Today's Logistics Report: Setting New Driving Hours; FedEx's Retail Limits; Freight Trains from China

May 15 2020 - 1:39PM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Highway safety regulators are hoping new flexibility in the

rules governing truckers' time behind the wheel puts to rest years

of argument over the driving limitations. The regulation that takes

effect in September provides more leeway in freight transport

operations, the WSJ Logistics Report's Jennifer Smith writes, and

could save trucking companies nearly $274 million annually over the

next 10 years. Shippers may expect the savings to be passed along

through lower rates, but the bigger benefit will come from having a

less rigid clock on operations. That includes allowing drivers to

split 10 hours in mandated off-duty time into two separate breaks

and exempting some duty time that isn't spent driving from hours

limitations. The Teamsters union says that provision could put

fatigued drivers on the road. The main independent drivers' group

supports the new rule, however, and so do groups representing the

large trucking companies.

E-COMMERCE

New distribution strategies retailers are undertaking to survive

the coronavirus pandemic are triggering turmoil in parcel-delivery

networks. FedEx Corp. has started to limit the number of items that

several big stores including Kohl's Corp. can ship from certain

locations, the WSJ's Paul Ziobro reports, as the carrier tries to

prevent its network from being overwhelmed by sharp swings in the

flow of goods. FedEx's action highlights the strains on parcel

operations as consumers have rushed to e-commerce while sheltering

at home. Retailers are responding by turning their stores into

makeshift warehouses, scrambling the normal flow of online

shipments from distribution centers to homes. FedEx compares the

limits to its holiday peak-season operations. But the company and

other parcel carriers may have to change their operations over the

long term if retailers and consumers like the shopping and

fulfillment practice and keep it going after the pandemic.

QUOTABLE

TRANSPORTATION

The burgeoning freight rail corridor connecting China to Europe

is getting a coronavirus-driven boost in demand. Growing numbers of

shippers are moving to the core element of China's Belt and Road

Initiative, the WSJ's Trefor Moss reports, as rising prices and

disruptions in ocean and air transport have companies turning to

trains. China Railway Corp., which operates the trains in China,

says it ran 976 trips in April, up 47% from last year. The trains

carried the equivalent of the capacity of four of the world's

largest container ships. Shenzhen-based logistics company

Chinatrans International says new customers are coming in

"desperate" because airfreight prices have been soaring and

container shipping lines are cutting sailings. The rail services

have bulked up capacity in the meantime, giving the transport

initiative a new audience among clothing suppliers and auto-parts

companies that could last beyond the pandemic.

LOGISTICS TECHNOLOGY

The robots may be getting ready to help with social distancing

in stores. Grocer Koninklijke Ahold Delhaize NV is accelerating

development of a robotic arm because Covid-19 created an urgent

need for technology to help workers clean stores and process

orders. The WSJ's Catherine Stupp writes that researchers in the

Netherlands are testing the technology, which could be rolled

across company operations that include stores in Europe and the

U.S. It's a sign of how some companies appear to be stepping up

automation efforts as as they adjust to the economic pressures of

the coronavirus pandemic. Ahold Delhaize's robotic arm is the

latest attempt to solve the robotics logistics challenge over how

to handle different goods with a wide variety of shapes and

textures. The research group's artificial intelligence team is

focusing on improving the robotic arm's ability to identify and

hold different products like fruits without damaging them.

IN OTHER NEWS

Nearly 3 million more Americans applied for unemployment

benefits. (WSJ)

The Trump administration plans to expand the nation's stockpile

of medical equipment to include 90 days' worth of supplies to

prepare for potential viral outbreaks. (WSJ)

China's Industrial output rebounded last month, growing 3.9%

from a year earlier. (WSJ)

Contract manufacturing giant Taiwan Semiconductor Manufacturing

plans to build a $12 billion advanced chip factory in Arizona.

(WSJ)

Delta Air Lines is retiring its 18 Boeing wide-body 777 jets by

the end of the year to preserve cash. (WSJ)

Airline Virgin Atlantic is talking to banks about raising some

$916 million to help it weather the coronavirus-driven drop in

demand. (WSJ)

Whirlpool, Dow and Reynolds Consumer Products are collaborating

to provide respirators for front-line health-care workers.

(WSJ)

New York City lawmakers passed measures capping delivery fees

charged by services like Grubhub and prohibiting charges for

undelivered food. (WSJ)

Apple supplier Foxconn Technology Group's first-quarter net

profit slumped 90% from a year ago. (WSJ)

China exempted another 79 U.S. products from import tariffs.

(South China Morning Post)

Investors are flocking to funds focused on logistics facilities

in Asia in anticipation of booming post-coronavirus demand for

e-commerce facilities. (Nikkei Asian Review)

The U.S. Postal Service is reviewing its package delivery

contracts with major private parcel companies. (Washington

Post)

Taiwanese container line Yang Ming lost $27.2 million in the

first quarter on a 4% drop in container volume. (Lloyd's List)

Singapore Airlines lost $212 million in the year ending March

31, the first annual loss in its 48-year history. (Straits

Times)

The family of a Florida woman killed by a delivery driver

dropped a lawsuit against Best Buy, J.B. Hunt Transport Services

and XM Delivery. (Palm Beach Post)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

May 15, 2020 13:24 ET (17:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

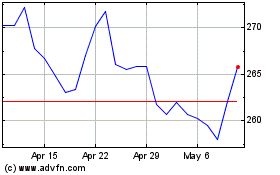

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

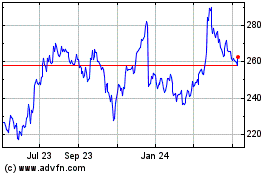

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024