By Peter Loftus and Joseph Walker

Drugmakers are reconfiguring manufacturing plants and hiring

hundreds of new workers to be ready to make coronavirus drugs and

vaccines should they prove in testing to be effective in fighting

off the virus.

Johnson & Johnson, Pfizer Inc. and other companies are

gearing up so they can make hundreds of millions of doses of

coronavirus pills and shots as quickly as possible if studies

support their worth.

For some companies, the efforts involve shifting production of

existing drugs to other factories, rejiggering supply chains and

even partnering with rivals.

Companies, which typically only make enough doses of

developmental drugs for studies, don't usually start readying for

full-scale production this early. This manufacturing ramp-up,

however, is part of the industry's speedy mobilization to deal with

the pandemic even as companies lose out on tens of millions of

dollars in manufacturing investments if their drug and vaccine

candidates fail during testing.

Regeneron Pharmaceuticals Inc. plans to shift production of

eye-disease treatment Eylea and other drugs to facilities in

Ireland to devote its Rensselaer, N.Y., plant to making a Covid-19

drug.

"By the end of the summer, I'd like our plant to be completely

operational to produce large quantities" of a coronavirus drug,

Regeneron Chief Executive Leonard Schleifer said in an interview,

"and not far behind that, to have other companies using our

technology to make sure we can supply as many people as

possible."

There is no approved treatment or vaccine for Covid-19, the

disease caused by the virus. Drugmakers and public-health officials

are hoping a drug to treat symptoms of the disease could clear

testing and be greenlighted for widespread use within months, and a

vaccine by early 2021.

To be ready to make large volumes of the products, companies

must begin preparing their plants now. They need to secure supply

chains for key ingredients -- sometimes from other countries --

install new equipment, and find contract manufacturers who can

help.

Gilead Sciences Inc. began ramping up manufacturing of its

experimental antiviral drug remdesivir in January, when researchers

began exploring its use against Covid-19. As of late March, the

drugmaker had produced more than 30,000 treatment courses.

Gilead aims to have produced 140,000 treatment courses for

Covid-19 patients by the end of May, and more than one million by

the end of December, though the company is still waiting for the

results of testing.

In a pandemic, "you can't wait to start making your investment

in the manufacturing until you're sure you have a product," said

Bruce Gellin, president of global immunization at the Sabin Vaccine

Institute, which promotes vaccine adoption and trains immunization

professionals.

Preparing manufacturing plants to make a new vaccine can cost

anywhere from $50 million to $700 million, according to a 2017

paper in the medical journal Vaccine.

To reduce the risk of squandering the investment, pharmaceutical

companies typically wait until a drug or vaccine is in the advanced

stages of testing, and looks like it will succeed in the studies,

before starting to make it in large quantities.

But the unpredictable nature of pandemics has wound up costing

drugmakers in previous outbreaks of viruses like Ebola, which

subsided before drugs finished testing and companies could start

selling them.

Drugmakers would likely have a big market for products that are

successful in clinical trials, but profits may be limited because

some companies have said they'll sell on a not-for-profit basis at

affordable prices.

Now, governments and nonprofits are trying to help companies

reduce their financial risks, and companies are putting their hands

out for financial assistance.

"We cannot produce all of this and not know if there's going to

be a market or not, or if it is going to work or not," said David

Loew, who leads Sanofi SA's vaccine business, one of the world's

biggest.

He said Sanofi is talking with governments and nonprofits about

getting financial help to pay for making hundreds of millions of

doses of its coronavirus vaccine candidate.

The Bill and Melinda Gates Foundation said last week it plans to

work with governments and other organizations to help finance the

expansion of vaccine production to expedite a global supply once

clinical trial results are available.

The U.S. Biomedical Advanced Research and Development Authority

recently agreed to give Moderna Inc. up to $483 million partly to

pay for scaling up capabilities to make the biotech's coronavirus

vaccine candidate, one of the most advanced.

The new federal funding will help the company develop processes

for large-scale manufacturing of tens of millions of doses a month

next year, Chief Executive Stephane Bancel said.

Moderna, which has about 850 employees, plans to hire another

150 by the end of the year to help with the manufacturing ramp-up,

Mr. Bancel said. The company will expand manufacturing to three

shifts a day, seven days a week, from two daily shifts each

weekday.

J&J aims to make more than one billion doses of its

experimental vaccine, Chief Scientific Officer Paul Stoffels said.

It will start making the shots soon at a plant in Leiden, the

Netherlands, which has been making experimental vaccines for other

diseases.

The company plans to produce the vaccine at plants in the U.S.,

Dr. Stoffels said, and is talking with contract manufacturers that

could make it in Europe and Asia.

Pfizer aims to begin testing four vaccine candidates in

development with Germany's BioNTech SE by the end of this month.

Pfizer has been buying raw materials to make the vaccines and plans

to tap manufacturing plants that make sterile injectable products

or vaccines such as its pneumococcal vaccine Prevnar 13, said Mike

McDermott, the company's global-supply president.

Yet a single plant doesn't have capacity to make hundreds of

millions of doses by the end of the year, so Pfizer is assembling a

network of facilities across the globe that will contribute

different steps in the process, Mr. McDermott said.

Pfizer will also hire more workers, he said, and may shift

production of existing products to its own facilities or have

contract manufacturers temporarily make them to free up

capacity.

Jared S. Hopkins and Denise Roland contributed to this

article.

Write to Peter Loftus at peter.loftus@wsj.com and Joseph Walker

at joseph.walker@wsj.com

(END) Dow Jones Newswires

April 23, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

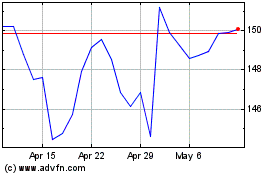

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

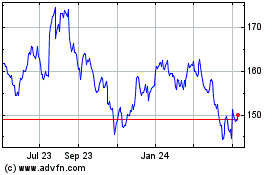

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Sep 2023 to Sep 2024