority, perform such executive functions and discharge such responsibilities

as are reasonably associated with or required Executive’s positions, commensurate with the authority vested in Executive

pursuant to this Agreement and consistent with the governing documents of the Company. The Company understands that Executive is

engaged in other Advisory and Board Duties of other public companies and Executive will minimize their impact on Executive’s

Company duties and avoid all conflicts of interest arising from those other advisory and board duties.

Executive’s

duties include:

| 1. | Manage all daily financial transactions, public reporting and filings required by the Company. |

| 2. | Manage all Chief Financial Officer duties, including but not limited to: assisting existing financial

management, financial review, liaison with audit firms; |

| 3. | Report to the Board on matters under Executive’s control on a monthly basis; |

| 4. | Work with the Chief Executive Officer to develop strategic planning for Company in business development,

marketing and sales, and strategic planning; |

| 5. | Executive oversight of other staff of Company |

| 6. | Direct media and public/investor relations for Company; and |

| 7. | Perform administrative and related duties necessary to above duties. |

| 3. | Compensation and Benefits |

(a) Salary.

The Company shall pay to Executive, as full and fair compensation for the performance of his duties and obligations under this

Agreement and required for his position as Chief Financial Officer and Secretary, a base annual salary of $100,000 per annum, payable

semi-monthly in equal installments and in accordance with Company’s payroll cycle and practices. The Executive will be eligible

for annual compensation increases, determined by the Board. Until the Company is adequately funded (as determined by the Board)

and can pay Executive base annual salary without impairing Company’s ability to pay Company’s current operational debts

and obligations this salary, the Executive’s salary will be accrued. The Executive’s accrued base salary can either

be paid in total when Company is adequately funded or, alternatively, the accrued unpaid base salary can be converted into shares

of the Company’s Common Stock at the lower conversion price of the initial public offering price of $2.00 or current market

price at time of conversion by the Executive. Any conversion of unpaid base annual salary must comply with all applicable laws

and regulations, including insider trading laws and Section 16 and Rule 144 of Securities Exchange Act of 1934, as amended, and

any other pertinent underlying rules.

(b) Mr.

Guzy may participate in any incentive compensation and other benefit plans to the extent that he is eligible to do so.

(c) During

the Employment Period, Executive may be granted ad hoc, performance bonus payments to be paid in cash, stock or both and on terms

that are declared by the Board. Granting of any bonus will be at sole discretion of the Board.

(d) Incentive

Stock Options. The Executive shall have the right to participate in the Company’s Stock Option Plan (“Plan”),

subject to eligibility under Plan terms and as determined in accordance with the Plan.

(e) Other

Benefits. Executive shall be entitled to participate in all of the employee benefit plans, programs and arrangements of the

Company in effect during the Employment Period and that are generally available to senior executives of the Company, subject to

and on a basis consistent with the terms, conditions and overall administration of such plans, programs and arrangements. In addition,

and subject to eligibility, during the Employment Period, Executive shall be entitled to fringe benefits and perquisites comparable

to those of other senior executives of the Company, including, but not limited to, the following: (i) paid holidays observed by

Company; (ii) twenty (20) days of paid vacation; and (iii) five (5) days of paid sick/personal leave. All vacation leave must be

approved in advance by the Board, which approval will not be unreasonably withheld, and which vacation leave may be taken during

any audit or review of Company financial statements. All leave is subject to Company’s published policies.

(f) Business

Expenses. The Company shall promptly reimburse Executive for all appropriately documented, reasonable business expenses reasonably

incurred by Executive in the performance of and necessary to the performance of his duties under this Agreement, including business

telecommunications expenses and travel expenses. All expenses are reimbursed for cost without markup.

| 4. | Termination of Employment |

| (a) | Termination for Cause. The Company may terminate Executive’s

employment hereunder for Cause (defined below). For purposes of this Agreement and subject to Executive’s opportunity to

cure as provided in Section 4(c) hereof, the Company shall have Cause to terminate Executive’s employment hereunder if such

termination shall be the result of: |

| (i) | a material breach of fiduciary duty or material breach of the terms of this Agreement or any

other agreement between Executive and the Company (including without limitation any agreements regarding confidentiality, inventions

assignment and non-competition); |

| (ii) | the commission by Executive of any act of embezzlement, fraud, larceny or theft on or from the

Company; |

| (iii) | substantial and continuing neglect or inattention by Executive of the duties of his employment

or the willful misconduct or gross negligence of Executive in connection with the performance of his duties hereunder, including

insubordination, which willful misconduct or gross negligence or insubordination remains uncured for a period of fifteen (15) days

following the receipt date of written notice from the Board specifying the nature of the alleged breach; |

| (iv) | the commission by and indictment of Executive of any crime involving moral turpitude or a felony;

and |

| (v) | Executive’s performance or omission of any act which, in the judgment of the Board, if

known to the customers, clients, stockholders or any regulators of the Company, would have a material and adverse impact on the

business or public reputation of the Company. |

| (b) | Termination for Good Reason. Executive shall have the right at any

time to terminate his employment and this Agreement with the Company upon not less than thirty (30) days prior written notice of

termination for Good Reason (defined below). For purposes of this Agreement and subject to the Company’s opportunity to cure

as provided in Section 4(c) hereof, Executive shall have Good Reason to terminate his employment hereunder if such termination

shall be the result of: |

| (i) | the Company’ s material breach of this Agreement; or |

| (ii) | A requirement by the Company that Executive perform any act or refrain from performing any act

that would be in violation of any applicable law. |

(c) Notice

and Opportunity to Cure. Notwithstanding the foregoing provisions of this Section 4, it shall be a condition precedent to the

Company’s right to terminate Executive’ s employment for Cause and Executive’s right to terminate for Good Reason

that (i) the party seeking termination shall first have given the other party written notice stating with specificity the reason

for the termination (“breach”) and (ii) if such breach is susceptible of cure or remedy, a period of fifteen(15)days

from and after the date of the giving of such notice shall have elapsed without the breaching party having effectively cured or

remedied such breach during such 15-day period, unless such breach cannot be cured or remedied within fifteen(15) days, in which

case the period for remedy or cure shall be extended for a reasonable time (not to exceed an additional thirty (30) days) provided

the breaching party has made and continues to make a diligent and good faith effort to effect such remedy or cure.

(d) Voluntary

Termination. Executive, at his election, may terminate his employment and this Agreement upon not less than sixty (60) days

prior written notice of termination other than for Good Reason and without cause.

(e) Termination

Upon Death or Permanent and Total Disability. The Employment Period shall be terminated by and as of the death of Executive.

The Employment Period may be terminated by the Board if Executive shall be rendered incapable of performing his executive duties

to the Company by reason of any medically determined physical or mental impairment that can be reasonably expected to result in

death or that can be reasonably be expected to last for a period of either (i) six(6) or more consecutive months from the first

date of Executive’s absence due to the disability or (ii) nine (9) months during any twelve-month period (a “Permanent

and Total Disability”). If the Employment Period is terminated by reason of a Permanent and Total Disability of Executive,

the Company shall give thirty (30) days’ advance written notice to that effect to Executive.

(f) Termination

at the Election of the Company. At the election of the Company, otherwise than for Cause as set forth in Section 4(a) above,

upon not less than sixty (60) days prior written notice of termination.

(g) Termination

for Business Failure. Anything contained herein to the contrary notwithstanding, in the event the Company’s business

is discontinued by Board resolution and because continuation is rendered impracticable by substantial financial losses, lack of

funding, legal decisions , administrative rulings, declaration of war, dissolution, national or local economic depression or crisis

or any reasons beyond the control of the Company, then this Agreement shall terminate as of the day the Company determines to cease

operation by Board resolution with the same force and effect as if such day of the month were originally set as the termination

date hereof. In the event this Agreement is terminated pursuant to this Section 4(g), the Executive will not be entitled to severance

pay.

| 5. | Consequences of Termination |

(a) By

Executive for Good Reason or the Company Without Cause. In the event of a termination of Executive’ s employment during

the Employment Period by Executive for Good Reason pursuant to Section4(b) or the Company without Cause pursuant to Section4(f)

the Company shall pay Executive (or his estate) and provide him with the following, provided that Executive enter into a release

of claims agreement agreeable to the Company and Executive:

(i) Cash Payment. A cash

payment, payable in equal installments over a six (6) month period after Executive’s termination of employment, equal

to the sum of the following:

(A) Base

Annual Salary. Subject to the payment of the following sums in this subsection(i)(A) not causing the insolvency of the Company,

the equivalent of the greater of (i) twenty-four (24) months of Executive’ s then-current base salary or (ii) the remainder

of the term of this Agreement (the “Severance Period”);plus

(B) Earned but Unpaid Amounts. Any previously earned but unpaid salary through Executive’s final date of employment with the Company, and any previously earned but unpaid bonus amounts prior to the date of Executive’s termination of employment.

(C) Equity. All Options vested at time of termination shall be retained by Executive and all Options that are not vested shall be accelerated and be deemed vested for purposes of this Section5, unless vesting is prohibited by the Plan or applicable laws or regulations.

(ii) Other Benefits. The Company shall provide continued coverage for the Severance Period under all health, life, disability and similar employee benefit plans and programs of the Company on the same basis as Executive was entitled to participate immediately prior to such termination, provided that Executive’s continued participation is possible under the general terms and provisions of such plans and programs. In the event that Executive’s participation in any such plan or program is barred, the Company shall use its commercially reasonable efforts to provide Executive with benefits substantially similar (including all tax effects) to those which Executive would otherwise have been entitled to receive under such plans and programs from which his continued participation is barred. In the event that Executive is covered under substitute benefit plans of another employer prior to the expiration of the Severance Period, the Company will no longer be obligated to continue the coverages provided for in this Section5(a)(ii).

| (b) | Other Termination of Employment. In the event that Executive’s

employment with the Company is terminated during the Employment Period by the Company for Cause (as provided for in Section4(a)

hereof) or by Executive other than for Good Reason (as provided for in Section4(b) hereof), the Company shall pay or grant Executive

any earned but unpaid salary, bonus, and Options through Executive’s final date of employment with the Company, and the Company

shall have no further obligations to Executive. |

| (c) | Withholding of Taxes. All payments required to be made by the Company

to Executive under this Agreement shall be subject only to the required withholdings of such amounts, if any, relating to tax,

excise tax and other payroll deduction s as may be required by law or regulation. |

| (d) | No Other Obligations. The benefits payable to Executive under this

Agreement are not in lieu of any benefits payable under any employee benefit plan, program or arrangement of the Company, except

as specifically provided herein, and Executive will receive such benefits or payments, if any, as he may be entitled to receive

pursuant to the terms of such plans, programs and arrangements. Except for the obligations of the Company provided by the foregoing

and this Section 5, the Company shall have no further obligations to Executive upon his termination of employment. |

| (e) | Mitigation or Offset. Executive shall not be required to mitigate

the damages provided by this Section 5 by seeking substitute employment or otherwise and there shall not be an offset of the payments

or benefits set forth in this Section5, unless permitted by court order or applicable laws and regulations. |

This

Agreement and the rights and obligations of the parties hereto shall be construed in accordance with the laws of the Commonwealth

of Virginia, without giving effect to the principles of conflict of laws.

| 7. | Indemnity and Insurance |

The

Company shall indemnify and save harmless Executive for any liability incurred by reason of any act or omission performed by

Executive while acting in good faith on behalf of the Company and within the scope of the authority of Executive pursuant to this

Agreement and to the fullest extent provided under the Bylaws, the Articles of Incorporation and the Stock Corporation Act of

Virginia, except that Executive must have in good faith believed that such action was in, or not opposed to, the best interests of

the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe that such conduct was

unlawful. No indemnification barred by regulations or policies of the Securities and Exchange Commission (“SEC”) or in

clear violation of public policy will be permitted under this Section 7 or otherwise.

If the Executive

is eligible under the insurance policy’s terms and conditions, then the Company shall provide that Executive is covered by

Directors and Officers insurance, if any, that the Company provides to other senior executives and/or Board members.

| 8. | Cooperation with the Company After Termination of Employment |

Following

termination of Executive’ s employment for any reason, Executive shall fully cooperate with the Company in all matters

relating to the winding up of Executive’s pending work on behalf of the Company including, but not limited to, any

litigation in which the Company is involved, and the orderly transfer of any such pending work to other employees of the

Company as may be designated by the Company. Following any notice of termination of employment by either the Company or

Executive, the Company shall be entitled to such full time or part time services of Executive as the Company may reasonably

require during all or any part of the sixty (60)-day period following any notice of termination, provided that Executive

shall be compensated for such services at the same rate as in effect immediately before the notice of termination.

All

notices, requests and other communications pursuant to this Agreement shall be sent by overnight mail or by fax with proof of transmission

to the following addresses:

If to Executive:

Jeffrey J. Guzy

3130 19th Street North

Arlington, VA 22201

Phone: (703) 216-8606

Email: jeff@jeffguzy.com

If to the Company:

CoJax Oil and Gas Corporation

Attn: Will Downs, Chairman & CEO

3033 Wilson Blvd, Suite E-605

Arlington, Virginia 22201

Phone: (318) 465-1302

Email: wdowns@downs-energy.com

| 10. | Non-Disclosure of Trade Secrets, Customer Lists and Other Proprietary Information |

(a) Confidentiality.

For term of employment and one year thereafter, the Executive agrees not to use, disclose or communicate, in any manner, proprietary

information about the Company, its operations, clientele, or any other proprietary information, that relate to the business of

Company. This includes, but is not limited to, the names of Company’s customers, its marketing strategies, operations, or

any other information of any kind which would be deemed confidential or proprietary information of Company. To the extent Executive

feels that they need to disclose confidential information, they may do so only after being authorized to so do in writing by the

Company.

(b) Non-Solicitation

Covenant. Executive agrees that for a period of term of employment and one year following termination of employment, for any

reason whatsoever, Executive will not solicit customers or clients of Company. By agreeing to this covenant, Executive acknowledges

that their contributions to Company are unique to Company’s success and that they have significant access to Company’s

trade secrets and other confidential or proprietary information regarding Company’s customers or clients.

(c) Non-Recruit

Covenant. Executive agrees not to recruit any of Company’s employees for the purpose of any outside business either during

or for a period of one year after Executive’s tenure of employment with Company. Executive agrees that such effort at recruitment

also constitutes a violation of the non-solicitation covenant set forth above.

(d) Adherence

to Company’s Policies, Procedures, Rules and Regulations. Executive agrees to adhere by all of the policies, procedures,

rules and regulations set forth by the Company. These policies, procedures, rules and regulations include, but are not limited

to, those set forth within any Company employee manual, any summary benefit plan descriptions, or any other personnel practices

or policies or Company. To the extent that Company’s policies, procedures, rules and regulations conflict with the terms

of this Agreement, the specific terms of this Agreement will control.

Any

waiver of any breach of this Agreement shall not be construed to be a continuing waiver or consent to any subsequent breach on

the part of either Executive or of the Company.

| 12. | Non-Assignment; Successors |

Neither

party may assign his/her or its rights or delegate his/hers or its duties under this Agreement without the prior written consent

of the other party; provided, however, that (i) this Agreement shall inure to the benefit of and be binding upon the successors

and assigns of the Company upon any sale or all or substantially all of the Company’s assets, or upon any merger, consolidation

or reorganization of the Company with or into any other corporation, all as though such successors and assigns of the Company and

their respective successors and assigns were the Company; and (ii) this Agreement shall inure to the benefit of and be binding

upon the heirs, assigns or designees of Executive to the extent of any payments due to them hereunder. As used in this Agreement,

the term “Company’· shall be deemed to refer to any such successor or assign of the Company referred to in the

preceding sentence.

To the

extent any provision of this Agreement or portion thereof shall be invalid or unenforceable, it shall be considered deleted there

from and the remainder of such provision and of this Agreement shall be unaffected and shall continue in full force and effect.

The restrictive covenants and promises of the Executive contained in this Agreement will survive any termination or rescission

of this Agreement, unless the Company executes a written agreement specifically releasing the Executive from those restrictive

covenants or any specified restrictive covenants.

This

Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together

will constitute one and the same instrument.

Executive

and the Company shall submit to mandatory and exclusive binding arbitration, any controversy or claim arising out of, or

relating to, this Agreement or any breach hereof where the amount in dispute is greater than or equal to $75,000 (excluding

attorney’s fees and proceeding costs), provided, however, that the parties retain their right to, and shall not be

prohibited, limited or in any other way restricted from, seeking or obtaining equitable relief from a court having

jurisdiction over the parties. In the event the amount of any controversy or claim arising out of, or relating to, this

Agreement, or any breach hereof, is less than $75,000 (excluding attorney’s fees and proceeding costs), the parties

hereby agree to submit such claim to mediation. Such arbitration shall be governed by the Federal Arbitration Act and

conducted through the American Arbitration Association (“AAA”) in Arlington County, Virginia before a single

neutral arbitrator, in accordance with the National Rules for the Resolution of Employment Disputes of the American

Arbitration Association in effect at that time. The parties may conduct only essential discovery prior to the hearing, as

defined by the AAA arbitrator. The arbitrator shall issue a written decision which contains the essential findings and

conclusions on which the decision is based. Mediation shall be governed by, and conducted through, the AAA. Judgment upon the

determination or award rendered by the arbitrator may be entered in any court having jurisdiction thereof.

This

Agreement and all exhibits, schedules and other attachments hereto and expressly referenced in this Agreement will constitute the

entire agreement by the Company and Executive with respect to the subject matter hereof and, except as specifically provided herein,

supersedes any and all prior agreements or understandings between Executive and the Company with respect to the subject matter

hereof, whether written or oral. This Agreement may be amended or modified only by a written instrument executed by Executive and

the Company. Any exhibits, attachments and schedules referenced herein are incorporated herein by reference.

IN WITESS WHEREOF, the parties have executed this Agreement

as of the first date above.

CoJax Oil & Gas Corporation, a Virginia corporation

| By: /s/ William R. Downs |

|

| William R Downs |

|

| Chief Executive Officer |

|

| |

|

| Accepted by: |

|

| |

|

| /s/ Jeffrey J. Guzy |

|

| By: Jeffrey J. Guzy |

|

| Chief Financial Officer |

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

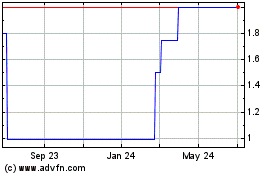

CoJax Oil and Gas (PK) (USOTC:CJAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

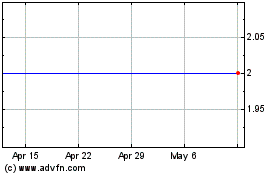

CoJax Oil and Gas (PK) (USOTC:CJAX)

Historical Stock Chart

From Apr 2023 to Apr 2024