British American Tobacco Expects 2Q Stock Reduction, Revenue Fall

April 30 2020 - 3:14AM

Dow Jones News

By Ian Walker

British American Tobacco PLC said Thursday that to date it has

seen limited impact on consumer demand, pricing or consumers'

ability to access products, but that expects a reduction in stock

levels and a subsequent fall in revenue growth in the second

quarter.

The company--which houses a number of electronic and vaping

products as well as traditional cigarettes--added that revenue is

expected to grow at the low end of the 3%-5% range this year on a

constant-currency basis.

However, it added that the board is committed to high single

figure constant currency adjusted diluted earnings per share

growth.

BATs also said that it plans to pay 65% of adjusted EPS in

dividends.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

April 30, 2020 02:59 ET (06:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

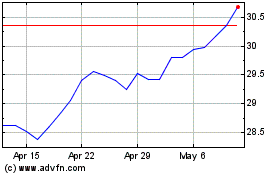

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Aug 2024 to Sep 2024

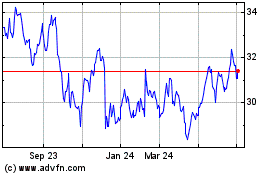

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Sep 2023 to Sep 2024