Kaplan Financial Education to Present Free Webcast on the CARES Act - COVID-19 Tax Provisions

March 31 2020 - 11:48AM

Business Wire

Edward Zollars, CPA and instructor at Kaplan Financial

Education, will lead a free webcast on the CARES Act - COVID-19 Tax

Provisions on April 3, 2020 from 12-1pm CDT.

The webcast, which will deliver 1.0 CPE, will cover the third

coronavirus bill passed by Congress containing numerous provisions

related to COVID-19 relief, including a number of tax provisions.

This session will look at tax-related provisions in the provision,

including:

- Payments to individual taxpayers, with phase-out for higher

income taxpayers;

- Special rules for distributions from retirement plans related

to COVID-19, extended rollover rules and expansion of maximum

borrowing from employer plans;

- Delay in required minimum distributions;

- Ability to delay deposit of employer portion of payroll taxes

for 2020, with amounts paid over two years;

- Fix for the "retail glitch" related to qualified

improvement;

- Temporary restoration of net operating loss carrybacks, along

with other modifications of NOL and business loss rules.

Edward Zollars, CPA, licensed as a CPA in Arizona, is in public

practice in Phoenix, Arizona, as a partner with the firm of Thomas,

Zollars & Lynch, Ltd. He has been in practice for over 35

years, specializing in tax issues for closely held businesses and

individuals.

Ed has been professionally involved with both tax and technology

issues, combining the two disciplines in producing the Current

Federal Tax Development Update podcast and website, dealing with

current tax issues. He has been a member of AICPA Tax Division

Committees, dealing with tax and technology issues, and was the Tax

Section’s representative on three occasions to the AICPA’s Top Ten

Technologies project. Ed is also a member of the Phoenix Tax

Workshop’s Advisory Committee, and currently serves on the Tax

Legislation Liaison Committee for the Arizona Society of CPAs. Ed

was selected as a Life Member by the Arizona Society of CPAs in May

of 2010.

For more information, go to Kaplan Financial Education.

About Kaplan Professional

Kaplan Professional®—a division of Kaplan, Inc. is a leading

provider of training and education services operating in more than

30 countries and working with over 10,000 corporations and

businesses globally. Kaplan Professional helps professionals obtain

certifications, licensure, and designations that enable them to

advance and succeed in their careers. Kaplan Professional partners

with organizations to solve their talent management challenges

through customized corporate learning and development solutions.

Through live and online instruction, Kaplan Professional provides

test preparation, licensing, continuing education, and professional

development programs to businesses and individuals in the

accounting, insurance, securities, real estate, financial, wealth

management, engineering, and architecture industries. Kaplan, Inc.

is part of the Graham Holdings Company (NYSE: GHC).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200331005640/en/

John Vita John Steven Vita Communications John.vita@jsvcom.com

847/853-8283

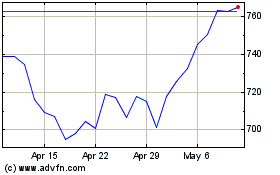

Graham (NYSE:GHC)

Historical Stock Chart

From Aug 2024 to Sep 2024

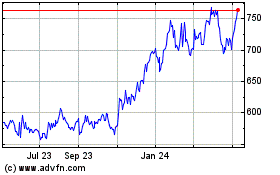

Graham (NYSE:GHC)

Historical Stock Chart

From Sep 2023 to Sep 2024