0001527599false00015275992023-12-292023-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 29, 2023 |

SYNLOGIC, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37566 |

26-1824804 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

301 Binney St. Suite 402 |

|

Cambridge, Massachusetts |

|

02142 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 401-9975 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

SYBX |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 26, 2023, Synlogic, Inc. (the “Company”) entered into an amendment to the previously filed employment agreement between the Company and Aoife Brennan, President and CEO (the “Brennan Amendment”). The Brennan Amendment extends the period during which Dr. Brennan will receive continued payments of her base salary in the event that her employment is terminated by the Company without Cause (as defined in the Brennan Amendment) or for Good Reason (as defined in the Brennan Amendment) in the event of a qualifying change in control (a “CiC termination”), from twelve (12) months to eighteen (18) months. The Brennan Amendment also provides that Dr. Brennan will receive (i) a lump sum payment equal to 100% of Dr. Brennan’s target bonus for the period during which Dr. Brennan was employed in the year of termination; (ii) continued coverage under the Company’s group health insurance plan until the earlier of eighteen months from termination or the date she becomes eligible for medical benefits with another employer, and (iii) accelerated vesting of all unvested equity awards. The BrennanAmendment also revises certain provisions regarding the definition of termination without Cause and Good Reason and otherwise substantially restates the general termination and severance provisions.

The foregoing summary of the Brennan Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Brennan Amendment filed hereto as Exhibit 10.1, which is incorporated by reference herein.

On December 26, 2023, the Company entered into an amendment to the previously filed employment agreement between the Company and Antoine Awad, Chief Operating Officer (the “Awad Amendment”). The Awad Amendment extends the period during which Mr. Awad will receive continued payments of his base salary in the event that his employment is terminated by the Company without Cause (as defined in the Awad Amendment) or for Good Reason (as defined in the Awad Amendment) in the event of a qualifying change in control (a “CiC termination”), from six (6) months to twelve (12) months. The Awad Amendment also provides that Mr. Awad will receive (i) a lump sum payment equal to 100% of the target bonus for the period during which Mr. Awad was employed in the year of termination; (ii) continued coverage under the Company’s group health insurance plan until the earlier of twelve months from termination or the date he becomes eligible for medical benefits with another employer, and (iii) accelerated vesting of all unvested equity awards. The Amendment also revises certain provisions regarding the definition of termination without Cause and Good Reason and otherwise substantially restates the general termination and severance provisions.

The foregoing summary of the Awad Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Awad Amendment filed hereto as Exhibit 10.2, which is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

Date: December 29, 2023 |

Synlogic, Inc. |

|

|

By: |

/s/ Aoife Brennan |

|

|

Name: Title: |

Aoife Brennan

President and Chief Executive Officer |

Exhibit 10.1

Synlogic, Inc.

301 Binney Street, Suite 402

Cambridge, MA 02142

December 26, 2023

Dr. Aoife M. Brennan

Re: Amendment to Employment Agreement (the “Amendment”)

Dear Aoife,

I am pleased to provide you with the updated terms and conditions of your employment by Synlogic, Inc. a Delaware corporation, Inc. (hereinafter referred to collectively with its subsidiaries as the “Company”), and together with you, the “Parties.”

1.Pursuant to this amendment, Section 7 (Termination and Severance) and Section 8 (Change of Control) of the employment letter dated October 1, 2018 is hereby amended and restated as follows:

7. Termination and Severance.

Your employment may be terminated by you or the Company as follows:

(a) the Company may terminate your employment for “Cause” (as defined below) upon written notice to you effectively immediately, in which case you will not be entitled to receive any form of payment other than your earned compensation through your date of separation and reimbursable expenses;

(b) you may terminate your employment voluntarily other than for “Good Reason” (as defined below) upon at least thirty (30) days’ prior written notice to the Company, in which case you will not be entitled to receive any form of payment other than your earned compensation through your date of separation and reimbursable expenses; and

(c)(i) the Company may terminate your employment other than for “Cause” upon written notice to you and (ii) you may you terminate your employment voluntarily for “Good

Reason” as per the procedures below, whereupon, in each case subject to and conditioned upon your execution and delivery to the Company of a formal separation agreement (which will contain, among other obligations, your release of all claims against the Company and related persons and entities, and confidentiality/non-disparagement and non-compete provisions in a form and manner satisfactory to the Company), the Company will: (A) pay you salary continuation payments at your then Base Salary rate for a period of twelve (12) months (the “Severance Period”) following the termination of your employment, in accordance with the Company’s regularly established payroll procedure (the “Severance Payments”), and (B) provided you are eligible for and timely elect to continue receiving group medical insurance pursuant to the “COBRA” law, continue to pay the share of the premium for health coverage that is paid by the Company for active and similarly-situated employees who receive the same type of coverage until the earlier of (i) the last day of the Severance Period, or (ii) the date on which you become eligible for healthcare insurance with a subsequent employer, unless the Company’s provision of such COBRA payments will violate the nondiscrimination requirements of applicable law, in which case this benefit will not apply. In addition, within sixty (60) days following such termination without Cause or for Good Reason, as applicable, the Company will pay you a lump-sum payment equal to the prorated portion of your current target bonus for the fiscal year in which you are terminated (with such prorated portion determined by the number of days you were employed during such fiscal year). To the extent applicable, the Severance Payments, “COBRA” payments and lump-sum payment will commence (or, in the case of the lump-sum payment, be paid) within sixty (60) days after your termination, and once they commence, will include any unpaid amounts accrued from the date of your termination; provided, that, if such 60-day period spans two calendar years, then such payments in any event will commence, or if applicable, be paid in the second calendar year.

(d) For purposes of this letter, “Cause” means (i) your dishonest statements or acts with respect to the Company, or any current or prospective customers, investors, suppliers, vendors or other third parties with which the Company does business; (ii) your commission of (a) a felony or (b) any misdemeanor involving moral turpitude, deceit, dishonesty or fraud, or in the case of (a) or (b), your plea of guilty or “no contest” or confession to such felony or misdemeanor; (iii) any act or omission by you which constitutes willful misconduct, negligence or insubordination; (iv) your failure, refusal, or unwillingness to perform, to the reasonable satisfaction of the Board or Company, determined in good faith, any duty or responsibility assigned to you in connection with the performance of your duties hereunder, which failure of performance continues for a period of more than two weeks after written notice thereof has been provided to you by

2

the Company or the Board, such notice to set forth in reasonable detail the nature of such failure of performance; (v) your failure to cooperate with Company in any investigation or formal proceeding; or (vi) your material violation of any Company policy or any of the provisions of this letter or the Related Agreements.

(e) For purposes of this letter, “Good Reason” means you have complied with the “Good Reason Process” as defined below, following the occurrence of one or more of the following events: (i) a change in the principal location at which you provide services to the Company of more fifty (50) miles from your current location or Cambridge, MA upon the Company’s request; (ii) a material reduction in your compensation or a material reduction in your benefits, except such a reduction in connection with a general reduction in compensation or other benefits of other senior executives of the Company; (iii) a material breach of this letter by the Company that has not been cured within two weeks days after written notice thereof by you to the Company; or (iv) a failure by the Company to obtain the assumption of this letter by any successor to the Company. “Good Reason Process” means that (i) you reasonably determine in good faith that one of the foregoing “Good Reason” conditions has occurred; (ii) you notify the Company in writing of the first occurrence of the Good Reason condition within thirty (30) days of the first occurrence of such condition; (iii) you cooperate in good faith with the Company’s efforts, for a period not less than thirty (30) days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding such efforts, the Good Reason condition continues to exist; and (v) you terminate your employment within thirty (30) days after the end of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have occurred.

(f) In the event of your death or permanent disability (as defined below) while you are employed by the Company, your employment hereunder shall immediately and automatically terminate and the Company shall pay to you or your personal representative or designated beneficiary or, if no beneficiary has been designated by you, to your estate, any earned and unpaid base salary, pro-rated through the date of your death or permanent disability. For purposes of this letter, “Permanent Disability” shall mean your inability, due to physical or mental illness or disease, to perform the functions then performed by you for one hundred eighty (180) days (which need not be consecutive) in any 12-month period. If any question shall arise as to whether during any period you are disabled so as to be unable to perform the essential functions of your existing position or positions with or without reasonable accommodation, you may, and at the request of the Company shall, submit to the Company a certification in reasonable detail by a physician selected by the Company to whom the you or your guardian has no reasonable objection as to whether

3

you are disabled or how long such disability is expected to continue, and such certification shall for the purposes of this letter be conclusive of the issue. You shall cooperate with any reasonable request of the physician in connection with such certification. If such question shall arise and you shall fail to submit such certification, the Company’s determination of such issue shall be binding on you. Nothing in this section shall be construed to waive your rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C. §2601 et seq. and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

(g) The time for payment, or schedule for payment, of any severance payments due hereunder may not be accelerated, except as provided for in the Treasury Regulations promulgated under Section 409A of the Internal Revenue Code of 1986 (the “Code”), or any law replacing or superseding such Section or regulations. Notwithstanding the preceding provisions of this Section 7(g), in the case that you are deemed a “specified employee” (as defined in Section 409A(2)(B)(i) of the Code), no severance payment may be made earlier than the date which is six (6) months after the termination of employment hereunder (or, if earlier, the date of the death of the Executive) if and to the extent required by applicable law or other rules of any stock exchange upon which any of shares of the Company’s capital stock are then traded.

8. Change of Control.

(a) Notwithstanding anything to the contrary in any then outstanding option agreement or stock based award, subject to any permitted action by the Board under the Company’s applicable equity plan to terminate options or other stock based awards, and subject to your signing and not revoking a separation agreement that becomes effective within sixty (60) days of such termination, such agreement to be in a form provided by and acceptable to the Company (which will contain, among other obligations, your release of all claims against the Company and related persons and entities, covenants of non-disparagement, and confidentiality/non-disparagement and non-compete provisions in a form and manner satisfactory to the Company), in the event that, within the twelve (12) month period that immediately follows or the thirty (30) day period immediately prior to a Change in Control (as defined below), (a) your employment with the Company is terminated: (i) on account of your death or Permanent Disability, (ii) by the Company without Cause, or (iii) as a result of your termination for (A) Good Reason as defined in this Agreement; or (B) you terminate your employment due to a material diminution in your authority, duties, or responsibilities, subject to your providing the Company with the same notice and opportunity to cure as otherwise set forth in the definition of Good Reason, then:

4

i.The Company will make salary continuation payments at your then Base Salary rate for a period of eighteen (18) months following the termination of your employment according to regularly established payroll procedures then in effect (“Change in Control Compensation Payments”);

ii.Provided you are eligible for and timely elect to continue receiving group medical insurance pursuant to the “COBRA” law, the Company will continue to pay the share of the premium for health coverage that would have been maintained by active and similarly-situated employees who received the same type of coverage until the earlier of (i) eighteen (18) months following the termination of your employment, or (ii) the date on which you become eligible for healthcare insurance with a subsequent employer, unless the Company’s provision of such payments will would result in a violation of any law, rule or regulation or is not possible under the terms of any one or more of applicable insurance plans (the “Change in Control Benefits Payments”);

iii.Within sixty (60) days following such resignation or termination, as applicable, the Company will pay you a lump-sum payment equal to 100% of your current target bonus for the fiscal year in which you are terminated. (“Change in Control Bonus Payment”); and

iv.all of your then unvested restricted stock and/or options to purchase shares of the Company’s Common Stock shall accelerate and become fully vested.

(b) To the extent applicable, the Change in Control Compensation Payments, Change in Control Benefits Payments, and the Change in Control Bonus Payment will commence (or, in the case of the Change in Control Bonus Payment, be paid) within sixty (60) days after your termination (subject to an appropriate release), and once they commence, will include any unpaid amounts accrued from the date of your termination; provided, that, if such 60-day period spans two calendar years, then such payments in any event will commence, or if applicable, be paid in the second calendar year.

(c) As used herein, “Change in Control” shall mean the (i) the sale of the Company by merger in which the shareholders of the Company in their capacity as such no longer own a majority of the outstanding equity securities of the Company (or its successor); (ii) any sale of all or substantially all of the assets or capital stock of the Company (other than in a spin-off or similar transaction); or (iii) any other acquisition of the business of the Company, as determined by the Company’s Board of Directors in their sole discretion. For the avoidance of doubt, in no event shall a bona fide equity or debt financing of the

5

Company, including a financing in which greater than 50% of the Company’s outstanding equity securities are acquired by a third-party be deemed a “Change of Control” for purposes of this letter.

(d) In connection with a Change of Control, the Company agrees to give due consideration to obtaining such vote by disinterested shareholders (and/or members) as may be necessary such that Section 280G of the Code and the applicable IRS regulations thereunder, will not apply to any compensation, payment, or distribution by the Company to you in connection with such Change of Control.

2. This Amendment is the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior and contemporaneous oral and written agreements and discussions. This Amendment may be amended only by an agreement in writing, signed by the Parties hereto.

3. This Amendment may be executed by the Parties in any number of counterparts, each of which will be deemed an original, but all of which will constitute one and the same instrument. Any electronic facsimile transmission by a Party of any signature of that Party to the other Party shall be deemed an original and shall bind such Party sending such transmission.

Sincerely,

SYNLOGIC, INC.

SYNLOGIC OPERATING COMPANY, INC.

By:

/s/ Adam J. Thomas

Name: Adam J. Thomas

Title: Chief People Officer

Accepted and Approved:

/s/ Aoife M. Brennan

Name: Aoife M. Brennan

Date: December 26, 2023

6

Exhibit 10.2

Synlogic, Inc.

301 Binney Street, Suite 402

Cambridge, MA 02142

December 26, 2023

Antoine Awad

Re: Amendment to Employment Agreement (the “Amendment”)

Dear Tony,

I am pleased to provide you with the updated terms and conditions of your employment by Synlogic, Inc. a Delaware corporation, Inc. (hereinafter referred to collectively with its subsidiaries as the “Company”), and together with you, the “Parties.”

1.Pursuant to this amendment, Section 7 (Termination and Severance) and Section 8 (Change of Control) of the employment letter dated November 28, 2018 is hereby amended and restated as follows:

7. Termination and Severance.

Your employment may be terminated by you or the Company as follows:

(a) the Company may terminate your employment for “Cause” (as defined below) upon written notice to you effectively immediately, in which case you will not be entitled to receive any form of payment other than your earned compensation through your date of separation and reimbursable expenses;

(b) you may terminate your employment voluntarily other than for “Good Reason” (as defined below) upon at least thirty (30) days’ prior written notice to the Company, in which case you will not be entitled to receive any form of payment other than your earned compensation through your date of separation and reimbursable expenses; and

(c)(i) the Company may terminate your employment other than for “Cause” upon written notice to you and (ii) you may you terminate your employment voluntarily for “Good

Reason” as per the procedures below, whereupon, in each case subject to and conditioned upon your execution and delivery to the Company of a formal separation agreement (which will contain, among other obligations, your release of all claims against the Company and related persons and entities, and confidentiality/non-disparagement and non-compete provisions in a form and manner satisfactory to the Company), the Company will: (A) pay you salary continuation payments at your then Base Salary rate for a period of six (6) months (the “Severance Period”) following the termination of your employment, in accordance with the Company’s regularly established payroll procedure (the “Severance Payments”), and (B) provided you are eligible for and timely elect to continue receiving group medical insurance pursuant to the “COBRA” law, continue to pay the share of the premium for health coverage that is paid by the Company for active and similarly-situated employees who receive the same type of coverage until the earlier of (i) the last day of the Severance Period, or (ii) the date on which you become eligible for healthcare insurance with a subsequent employer, unless the Company’s provision of such COBRA payments will violate the nondiscrimination requirements of applicable law, in which case this benefit will not apply. In addition, within sixty (60) days following such termination without Cause or for Good Reason, as applicable, the Company will pay you a lump-sum payment equal to the prorated portion of your current target bonus for the fiscal year in which you are terminated (with such prorated portion determined by the number of days you were employed during such fiscal year). To the extent applicable, the Severance Payments, “COBRA” payments and lump-sum payment will commence (or, in the case of the lump-sum payment, be paid) within sixty (60) days after your termination, and once they commence, will include any unpaid amounts accrued from the date of your termination; provided, that, if such 60-day period spans two calendar years, then such payments in any event will commence, or if applicable, be paid in the second calendar year.

(d) For purposes of this letter, “Cause” means (i) your dishonest statements or acts with respect to the Company, or any current or prospective customers, investors, suppliers, vendors or other third parties with which the Company does business; (ii) your commission of (a) a felony or (b) any misdemeanor involving moral turpitude, deceit, dishonesty or fraud, or in the case of (a) or (b), your plea of guilty or “no contest” or confession to such felony or misdemeanor; (iii) any act or omission by you which constitutes willful misconduct, negligence or insubordination; (iv) your failure, refusal, or unwillingness to perform, to the reasonable satisfaction of the Board or Company, determined in good faith, any duty or responsibility assigned to you in connection with the performance of your duties hereunder, which failure of performance continues for a period of more than two weeks after written notice thereof has been provided to you by

2

the Company or the Board, such notice to set forth in reasonable detail the nature of such failure of performance; (v) your failure to cooperate with Company in any investigation or formal proceeding; or (vi) your material violation of any Company policy or any of the provisions of this letter or the Related Agreements.

(e) For purposes of this letter, “Good Reason” means you have complied with the “Good Reason Process” as defined below, following the occurrence of one or more of the following events: (i) a change in the principal location at which you provide services to the Company of more fifty (50) miles from your current location or Cambridge, MA upon the Company’s request; (ii) a material reduction in your compensation or a material reduction in your benefits, except such a reduction in connection with a general reduction in compensation or other benefits of other senior executives of the Company; (iii) a material breach of this letter by the Company that has not been cured within two weeks days after written notice thereof by you to the Company; or (iv) a failure by the Company to obtain the assumption of this letter by any successor to the Company. “Good Reason Process” means that (i) you reasonably determine in good faith that one of the foregoing “Good Reason” conditions has occurred; (ii) you notify the Company in writing of the first occurrence of the Good Reason condition within thirty (30) days of the first occurrence of such condition; (iii) you cooperate in good faith with the Company’s efforts, for a period not less than thirty (30) days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding such efforts, the Good Reason condition continues to exist; and (v) you terminate your employment within thirty (30) days after the end of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have occurred.

(f) In the event of your death or permanent disability (as defined below) while you are employed by the Company, your employment hereunder shall immediately and automatically terminate and the Company shall pay to you or your personal representative or designated beneficiary or, if no beneficiary has been designated by you, to your estate, any earned and unpaid base salary, pro-rated through the date of your death or permanent disability. For purposes of this letter, “Permanent Disability” shall mean your inability, due to physical or mental illness or disease, to perform the functions then performed by you for one hundred eighty (180) days (which need not be consecutive) in any 12-month period. If any question shall arise as to whether during any period you are disabled so as to be unable to perform the essential functions of your existing position or positions with or without reasonable accommodation, you may, and at the request of the Company shall, submit to the Company a certification in reasonable detail by a physician selected by the Company to whom the you or your guardian has no reasonable objection as to whether

3

you are disabled or how long such disability is expected to continue, and such certification shall for the purposes of this letter be conclusive of the issue. You shall cooperate with any reasonable request of the physician in connection with such certification. If such question shall arise and you shall fail to submit such certification, the Company’s determination of such issue shall be binding on you. Nothing in this section shall be construed to waive your rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C. §2601 et seq. and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

(g) The time for payment, or schedule for payment, of any severance payments due hereunder may not be accelerated, except as provided for in the Treasury Regulations promulgated under Section 409A of the Internal Revenue Code of 1986 (the “Code”), or any law replacing or superseding such Section or regulations. Notwithstanding the preceding provisions of this Section 7(g), in the case that you are deemed a “specified employee” (as defined in Section 409A(2)(B)(i) of the Code), no severance payment may be made earlier than the date which is six (6) months after the termination of employment hereunder (or, if earlier, the date of the death of the Executive) if and to the extent required by applicable law or other rules of any stock exchange upon which any of shares of the Company’s capital stock are then traded.

8. Change of Control.

(a) Notwithstanding anything to the contrary in any then outstanding option agreement or stock based award, subject to any permitted action by the Board under the Company’s applicable equity plan to terminate options or other stock based awards, and subject to your signing and not revoking a separation agreement that becomes effective within sixty (60) days of such termination, such agreement to be in a form provided by and acceptable to the Company (which will contain, among other obligations, your release of all claims against the Company and related persons and entities, covenants of non-disparagement, and confidentiality/non-disparagement and non-compete provisions in a form and manner satisfactory to the Company), in the event that, within the twelve (12) month period that immediately follows or the thirty (30) day period immediately prior to a Change in Control (as defined below), (a) your employment with the Company is terminated: (i) on account of your death or Permanent Disability, (ii) by the Company without Cause, or (iii) as a result of your termination for (A) Good Reason as defined in this Agreement; or (B) you terminate your employment due to a material diminution in your authority, duties, or responsibilities, subject to your providing the Company with the same notice and opportunity to cure as otherwise set forth in the definition of Good Reason, then:

4

i.The Company will make salary continuation payments at your then Base Salary rate for a period of twelve (12) months following the termination of your employment according to regularly established payroll procedures then in effect (“Change in Control Compensation Payments”);

ii.Provided you are eligible for and timely elect to continue receiving group medical insurance pursuant to the “COBRA” law, the Company will continue to pay the share of the premium for health coverage that would have been maintained by active and similarly-situated employees who received the same type of coverage until the earlier of (i) twelve (12) months following the termination of your employment, or (ii) the date on which you become eligible for healthcare insurance with a subsequent employer, unless the Company’s provision of such payments will would result in a violation of any law, rule or regulation or is not possible under the terms of any one or more of applicable insurance plans (the “Change in Control Benefits Payments”);

iii.Within sixty (60) days following such resignation or termination, as applicable, the Company will pay you a lump-sum payment equal to 100% of your current target bonus for the fiscal year in which you are terminated. (“Change in Control Bonus Payment”); and

iv.all of your then unvested restricted stock and/or options to purchase shares of the Company’s Common Stock shall accelerate and become fully vested.

(b) To the extent applicable, the Change in Control Compensation Payments, Change in Control Benefits Payments, and the Change in Control Bonus Payment will commence (or, in the case of the Change in Control Bonus Payment, be paid) within sixty (60) days after your termination (subject to an appropriate release), and once they commence, will include any unpaid amounts accrued from the date of your termination; provided, that, if such 60-day period spans two calendar years, then such payments in any event will commence, or if applicable, be paid in the second calendar year.

(c) As used herein, “Change in Control” shall mean the (i) the sale of the Company by merger in which the shareholders of the Company in their capacity as such no longer own a majority of the outstanding equity securities of the Company (or its successor); (ii) any sale of all or substantially all of the assets or capital stock of the Company (other than in a spin-off or similar transaction); or (iii) any other acquisition of the business of the Company, as determined by the Company’s Board of Directors in their sole discretion. For the avoidance of doubt, in no event shall a bona fide equity or debt financing of the

5

Company, including a financing in which greater than 50% of the Company’s outstanding equity securities are acquired by a third-party be deemed a “Change of Control” for purposes of this letter.

2. This Amendment is the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior and contemporaneous oral and written agreements and discussions. This Amendment may be amended only by an agreement in writing, signed by the Parties hereto.

3. This Amendment may be executed by the Parties in any number of counterparts, each of which will be deemed an original, but all of which will constitute one and the same instrument. Any electronic facsimile transmission by a Party of any signature of that Party to the other Party shall be deemed an original and shall bind such Party sending such transmission.

Sincerely,

SYNLOGIC, INC.

SYNLOGIC OPERATING COMPANY, INC.

By:

/s/ Adam J. Thomas

Name: Adam J. Thomas

Title: Chief People Officer

Accepted and Approved:

/s/ Antoine Awad

Name: Antoine Awad

Date: December 26, 2023

6

v3.23.4

Document And Entity Information

|

Dec. 29, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 29, 2023

|

| Entity Registrant Name |

SYNLOGIC, INC.

|

| Entity Central Index Key |

0001527599

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37566

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

26-1824804

|

| Entity Address, Address Line One |

301 Binney

|

| Entity Address, Address Line Two |

St.

|

| Entity Address, Address Line Three |

Suite 402

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02142

|

| City Area Code |

(617)

|

| Local Phone Number |

401-9975

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SYBX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

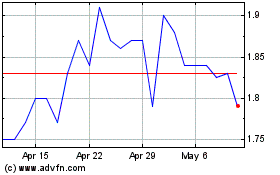

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Apr 2023 to Apr 2024