UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2024

ZHONGCHAO

INC.

(Exact

name of registrant as specified in its charter)

Nanxi

Creative Center, Suite 218

841

Yan’an Middle Road

Jing’An

District, Shanghai, China 200040

Tel:

021-32205987 (Address of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Contents

On

February 27, 2024, Zhongchao Inc., a Cayman Islands exempt company (the “Company”) issued a press release announcing

the extraordinary general meeting of shareholders held on February 20, 2024 approved the proposed 1-for-10 share consolidation of the

Company’s ordinary shares of US$0.0001 par value each (the “Share Consolidation”).

Beginning

with the opening of trading on February 29, 2024, the Company’s Class A ordinary shares will begin trading on a post-Share Consolidation

basis on the Nasdaq Capital Market under the same symbol “ZCMD,” but under a new CUSIP number of G9897X115. The objective

of the Share Consolidation is to enable the Company to regain compliance with Nasdaq Marketplace Rule 5550(a)(2) and maintain its listing

on the Nasdaq Capital Market.

Upon

the effectiveness of the Share Consolidation, every ten (10) Class A Ordinary Shares with a par value of US$0.0001 each will be consolidated

into one (1) Class A Ordinary Share with a par value of US$0.001 each, and every ten (10) Class B Ordinary Shares with a par value of

US$0.0001 each will be consolidated into one (1) Class B Ordinary Share with a par value of US$0.001 each. No fractional shares will

be issued as a result of the Share Consolidation. Instead, any fractional shares that would have resulted from the Share Consolidation

will be rounded up to the next whole number. The Share Consolidation affects all shareholders uniformly and will not alter any shareholder’s

percentage interest in the Company’s outstanding ordinary shares, except for adjustments that may result from the treatment of

fractional shares. The Share Consolidation was approved by the Company’s board of directors on January 9, 2024 and its shareholders

on February 20, 2024.

A

copy of this press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

This

report does not constitute an offer to sell, or the solicitation of an offer to buy, nor shall there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under

the securities laws of any such state or jurisdiction.

Financial

Statements and Exhibits.

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Zhongchao

Inc. |

| |

|

| Date: February 27, 2024 |

By: |

/s/ Weiguang Yang |

| |

|

Weiguang Yang

Chief Executive Officer |

2

Exhibit 99.1

Zhongchao

Inc. Announces 1-for-10 Share Consolidation

Shanghai,

China, February 27, 2024 /PRNewswire/ -- Zhongchao Inc. (NASDAQ: ZCMD) (“Zhongchao” or the “Company”), a platform-based

internet technology company offering services for patients with cancer and other major diseases, today announced that an extraordinary

general meeting of shareholders held on Tuesday, February 20, 2024, approved the proposed 1-for-10 share consolidation of the Company’s

ordinary shares of US$0.0001 par value each (the “Share Consolidation”).

Beginning

with the opening of trading on February 29, 2024, the Company’s Class A ordinary shares will begin trading on a post-Share Consolidation

basis on the Nasdaq Capital Market under the same symbol “ZCMD”, but under a new CUSIP number of G9897X115. The objective

of the Share Consolidation is to enable the Company to regain compliance with Nasdaq Marketplace Rule 5550(a)(2) and maintain its listing

on the Nasdaq Capital Market.

Upon

the effectiveness of the Share Consolidation, every ten (10) Class A Ordinary Shares with a par value of US$0.0001 each will be consolidated

into one (1) Class A Ordinary Share with a par value of US$0.001 each, and every ten (10) Class B Ordinary Shares with a par value of

US$0.0001 each will be consolidated into one (1) Class B Ordinary Share with a par value of US$0.001 each. No fractional shares will

be issued as a result of the Share Consolidation. Instead, any fractional shares that would have resulted from the Share Consolidation

will be rounded up to the next whole number. The Share Consolidation affects all shareholders uniformly and will not alter any shareholder’s

percentage interest in the Company’s outstanding ordinary shares, except for adjustments that may result from the treatment of

fractional shares. The Share Consolidation was approved by the Company’s board of directors on January 9, 2024 and its shareholders

on February 20, 2024.

About Zhongchao

Inc.

Zhongchao

Inc. is an offshore holding company incorporated in the Cayman Islands. It consolidates the financial results of a variable interest

entity, Zhongchao Medical Technology (Shanghai) Limited, and its subsidiaries (the “PRC operating entities”) through a series

of contractual arrangements. Zhongchao Inc. is a platform-based internet technology company offering services to patients with oncology

and other major diseases. The PRC operating entities provide online healthcare information, professional training and educational services

to healthcare professionals under their “MDMOOC” platform (www.mdmooc.org), offer patient management services in the professional

field of tumor and rare diseases through Zhongxin, offer internet healthcare services through Zhixun Internet Hospital, and pharmaceutical

services through Xinjiang Medical and operate an online information platform, Sunshine Health Forums, to general public. More information

about the Company can be found at its investor relations website at http://izcmd.com.

Safe

Harbor Statement

This

press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking

statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions

and other statements that are other than statements of historical facts. When the Company uses words such as "may," "will,"

"intend," "should," "believe," "expect," "anticipate," "project," "estimate"

or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements

are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from

the Company's expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including,

but not limited to, the following: the Company's goals and strategies; the Company's future business development; product and service

demand and acceptance; changes in technology; economic conditions; the growth of the professional training and educational services market

in China and the other international markets the Company plans to serve; reputation and brand; the impact of competition and pricing;

government regulations; fluctuations in general economic and business conditions in China and the international markets the Company plans

to serve and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with

the SEC, the length and severity of the recent coronavirus outbreak, including its impacts across our business and operations. For these

reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company's filings with the SEC, which are available for review at www.sec.gov. The Company undertakes

no obligation to publicly revise these forward–looking statements to reflect events or circumstances that arise after the date

hereof.

For

more information, please contact:

At

the Company: Pei Xu, CFO

Email: xupei@mdmooc.org

Phone:

+86 13901629242

Investor

Relations: Sherry Zheng

Weitian

Group LLC

Email: shunyu.zheng@weitian-ir.com

Phone:

+1 718-213-7386

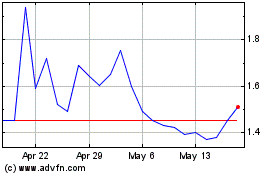

Zhongchao (NASDAQ:ZCMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zhongchao (NASDAQ:ZCMD)

Historical Stock Chart

From Apr 2023 to Apr 2024