Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 23 2024 - 1:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ |

Filed by the Registrant |

☐ |

Filed by a party other than the Registrant |

|

| CHECK

THE APPROPRIATE BOX: |

| |

| ☐ |

|

Preliminary Proxy Statement |

| ☐ |

|

Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

|

Definitive Proxy Statement |

| ☑ |

|

Definitive Additional Materials |

| ☐ |

|

Soliciting Material under §240.14a-12 |

SL Green Realty

Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| |

| ☑ |

|

No fee required |

| ☐ |

|

Fee paid previously with preliminary materials |

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Fellow Stockholders,

Ahead of the annual meeting of SL Green Realty Corp. (“SL Green”

or the “Company”) on June 3, 2024 (the “Annual Meeting”), the Board and Compensation Committee (the “Committee”)

want to express our appreciation for stockholders’ consistent support of the Company over many years, as we have enhanced our executive

compensation program to align with Company performance and stockholder value while retaining our talented and tenured management team.

2023 was a banner year for SL Green with our total shareholder return

(“TSR”) of 48% ranking the highest of our office REIT peers, the 3rd highest of 128 REITs with a market capitalization in

excess of $1 billion and outperforming the Dow Jones US Office Real Estate Index by nearly 5,000 basis points. This performance reflects

the market’s recognition of our significant accomplishments in 2023, including achieving a majority of the goals and objectives

that we outlined at our Institutional Investor Conference on December 5, 2022. On a longer term basis, over the three-year period

from 2021 through 2023, our TSR ranks in the top 16th percentile of the Dow Jones US Office Real Estate Index (#3 out of 20

companies in such index).

We Have Demonstrated Extensive Responsiveness to Stockholder Feedback

in Successive Years

We strongly disagree with the statement in the ISS report issued on

May 21, 2024, that the Committee has not been sufficiently responsive to the 2023 say on pay vote.

To the contrary, the Committee is committed to robust stockholder engagement

and has direct communication with a significant number of stockholders each year to gather valuable feedback. This feedback is critical

to the Committee and Board discussions on executive compensation and informs the decisions taken and changes implemented.

Committee Responsiveness to 2023 Say on Pay

In 2023, our stockholder outreach program was the most extensive in

our history. Starting in the fall of 2023 SL Green contacted stockholders holding approximately 75% of outstanding shares, had substantive

one-on-one discussions with stockholders owning approximately 69% of outstanding shares and Directors participated in conversations with

stockholders owning approximately 38% of outstanding shares.

During these conversations, stockholders expressed strong support for

the significant changes made to the executive compensation program over recent years and appreciated our strong commitment to stockholder

engagement. The majority of the feedback focused on the short-term performance periods in long-term performance incentives. Stockholders

who raised this issue understand and appreciate that the CEO’s current employment agreement expires in January 2025, and recognized

that any changes could not be implemented prior to the expiration of that contract.

Given the inability to make any immediate changes to the short-term

performance periods, during these discussions, the Company affirmed that this issue would be part of an overall assessment by the Committee

in connection with our CEO’s new employment agreement, consistent with the commitment disclosed in the 2023 proxy statement. Discussions

regarding that agreement have already commenced. The Company also reaffirms that it will solicit further feedback on employment agreement

matters from stockholders during its 2024 stockholder outreach.

In direct response to feedback received in prior years, the Committee

implemented the following enhancements in its 2023 executive compensation:

| § | A vesting cap for performance-based awards subject to relative TSR performance such that the awards cannot be earned above target

level when absolute TSR is negative even if relative TSR outperforms peers. |

| § | A formulaic cash bonus component for our CFO’s annual cash bonus that accounts for 60% of his annual bonus, eliminating a 100%

discretionary annual bonus. |

| § | Eliminated automobile benefits for leased and company-owned vehicles for all NEOs. |

We Have Designed a Pay Program That Enables a Pay-for-Performance

Culture

The Committee believes that the actions taken in direct response to

stockholder feedback are consistent with our Executive Compensation Philosophy and further strengthened the link between Company performance

and executive pay outcomes.

The link between pay and performance is already reflected in the compensation

reported in the 2024 proxy statement. Notably, for 2023:

| § | Approximately 92% of CEO pay and 85% of other NEO pay was at risk; |

| § | Approximately 83% of CEO compensation and 84% of other NEO compensation was equity based; and |

| § | 100% of annual bonus for the CEO and 60% of the CFO’s annual bonus was based on Company performance against preset goals. |

This pay-for-performance linkage is confirmed by a LOW CONCERN level

under the Initial Quantitative Concern of the ISS Pay-For-Performance Quantitative Screen.

We Want to Clarify Certain Other Misunderstandings

The report issued by ISS on May 21, 2024, raises three other issues

that we believe are mischaracterized:

| § | The ISS report cites that the clarification to our CFO’s employment agreement contains problematic provisions. Here are the

facts: |

| o | As disclosed in our Form 8-K filed on February 2, 2024, we merely clarified the methodology for calculating Mr. DiLiberto’s

annual bonus – the same agreement that was entered into in March 2023 to introduce a performance basis for 60% of his annual

bonus, in line with stockholder feedback received. There were no other changes to the agreement. |

| o | During our extensive stockholder outreach immediately prior to the 2023 annual meeting, we specifically inquired as to the severance

provisions of our CFO’s employment agreement. No stockholder raised any concerns. |

| § | The ISS report cites that Andrew Mathias, upon the non-renewal of his employment agreement, received “excessive cash severance.” |

| o | To be clear, Mr. Mathias received only the severance expressly provided under his employment agreement and outlined in previous

proxy statements. He received no incremental severance upon the Company’s decision not to renew his employment agreement. |

| o | Also, in line with the terms of his employment agreement, Andrew Mathias did not receive an annual time-based equity award for 2023

because the term of his employment concluded prior to January 2024 when the annual grants would have been made under his employment

agreement. |

| o | Perhaps most importantly, ISS never raised this provision as a concern in any of its reports prior to 2023, and as noted above,

no stockholder responded negatively to questions asked on account of the severance provisions in any of the executive employment agreements. |

| § | ISS fails to recognize the Company’s relative performance by comparing SL Green to the GICS Industry Group and the Russell 3000.

When compared to a more appropriate index such as the Dow Jones U.S. Real Estate Office Index, SL Green’s one-year, three-year

and five-year TSR performance ranks in the 100th, 84th and 57th percentiles, respectively, of the index

constituents. Further, when compared to SL Green’s executive compensation peer group, SL Green’s one-year, three-year

and five-year TSR performance ranks in the 100th, 80th and 68th percentiles, respectively. |

We Remain Committed to Stockholder Engagement

The Committee has conducted a robust stockholder outreach program

for many, many years and the feedback received from stockholders has served as a key input to compensation design and structural upgrades

that we have implemented in our executive compensation program. The success of the engagement program is evidenced by the significant

enhancements that were adopted as a direct result of the feedback received.

In aggregate, over the past 5 years, SL Green has engaged with stockholders

as outlined in the table below.

| | |

Stockholder Outreach following Annual Meeting | |

| | |

| 2023 | | |

| 2022 | | |

| 2021 | | |

| 2020 | | |

| 2019 | |

| Offered Engagement to stockholders representing approximately | |

| 75 | % | |

| 66 | % | |

| 65 | % | |

| 65 | % | |

| 65 | % |

| Had one-on-one discussions with stockholders representing approx. | |

| 69 | % | |

| 30 | % | |

| 50 | % | |

| 41 | % | |

| 11 | % |

| Directors participated in calls with stockholders representing approx. | |

| 38 | % | |

| 29 | % | |

| 36 | % | |

| 41 | % | |

| 11 | % |

The reality is that responsiveness to stockholders is not simply a

one-year event. In fact, the Committee has systematically and successively updated our executive compensation structure to ensure incentives

align with Company performance, and that payouts align with stockholder value creation. As a result of these enhancements:

| § | Our CEO’s salary has been unchanged since we retroactively reduced it in 2019; |

| § | 100% of the CEO’s annual incentive has a formulaic outcome; |

| o | Moreover, to foster further alignment with stockholder interests, when the Committee issues annual incentive payouts to executives

in equity instead of cash, the shares issued are subject to a three-year no-sell restriction; |

| § | Greater than 60% of the CEO’s target equity incentives are in the form of performance-based equity incentives; and |

| § | We have a simple, transparent compensation structure with no excessive benefits for NEOs. |

For full details of all the actions taken in response to stockholder

feedback received, please see the section titled “Our Track Record of Responsiveness” in our 2024 proxy statement.

Conclusion

Every year, the Committee demonstrates that it deeply values all of

the feedback received from stockholders through its actions. 2024 is no different. The Committee and our Board will continue to collaborate

with investors on these important topics and the Committee will continue to assess our executive compensation program to ensure strong

alignment between management and our stockholders.

We appreciate your continued support of SL Green.

Sincerely,

John H. Alschuler, Lead Independent Director

Lauren B. Dillard

Compensation Committee Chair and Independent Director

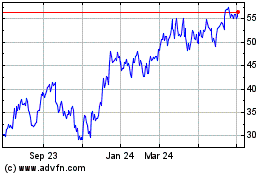

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From May 2024 to Jun 2024

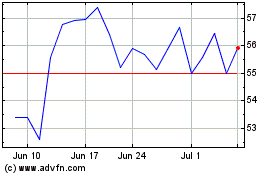

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Jun 2023 to Jun 2024