By Tim Higgins

As longtime auto makers try to sell investors on their visions

for the future, they keep hearing the same thing: What about

Tesla?

Investors increasingly see the future of the car as electric --

even if most car buyers haven't yet. And lately, those investors

are placing bets on Tesla Inc. to bring about that future versus

auto makers with deeper pockets and generations of experience.

Tesla's stock is up 91% this year through Friday. That rise has

been attributed to Chief Executive Elon Musk showing some

leadership stability and executing on some promises, including two

consecutive quarters of profit. And also to trader

overexuberance.

But investors and analysts also say it reflects a view that the

moment for electric vehicles is arriving.

Tesla, to a large extent, has become the purest proxy for

betting on electric vehicles. Early on it ditched plans for a

hybrid electric car -- the kind of part-gas, part-electric

half-measure favored by traditional auto makers for improving fuel

efficiency. More than just selling an electric car, Mr. Musk has

crafted an aura around Tesla with a stated mission of accelerating

the world's transition to sustainable energy.

The excitement around Tesla's stock signals the market believes

the company will be "the sole winner" in the move to electric

vehicles, Brian Johnson, an analyst for Barclays, told investors in

a note this month. He also compared the stock run-up with the

overvaluations of the tech boom of the 1990s.

When Tesla on Thursday announced it would issue new shares to

raise more than $2 billion, shares rose more than 4%. The money

gives Tesla more financial muscle to fund models and factories.

Meanwhile, top executives at rivals such as General Motors Co.,

Ford Motor Co. and Fiat Chrysler Automobiles NV in recent days have

faced pointed questions about the Silicon Valley electric-car maker

as Tesla's market value continued its meteoric rise.

When Tesla was founded 16 years ago, the idea of electric cars

competing, let alone replacing gas guzzlers, seemed far fetched.

But more recently, falling battery prices, pressure from

governments such as China to reduce pollution through a shift to

electric vehicles and an increasing focus on climate change more

broadly have heightened expectations that adoption might be

attainable.

Tesla wasn't the first car maker to embrace electric cars. GM

seemed to be cutting a new path in the 1990s with the development

of the EV1 only to be cast as a villain when it killed off the

two-door car years later to the anger of loyal California

customers.

As a startup, Tesla focused on more than just swapping a

gasoline engine for an electric motor. It developed expertise in

software and battery technology and pioneered a direct sales model

(skipping franchise dealers) that once seemed largely impossible in

the U.S. It made costly missteps, too: Its extreme focus on

automating the assembly line and battery factory almost led to the

collapse of the company in 2018 as it worked to untangle the

mess.

But many investors have been willing to overlook the fits and

starts, especially as 100-year-old car giants have struggled with

their own existential challenges -- bankruptcies, fatal recalls and

emissions-cheating scandals.

Tesla's Model 3 compact car, which fueled its 50% delivery

growth last year, has helped show a market exists for fully

electric cars, and analysts predict Tesla could turn its first

full-year profit this year.

Tesla global deliveries last year represented a fraction of

world-wide new vehicle sales but almost one in four of

full-electric deliveries. Supporters believe that means there is

exponential growth ahead, while others question if customers really

want EVs. Fully electric vehicles represented just 1.9% of sales

last year while researcher LMC Automotive predicts that share could

grow to 11% in 2027.

All that has led senior executives at traditional auto makers to

race to put Tesla-killers on the road in coming years. Volkswagen

AG's luxury-car brands Audi and Porsche and GM's GMC brand showed

off electric vehicles on Super Bowl Sunday. Ford, BMW AG and others

also plan electric-vehicle model releases this year.

"If Tesla proves to be profitable...we think this removes one of

the biggest impediments for why legacy [auto makers] were hesitant

to go 'all in' on EVs," Adam Jonas, a Morgan Stanley analyst, wrote

in a note to investors last week.

Tesla rivals first tried to compete with modest models. The

Chevrolet Volt and Nissan Leaf targeted buyers who executives

believed would be motivated by environmental concerns or desires

for gas savings. Mr. Musk bet performance and cool would win

out.

Now the industry is moving in that direction, too, offering

sport-utility vehicles, high-end sedans and sports cars. Car

companies have announced $225 billion in electric-vehicle

investments by 2023, according to AlixPartners LLP, a consulting

firm. So far, however, none of the offerings from GM and

Volkswagen's Audi and Porsche have ignited the same kind of

excitement or sales as Tesla's Model 3.

Even when legacy car makers embrace electric vehicles, they can

stumble. Daimler AG, the maker of Mercedes-Benz, blamed part of its

fourth-quarter loss on the challenges and costs of switching over

to electric-powered cars. The problem for electric cars remains

similar to what it was back with GM's EV1: battery cost. Tesla has

found ways to reduce those costs, but it is still a battle for

all.

Following another disappointing quarter earlier this month, Ford

CEO Jim Hackett tried to assure skeptics that he was preparing the

auto giant for the future. "Tesla's now worth over 5x the market

cap of Ford," an analyst pressed him. "What's the message the

market's sending Ford?"

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

February 17, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

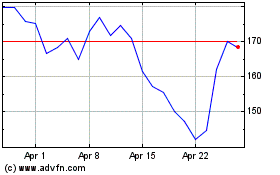

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024