Current Report Filing (8-k)

November 06 2019 - 1:20PM

Edgar (US Regulatory)

false0001597672

0001597672

2019-11-04

2019-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED)

November 4, 2019

COMMISSION FILE NUMBER 001-36285

Incorporated in the State of Delaware

I.R.S. Employer Identification Number 46-4559529

Rayonier Advanced Materials Inc.

1301 Riverplace Boulevard, Jacksonville, Florida 32207

(Principal Executive Office)

Telephone Number: (904) 357-4600

Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

RYAM

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Rayonier Advanced Materials Inc.

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

Item 2.01

|

|

|

|

|

Item 8.01

|

|

|

|

|

Item 9.01

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

On November 4, 2019, Rayonier Advanced Materials Inc. (the “Company”) completed its previously announced sale of its Matane, Quebec pulp mill (the “Matane Mill”) and related assets to Sappi Limited, a global diversified wood fiber company, for a total purchase price of US$175 million. There is no material relationship, other than in respect of the transaction, between Sappi Limited or any of its affiliates and the Company, or any director or officer of the Company, or any associate of any such director or officer.

A copy of the Company’s press release in respect of the completion of the sale of the Matane Mill is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The press release referenced in this Item 8.01 shall not be deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(b) Pro forma financial information.

As a result of the sale of the Matane Mill, beginning in the third quarter of 2019, the historical financial results of the Matane Mill, for periods prior to the sale, will be reflected in the Company’s consolidated financial statements as discontinued operations. Attached as Exhibit 99.2 are the unaudited pro forma financial statements which are based on the historical financial statements of the Company, prepared to reflect the sale of the Matane Mill.

These statements are intended for information purposes only, and the information provided therein is not intended to represent or be indicative of what the Company’s results of operations or financial position would have been if the sale had occurred on the dates indicated. The unaudited pro forma condensed consolidated financial statements should be read with the Company’s historical financial statements, which are included in the Company’s latest annual report on Form 10-K and quarterly report on Form 10-Q. The unaudited pro forma financial statements should not be considered representative of the Company’s future results or financial position.

(d) Exhibits

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

Press Release entitled “Rayonier Advanced Materials Completes Sale of Matane, Quebec Pulp Mill” issued November 4, 2019.

|

|

|

|

Unaudited Pro Forma Financial Information

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted as Inline XBRL.

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Rayonier Advanced Materials Inc. (Registrant)

|

|

|

|

|

|

BY:

|

|

/s/ MICHAEL R. HERMAN

|

|

|

|

Michael R. Herman

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

|

|

|

November 6, 2019

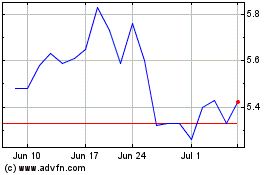

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Sep 2023 to Sep 2024