false

0000812074

0000812074

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

February 6, 2024

Date of Report (Date of earliest event reported)

O-I

GLASS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-9576 |

|

22-2781933 |

(State or other

jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

|

One Michael Owens Way

Perrysburg, Ohio

(Address

of principal executive offices) |

43551-2999

(Zip

Code) |

(567) 336-5000

(Registrant’s telephone number, including

area code)

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name

of each exchange on which

registered |

| Common stock, $.01 par value |

OI |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 2.02. | RESULTS

OF OPERATIONS AND FINANCIAL CONDITION. |

On

February 6, 2024, O-I Glass, Inc. (the “Company”) issued a press release announcing its results of operations for the year

ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information set forth in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities

of that Section. The information in this Item 2.02, including Exhibit 99.1, shall not be incorporated by reference into any filing of

the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act except as shall be expressly

set forth by specific reference in such a filing.

| ITEM 9.01 | FINANCIAL

STATEMENTS AND EXHIBITS. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 6, 2024 |

O-I

GLASS, INC. |

| |

|

| |

By: |

/s/

John A. Haudrich |

| |

|

John

A. Haudrich |

| |

|

Senior

Vice President and Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE

RELEASE

For more information, contact:

Chris Manuel, Vice President of Investor Relations

567-336-2600

Chris.Manuel@o-i.com

O-I GLASS REPORTS FULL YEAR AND FOURTH QUARTER

2023 RESULTS

Strong 2023 Performance Positions O-I Well

for Volume Recovery

Transformative MAGMA Greenfield to be Deployed

Mid-2024

PERRYSBURG, Ohio (February 6, 2024) –

O-I Glass, Inc. (“O-I”) (NYSE: OI) today reported financial results for the full year and fourth quarter ended December 31,

2023.

Full Year 2023 Results

| |

|

Net Earnings (Loss) Attributable to

To the Company

Earnings Per Share (Diluted) |

|

Earnings Before

Income Taxes

$M |

|

Cash Provided by Operating Activities

$M |

|

| |

|

FY23 |

|

FY22 |

|

FY23 |

|

FY22 |

|

FY23 |

|

FY22 |

|

| Reported |

|

($0.67) |

|

$3.67 |

|

$67 |

|

$805 |

|

$818 |

|

$154 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Adjusted Earnings

Earnings Per Share (Diluted) |

|

Segment Operating Profit

$M |

|

Free Cash Flow

$M |

|

| |

|

FY23 |

|

FY22 |

|

FY23 |

|

FY22 |

|

FY23 |

|

FY22 |

|

| Non

– GAAP |

|

$3.09

(Guidance: ~ $3.00) |

|

$2.30 |

|

$1,193 |

|

$960 |

|

$130

(Guidance: $100-$150) |

|

$236 |

|

“I’m pleased to report strong 2023

performance as we successfully navigated softer macro conditions that developed over the course of the year including significant inventory

de-stocking across the value chain. O-I continued to execute well through the fourth quarter and business performance moderately exceeded

our expectations. As we concluded the year, strong net price and the benefit from our margin expansion initiatives helped mitigate the

impact of softer demand and elevated production curtailment to balance supply with lower shipments,” said Andres Lopez, O-I Glass

CEO.

“In addition to operating well in 2023,

we continued to advance our long-term strategy. The benefit from margin expansion initiatives significantly exceeded our target with the

strongest results in that program’s seven-year history. We made solid progress on our capital expansion program completing the first

round of new capacity additions in Canada and Colombia, on time and on budget. Importantly, development efforts for MAGMA and ULTRA continued

and our first MAGMA Greenfield project in Bowling Green, KY is on track to be commissioned in mid-2024. Our freshly updated ESG roadmap

has been fully integrated into our strategy and long-term capital allocation plan as we advance glass as the most sustainable packaging

solution. Finally, our balance sheet is in its best position in nearly a decade.”

“Building off our strong operating performance

last year, O-I is well positioned to manage through current soft macro conditions that should improve as the year progresses. I believe

the most challenging market conditions are behind us and we anticipate stronger future earnings as both sales and production volumes recover

to pre-pandemic levels over time,” concluded Lopez.

Net sales were $7.1 billion in 2023, up approximately

4 percent compared to $6.9 billion in the prior year primarily due to higher average selling prices as well as favorable foreign currency

translation. As anticipated, sales volume (in tons) was down 12 percent from the prior year mainly attributed to elevated inventory destocking

across the value chain amid modestly softer consumer consumption.

Earnings before income taxes were $67 million

in 2023, down from $805 million in the prior year mostly due to items management does not consider representative of ongoing operations

which included a $445 million charge for impairment of goodwill in the company’s North America reporting unit in 2023 as well as

a $334 million one-time gain on sales-leaseback transactions in 2022 that did not repeat. The goodwill impairment primarily reflected

changes in macro conditions resulting in lower sales volumes and a smaller asset base following recent restructuring activities intended

to improve long-term performance as well as the impact of a higher weighted average cost of capital on valuation given elevated interest

rates. Earnings also reflected higher segment operating profit which was partially offset by elevated interest expense.

Segment operating profit was $1,193 million in

2023 compared to $960 million in the prior year.

| • | Americas: Segment operating profit

in the Americas was $511 million compared to $472 million in 2022 and primarily benefited from favorable net price and margin expansion

initiatives which were partially offset by the impact of lower sales volume and elevated operating costs mostly attributed to temporary

production curtailments to balance supply with lower demand. Segment operating profit also benefited $12 million from favorable foreign

currency translation. |

| • | Europe: Segment operating profit

in Europe was $682 million compared to $488 million in 2022 and primarily benefited from favorable net price and margin expansion initiatives.

These benefits were partially offset by lower sales volume as well as higher operating costs due to temporary production curtailments

to balance supply with lower demand. Segment operating profit also benefited $17 million from favorable foreign currency translation. |

Retained corporate and other costs were $224 million,

down from $232 million in 2022.

O-I reported a loss attributable to the company

of $0.67 per share (diluted) in 2023, compared to earnings of $3.67 per share (diluted) in 2022.

Adjusted earnings were $3.09 per share (diluted)

in 2023, exceeding management’s most recent guidance of approximately $3.00 per share (diluted) and compared to $2.30 per share

(diluted) in 2022.

Cash provided by operating activities was $818

million in 2023 compared to $154 million in 2022 which included a $621 million one-time payment to fund the Paddock Trust and related

expenses.

Free cash flow was $130 million in 2023, within

management’s most recent outlook of $100 million to $150 million and compared to $236 million in the prior year. Free cash flow

included elevated capital expenditures of $688 million in 2023 compared to most recent guidance of approximately $700 million and $539

million in 2022.

Total debt was $4.9 billion on December 31,

2023, compared to $4.7 billion at prior year end. Net debt was $4.0 billion compared to $3.9 billion in 2022.

Fourth Quarter 2023 Results

| | |

Net Earnings

(Loss) Attributable to the Company

Earnings Per Share (Diluted) | |

Earnings

(Loss) Before Income Taxes

$M |

| | |

4Q23 | |

4Q22 | |

4Q23 | |

4Q22 |

| Reported | |

($3.05) | |

$0.08 | |

($439) | |

$29 |

| | |

| |

| |

| |

|

| | |

Adjusted Earnings

Earnings Per Share (Diluted) | |

Segment Operating Profit

$M |

| | |

4Q23 | |

4Q22 | |

4Q23 | |

4Q22 |

| Non - GAAP | |

$0.12 (Guidance: ~ $0.03) | |

$0.38 | |

$168 | |

$206 |

Net sales were $1.6 billion in the fourth quarter

of 2023 compared to $1.7 billion in the prior year period as the benefit from higher average selling prices and favorable foreign currency

translation partially offset a 16 percent decline in sales volumes (in tons).

The company reported a $439 million loss before

income taxes in the fourth quarter of 2023 compared to earnings before income tax of $29 million in the prior year quarter. This decrease

was mostly due to items management does not consider representative of ongoing operations which included the aforementioned $445 million

charge for impairment of goodwill in the company’s North America reporting unit in 2023. Earnings before income tax also reflected

lower segment operating profit and elevated interest expense.

Segment operating profit was $168 million in the

fourth quarter of 2023 compared to $206 million in the prior year period.

| • | Americas: Segment operating profit

in the Americas was $93 million compared to $83 million in the fourth quarter of 2022 as favorable net price and margin expansion initiatives

more than offset lower sales volume and moderately higher operating costs. Segment operating profit also benefited $2 million from favorable

foreign currency translation. |

| • | Europe: Segment operating profit

in Europe was $75 million compared to $123 million in the fourth quarter of 2022 as favorable net price partially offset lower shipment

levels and significantly higher operating costs due to elevated temporary production curtailment to balance supply with softer demand.

Segment operating profit also benefited $4 million from favorable foreign currency translation. |

Retained corporate and other costs were $49 million,

down from $66 million in 2022.

The company reported a loss attributable to the

company of $3.05 per share (diluted) in the fourth quarter of 2023 compared to earnings of $0.08 per share (diluted) in the fourth quarter

of 2022.

Adjusted earnings were $0.12 per share (diluted)

in the fourth quarter of 2023, higher than management's most recent guidance of approximately $0.03 per share (diluted) and compared to

$0.38 (diluted) per share in the prior year quarter.

2024 Outlook

| | |

2023 Actual | |

2024 Guidance |

| Sales Volume Growth (in Tons) | |

▼ 12% | |

▲ LSD / MSD |

| Adjusted Earnings Per Share | |

$3.09 | |

$2.25 - $2.65 |

| Free Cash Flow ($M) | |

$130 | |

$150 - $200 |

O-I expects 2024 adjusted earnings of $2.25 to

$2.65 per share which should meet or exceed the company’s 2024 earnings target of $2.20 to $2.40 per share set during the last Investor

Day in 2021. Results will likely be down from 2023, which represented O-I’s highest adjusted earnings in the past 15 years, as the

company expects the benefit of low-to-mid single digit volume growth and the company’s robust margin expansion initiatives will

partially mitigate the impact of lower net price and higher interest expense. While net price will likely decline in 2024, the company

expects to retain 75 percent of the favorable net price realized over the prior two years. Furthermore, the company will benefit from

strong operating leverage as sales and production volumes more fully recover to pre-pandemic levels over time.

O-I anticipates 2024 free cash flow will approximate

$150 million to $200 million, an improvement from 2023 levels as reduced capital expenditures more than offset lower operating results

and elevated tax and interest payments.

Guidance primarily reflects the company’s

current view on sales and production volume, mix and working capital trends. O-I’s adjusted earnings outlook assumes foreign currency

rates as of January 31, 2024, and a full-year adjusted effective tax rate of approximately 25 to 27 percent. The earnings and cash

flow guidance ranges may not fully reflect uncertainty in macroeconomic conditions, currency rates, energy and raw materials costs, supply

chain disruptions and labor challenges, among other factors.

Conference Call Scheduled for February 7, 2023

O-I CEO Andres Lopez and CFO John Haudrich will

conduct a conference call to discuss the company’s latest results on Wednesday, February 7, 2023, at 8:00 a.m. EST A

live webcast of the conference call, including presentation materials, will be available on the O-I website, www.o-i.com/investors,

in the News and Events section. A replay of the call will be available on the website for a year following the event.

Contact: Sasha Sekpeh, 567-336-5128 – O-I

Investor Relations

O-I news releases are available on the O-I website

at www.o-i.com.

O-I’s first quarter 2024 earnings conference

call is currently scheduled for Wednesday, May 1, 2024, at 8:00 a.m. EST.

About O-I Glass

At O-I

Glass, Inc. (NYSE: OI), we love glass and we’re proud to be one of the leading producers of glass bottles and jars around

the globe. Glass is not only beautiful, it’s also pure and completely recyclable, making it the most sustainable rigid packaging

material. Headquartered in Perrysburg, Ohio (USA), O-I is the preferred partner for many of the world’s leading food and beverage

brands. We innovate in line with customers’ needs to create iconic packaging that builds brands around the world. Led by our diverse

team of approximately 23,000 people across 68 plants in 19 countries, O-I achieved net sales of $7.1 billion in 2023. Learn

more about us: o-i.com / Facebook / Twitter / Instagram / LinkedIn

Non-GAAP Financial Measures

The company uses certain non-GAAP financial measures,

which are measures of its historical or future financial performance that are not calculated and presented in accordance with GAAP, within

the meaning of applicable SEC rules. Management believes that its presentation and use of certain non-GAAP financial measures, including

adjusted earnings, adjusted earnings per share, free cash flow, segment operating profit, segment operating profit margin, net debt and

adjusted effective tax rate provide relevant and useful supplemental financial information that is widely used by analysts and investors,

as well as by management in assessing both consolidated and business unit performance. These non-GAAP measures are reconciled to the most

directly comparable GAAP measures and should be considered supplemental in nature and should not be considered in isolation or be construed

as being more important than comparable GAAP measures.

Adjusted earnings relates to net earnings (loss)

attributable to the company, exclusive of items management considers not representative of ongoing operations and other adjustments

because such items are not reflective of the company’s principal business activity, which is glass container production. Adjusted

earnings are divided by weighted average shares outstanding (diluted) to derive adjusted earnings per share. Segment operating profit

relates to earnings (loss) before interest expense, net, and before income taxes and is also exclusive of items management considers not

representative of ongoing operations as well as certain retained corporate costs and other adjustments. Segment operating profit margin

is calculated as segment operating profit divided by segment revenue. Adjusted effective tax rate relates to provision for income taxes,

exclusive of items management considers not representative of ongoing operations and other adjustments divided by earnings (loss) before

income taxes, exclusive of items management considers not representative of ongoing operations and other adjustments. Management uses

adjusted earnings, adjusted earnings per share, segment operating profit, segment operating profit margin, and adjusted effective tax

rate to evaluate its period-over-period operating performance because it believes these provide useful supplemental measures of the results

of operations of its principal business activity by excluding items that are not reflective of such operations. The above non-GAAP

financial measures may be useful to investors in evaluating the underlying operating performance of the company’s business as these

measures eliminate items that are not reflective of its principal business activity.

Net debt is defined as total debt less cash. Management

uses net debt to analyze the liquidity of the company.

Further, free cash flow relates to cash provided

by operating activities plus cash payments to the Paddock 524(g) trust and related expenses less cash payments for property, plant,

and equipment. Management has historically used free cash flow to evaluate its period-over-period cash generation performance because

it believes these have provided useful supplemental measures related to its principal business activity. It should not be inferred that

the entire free cash flow amount is available for discretionary expenditures, since the company has mandatory debt service requirements

and other non-discretionary expenditures that are not deducted from these measures. Management uses non-GAAP information principally for

internal reporting, forecasting, budgeting and calculating compensation payments.

The company routinely posts important information

on its website – www.o-i.com/investors.

Forward-Looking Statements

This press release contains “forward-looking”

statements related to O-I Glass, Inc. (“O-I Glass” or the “company”) within the meaning of Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the Securities Act of 1933,

as amended. Forward-looking statements reflect the company’s current expectations and projections about future events at the time,

and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,”

“could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,”

“predict,” “potential,” “continue,” and the negatives of these words and other similar expressions

generally identify forward-looking statements.

It is possible that the Company’s future

financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) the

general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties

related to economic and social conditions, trade disputes, disruptions in the supply chain, competitive pricing pressures, inflation or

deflation, changes in tax rates and laws, war, civil disturbance or acts of terrorism, natural disasters, public health issues and weather,

(2) cost and availability of raw materials, labor, energy and transportation (including impacts related to the current Ukraine-Russia

and Israel-Hamas conflicts and disruptions in supply of raw materials caused by transportation delays), (3) competitive pressures,

consumer preferences for alternative forms of packaging or consolidation among competitors and customers, (4) changes in consumer

preferences or customer inventory management practices, (5) the continuing consolidation of the Company’s customer base, (6) the

Company’s ability to improve its glass melting technology, known as the MAGMA program, and implement it within the timeframe expected,

(7) unanticipated supply chain and operational disruptions, including higher capital spending, (8) seasonability of customer

demand, (9) the failure of the Company’s joint venture partners to meet their obligations or commit additional capital to the

joint venture, (10) labor shortages, labor cost increases or strikes, (11) the Company’s ability to acquire or divest businesses,

acquire and expand plants, integrate operations of acquired businesses and achieve expected benefits from acquisitions, divestitures or

expansions, (12) the Company’s ability to generate sufficient future cash flows to ensure the Company’s goodwill is not impaired,

(13) any increases in the underfunded status of the Company’s pension plans, (14) any failure or disruption of the Company’s

information technology, or those of third parties on which the Company relies, or any cybersecurity or data privacy incidents affecting

the Company or its third-party service providers, (15) risks related to the Company’s indebtedness or changes in capital availability

or cost, including interest rate fluctuations and the ability of the Company to generate cash to service indebtedness and refinance debt

on favorable terms, (16) risks associated with operating in foreign countries, (17) foreign currency fluctuations relative to the U.S.

dollar, (18) changes in tax laws or U.S. trade policies, (19) the Company’s ability to comply with various environmental legal requirements,

(20) risks related to recycling and recycled content laws and regulations, (21) risks related to climate-change and air emissions, including

related laws or regulations and increased ESG scrutiny and changing expectations from stakeholders and the other risk factors discussed

in the Company's filings with the Securities and Exchange Commission.

It is not possible to foresee or identify all

such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light

of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes

are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments

may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company’s

results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking

statements contained in this document.

O-I GLASS, INC.

Condensed Consolidated Results of Operations

(Dollars in millions, except per share amounts)

| | |

Three months ended

December 31 | | |

Year ended

December 31 | |

| Unaudited | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales | |

$ | 1,641 | | |

$ | 1,693 | | |

$ | 7,105 | | |

$ | 6,856 | |

| Cost of goods sold | |

| (1,410 | ) | |

| (1,434 | ) | |

| (5,609 | ) | |

| (5,643 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 231 | | |

| 259 | | |

| 1,496 | | |

| 1,213 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling and administrative expense | |

| (116 | ) | |

| (126 | ) | |

| (540 | ) | |

| (496 | ) |

| Research, development and engineering expense | |

| (26 | ) | |

| (23 | ) | |

| (92 | ) | |

| (79 | ) |

| Interest expense, net | |

| (79 | ) | |

| (64 | ) | |

| (342 | ) | |

| (239 | ) |

| Equity earnings | |

| 27 | | |

| 36 | | |

| 127 | | |

| 107 | |

| Other income (expense), net (incl. goodwill impairment) | |

| (476 | ) | |

| (53 | ) | |

| (582 | ) | |

| 299 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) before income taxes | |

| (439 | ) | |

| 29 | | |

| 67 | | |

| 805 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| (25 | ) | |

| (14 | ) | |

| (152 | ) | |

| (178 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings (loss) | |

| (464 | ) | |

| 15 | | |

| (85 | ) | |

| 627 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings attributable to non-controlling interests | |

| (6 | ) | |

| (2 | ) | |

| (18 | ) | |

| (43 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings (loss) attributable to the Company | |

$ | (470 | ) | |

$ | 13 | | |

$ | (103 | ) | |

$ | 584 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) attributable to the Company | |

$ | (3.05 | ) | |

$ | 0.09 | | |

$ | (0.67 | ) | |

$ | 3.76 | |

| Weighted average shares outstanding (thousands) | |

| 154,223 | | |

| 154,604 | | |

| 154,651 | | |

| 155,309 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) attributable to the Company | |

$ | (3.05 | ) | |

$ | 0.08 | | |

$ | (0.67 | ) | |

$ | 3.67 | |

| Weighted average diluted shares outstanding (thousands) | |

| 154,223 | | |

| 159,271 | | |

| 154,651 | | |

| 158,985 | |

O-I GLASS, INC.

Condensed Consolidated Balance Sheets

(Dollars in millions)

| Unaudited | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 913 | | |

$ | 773 | |

| Trade receivables, net | |

| 671 | | |

| 760 | |

| Inventories | |

| 1,071 | | |

| 848 | |

| Prepaid expenses and other current assets | |

| 229 | | |

| 222 | |

| Total current assets | |

| 2,884 | | |

| 2,603 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 3,555 | | |

| 2,962 | |

| Goodwill | |

| 1,473 | | |

| 1,813 | |

| Intangibles, net | |

| 254 | | |

| 262 | |

| Other assets | |

| 1,503 | | |

| 1,421 | |

| | |

| | | |

| | |

| Total assets | |

$ | 9,669 | | |

$ | 9,061 | |

| | |

| | | |

| | |

| Liabilities and Share Owners' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,437 | | |

$ | 1,355 | |

| Short-term loans and long-term debt due within one year | |

| 248 | | |

| 345 | |

| Other liabilities | |

| 661 | | |

| 657 | |

| Total current liabilities | |

| 2,346 | | |

| 2,357 | |

| | |

| | | |

| | |

| Long-term debt | |

| 4,698 | | |

| 4,371 | |

| Other long-term liabilities | |

| 881 | | |

| 805 | |

| Share owners' equity | |

| 1,744 | | |

| 1,528 | |

| | |

| | | |

| | |

| Total liabilities and share owners' equity | |

$ | 9,669 | | |

$ | 9,061 | |

O-I GLASS, INC.

Condensed Consolidated Cash Flows

(Dollars in millions)

| Unaudited | |

Three months ended

December 31 | | |

Year ended

December 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Net earnings (loss) | |

$ | (464 | ) | |

$ | 15 | | |

$ | (85 | ) | |

$ | 627 | |

| Non-cash charges | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 125 | | |

| 118 | | |

| 494 | | |

| 465 | |

| Deferred taxes | |

| 4 | | |

| 4 | | |

| 25 | | |

| 22 | |

| Pension expense | |

| 8 | | |

| 9 | | |

| 30 | | |

| 34 | |

| Stock-based compensation expense | |

| 7 | | |

| 5 | | |

| 43 | | |

| 33 | |

| Restructuring, asset impairment and related charges | |

| 19 | | |

| 29 | | |

| 97 | | |

| 50 | |

| Pension settlement and curtailment charges | |

| 19 | | |

| 15 | | |

| 19 | | |

| 20 | |

| Gain on sale of divested businesses and miscellaneous assets | |

| (4 | ) | |

| | | |

| (4 | ) | |

| (55 | ) |

| Gain on sale leasebacks | |

| | | |

| | | |

| | | |

| (334 | ) |

| Goodwill Impairment | |

| 445 | | |

| | | |

| 445 | | |

| | |

| Cash payments | |

| | | |

| | | |

| | | |

| | |

| Pension contributions | |

| (8 | ) | |

| (4 | ) | |

| (32 | ) | |

| (26 | ) |

| Paddock Trust settlement payment and related expenses | |

| | | |

| (3 | ) | |

| | | |

| (621 | ) |

| Cash paid for restructuring activities | |

| (5 | ) | |

| (6 | ) | |

| (26 | ) | |

| (20 | ) |

| Change in components of working capital (a) | |

| 268 | | |

| 257 | | |

| (148 | ) | |

| 95 | |

| Other, net (b) | |

| (33 | ) | |

| (61 | ) | |

| (40 | ) | |

| (136 | ) |

| Cash provided by operating activities | |

| 381 | | |

| 378 | | |

| 818 | | |

| 154 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Cash payments for property, plant and equipment | |

| (223 | ) | |

| (193 | ) | |

| (688 | ) | |

| (539 | ) |

| Contributions and advances to joint ventures | |

| (1 | ) | |

| (1 | ) | |

| (10 | ) | |

| (12 | ) |

| Cash proceeds on disposal of other businesses and misc. assets | |

| | | |

| 2 | | |

| 11 | | |

| 98 | |

| Cash proceeds on sale leasebacks | |

| | | |

| | | |

| | | |

| 368 | |

| Reconsolidation of Reorganized Paddock | |

| | | |

| | | |

| | | |

| 12 | |

| Net cash proceeds (payments) from hedging activities | |

| (2 | ) | |

| (13 | ) | |

| 4 | | |

| (24 | ) |

| Cash utilized in investing activities | |

| (226 | ) | |

| (205 | ) | |

| (683 | ) | |

| (97 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Changes in borrowings, net | |

| (45 | ) | |

| (25 | ) | |

| 81 | | |

| (29 | ) |

| Shares repurchased | |

| (10 | ) | |

| (10 | ) | |

| (40 | ) | |

| (40 | ) |

| Payment of finance fees | |

| | | |

| | | |

| (22 | ) | |

| (29 | ) |

| Net cash receipts (payments) for hedging activity | |

| | | |

| 95 | | |

| (40 | ) | |

| 133 | |

| Distributions to non-controlling interests | |

| (3 | ) | |

| | | |

| (6 | ) | |

| (27 | ) |

| Issuance of common stock and other | |

| | | |

| | | |

| | | |

| (2 | ) |

| Cash provided by (utlilized in) financing activities | |

| (58 | ) | |

| 60 | | |

| (27 | ) | |

| 6 | |

| Effect of exchange rate fluctuations on cash | |

| 24 | | |

| 17 | | |

| 32 | | |

| (15 | ) |

| Change in cash | |

| 121 | | |

| 250 | | |

| 140 | | |

| 48 | |

| Cash at beginning of period | |

| 792 | | |

| 523 | | |

| 773 | | |

| 725 | |

| Cash at end of period | |

$ | 913 | | |

$ | 773 | | |

$ | 913 | | |

$ | 773 | |

| (a) |

The Company uses various factoring programs to sell certain receivables to financial institutions as part of managing its cash flows.

At December 31, 2023 and 2022 , the amount of receivables sold by the Company was $542 million and $535 million, respectively. For the

years ended December 31, 2023 and 2022, the Company's use of its factoring programs resulted in increases of $7 million and $54 million

to cash provided by operating activities, respectively. |

| |

|

| (b) |

Other, net includes other non-cash charges plus other changes in non-current assets and liabilities.

|

O-I GLASS, INC.

Reportable Segment Information and Reconciliation to Earnings Before Income Taxes

(Dollars in millions)

| Unaudited | |

Three months ended

December 31 | | |

Year ended

December 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales: | |

| | | |

| | | |

| | | |

| | |

| Americas | |

$ | 922 | | |

$ | 937 | | |

$ | 3,865 | | |

$ | 3,835 | |

| Europe | |

| 689 | | |

| 724 | | |

| 3,117 | | |

| 2,878 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reportable segment totals | |

| 1,611 | | |

| 1,661 | | |

| 6,982 | | |

| 6,713 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other | |

| 30 | | |

| 32 | | |

| 123 | | |

| 143 | |

| Net sales | |

$ | 1,641 | | |

$ | 1,693 | | |

$ | 7,105 | | |

$ | 6,856 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) before income taxes | |

$ | (439 | ) | |

$ | 29 | | |

$ | 67 | | |

$ | 805 | |

| Items excluded from segment operating profit: | |

| | | |

| | | |

| | | |

| | |

| Retained corporate costs and other | |

| 49 | | |

| 66 | | |

| 224 | | |

| 232 | |

| Items not considered representative of ongoing operations and other adjustments (a) | |

| 479 | | |

| 47 | | |

| 560 | | |

| (316 | ) |

| Interest expense, net | |

| 79 | | |

| 64 | | |

| 342 | | |

| 239 | |

| Segment operating profit (b): | |

$ | 168 | | |

$ | 206 | | |

$ | 1,193 | | |

$ | 960 | |

| | |

| | | |

| | | |

| | | |

| | |

| Americas | |

$ | 93 | | |

$ | 83 | | |

$ | 511 | | |

$ | 472 | |

| Europe | |

| 75 | | |

| 123 | | |

| 682 | | |

| 488 | |

| Reportable segment totals | |

$ | 168 | | |

$ | 206 | | |

$ | 1,193 | | |

$ | 960 | |

| | |

| | | |

| | | |

| | | |

| | |

| Ratio of earnings before income taxes to net sales | |

| -26.8 | % | |

| 1.7 | % | |

| 0.9 | % | |

| 11.7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Segment operating profit margin (c): | |

| | | |

| | | |

| | | |

| | |

| Americas | |

| 10.1 | % | |

| 8.9 | % | |

| 13.2 | % | |

| 12.3 | % |

| Europe | |

| 10.9 | % | |

| 17.0 | % | |

| 21.9 | % | |

| 17.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reportable segment margin totals | |

| 10.4 | % | |

| 12.4 | % | |

| 17.1 | % | |

| 14.3 | % |

| (a) |

Reference reconciliation for adjusted earnings. |

| |

|

| (b) |

Segment operating profit consists of consolidated earnings before interest income, interest expense, and provision for income taxes and

excludes amounts related to certain items that management considers not representative of ongoing operations as well as certain retained

corporate costs and other adjustments. |

| |

|

| The Company presents information on segment operating profit because management believes that it provides investors with a measure of operating performance separate from the level of indebtedness or other related costs of capital. The most directly comparable GAAP financial measure to segment operating profit is earnings before income taxes. The Company presents segment operating profit because management uses the measure, in combination with net sales and selected cash flow information, to evaluate performance and to allocate resources. |

| |

| (c) |

Segment operating profit margin is segment operating profit divided by segment net sales.

|

O-I GLASS, INC.

Changes in Net Sales and Segment Operating Profit for Reportable Segments

(Dollars in millions)

Unaudited

| | |

Three months ended December 31 | |

| | |

Americas | | |

Europe | | |

Total | |

| Net sales for reportable segments- 2022 | |

$ | 937 | | |

$ | 724 | | |

$ | 1,661 | |

| Effects of changing foreign currency rates (a) | |

| 46 | | |

| 44 | | |

| 90 | |

| Price | |

| 50 | | |

| 92 | | |

| 142 | |

| Sales volume & mix | |

| (111 | ) | |

| (171 | ) | |

| (282 | ) |

| Total reconciling items | |

| (15 | ) | |

| (35 | ) | |

| (50 | ) |

| Net sales for reportable segments- 2023 | |

$ | 922 | | |

$ | 689 | | |

$ | 1,611 | |

| | |

Three months ended December 31 | |

| | |

Americas | | |

Europe | | |

Total | |

| Segment operating profit - 2022 | |

$ | 83 | | |

$ | 123 | | |

$ | 206 | |

| Effects of changing foreign currency rates (a) | |

| 2 | | |

| 4 | | |

| 6 | |

| Net price (net of cost inflation) | |

| 52 | | |

| 57 | | |

| 109 | |

| Sales volume & mix | |

| (23 | ) | |

| (39 | ) | |

| (62 | ) |

| Operating costs | |

| (21 | ) | |

| (70 | ) | |

| (91 | ) |

| Divestitures | |

| | | |

| | | |

| - | |

| Total reconciling items | |

| 10 | | |

| (48 | ) | |

| (38 | ) |

| Segment operating profit - 2023 | |

$ | 93 | | |

$ | 75 | | |

$ | 168 | |

| | |

Year ended December 31 | |

| | |

Americas | | |

Europe | | |

Total | |

| Net sales for reportable segments- 2022 | |

$ | 3,835 | | |

$ | 2,878 | | |

$ | 6,713 | |

| Effects of changing foreign currency rates (a) | |

| 136 | | |

| 99 | | |

| 235 | |

| Price | |

| 287 | | |

| 596 | | |

| 883 | |

| Sales volume & mix | |

| (385 | ) | |

| (456 | ) | |

| (841 | ) |

| Divestiture | |

| (8 | ) | |

| | | |

| (8 | ) |

| Total reconciling items | |

| 30 | | |

| 239 | | |

| 269 | |

| Net sales for reportable segments- 2023 | |

$ | 3,865 | | |

$ | 3,117 | | |

$ | 6,982 | |

| | |

Year ended December 31 | |

| | |

Americas | | |

Europe | | |

Total | |

| Segment operating profit - 2022 | |

$ | 472 | | |

$ | 488 | | |

$ | 960 | |

| Effects of changing foreign currency rates (a) | |

| 12 | | |

| 17 | | |

| 29 | |

| Net price (net of cost inflation) | |

| 288 | | |

| 344 | | |

| 632 | |

| Sales volume & mix | |

| (95 | ) | |

| (110 | ) | |

| (205 | ) |

| Operating costs | |

| (153 | ) | |

| (57 | ) | |

| (210 | ) |

| Divestitures | |

| (13 | ) | |

| | | |

| (13 | ) |

| Total reconciling items | |

| 39 | | |

| 194 | | |

| 233 | |

| Segment operating profit - 2023 | |

$ | 511 | | |

$ | 682 | | |

$ | 1,193 | |

(a) Currency effect on net sales and segment

operating profit determined by using 2023 foreign currency exchange rates to translate 2022 local currency results.

O-I GLASS, INC.

Reconciliation for Adjusted Earnings

(Dollars in millions, except per share amounts)

The reconciliation below

describes the items that management considers not representative of ongoing operations.

Unaudited

| | |

Three months ended

December 31 | | |

Year ended

December 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net earnings (loss) attributable to the Company | |

$ | (470 | ) | |

$ | 13 | | |

$ | (103 | ) | |

$ | 584 | |

| Items impacting other income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Restructuring, asset impairment and other charges | |

| 19 | | |

| 32 | | |

| 100 | | |

| 53 | |

| Goodwill impairment | |

| 445 | | |

| | | |

| 445 | | |

| | |

| Gain on sale of divested businesses and miscellaneous assets | |

| (4 | ) | |

| | | |

| (4 | ) | |

| (55 | ) |

| Gain on sale leasebacks | |

| | | |

| | | |

| | | |

| (334 | ) |

| Pension settlement and curtailment charges | |

| 19 | | |

| 15 | | |

| 19 | | |

| 20 | |

| Items impacting interest expense: | |

| | | |

| | | |

| | | |

| | |

| Charges for note repurchase premiums and write-off of deferred finance fees and related charges | |

| | | |

| | | |

| 39 | | |

| 26 | |

| Items impacting income tax: | |

| | | |

| | | |

| | | |

| | |

| Valuation Allowance-Interest carryovers | |

| 20 | | |

| | | |

| 20 | | |

| | |

| Tax charge recorded for certain tax adjustments | |

| | | |

| 2 | | |

| | | |

| 2 | |

| Net expense (benefit) for income tax on items above | |

| (11 | ) | |

| (2 | ) | |

| (25 | ) | |

| 41 | |

| Items impacting net earnings attributable to noncontrolling interests: | |

| | | |

| | | |

| | | |

| | |

| Net impact of noncontrolling interests on items above | |

| | | |

| | | |

| | | |

| 29 | |

| Total adjusting items (non-GAAP) | |

$ | 488 | | |

$ | 47 | | |

$ | 594 | | |

$ | (218 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted earnings (non-GAAP) | |

$ | 18 | | |

$ | 60 | | |

$ | 491 | | |

$ | 366 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted average shares (thousands) | |

| 154,223 | | |

| 159,271 | | |

| 154,651 | | |

| 158,985 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings attributable to the Company (diluted) | |

$ | (3.05 | ) | |

$ | 0.08 | | |

$ | (0.67 | ) | |

$ | 3.67 | |

| Adjusted earnings per share (non-GAAP) (a) | |

$ | 0.12 | | |

$ | 0.38 | | |

$ | 3.09 | | |

$ | 2.30 | |

(a) For purposes of computing adjusted earnings per share, the diluted average shares (in thousands) are 158,837 for the three months ended December 31, 2023.

For purposes of computing adjusted earnings per share, the diluted average shares (in thousands) are 159,135 for the year ended December 31, 2023.

The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, adjusted earnings and adjusted earnings per share, for the year ended December 31, 2024 to its most directly comparable GAAP financial measure, Net earnings attributable to the Company, because management cannot reliably predict all of the necessary components of this GAAP financial measure without unreasonable efforts. Net earnings attributable to the Company includes several significant items, such as restructuring charges, asset impairment charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these and other similar items are complex and inherently unpredictable, and the amount recognized for each item can vary significantly. Accordingly, the Company is unable to provide a reconciliation of adjusted earnings and adjusted earnings per share to net earnings attributable to the Company or address the probable significance of the unavailable information, which could be material to the Company's future financial results.

O-I GLASS, INC.

Reconciliation to Free Cash Flow

(Dollars in millions)

Unaudited

| | |

Year Ended

December 31, 2023 | | |

Year Ended

December 31, 2022 | | |

Forecast

Year Ended

December 31, 2023 | | |

Forecast

Year Ended

December 31, 2024 | |

| Cash provided by operating activities | |

$ | 818 | | |

$ | 154 | | |

$ | 800 to 850 | | |

$ | 750 | |

| Addback: Funding of Paddock 524(g) trust and related expenses | |

| | | |

| 621 | | |

| | | |

| | |

| Cash payments for property, plant and equipment | |

| (688 | ) | |

| (539 | ) | |

| (700 | ) | |

| (550 to 600 | ) |

| Free cash flow (non-GAAP) | |

$ | 130 | | |

$ | 236 | | |

$ | 100 to 150 | | |

$ | 150 to 200 | |

O-I GLASS, INC.

Reconciliation to Net Debt

Unaudited

| | |

December 31, 2023 | | |

December 31, 2022 | |

| Total debt | |

$ | 4,946 | | |

$ | 4,716 | |

| Cash and cash equivalents | |

| 913 | | |

| 773 | |

| Net Debt | |

$ | 4,033 | | |

$ | 3,943 | |

O-I GLASS, INC.

Reconciliation to Adjusted Effective Tax Rate

The Company is unable to present a quantitative reconciliation of its

forward-looking non-GAAP measure, adjusted effective tax rate, for the year ending December 31, 2024, to its most directly comparable

GAAP financial measure, provision for income taxes divided by earnings (loss) before income taxes, because management cannot reliably

predict all of the necessary components of these GAAP financial measures without unreasonable efforts. Earnings (loss) before income taxes

includes several significant items, such as restructuring charges, asset impairment charges, charges for the write-off of finance fees,

and the provision for income taxes would include the income tax effect on such items. The decisions and events that typically lead to

the recognition of these and other similar items are complex and inherently unpredictable, and the amount recognized for each item can vary significantly. Accordingly, the Company is unable

to provide a reconciliation of adjusted effective tax rate to earnings (loss) before income taxes divided by provision for income taxes

or address the probable significance of the unavailable information, which could be material to the Company's future financial results.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

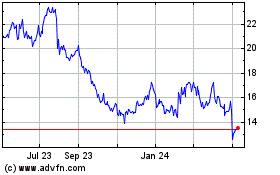

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to Apr 2024

OI Glass (NYSE:OI)

Historical Stock Chart

From Apr 2023 to Apr 2024