false000081201100008120112024-03-112024-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 11, 2024

Vail Resorts, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-09614 | | 51-0291762 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | |

| 390 Interlocken Crescent | | | | |

| Broomfield, | Colorado | | | | 80021 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

| | | | | |

| (303) | 404-1800 |

| (Registrant’s telephone number, including area code) |

| | |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MTN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On March 11, 2024, Vail Resorts, Inc. issued a press release announcing its results for the three and six months ended January 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 11, 2024, the Board of Directors (the “Board”) of Vail Resorts, Inc. (the “Company”), based on the recommendation of the Nominating and Governance Committee of the Board, appointed Reginald Chambers as a director of the Company, to serve until his successor is elected and qualified or until his earlier resignation or removal. To appoint Mr. Chambers, the Board increased the size of the Board from eleven to twelve members. Mr. Chambers was also appointed to serve on the Audit Committee of the Board on March 11, 2024.

Mr. Chambers, age 48, has served as Executive Vice President and the Chief Transformation Officer at the Teachers Insurance and Annuity Association of America (“TIAA”) since September 2023. TIAA is a financial services organization and private provider of financial retirement services in the academic, research, medical, cultural, and governmental fields. From May 2017 to September 2023, he held various senior executive roles at JPMorgan Chase & Co., a financial holding company that offers consumer and commercial banking, investment banking, financial transaction processing, and asset management solutions, including having been Head of Investor Relations for the firm and serving most recently as Chief Financial Officer and Head of Strategy for Commercial Banking. Previously, Mr. Chambers served in the Strategy and Corporate Finance practice at McKinsey & Company, a global management consulting firm (2013 – 2017); as White House Fellow at the White House National Economic Council (2011 – 2012); as an investor with 3i Group plc, a multinational private equity and venture capital firm based in London, United Kingdom (2008 – 2011); as Vice President in the Global Energy Group of the Investment Banking Division of Citigroup Inc., a diversified financial services holding company that provides a broad range of financial services to consumer and corporate customers (2006 – 2008); and as a corporate lawyer with Uria Menendez Abogados, S.L.P., an international Spanish law firm (2001 – 2002), and then with Simpson Thacher & Bartlett LLP, an international law firm headquartered in New York City, (2002 – 2006). Mr. Chambers received a J.D. from Harvard Law School and an A.B. in Political Science, Spanish, and Markets & Management from Duke University.

There are no arrangements or understandings between Mr. Chambers and the Company or any other person pursuant to which he was appointed to the Board. There are no related party transactions between the Company and Mr. Chambers that would require disclosure under Item 404(a) of Regulation S-K. As a non-employee director, Mr. Chambers will participate in the Company’s standard compensation arrangements for non-employee directors.

A copy of the press release announcing the appointment of Mr. Chambers to the Board is attached hereto as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Vail Resorts, Inc. |

Date: March 11, 2024 | By: |

/s/ Angela A. Korch |

| | Angela A. Korch |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Vail Resorts Contacts:

Investor Relations: Bo Heitz, (303) 404-1800, InvestorRelations@vailresorts.com

Media: Sara Olson, (303) 404-6497, News@vailresorts.com

Vail Resorts Reports Fiscal 2024 Second Quarter Results, Increases Quarterly Dividend, and Provides Updated Fiscal 2024 Guidance

BROOMFIELD, Colo. - March 11, 2024 - Vail Resorts, Inc. (NYSE: MTN) today reported results for the second quarter of fiscal 2024 ended January 31, 2024 and provided the Company’s ski season-to-date metrics through March 3, 2024.

Highlights

•Net income attributable to Vail Resorts, Inc. was $219.3 million for the second fiscal quarter of 2024 compared to net income attributable to Vail Resorts, Inc. of $208.7 million in the same period in the prior year.

•Resort Reported EBITDA was $425.0 million for the second quarter of fiscal 2024, which included $2.1 million of acquisition related expenses. In the same period in the prior year, Resort Reported EBITDA was $394.8 million, which included $0.3 million of acquisition and integration related expenses.

•Season-to-date total skier visits decreased 9.7% and total lift revenue increased 2.6% through March 3, 2024 compared to the fiscal year 2023 season-to-date period through March 5, 2023. Season-to-date ski school revenue was up 5.5% and dining revenue was down 0.5% compared to the prior year season-to-date period. Retail/rental revenue for North American resort and ski area store locations was down 9.3% compared to the prior year season-to-date period.

•The Company updated its guidance for fiscal year 2024 and is now expecting net income attributable to Vail Resorts, Inc. to be between $270 million and $325 million and Resort Reported EBITDA to be between $849 million and $885 million, which includes an estimated $4 million of acquisition related expenses specific to Crans-Montana.

•The Company’s Board of Directors approved an 8% increase in the quarterly cash dividend to $2.22 per share beginning with the dividend payable on April 11, 2024 to shareholders of record as of March 28, 2024.

Commenting on the Company’s fiscal 2024 second quarter results, Kirsten Lynch, Chief Executive Officer, said, “Given the unfavorable conditions across our North American resorts, we are pleased that our results for the quarter demonstrate the resiliency of our strategic business model and our network of resorts and loyal guests. The results for the

second quarter were negatively impacted by challenging conditions at all of our North American resorts, with approximately 42% lower snowfall across our western North American resorts through January compared to the same period in the prior year and limited natural snow and variable temperatures at our Eastern U.S. resorts (comprising the Midwest, Mid-Atlantic, and Northeast).

“Despite the impacts of conditions, Resort Reported EBITDA in the second quarter increased approximately 8% compared to the prior year, primarily driven by the stability created by our season pass results. Resort EBITDA Margin also improved 3.3 points in the second quarter compared to the prior year driven by disciplined cost management.

“While visitation declined, our ancillary businesses performed well, in particular our ski and ride school, dining and rental businesses experienced strong growth in spending per visit compared to the prior year. We are pleased with the strong execution across our mountain resorts, as well as the impact of the Company’s investments in our employees, technology, and on-mountain experience.”

Season-to-Date Metrics through March 3, 2024 & Interim Results Commentary

The Company reported certain ski season metrics for the comparative periods from the beginning of the ski season through March 3, 2024, and for the prior year period through March 5, 2023. The reported ski season metrics are for the Company's North American destination mountain resorts and regional ski areas, excluding the results of the Australian ski areas and Andermatt-Sedrun in both periods. The data mentioned in this release is interim period data and is subject to fiscal quarter end review and adjustments.

•Season-to-date total skier visits were down 9.7% compared to the prior year season-to-date period.

•Season-to-date total lift ticket revenue, including an allocated portion of season pass revenue for each applicable period, was up 2.6% compared to the prior year season-to-date period.

•Season-to-date ski school revenue was up 5.5% and dining revenue was down 0.5% compared to the prior year season-to-date period. Retail/rental revenue for North American resort and ski area store locations was down 9.3% compared to the prior year season-to-date period.

Commenting on the season-to-date metrics, Lynch said, “Across our North American resorts, unfavorable conditions negatively impacted season-to-date visitation, which was below both prior year levels and our expectations based on the number of guests visiting and their frequency. Following the Martin Luther King Jr. holiday weekend, challenging conditions persisted until early March at Whistler Blackcomb and our Tahoe resorts, and while conditions improved at our Rockies and Eastern resorts, visitation did not improve as quickly as expected. We expect a portion of the lower visitation is related to the challenging conditions in the first half of the season as well as a shift in visitation patterns. Despite the decline in season-to-date visitation relative to the prior year period, we are pleased with lift revenue growth driven by the stability created from the

season pass program, the strength in ancillary spending per skier visit across our ski school, dining, and rental businesses, and the improving trends as the season progresses.”

Operating Results

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the Company’s Form 10-Q for the second fiscal quarter ended January 31, 2024, which was filed today with the Securities and Exchange Commission. The following are segment highlights:

Mountain Segment

•Total lift revenue increased $10.9 million, or 1.8%, compared to the same period in the prior year, to $603.5 million for the three months ended January 31, 2024, primarily due to an increase in North American pass product revenue, which increased 8.3% due to an increase in pass product sales for the 2023/2024 North American ski season compared to the prior year. Pass product revenue, although primarily collected prior to the ski season, is recognized in the Consolidated Condensed Statements of Operations throughout the ski season on a straight-line basis using the skiable days of the season to date period relative to the total estimated skiable days of the season. Challenging conditions during the early portion of the 2023/2024 North American ski season resulted in delayed openings for a number of our resorts and, as a result, we expect to recognize approximately $14 million of pass product revenue during the three months ending April 30, 2024 that would have otherwise been recognized during the three months ended January 31, 2024. Additionally, non-pass product lift revenue decreased 13.1%, driven by a decrease in skier visitation across all regions, which was impacted by limited natural snow and variable temperatures that resulted in delayed openings and reduced terrain offerings as compared to the prior year, and particularly impacted our resorts in the Eastern U.S. and Tahoe, partially offset by an increase in non-pass Effective Ticket Price (“ETP”) of 10.8%.

•Ski school revenue increased $3.2 million, or 2.6%, primarily driven by increased revenue at our resorts in Colorado and Park City, which benefited from an increase in guest spending per visit.

•Dining revenue decreased $3.8 million, or 4.4%, primarily due to decreased revenue from on-mountain dining venues at our resorts in the Eastern U.S. and Tahoe, partially offset by an increase in guest spending per visit.

•Retail/rental revenue decreased $23.8 million, or 14.9%, for which retail sales decreased $15.9 million, or 17.2%, and rental sales decreased $7.9 million, or 11.6%. The decrease in both retail and rental revenue was primarily driven by a decrease in skier visitation, as well as our exit of certain leased store operations which we operated in the prior year and resulted in a reduction in revenue of approximately $8.4 million.

•Operating expense decreased $35.6 million, or 5.8%, which was primarily attributable to reduced labor hours at our North American resorts as a result of challenging early season weather conditions including limited natural snow and variable temperatures that resulted in delayed openings and reduced terrain offerings which impacted our ability to

operate at full capacity, as compared to the prior year, as well as lower variable expenses associated with decreased revenue, and disciplined cost management.

•Mountain Reported EBITDA increased $21.5 million, or 5.4%, for the second quarter compared to the same period in the prior year, which includes $6.3 million of stock-based compensation expense for the three months ended January 31, 2024 compared to $5.7 million in the same period in the prior year.

Lodging Segment

•Lodging segment net revenue (excluding payroll cost reimbursements) for the three months ended January 31, 2024 decreased $2.3 million, or 3.0%, driven primarily by a decrease in revenue from managed condominium rooms of $3.0 million, or 9.7%, as a result of decreased demand, including the impact of decreased skier visitation driven by challenging weather conditions, as well as a reduction in our inventory of available managed condominium rooms proximate to our mountain resorts.

•Operating expense (excluding reimbursed payroll costs) decreased $11.0 million, or 13.8%, which was primarily attributable to: a reduction in labor hours associated with decreased demand, as well as lower staffing required to support a reduced inventory of managed condominium rooms; a decrease in allocated corporate overhead costs; and the receipt of property tax refunds during the three months ended January 31, 2024.

•Lodging Reported EBITDA increased $8.8 million, or 216.1%, for the second quarter compared to the same period in the prior year, which includes $0.9 million of stock-based compensation expense for the three months ended January 31, 2024 compared to $1.1 million in the same period in the prior year.

Resort - Combination of Mountain and Lodging Segments

•Resort net revenue decreased $16.2 million, or 1.5%, compared to the same period in the prior year, to $1,077.8 million for the three months ended January 31, 2024.

•Resort Reported EBITDA was $425.0 million for the three months ended January 31, 2024, an increase of $30.2 million, or 7.7%, compared to the same period in the prior year, which includes $2.1 million of acquisition related expenses for the second quarter of fiscal 2024 compared to $0.3 million of acquisition and integration related expenses in the second quarter of the prior year.

Total Performance

•Total net revenue decreased $23.8 million, or 2.2%, to $1,078.0 million for the three months ended January 31, 2024 as compared to the same period in the prior year.

•Net income attributable to Vail Resorts, Inc. was $219.3 million, or $5.76 per diluted share, for the second quarter of fiscal 2024 compared to the net income attributable to Vail Resorts, Inc. of $208.7 million, or $5.16 per diluted share, in the second quarter of the prior year. Additionally, net income for the second quarter of fiscal 2024 includes the

after-tax effect of acquisition related expenses of approximately $1.6 million, compared to $0.2 million of acquisition and integration related expenses in the second quarter of the prior year.

Return of Capital

Commenting on capital allocation, Lynch said, “Our balance sheet remains strong, including total cash and revolver availability as of January 31, 2024 of approximately $1.4 billion, with $812 million of cash on hand, $409 million of revolver availability under the Vail Holdings Credit Agreement and $221 million of revolver availability under the Whistler Credit Agreement. As of January 31, 2024, our Net Debt was 2.4 times trailing twelve months Total Reported EBITDA. We remain confident in the strong free cash flow generation and stability of the underlying business model. Given these dynamics, we are pleased to announce that our Board of Directors declared a quarterly cash dividend on Vail Resorts’ common stock of $2.22 per share, representing an 8% increase in our quarterly dividend. The dividend will be payable on April 11, 2024 to shareholders of record as of March 28, 2024. We remain committed to returning capital to shareholders and intend to maintain an opportunistic approach to share repurchases. We will continue to be disciplined stewards of our capital and remain committed to prioritizing investments in our guest and employee experience, high-return capital projects, strategic acquisition opportunities, and returning capital to our shareholders through our quarterly dividend and share repurchase program.”

Crans-Montana Acquisition

As previously announced on November 30, 2023, the Company entered into an agreement to acquire a majority stake in Crans-Montana Mountain Resort (“Crans-Montana”) in Switzerland, the Company’s second ski resort in Europe. Crans-Montana is an iconic ski destination in the heart of the Swiss Alps, with a unique heritage, incredible terrain, passionate team, and a community dedicated to the success of the region. This acquisition aligns to the Company’s growth strategy of expanding its resort network in Europe, creating even more value for pass holders and guests around the world. Much like Andermatt-Sedrun, the Company believes Crans-Montana has a unique opportunity for future growth. The transaction is expected to close this spring, subject to certain third-party consents.

Capital Investments

Regarding calendar year 2024 capital expenditures, Lynch said, “We remain dedicated to delivering an exceptional guest experience and will continue to prioritize reinvesting in the experience at our resorts, including consistently increasing capacity through lift, terrain, and food and beverage expansion projects, along with investments in technology to further elevate the guest and employee experience at our resorts. As previously announced, we expect our capital plan for calendar year 2024 to be approximately $189 million to $194 million, excluding $13 million of incremental capital investments in premium fleet and fulfillment infrastructure to support the official launch of My Epic Gear for the 2024/2025 winter season at 12 destination and regional resorts across North America, $11 million of growth capital investments at Andermatt-Sedrun and $1 million of reimbursable capital. Including My Epic Gear premium fleet and fulfillment infrastructure capital and one-time investments,

our total capital plan for calendar year 2024 is expected to be approximately $214 million to $219 million. This excludes any capital expenditures associated with the Crans-Montana acquisition, which remains subject to closing.

“At Whistler Blackcomb, the Company plans to replace the four-person high speed Jersey Cream lift with a new six-person high speed lift. This lift is expected to provide a meaningful increase to uphill capacity and better distribute guests at a central part of the resort. At Hunter Mountain, subject to approvals, we plan to replace the four-person fixed-grip Broadway lift with a new six-person high speed lift and plan to relocate the existing Broadway lift to replace the two-person fixed-grip E lift, providing a meaningful increase in uphill capacity and improved access to terrain that is key to the progressive learning experience for our guests. At Park City, we are in the planning process to support the approved replacement of the Sunrise lift with a new 10-person gondola in partnership with the Canyons Village Management Association in calendar year 2025, which will provide improved access and enhanced guest experience for existing and future developments within Canyons Village.

“At Park City and Hunter Mountain beyond the planned lift investments we plan to enhance snowmaking systems to improve the experience for key terrain, increase early season terrain consistency, and improve the efficiency through the installation of automated and energy-efficient snowguns. We also plan to further support the Company’s Commitment to Zero by investing in waste reduction projects across our resorts to achieve the goal of zero waste to landfill by 2030. At Afton Alps, we plan to install a 10-lane tubing experience and renovate the existing Alpine Building to create a 200 seat restaurant to further enhance the guest experience. At Seven Springs, we plan to add 390 new parking spaces to increase capacity and improve the guest experience. At Perisher, in advance of the 2025 winter season in Australia, we plan to replace the Mt Perisher Double and Triple Chairs with a new six person high speed lift, with capital spending commencing in calendar year 2024 and continuing into calendar year 2025. These projects remain subject to approvals.

“In addition, we are continuing to invest in innovative technology to enhance the guest experience. In the coming year, we are investing in new functionality for the My Epic App, and expanding Mobile Pass and Mobile Lift Tickets to Whistler Blackcomb. Across our resorts, we plan to pilot new technologies at select restaurants to make it both easier and faster for guests to dine at our resorts. In addition, in order to support the launch of My Epic Gear, we plan to invest in logistics and technology infrastructure to help deliver a transformational and elevated gear access experience for our guests.

“The 2023/2024 My Epic Gear pilot at Vail, Beaver Creek, Breckenridge, and Keystone is delivering a strong guest experience to pilot participants and valuable learnings for the business launch. My Epic Gear provides its members with the ability to choose the gear they want, for the full season or for the day, from a selection of the most popular and latest ski and snowboard models, and have it delivered to them when and where they want it, including slopeside pick up and drop off every day. In addition to offering the latest skis and snowboards, My Epic Gear will also offer name brand, high-quality ski and snowboard boots with personalized insoles and boot fit scanning technology. The entire My Epic Gear membership, from gear selection to boot fit to personalized recommendations to delivery, will be at the members’ fingertips in the new My Epic app.

The Company plans to launch My Epic Gear for the 2024/2025 winter season at 12 destination and regional resorts across North America, including kids gear, and will be limiting membership to 60,000 to 80,000 members in the first year launch as the business scales. To support the initial year of this new business, in calendar year 2024 the Company plans to invest $13 million beyond our typical annual capital plan in incremental premium gear fleet and fulfillment infrastructure to support the anticipated growth of this business. We plan to provide additional updates on My Epic Gear and the on-going capital needs of the business after the year one launch.

“At Andermatt-Sedrun, we are pleased to announce plans to invest approximately $11 million in high-impact growth capital projects as part of a multi-year strategic growth investment plan to enhance the guest experience on the mountain, which will be funded by the CHF 110 million capital that was invested as part of the purchase of our majority stake in Andermatt-Sedrun. As part of the calendar year 2024 investments, we are planning to upgrade and replace snowmaking infrastructure at the Sedrun-Milez area on the eastern side of the resort to enhance the guest experience for key beginner and intermediate terrain and significantly improve energy efficiency. In addition, we plan to invest in the on-mountain dining experience with improvements to the Milez and Natschen restaurants. These investments are expected to be completed ahead of the 2024/2025 European ski season and remain subject to regulatory approvals.”

Pass Sales Launch

Commenting on the launch of season pass sales for the 2024/2025 North American ski season, Lynch said, “We are pleased to launch pass sales for the 2024/2025 season with a wide range of advance commitment products including our Epic Day Pass, which provides 1 to 7 days of access at our owned and operated resorts, and our unlimited Epic Pass and regional pass products, which can provide unlimited access to 41 resorts every day of the season and access to additional partner resorts, with no reservations required at any resort except Telluride. Subject to close, Vail Resorts plans to include access to Crans-Montana Mountain Resort on select Epic Pass products for the 2024/2025 ski and ride season. Starting in the 2024/2025 North American ski season, when pass holders are skiing or riding with a guest utilizing Buddy Tickets and Ski with a Friend Tickets, they can now skip the ticket line and go directly to the lift. On average, pass prices have increased 8% over the prior season’s launch price and continue to represent tremendous value to our guests, further supported by our compelling network of mountain resorts, our strong guest experience created at each mountain resort, and our commitment to continually invest in the guest experience. We greatly appreciate the loyalty of our guests visiting across our entire network of resorts this season, and the continued loyalty of our pass holders that have already committed to next season.”

Outlook

Commenting on fiscal 2024 guidance, Lynch said, “Due to the season-to-date underperformance, we are lowering our guidance for fiscal 2024. For the remainder of the season, we are expecting improved performance compared to the season-to-date period, including an expected shift in visitation patterns into March and April. This is based on our significant base of pre-committed guests and guest historical behavior patterns, the improvement in conditions across our western North American and Northeast resorts, and our lodging booking trends for the Spring Break period. While we are lowering guidance for the fiscal year, we know that the financial impact of the weather disruptions was greatly mitigated by our advance commitment products, which create stability for our Company, our shareholders, and our communities in exchange for an incredible value to the guest.

“We now expect net income attributable to Vail Resorts, Inc. for fiscal 2024 to be between $270 million and $325 million, and Resort Reported EBITDA for fiscal 2024 to be between $849 million and $885 million. We estimate Resort EBITDA Margin for fiscal 2024 to be approximately 29.6%, using the midpoint of the guidance range. Our guidance includes an estimated $4 million of acquisition related expenses specific to Crans-Montana, but does not include any estimate for the closing costs, operating results or integration expense associated with the Crans-Montana acquisition, which is expected to close this spring. The updated outlook for fiscal 2024 assumes a continuation of the current economic environment and normal weather conditions for the remainder of the 2023/2024 North American and European ski season and for the 2024 Australian ski season. The guidance assumes an exchange rate of $0.74 between the Canadian dollar and U.S. dollar related to the operations of Whistler Blackcomb in Canada, an exchange rate of $0.65 between the Australian dollar and U.S. dollar related to the operations of Perisher, Falls Creek and Hotham in Australia, and an exchange rate of $1.13 between the Swiss Franc and U.S. dollar related to the operations of Andermatt-Sedrun in Switzerland.”

The following table reflects the forecasted guidance range for the Company’s fiscal year ending July 31, 2024, for Total Reported EBITDA (after stock-based compensation expense) and reconciles net income attributable to Vail Resorts, Inc. guidance to such Total Reported EBITDA guidance.

| | | | | | | | | | | |

| Fiscal 2024 Guidance |

| (In thousands) |

| For the Year Ending |

| July 31, 2024 (6) |

| Low End | | High End |

| Range | | Range |

| Net income attributable to Vail Resorts, Inc. | $ | 270,000 | | | $ | 325,000 | |

| Net income attributable to noncontrolling interests | 26,000 | | | 18,000 | |

| Net income | 296,000 | | | 343,000 | |

Provision for income taxes (1) | 105,000 | | | 122,000 | |

| Income before income taxes | 401,000 | | | 465,000 | |

| Depreciation and amortization | 274,000 | | | 266,000 | |

| Interest expense, net | 164,000 | | | 158,000 | |

Other (2) | 8,000 | | | — | |

| Total Reported EBITDA | $ | 847,000 | | | $ | 889,000 | |

| | | |

Mountain Reported EBITDA (3) | $ | 830,000 | | | $ | 864,000 | |

Lodging Reported EBITDA (4) | 18,000 | | | 22,000 | |

Resort Reported EBITDA (5) | 849,000 | | | 885,000 | |

| Real Estate Reported EBITDA | (2,000) | | | 4,000 | |

| Total Reported EBITDA | $ | 847,000 | | | $ | 889,000 | |

| | | |

(1) The provision for income taxes may be impacted by excess tax benefits primarily resulting from vesting and exercises of equity awards. Our estimated provision for income taxes does not include the impact, if any, of unknown future exercises of employee equity awards, which could have a material impact given that a significant portion of our awards may be in-the-money depending on the current value of the stock price. |

(2) Our guidance includes certain forward looking known changes in the fair value of the contingent consideration based solely on the passage of time and resulting impact on present value. Guidance excludes any forward looking change based upon, among other things, financial projections including long-term growth rates for Park City, which such change may be material. Separately, the intercompany loan associated with the Whistler Blackcomb transaction requires foreign currency remeasurement to Canadian dollars, the functional currency of Whistler Blackcomb. Our guidance excludes any forward looking change related to foreign currency gains or losses on the intercompany loans, which such change may be material. Additionally, our guidance excludes the impact of any future sales or disposals of land or other assets, which are contingent upon future approvals or other outcomes. |

(3) Mountain Reported EBITDA also includes approximately $23 million of stock-based compensation. |

(4) Lodging Reported EBITDA also includes approximately $4 million of stock-based compensation. |

(5) The Company provides Reported EBITDA ranges for the Mountain and Lodging segments, as well as for the two combined. The low and high of the expected ranges provided for the Mountain and Lodging segments, while possible, do not sum to the high or low end of the Resort Reported EBITDA range provided because we do not expect or assume that we will hit the low or high end of both ranges. |

(6) Guidance estimates are predicated on an exchange rate of $0.74 between the Canadian dollar and U.S. dollar, related to the operations of Whistler Blackcomb in Canada; an exchange rate of $0.65 between the Australian dollar and U.S. dollar, related to the operations of our Australian ski areas; and an exchange rate of $1.13 between the Swiss franc and U.S. dollar, related to the operations of Andermatt-Sedrun in Switzerland. |

Earnings Conference Call

The Company will conduct a conference call today at 5:00 p.m. eastern time to discuss the financial results. The call will be webcast and can be accessed at www.vailresorts.com in the Investor Relations section, or dial (800) 267-6316 (U.S. and Canada) or +1 (203) 518-9783 (international). The conference ID is MTNQ224. A replay of the conference call will be available two hours following the conclusion of the conference call through March 18, 2024, at 8:00 p.m. eastern time. To access the replay, dial (877) 829-9029 (U.S. and Canada) or +1 (402) 220-1607 (international). The conference call will also be archived at www.vailresorts.com.

About Vail Resorts, Inc. (NYSE: MTN)

Vail Resorts is a network of the best destination and close-to-home ski resorts in the world including Vail Mountain, Breckenridge, Park City Mountain, Whistler Blackcomb, Stowe, and 32 additional resorts across North America; Andermatt-Sedrun in Switzerland; and Perisher, Hotham, and Falls Creek in Australia. We are passionate about providing an Experience of a Lifetime to our team members and guests, and our EpicPromise is to reach a zero net operating footprint by 2030, support our employees and communities, and broaden engagement in our sport. Our company owns and/or manages a collection of elegant hotels under the RockResorts brand, a portfolio of vacation rentals, condominiums and branded hotels located in close proximity to our mountain destinations, as well as the Grand Teton Lodge Company in Jackson Hole, Wyo. Vail Resorts Retail operates more than 250 retail and rental locations across North America. Learn more about our company at www.VailResorts.com, or discover our resorts and pass options at www.EpicPass.com.

Forward-Looking Statements

Certain statements discussed in this press release and on the conference call, other than statements of historical information, are forward-looking statements within the meaning of the federal securities laws, including the statements regarding fiscal 2024 performance (including the assumptions related thereto), including our expected Resort Reported EBITDA and expected net income; our expectations regarding our liquidity; our expectations regarding the Crans-Montana acquisition; our expectations related to our season pass sales and products; our expectations regarding our My Epic App and My Epic Gear program; our expectations related to customer demand and lift ticket sales for the remainder of the 2023/2024 North American ski season; our expectations for the 2024/2025 ski season and 2025 winter season; our expectations regarding our ancillary lines of business; the payment of dividends; our calendar year 2024 capital plans and expectations related thereto, including expected capital investments. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. Such risks and uncertainties include, but are not limited to, the economy generally and our business and results of operations, including the ultimate amount of refunds that we would be required to refund to our pass product holders for qualifying circumstances under our Epic Coverage program; prolonged

weakness in general economic conditions, including adverse effects on the overall travel and leisure related industries; risks associated with the effects of high or prolonged inflation, rising interest rates and financial institution disruptions; unfavorable weather conditions or the impact of natural disasters or other unexpected events; the willingness of our guests to travel due to terrorism, the uncertainty of military conflicts or public health emergencies, and the cost and availability of travel options and changing consumer preferences, discretionary spending habits, or willingness to travel; risks related to interruptions or disruptions of our information technology systems, data security, or cyberattacks; risks related to our reliance on information technology, including our failure to maintain the integrity of our customer or employee data and our ability to adapt to technological developments or industry trends; our ability to acquire, develop and implement relevant technology offerings for customers and partners, including effectively implementing our My Epic application; the seasonality of our business combined with adverse events that may occur during our peak operating periods; competition in our mountain and lodging businesses or with other recreational and leisure activities; risks related to the high fixed cost structure of our business; our ability to fund resort capital expenditures; risks related to a disruption in our water supply that would impact our snowmaking capabilities and operations; our reliance on government permits or approvals for our use of public land or to make operational and capital improvements; risks related to federal, state, local and foreign government laws, rules, and regulations, including environmental and health and safety laws and regulations; risks related to changes in security and privacy laws and regulations which could increase our operating costs and adversely affect our ability to market our products, properties, and services effectively; potential failure to adapt to technological developments or industry trends regarding information technology; risks related to our workforce, including increased labor costs, loss of key personnel, and our ability to maintain adequate staffing, including hiring and retaining a sufficient seasonal workforce; a deterioration in the quality or reputation of our brands, including our ability to protect our intellectual property and the risk of accidents at our mountain resorts; risks related to scrutiny and changing expectations regarding our environmental, social and governance practices and reporting; our ability to successfully integrate acquired businesses, or that acquired businesses may fail to perform in accordance with expectations, such as, the Seven Springs Resorts, including their integration into our internal controls and infrastructure; our ability to successfully navigate new markets, including Europe; risks associated with international operations; fluctuations in foreign currency exchange rates where the Company has foreign currency exposure, primarily the Canadian and Australian dollars and the Swiss franc, as compared to the U.S. dollar; changes in tax laws, regulations or interpretations, or adverse determinations by taxing authorities; risks related to our indebtedness and our ability to satisfy our debt service requirements under our outstanding debt, including our unsecured senior notes, which could reduce our ability to use our cash flow to fund our operations, capital expenditures, future business opportunities, and other purposes; a materially adverse change in our financial condition; adverse consequences of current or future legal claims; changes in accounting judgments and estimates, accounting principles, policies, or guidelines; and other

risks detailed in the Company’s filings with the Securities and Exchange Commission, including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2023, which was filed on September 28, 2023.

All forward-looking statements attributable to us or any persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. All guidance and forward-looking statements in this press release are made as of the date hereof and we do not undertake any obligation to update any forecast or forward-looking statements whether as a result of new information, future events or otherwise, except as may be required by law.

Statement Concerning Non-GAAP Financial Measures

When reporting financial results, we use the terms Resort Reported EBITDA, Total Reported EBITDA, Resort EBITDA Margin, Net Debt and Net Real Estate Cash Flow, which are not financial measures under accounting principles generally accepted in the United States of America (“GAAP”). Resort Reported EBITDA, Total Reported EBITDA, Resort EBITDA Margin, Net Debt and Net Real Estate Cash Flow should not be considered in isolation or as an alternative to, or substitute for, measures of financial performance or liquidity prepared in accordance with GAAP. In addition, we report segment Reported EBITDA (i.e. Mountain, Lodging and Real Estate), the measure of segment profit or loss required to be disclosed in accordance with GAAP. These measures may not be comparable to similarly-titled measures of other companies. Additionally, with respect to discussion of impacts from currency, the Company calculates the impact by applying current period foreign exchange rates to the prior period results, as the Company believes that comparing financial information using comparable foreign exchange rates is a more objective and useful measure of changes in operating performance.

Reported EBITDA (and its counterpart for each of our segments) has been presented herein as a measure of the Company’s performance. The Company believes that Reported EBITDA is an indicative measurement of the Company’s operating performance, and is similar to performance metrics generally used by investors to evaluate other companies in the resort and lodging industries. The Company defines Resort EBITDA Margin as Resort Reported EBITDA divided by Resort net revenue. The Company believes Resort EBITDA Margin is an important measurement of operating performance. The Company believes that Net Debt is an important measurement of liquidity as it is an indicator of the Company’s ability to obtain additional capital resources for its future cash needs. Additionally, the Company believes Net Real Estate Cash Flow is important as a cash flow indicator for its Real Estate segment. See the tables provided in this release for reconciliations of our measures of segment profitability and non-GAAP financial measures to the most directly comparable GAAP financial measures.

Vail Resorts, Inc.

Consolidated Condensed Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Six Months Ended January 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net revenue: | | | | | | | |

| Mountain and Lodging services and other | $ | 905,053 | | | $ | 901,837 | | | $ | 1,087,887 | | | $ | 1,112,223 | |

| Mountain and Lodging retail and dining | 172,745 | | | 192,182 | | | 244,187 | | | 261,130 | |

| Resort net revenue | 1,077,798 | | | 1,094,019 | | | 1,332,074 | | | 1,373,353 | |

| Real Estate | 160 | | | 7,699 | | | 4,449 | | | 7,812 | |

| Total net revenue | 1,077,958 | | | 1,101,718 | | | 1,336,523 | | | 1,381,165 | |

| Segment operating expense: | | | | | | | |

| Mountain and Lodging operating expense | 474,170 | | | 507,216 | | | 729,746 | | | 749,502 | |

| Mountain and Lodging retail and dining cost of products sold | 65,289 | | | 75,431 | | | 96,584 | | | 110,516 | |

| General and administrative | 112,714 | | | 116,616 | | | 220,739 | | | 215,415 | |

| Resort operating expense | 652,173 | | | 699,263 | | | 1,047,069 | | | 1,075,433 | |

| Real Estate operating expense | 1,676 | | | 6,310 | | | 6,857 | | | 7,692 | |

| Total segment operating expense | 653,849 | | | 705,573 | | | 1,053,926 | | | 1,083,125 | |

| Other operating (expense) income: | | | | | | | |

| Depreciation and amortization | (69,399) | | | (65,989) | | | (136,127) | | | (130,603) | |

| Gain on sale of real property | — | | | 757 | | | 6,285 | | | 757 | |

| | | | | | | |

| Change in estimated fair value of contingent consideration | (3,400) | | | (1,100) | | | (6,457) | | | (1,736) | |

| Loss on disposal of fixed assets and other, net | (758) | | | (1,780) | | | (2,801) | | | (1,786) | |

| Income from operations | 350,552 | | | 328,033 | | | 143,497 | | | 164,672 | |

| Mountain equity investment (loss) income, net | (579) | | | 42 | | | 280 | | | 388 | |

| Investment income and other, net | 4,863 | | | 7,108 | | | 8,547 | | | 9,994 | |

| Foreign currency gain (loss) on intercompany loans | 3,040 | | | 2,338 | | | (1,925) | | | (3,797) | |

| Interest expense, net | (40,585) | | | (38,370) | | | (81,315) | | | (73,672) | |

| Income before provision for income taxes | 317,291 | | | 299,151 | | | 69,084 | | | 97,585 | |

| Provision for income taxes | (87,486) | | | (79,032) | | | (22,326) | | | (21,026) | |

| Net income | 229,805 | | | 220,119 | | | 46,758 | | | 76,559 | |

| Net income attributable to noncontrolling interests | (10,506) | | | (11,440) | | | (2,971) | | | (4,851) | |

| Net income attributable to Vail Resorts, Inc. | $ | 219,299 | | | $ | 208,679 | | | $ | 43,787 | | | $ | 71,708 | |

Per share amounts: | | | | | | | |

| Basic net income per share attributable to Vail Resorts, Inc. | $ | 5.78 | | | $ | 5.17 | | | $ | 1.15 | | | $ | 1.78 | |

| Diluted net income per share attributable to Vail Resorts, Inc. | $ | 5.76 | | | $ | 5.16 | | | $ | 1.15 | | | $ | 1.77 | |

| Cash dividends declared per share | $ | 2.06 | | | $ | 1.91 | | | $ | 4.12 | | | $ | 3.82 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 37,967 | | | 40,327 | | | 38,042 | | | 40,313 | |

| Diluted | 38,046 | | | 40,434 | | | 38,133 | | | 40,408 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Vail Resorts, Inc.

Consolidated Condensed Statements of Operations - Other Data

(In thousands)

(Unaudited) |

| Three Months Ended January 31, | | Six Months Ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Other Data: | | | | | | | |

| Mountain Reported EBITDA | $ | 420,340 | | | $ | 398,851 | | | $ | 280,815 | | | $ | 306,718 | |

| Lodging Reported EBITDA | 4,706 | | | (4,053) | | | 4,470 | | | (8,410) | |

| Resort Reported EBITDA | 425,046 | | | 394,798 | | | 285,285 | | | 298,308 | |

| Real Estate Reported EBITDA | (1,516) | | | 2,146 | | | 3,877 | | | 877 | |

| Total Reported EBITDA | $ | 423,530 | | | $ | 396,944 | | | $ | 289,162 | | | $ | 299,185 | |

| Mountain stock-based compensation | $ | 6,346 | | | $ | 5,732 | | | $ | 12,194 | | | $ | 11,079 | |

| Lodging stock-based compensation | 932 | | | 1,060 | | | 1,828 | | | 2,010 | |

| Resort stock-based compensation | 7,278 | | | 6,792 | | | 14,022 | | | 13,089 | |

| Real Estate stock-based compensation | 58 | | | 52 | | | 110 | | | 100 | |

| Total stock-based compensation | $ | 7,336 | | | $ | 6,844 | | | $ | 14,132 | | | $ | 13,189 | |

| | | | | | | |

|

Vail Resorts, Inc.

Mountain Segment Operating Results

(In thousands, except ETP)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Percentage

Increase | | Six Months Ended January 31, | | Percentage

Increase |

| | 2024 | | 2023 | | (Decrease) | | 2024 | | 2023 | | (Decrease) |

| Net Mountain revenue: | | | | | | | | | | | |

| Lift | $ | 603,459 | | | $ | 592,603 | | | 1.8 | % | | $ | 648,849 | | | $ | 652,143 | | | (0.5) | % |

| Ski school | 126,629 | | | 123,451 | | | 2.6 | % | | 133,807 | | | 132,378 | | | 1.1 | % |

| Dining | 82,060 | | | 85,828 | | | (4.4) | % | | 100,137 | | | 105,270 | | | (4.9) | % |

| Retail/rental | 136,156 | | | 159,932 | | | (14.9) | % | | 169,630 | | | 200,276 | | | (15.3) | % |

| Other | 51,677 | | | 51,628 | | | 0.1 | % | | 120,013 | | | 125,092 | | | (4.1) | % |

| Total Mountain net revenue | 999,981 | | | 1,013,442 | | | (1.3) | % | | 1,172,436 | | | 1,215,159 | | | (3.5) | % |

| Mountain operating expense: | | | | | | | | | | | |

| Labor and labor-related benefits | 252,641 | | | 277,537 | | | (9.0) | % | | 364,690 | | | 385,582 | | | (5.4) | % |

| Retail cost of sales | 41,177 | | | 48,197 | | | (14.6) | % | | 58,998 | | | 68,938 | | | (14.4) | % |

| Resort related fees | 44,568 | | | 43,550 | | | 2.3 | % | | 48,263 | | | 47,181 | | | 2.3 | % |

| General and administrative | 96,353 | | | 97,365 | | | (1.0) | % | | 189,521 | | | 180,654 | | | 4.9 | % |

| Other | 144,323 | | | 147,984 | | | (2.5) | % | | 230,429 | | | 226,474 | | | 1.7 | % |

| Total Mountain operating expense | 579,062 | | | 614,633 | | | (5.8) | % | | 891,901 | | | 908,829 | | | (1.9) | % |

| Mountain equity investment (loss) income, net | (579) | | | 42 | | | (1,478.6) | % | | 280 | | | 388 | | | (27.8) | % |

| Mountain Reported EBITDA | $ | 420,340 | | | $ | 398,851 | | | 5.4 | % | | $ | 280,815 | | | $ | 306,718 | | | (8.4) | % |

| | | | | | | | | | | |

| Total skier visits | 7,264 | | | 8,308 | | | (12.6) | % | | 7,922 | | | 9,301 | | | (14.8) | % |

| ETP | $ | 83.08 | | | $ | 71.33 | | | 16.5 | % | | $ | 81.90 | | | $ | 70.12 | | | 16.8 | % |

| | | | | | | | | | | |

|

Vail Resorts, Inc.

Lodging Operating Results

(In thousands, except Average Daily Rate (“ADR”) and Revenue per Available Room (“RevPAR”))

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Percentage

Increase | | Six Months Ended January 31, | | Percentage

Increase |

| | 2024 | | 2023 | | (Decrease) | | 2024 | | 2023 | | (Decrease) |

| Lodging net revenue: | | | | | | | | | | | |

| Owned hotel rooms | $ | 13,583 | | | $ | 13,479 | | | 0.8 | % | | $ | 38,760 | | | $ | 37,044 | | | 4.6 | % |

| Managed condominium rooms | 28,308 | | | 31,336 | | | (9.7) | % | | 40,311 | | | 44,195 | | | (8.8) | % |

| Dining | 13,609 | | | 13,184 | | | 3.2 | % | | 31,692 | | | 30,013 | | | 5.6 | % |

| Transportation | 6,405 | | | 5,888 | | | 8.8 | % | | 7,910 | | | 7,348 | | | 7.6 | % |

| Golf | — | | | — | | | nm | | 6,471 | | | 5,939 | | | 9.0 | % |

| Other | 11,417 | | | 11,700 | | | (2.4) | % | | 26,540 | | | 24,988 | | | 6.2 | % |

| 73,322 | | | 75,587 | | | (3.0) | % | | 151,684 | | | 149,527 | | | 1.4 | % |

| Payroll cost reimbursements | 4,495 | | | 4,990 | | | (9.9) | % | | 7,954 | | | 8,667 | | | (8.2) | % |

| Total Lodging net revenue | 77,817 | | | 80,577 | | | (3.4) | % | | 159,638 | | | 158,194 | | | 0.9 | % |

| Lodging operating expense: | | | | | | | | | | | |

| Labor and labor-related benefits | 33,151 | | | 39,497 | | | (16.1) | % | | 70,626 | | | 76,412 | | | (7.6) | % |

| General and administrative | 16,361 | | | 19,251 | | | (15.0) | % | | 31,218 | | | 34,761 | | | (10.2) | % |

| Other | 19,104 | | | 20,892 | | | (8.6) | % | | 45,370 | | | 46,764 | | | (3.0) | % |

| 68,616 | | | 79,640 | | | (13.8) | % | | 147,214 | | | 157,937 | | | (6.8) | % |

| Reimbursed payroll costs | 4,495 | | | 4,990 | | | (9.9) | % | | 7,954 | | | 8,667 | | | (8.2) | % |

| Total Lodging operating expense | 73,111 | | | 84,630 | | | (13.6) | % | | 155,168 | | | 166,604 | | | (6.9) | % |

| Lodging Reported EBITDA | $ | 4,706 | | | $ | (4,053) | | | 216.1 | % | | $ | 4,470 | | | $ | (8,410) | | | 153.2 | % |

| | | | | | | | | | | |

| Owned hotel statistics: | | | | | | | | | | | |

| ADR | $ | 317.51 | | | $ | 337.16 | | | (5.8) | % | | $ | 308.89 | | | $ | 297.69 | | | 3.8 | % |

| RevPAR | $ | 140.65 | | | $ | 145.48 | | | (3.3) | % | | $ | 151.64 | | | $ | 151.19 | | | 0.3 | % |

| Managed condominium statistics: | | | | | | | | | | | |

| ADR | $ | 522.29 | | | $ | 514.29 | | | 1.6 | % | | $ | 403.05 | | | $ | 405.00 | | | (0.5) | % |

| RevPAR | $ | 164.43 | | | $ | 171.81 | | | (4.3) | % | | $ | 106.98 | | | $ | 112.21 | | | (4.7) | % |

| Owned hotel and managed condominium statistics (combined): | | | | | | | | |

| ADR | $ | 463.26 | | | $ | 469.72 | | | (1.4) | % | | $ | 365.67 | | | $ | 365.05 | | | 0.2 | % |

| RevPAR | $ | 159.13 | | | $ | 166.37 | | | (4.4) | % | | $ | 118.73 | | | $ | 121.74 | | | (2.5) | % |

| | | | | | | | | | | |

|

Key Balance Sheet Data

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | As of January 31, |

| | 2024 | | 2023 |

| | | |

| Total Vail Resorts, Inc. stockholders’ equity | $ | 829,904 | | | $ | 1,462,578 | |

| Long-term debt, net | $ | 2,721,598 | | | $ | 2,789,827 | |

| Long-term debt due within one year | 69,135 | | | 69,582 | |

| Total debt | 2,790,733 | | | 2,859,409 | |

| Less: cash and cash equivalents | 812,163 | | | 1,295,252 | |

| Net debt | $ | 1,978,570 | | | $ | 1,564,157 | |

Reconciliation of Measures of Segment Profitability and Non-GAAP Financial Measures

Presented below is a reconciliation of net income attributable to Vail Resorts, Inc. to Total Reported EBITDA for the three and six months ended January 31, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands)

(Unaudited) | | (In thousands)

(Unaudited) |

| | Three Months Ended January 31, | | Six Months Ended January 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to Vail Resorts, Inc. | $ | 219,299 | | | $ | 208,679 | | | $ | 43,787 | | | $ | 71,708 | |

| Net income attributable to noncontrolling interests | 10,506 | | | 11,440 | | | 2,971 | | | 4,851 | |

| Net income | 229,805 | | | 220,119 | | | 46,758 | | | 76,559 | |

| Provision for income taxes | 87,486 | | | 79,032 | | | 22,326 | | | 21,026 | |

| Income before provision for income taxes | 317,291 | | | 299,151 | | | 69,084 | | | 97,585 | |

| Depreciation and amortization | 69,399 | | | 65,989 | | | 136,127 | | | 130,603 | |

| | | | | | | |

| Loss on disposal of fixed assets and other, net | 758 | | | 1,780 | | | 2,801 | | | 1,786 | |

| Change in fair value of contingent consideration | 3,400 | | | 1,100 | | | 6,457 | | | 1,736 | |

| Investment income and other, net | (4,863) | | | (7,108) | | | (8,547) | | | (9,994) | |

| Foreign currency (gain) loss on intercompany loans | (3,040) | | | (2,338) | | | 1,925 | | | 3,797 | |

| Interest expense, net | 40,585 | | | 38,370 | | | 81,315 | | | 73,672 | |

| Total Reported EBITDA | $ | 423,530 | | | $ | 396,944 | | | $ | 289,162 | | | $ | 299,185 | |

| | | | | | | |

| Mountain Reported EBITDA | $ | 420,340 | | | $ | 398,851 | | | $ | 280,815 | | | $ | 306,718 | |

| Lodging Reported EBITDA | 4,706 | | | (4,053) | | | 4,470 | | | (8,410) | |

Resort Reported EBITDA* | 425,046 | | | 394,798 | | | 285,285 | | | 298,308 | |

| Real Estate Reported EBITDA | (1,516) | | | 2,146 | | | 3,877 | | | 877 | |

| Total Reported EBITDA | $ | 423,530 | | | $ | 396,944 | | | $ | 289,162 | | | $ | 299,185 | |

| | | | | | | |

* Resort represents the sum of Mountain and Lodging | | | | |

|

Presented below is a reconciliation of net income attributable to Vail Resorts, Inc. to Total Reported EBITDA calculated in accordance with GAAP for the twelve months ended January 31, 2024.

| | | | | | | | | |

| (In thousands)

(Unaudited) | | | | |

| | Twelve Months Ended | | | | |

| | January 31, 2024 | | | | |

| Net income attributable to Vail Resorts, Inc. | $ | 240,227 | | | | | |

| Net income attributable to noncontrolling interests | 15,075 | | | | | |

| Net income | 255,302 | | | | | |

| Provision for income taxes | 89,714 | | | | | |

| Income before provision for income taxes | 345,016 | | | | | |

| Depreciation and amortization | 274,025 | | | | | |

| Loss on disposal of fixed assets and other, net | 10,085 | | | | | |

| | | | | |

| Change in fair value of contingent consideration | 54,557 | | | | | |

| Investment income and other, net | (22,297) | | | | | |

| Foreign currency loss on intercompany loans | 1,035 | | | | | |

| Interest expense, net | 160,665 | | | | | |

| Total Reported EBITDA | $ | 823,086 | | | | | |

| | | | | |

| Mountain Reported EBITDA | $ | 796,667 | | | | | |

| Lodging Reported EBITDA | 25,147 | | | | | |

| Resort Reported EBITDA* | 821,814 | | | | | |

| Real Estate Reported EBITDA | 1,272 | | | | | |

| Total Reported EBITDA | $ | 823,086 | | | | | |

| | | | | |

| * Resort represents the sum of Mountain and Lodging | | | | | |

| | | | |

The following table reconciles long-term debt, net to Net Debt and the calculation of Net Debt to Total Reported EBITDA for the twelve months ended January 31, 2024.

| | | | | |

| (In thousands)

(Unaudited) |

| As of January 31, 2024 |

| Long-term debt, net | $ | 2,721,598 | |

| Long-term debt due within one year | 69,135 | |

| Total debt | 2,790,733 | |

| Less: cash and cash equivalents | 812,163 | |

| Net debt | $ | 1,978,570 | |

| Net debt to Total Reported EBITDA | 2.4x |

The following table reconciles Real Estate Reported EBITDA to Net Real Estate Cash Flow for the three and six months ended January 31, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands)

(Unaudited) | | (In thousands)

(Unaudited) | | | | |

| Three Months Ended January 31, | | Six Months Ended January 31, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Real Estate Reported EBITDA | $ | (1,516) | | | $ | 2,146 | | | $ | 3,877 | | | $ | 877 | | | | | |

| Non-cash Real Estate cost of sales | — | | | 5,138 | | | 3,607 | | | 5,138 | | | | | |

| Non-cash Real Estate stock-based compensation | 58 | | | 52 | | | 110 | | | 100 | | | | | |

| Change in real estate deposits and recovery of previously incurred project costs/land basis less investments in real estate | (25) | | | 150 | | | 181 | | | 104 | | | | | |

| Net Real Estate Cash Flow | $ | (1,483) | | | $ | 7,486 | | | $ | 7,775 | | | $ | 6,219 | | | | | |

The following table reconciles Resort net revenue to Resort EBITDA Margin for the three months ended January 31, 2024 and 2023, and fiscal 2024 guidance.

| | | | | | | | | | | |

| (In thousands)

(Unaudited) | (In thousands)

(Unaudited) | (In thousands)

(Unaudited) |

| Three Months Ended

January 31, 2024 | Three Months Ended

January 31, 2023 | Fiscal 2024 Guidance (2) |

Resort net revenue (1) | $ | 1,077,798 | | $ | 1,094,019 | | $ | 2,931,000 | |

Resort Reported EBITDA (1) | $ | 425,046 | | $ | 394,798 | | $ | 867,000 | |

Resort EBITDA margin (1) | 39.4 | % | 36.1 | % | 29.6 | % |

| | | |

(1) Resort represents the sum of Mountain and Lodging | | | |

(2) Represents the mid-point of Guidance |

Exhibit 99.2

Vail Resorts Contacts:

Investor Relations: Bo Heitz, (303) 404-1800, InvestorRelations@vailresorts.com

Media: Sara Olson, (303) 404-6497, News@vailresorts.com

Reggie Chambers Appointed to Vail Resorts Board of Directors

BROOMFIELD, Colo. – March 11, 2024 - Vail Resorts, Inc. (NYSE: MTN) today announced that Reggie Chambers has been appointed to the company's board of directors.

Chambers is an executive vice president and the chief transformation officer for TIAA. Prior to joining TIAA in September 2023, he served as chief financial officer and head of strategy for the commercial banking division of JPMorgan Chase. During his six years at JPMorgan Chase, Chambers also served as chief administrative officer for consumer banking and wealth management and head of investor relations for the firm, a role for which he and his team were recognized by Institutional Investor as Best Investor Relations Professional and Best Investor Relations Team in sector.

His prior experiences include management consulting at McKinsey & Co., investing with 3i Group plc, an international private equity firm, and vice president in the investment banking division of Citigroup Global Markets Inc. He also has worked in the public sector and was appointed by President Obama as a White House Fellow at the White House National Economic Council. He began his career as a corporate lawyer in New York City and Madrid, Spain.

“We are thrilled to have Reggie join our board,” said Kirsten Lynch, chief executive officer of Vail Resorts. “Reggie is an accomplished finance executive who has had an impressive career driving strong financial performance and business transformation. His extensive financial expertise and acumen, along with his global business experience, will be an asset to our company as we continue to drive shareholder value and business growth.”

“I am excited to join the Vail Resorts board of directors,” said Chambers. “The company has seen incredible growth over the last decade as it has driven innovation with novel products such as its Epic Pass that have helped to transform the ski industry. I look forward to leveraging my experience to support Vail Resorts toward its future growth plans and continued financial success.”

Chambers earned his J.D. from Harvard Law School and his A.B. in Political Science, Spanish and Markets & Management from Duke University. Dedicated to creating educational opportunities for others, Chambers has served as an adjunct professor at Brooklyn College and Columbia University’s School of International and Public Affairs and currently serves on the board of Duke University’s undergraduate program. Additionally, he has served on the boards of the CUNY Graduate Center, the Bogliasco Foundation in Italy, and the Teachers Network. Originally from Mequon, Wisconsin, Chambers learned to ski in southeast Wisconsin, including at Vail Resorts’ Wilmot Mountain Resort. He currently lives in the greater New York City Area.

Chambers is Vail Resorts’ twelfth board member, joining recently appointed board member Iris Knobloch, as well as Sue Decker, Rob Katz, Kirsten Lynch, Nadia Rawlinson, John Redmond, Michele Romanow, Hilary Schneider, Bruce Sewell, John Sorte, and Peter Vaughn.

About Vail Resorts, Inc. (NYSE: MTN)

Vail Resorts is a network of the best destination and close-to-home ski resorts in the world including Vail Mountain, Breckenridge, Park City Mountain, Whistler Blackcomb, Stowe, and 32 additional resorts across North America; Andermatt-Sedrun in Switzerland; and Perisher, Hotham, and Falls Creek in Australia – all available on the company's industry-changing Epic Pass. We are passionate about providing an Experience of a Lifetime to our team members and guests, and our EpicPromise is to reach a zero net operating footprint by 2030, support our employees and communities, and broaden engagement in our sport. Our company owns and/or manages a collection of elegant hotels under the RockResorts brand, a portfolio of vacation rentals, condominiums and branded hotels located in close proximity to our mountain destinations, as well as the Grand Teton Lodge Company in Jackson Hole, Wyo. Vail Resorts Retail operates more than 250 retail and rental locations across North America. Learn more about our company at www.VailResorts.com, or discover our resorts and pass options at www.EpicPass.com.

v3.24.0.1

DEI Document

|

Mar. 11, 2024 |

| Document And Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

Vail Resorts, Inc.

|

| Entity Tax Identification Number |

51-0291762

|

| Entity Address, Address Line One |

390 Interlocken Crescent

|

| Entity Address, Postal Zip Code |

80021

|

| Entity Address, State or Province |

CO

|

| Entity Address, City or Town |

Broomfield,

|

| City Area Code |

(303)

|

| Local Phone Number |

404-1800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

MTN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000812011

|

| Entity File Number |

001-09614

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Period End Date |

Mar. 11, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

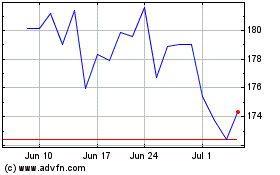

Vail Resorts (NYSE:MTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

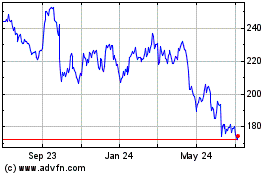

Vail Resorts (NYSE:MTN)

Historical Stock Chart

From Apr 2023 to Apr 2024