Notice of Exempt Solicitation. Definitive Material. (px14a6g)

April 29 2020 - 4:20PM

Edgar (US Regulatory)

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: Tenet Healthcare Corporation

NAME OF PERSON RELYING ON EXEMPTION: International Brotherhood of Teamsters

ADDRESS OF PERSON RELYING ON EXEMPTION: 25 Louisiana Avenue, N.W., Washington, D.C. 20001

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

______________________________________________________________________________________________________________________________________________________________________

April 2020

RE: Please Vote AGAINST Say-on-Pay (Item 2) and FOR an Independent Board Chair (Item 4) at Tenet Healthcare Corp. (NYSE:THC) on May 28, 2020

Dear Fellow Tenet Healthcare Shareholder:

We urge you to join us in voting against the advisory vote to Approve Executive Compensation (‘Say-on-Pay’) and in favor of our proposal to separate the roles of CEO and chair at Tenet’s annual shareholder meeting on May 28, 2020. We have long favored greater pay accountability and independent board leadership at Tenet, but these concerns have been heightened by the current Covid-19 pandemic and the attending challenges facing the company.

Critical pay concerns include the following:

-

New, lucrative employment agreements that lack real ties to performance: Initially appointed Executive Chair, in August 2017, CEO

Ronald Rittenmeyer has gone on to enter a series of lucrative employment extensions providing $42 million in exclusively time-based awards – vesting over a mere two to two and a half years. The hiring of COO Dr. Saum Sutaria has, similarly, been dominated by the large use of time-vesting awards: $12 million in sign-on grants and a $4 million long-term incentive (LTI) opportunity. With otherseniorexecutivesreceivinga farmore balancedlong- term mix, Tenet has quite perversely, made its two most senior executives the least exposed to corporate performance.

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

1

-

A series of egregious exit-arrangements: Vice Chairman Keith Pitts not only recently retiredwith a $14.4 million Supplemental Executive Retirement Plan (SERP) --inflatedby additional service credits --but is scheduled to earn $2 million over the next two years for advisory services not to exceed eight hours a week. Similarly, when he finally retires, CEO Rittenmeyer will receive a $750,000 annual retainer for two years - in this case for not more than eight days of consulting a month. Investors ought to be tired of consulting gigs that are little more than discretionary severance by another name.

-

A failure to reinforce accountability at the top: CEO Rittenmeyer trumpets a new "culture of Accountability" and a vision of "Community Built on Care;" but his own long-term pay is singularly divorced from any performance megtrics. While the short-term incentive plan for named executive officers (NEOs) does include financial metrics, it is only for other senior officers that specific operational quality and service metrics are factored into incentive pay. In pay terms, this is the equivalent of, "Do as I say, not as I do" and upends the3 idea that tone and accountability at the top is critical to organizational success.

Of course, the optics of these pay arrangements – topped off by a CEO to worker pay ratio of 452:1 based on CEO Rittenmeyer’s $24.3 million 2019 compensation -- could not be worse for a publicly-traded hospital chain amid the current pandemic. Two days after the proxy statement was published, the Washington Post reported on the treatment of overwhelmed nurses at the Company’s Detroit Medical Center who, pushed to breaking point, felt compelled to speak up about under-staffing and safety concerns.1 It is being reported that another nurse at the facility was fired after sharing her concerns over staffing and safety on social media.2 Similar concerns have been voiced at other Tenet facilities. Nurses at a Palm Beach County facility, for example, described a “culture of fear,” both from infection and retaliation if they

1 https://www.washingtonpost.com/nation/2020/04/19/nurse-detroit-coronavirus/ ?arc404=true

2 https://www.buzzfeednews.com/article/emmaloop/detroit-nurse-fired-lawsuit-coronavirus-sinai-grace

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

2

speak up.3 At the same time, Tenet has furloughed 10 percent of its workforce without pay as elective surgeries are put on hold.

But the problem with Tenet’s pay is more than just its “optics” even without the stresses from Covid-19, it should be clear that the very culture of accountability that CEO Rittenmeyer claims to be instilling, is missing in the compensation structure of the two most senior executives. CEO Rittenmeyer’s decision to give up 50 percent of his base salary for three months is a gesture towards shared sacrifice. However, it is only a gesture and one that is cushioned by the Board’s recent decision to boost CEO Rittenmeyer’s future annual base salary. Gestures are no substitute for comprehensive pay reform that matches executive pay with performance.

Teamster affiliated pension and benefit funds have more than $100 billion invested in the capital markets and are long-term shareholders in Tenet.

New, Lucrative Employment Agreements Lack Real Ties to Performance

We appreciate interim leaders are often compensated in a manner distinct from a permanent selection, and so it was with Rittenmeyer in August 2017, when he was awarded a $2.3 million one-year vesting performance stock option award, and a $2.9 million annual salary to serve as Executive Chair. What is troubling, however, is that since taking over the CEO role in March 2018, CEO Rittenmeyer has continued to be compensated outside the pay-for-performance norms of a CEO through a series of lucrative contract extensions that rely heavily on relatively short-term vesting restricted stock awards.

In March 2018, pursuant to a two-year agreement, we note that Rittenmeyer received approximately $16 million in two-year time-vesting restricted cash and restricted stock units (RSUs), with the company explaining that “two years is too short to set meaningful long-term performance goals especially in light of the Company’s current period of transition.” (CEO Rittenmeyer also qualified for an annual incentive opportunity, but not a separate, annual LTI-award.) However, just one

3https://www.palmbeachpost.com/news/20200403/coronavirus-florida-tenet-hospital-nurses-describe-culture-of-fear

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

3

year into the two-year agreement, in February 2019, CEO Rittenmeyer signed a 16-month extension, receiving a new $16 million 28-month vesting RSUs. Then this February, despite still having more than 16 months left on his prior extension, CEO Rittenmeyer entered a new 18-month extension and was granted an additional $10 million RSUs award vesting through the remainder of the extension.

At this point, the claim that it is impossible to set meaningful performance goals for CEO Rittenmeyer’s equity awards has worn more than a little thin. In all, given the upfront nature of the contract extension awards, which fully vest upon a qualifying termination, CEO Rittenmeyer has received $42 million in restricted-stock and -cash awards in just two years.

Moreover, similar concerns permeate COO Sutaria’s employment arrangement. Not only did Dr. Sutaria receive $12 million in a three-year award of restricted stock and-cash, as part of his recruitment to the company in 2019, but his $4 million annual LTI opportunity is entirely time-vesting owing to the Company’s concerns that he needs time to “transition…to a public company compensation program from a private partnership model at his prior employer.” We not only fundamentally disagree with this concern, but find it more than a little ironic that he received a one-off bonus award of $1 million performance-based RSUs in February of this year.

With the Company’s other NEOs receiving their LTI opportunity split between time-based and performance-based awards, Tenet has, quite perversely, made its two most senior executives the least exposed to corporate performance.

Egregious Exit-Arrangements

Post-retirement consulting gigs risk being little more than discretionary severance payouts by another name, particularly when they involve, as in the case of Tenet, generous retainers and minimal work requirements.

Pursuant to his 2019 contract extension, we note that CEO Rittenmeyer has a two-year post-retirement consulting arrangement, which pays $750,000 a year (along with health and welfare benefits and perquisites) for advisory services not to exceed eight days per month. Meanwhile, former Vice-Chairman Pitts will receive $2 million on the second anniversary of his retirement in exchange for making himself

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

4

“available” as an advisor to the CEO for up to eight hours per week – the equivalent of $2,400/hr., assuming he works the maximum number of hours per week.

Pitts, who joined Tenet as part of the Vanguard Health Systems acquisition in 2013, is already the beneficiary of a $14.4 million SERP that includes nearly $9.4 million in additional service credits.

At a time when resources are sorely needed to support the work and safety of Tenet’s frontline heroes, who are risking their own lives to save others, the Company‘s lavish executive payouts are particularly inappropriate.

A Failure to Reinforce Accountability at the Top

CEO Rittenmeyer’s cultural reset, with its emphasis on accountability and care, is at striking odds with a pay structure that becomes less accountable the higher up the organizational chart you go. This becomes deeply problematic when the cultural transformation – and its vision of a “Community Built on Care” -- is pursued alongside a $450 million cost-cutting initiative. Putting patients first and pursuing aggressive cost reductions are not natural bedfellows and demand carefully balanced incentives – distinctly absent from Tenet’s executive pay.

As noted earlier, CEO Rittenmeyer’s long-term incentives are divorced from any performance metrics -- even strategic goals tied to his turnaround plan. We appreciate it can be difficult to devise meaningful metrics as a turnaround plan is being developed, but subsequent awards should reflect the new long-term strategy. Moreover, while the annual incentive plan for NEOs does include financial metrics, it is only below this level that the specific operational quality and service metrics underlying Tenet’s vision are factored into compensation decisions. Not only do some peers include such metrics in their NEOs pay, but Tenet, under CEO Rittenmeyer’s leadership, went ahead and eliminated quantitative quality and service goals for corporate-wide executives two years ago.

While investors have only limited visibility into the specifics of the Company’s $450 million cost-cutting initiative, there is clearly a risk that aggressive cost reductions could undermine the Company’s quality of care and service – especially worrying at the present moment. This is particularly of concern given that there is no linkage

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

5

between care and service quality to CEO pay, while the benefits of cost-cutting flow directly into the adjusted EBITDA and adjusted free cash flow metrics used in the annual incentive plan.

Independent Board Leadership at a Premium

We appreciate that investors can disagree about whether an independent board chair is considered the best practice governance arrangement for all companies. However, we believe independent board leadership is vital at Tenet given the potentially dueling objectives in CEO Rittenmeyer’s turnaround–installing a culture focused on patient care while stripping out nearly half a billion dollars in annual costs. This was true before the Covid-19 pandemic, but becomes even more critical amid the circumstances the company currently finds itself and will quite possibly have to prepare for again in the future.

Summary

We appreciate Tenet’s Board has a lot on its plate at the moment, but that does not justify giving a free-pass to a pay structure that reserves the least accountability for the highest paid individuals. In fact, rightsizing this structure, along with enhancing the independence of the Board’s leadership, becomes ever more critical amid the current pandemic. For these reasons, we urge shareholders to join us in voting against the Company’s Say-on-Pay for our resolution to appoint an independent chair.

For more information, please contact Michael Pryce-Jones by email at: mpryce-jones@teamster.org or by telephone: 202-769-8842.

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

6

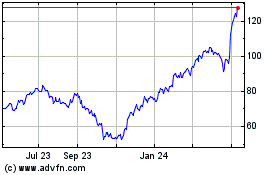

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

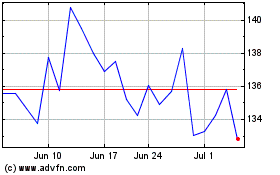

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024