Tesla to Sell Up to $5 Billion in Stock From Time to Time

September 01 2020 - 8:01AM

Dow Jones News

By Dave Sebastian

Tesla Inc. said it plans to sell up to $5 billion in stock

through an at-the-market offering from time to time.

Shares rose 6% in premarket trading Tuesday. Tesla shares on

Monday jumped 13% to $498.32 after the company's 5-for-1 split. Its

shares have surged 81% from the company's Aug. 11 stock-split

announcement and have more than quintupled this year.

The electric-vehicle maker said it has entered an equity

distribution agreement with Goldman Sachs & Co. LLC, BofA

Securities Inc., Barclays Capital Inc., Citigroup Global Markets

Inc., Deutsche Bank Securities Inc., Morgan Stanley & Co. LLC,

Credit Suisse Securities (USA) LLC, SG Americas Securities LLC,

Wells Fargo Securities LLC and BNP Paribas Securities Corp.

Those banks, which will act as sales agents, will get a

commission of up to 0.5% of gross proceeds from each sale of the

shares, as well as certain expenses, Tesla said. The company said

it could terminate the agreement at any time.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

September 01, 2020 07:46 ET (11:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

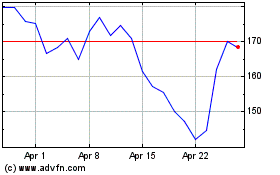

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024