Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

November 15 2019 - 4:21PM

Edgar (US Regulatory)

Filed by: Danaher Corporation

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Danaher Corporation

Commission File No.: 001-08089

November 15, 2019

Dear Danaher Associates,

Today, we announced the next step in

Envista’s journey to becoming a standalone company. As you recall, Danaher is currently Envista’s largest shareholder, owning about 80% of Envista’s common stock. In a press release today, we announced that we are offering Danaher

shareholders the choice to exchange shares of their Danaher common stock for shares of Envista common stock, currently held by Danaher. This transaction is commonly referred to as a “split off exchange offer.”

Following the completion of this exchange offer, Danaher expects that it will no longer have any ownership interest in Envista. Envista will be a standalone

company. Danaher executives that previously had been appointed to the Envista Board of Directors, with the exception of Dan Daniel and Daniel Raskas, will step down from the board.

Danaher shareholders may choose to tender all, some or none of their shares in exchange for Envista shares (subject to the terms of the exchange offer). More

information about the exchange offer can be found here. Shareholders have until December 13th to decide whether they wish to participate in the exchange offer (unless the offer period is extended

or terminated for any reason).

As an associate, this exchange offer may impact you and any shares of Danaher common stock you hold. Read on for further

information.

If you own Danaher common stock in a brokerage account or other investment account (including shares acquired from RSUs that have

vested):

|

|

•

|

|

You have the choice to participate in the exchange offer

|

|

|

•

|

|

You will receive additional information from your bank or broker explaining the exchange offer and the actions

you need to take if you wish to opt-in

|

If you participate in the Danaher stock fund in the

US 401k plan:

|

|

•

|

|

You have the choice to participate in the exchange offer

|

|

|

•

|

|

You will receive additional information from Fidelity explaining the exchange offer and the actions you need to

take if you wish to opt-in

|

|

|

•

|

|

After the split-off, any Envista shares you own will be held in your

Fidelity BrokerageLink account

|

|

|

•

|

|

The deadline for 401k participants to opt-in to the exchange offer will

be December 9th. The earlier deadline is required in order to give Fidelity sufficient time to transmit the elections of plan participants to the exchange agent

|

|

|

•

|

|

If you choose to participate in the exchange offer, you will not be able to make any trades (in/out) of your

Danaher stock fund for up to ten business days following the split-off. This blackout period is needed in order to give Fidelity time to settle account balances

|

If you are a Danaher equity award holder (PSUs, unvested RSUs, unvested stock options, and/or vested, unexercised stock options):

|

|

•

|

|

This exchange offer does not impact your Danaher equity awards

|

|

|

•

|

|

No adjustment to your existing equity awards, whether vested or unvested, is required as a result of the exchange

offer

|

If you hold Danaher shares in a non-qualified retirement plan, such as EDIP,

DCP/ECP:

|

|

•

|

|

This exchange offer does not impact any balances in your Danaher stock fund

|

|

|

•

|

|

No adjustment to your Danaher stock fund balance is required as a result of the exchange offer

|

This list does not account for all scenarios by which a Danaher associate may hold Danaher common stock. All Danaher shareholders

eligible to participate in the exchange offer will receive additional information about the offer. Please read all information you receive about the exchange offer and consult with your bank, broker and legal and tax advisors to understand your

choices and make the decision right for you.

We will share updates with you regarding the outcome of the exchange offer and next steps in due course.

********

FORWARD-LOOKING STATEMENTS

This communication contains certain statements about Danaher Corporation (“Danaher”) and Envista Holdings Corporation (“Envista”)

that are forward-looking statements. Forward-looking statements are based on current expectations and assumptions regarding Danaher’s and Envista’s respective businesses, the economy and other future conditions. In addition, the

forward-looking statements contained in this communication may include statements about the expected effects on Danaher and Envista of the exchange offer, the anticipated timing and benefits of the exchange offer, Danaher’s and Envista’s

anticipated financial results, and all other statements in this communication that are not historical facts.

Because forward-looking statements relate to the future, by their nature, they are subject to inherent

uncertainties, risks and changes in circumstances that are difficult to predict and are detailed more fully in Danaher’s and Envista’s respective periodic reports filed from time to time with the Securities and Exchange Commission (the

“SEC”), the registration statement on Form S-4 and Form S-1 filed by Envista (the “Registration Statement”), including a prospectus (the

“Prospectus”) forming a part thereof, the tender offer statement on Schedule TO filed by Danaher (the “Schedule TO”) and other exchange offer documents filed by Envista or Danaher, as applicable, with the SEC. Such uncertainties,

risks and changes in circumstances could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements included herein are made as of the date hereof, and neither Danaher nor

Envista undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances, except to the extent required by applicable securities laws. Investors should not put undue reliance on forward-looking statements.

ADDITIONAL INFORMATION

This communication is for

informational purposes only and is neither an offer to sell or the solicitation of an offer to buy any securities nor a recommendation as to whether investors should participate in the exchange offer. The offer will be made solely by the Prospectus.

The Prospectus contains important information about the exchange offer, Danaher, Envista, and related matters, and Danaher will deliver the Prospectus to holders of Danaher common stock. Investors and security holders are urged to read the

Prospectus and any other relevant documents filed with the SEC, when they become available and before making any investment decision, because they contain important information about Danaher, Envista and the exchange offer. None of Danaher,

Envista, or any of their respective directors or officers makes any recommendation as to whether investors should participate in the exchange offer.

Envista has filed with the SEC the Registration Statement, including the Prospectus forming a part thereof, and Danaher has filed with the SEC the Schedule

TO, which contain important information about the exchange offer. Holders of Danaher common stock may obtain copies of the Prospectus, the Registration Statement, the Schedule TO, other related documents, and any other information that Danaher and

Envista file electronically with the SEC free of charge at the SEC’s website at www.sec.gov.

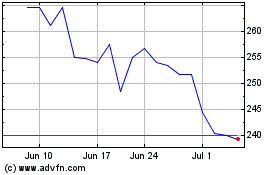

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

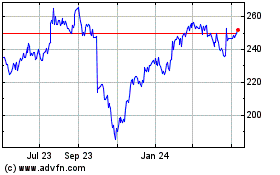

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024