Dundee Corporation Reports First Quarter 2013 Financial Results

May 15 2013 - 6:31PM

Marketwired

Dundee Corporation (TSX:DC.A)(TSX:DC.PR.A)(TSX:DC.PR.B) (the

"Corporation") is reporting its financial results as at and for the

three months ended March 31, 2013. The Corporation's unaudited

condensed interim consolidated financial statements, along with the

accompanying management's discussion and analysis have been filed

on the System for Electronic Document Analysis and Retrieval

("SEDAR") and may be viewed under the Corporation's profile at

www.sedar.com or the Corporation's website at

www.dundeecorp.com.

FINANCIAL HIGHLIGHTS

-- Net Earnings - During the three months ended March 31, 2013, the

Corporation incurred a loss attributable to owners of Dundee Corporation

of $10.2 million, or $0.23 per share. This compares with net earnings

attributable to owners of Dundee Corporation of $32.5 million, or $0.53

per fully diluted share earned in the same period of the prior year.

Recent economic conditions resulted in a realized provision against the

market value of certain of the Corporation's portfolio investments,

including several of its resource-based investments. As a result, the

Corporation's corporate and portfolio holdings incurred a loss of $24.4

million in the first quarter of 2013, inclusive of marked-to-market

depreciation in investments, compared with earnings of $32.3 million

generated in the same period of the prior year.

-- Fee Earning Assets under Management and Administration - Fee earning

assets under management and administration increased to $17.1 billion at

March 31, 2013, compared with $15.8 billion at December 31, 2012.

-- Equity Accounted Investments - Earnings from equity accounted

investments were $12.0 million during the three months ended March 31,

2013, compared with $10.6 million earned during the same period of the

prior year. At March 31, 2013, the market value of equity accounted

investments was $678.9 million, compared with $685.8 million at December

31, 2012.

-- Market Value of Investments - The market value of the Corporation's

portfolio of investments, excluding equity accounted investments, was

$1.3 billion at March 31, 2013.

-- Corporate Debt at March 31, 2013 was $481.0 million, of which $344.1

million was borrowed by the Corporation's operating subsidiaries,

primarily Dundee Realty Corporation and Dundee Energy Limited. This

compares with corporate debt of $333.1 million at December 31, 2012.

ABOUT THE CORPORATION

Dundee Corporation is a public Canadian independent holding

company listed on the Toronto Stock Exchange ("TSX") under the

symbol "DC.A." Through its operating subsidiaries, Dundee

Corporation is engaged in diverse business activities in the areas

of its core competencies including investment advisory and

corporate finance, real estate and infrastructure, energy,

resources and agriculture. Dundee Corporation also holds, directly

and indirectly, a portfolio of investments mostly in these core

focus areas, as well as other select investments in both publicly

listed and private companies.

Contacts: Dundee Corporation Ned Goodman President and Chief

Executive Officer (416) 365-5665 Dundee Corporation Lucie Presot

Vice President and Chief Financial Officer (416) 365-5157

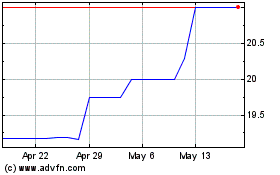

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

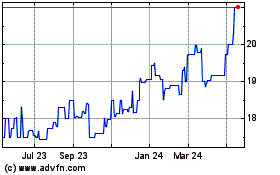

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Apr 2023 to Apr 2024