0000867773SUNPOWER CORPfalse00008677732024-02-262024-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2024

SunPower Corporation

(Exact name of registrant as specified in its charter)

001-34166

(Commission File Number)

| | | | | |

| Delaware | 94-3008969 |

(State or other jurisdiction

of incorporation) | (I.R.S. Employer

Identification No.) |

880 Harbour Way South, Suite 600, Richmond, California 94804

(Address of principal executive offices, with zip code)

(408) 240-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock, $0.001 par value per share | SPWR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Departure of Peter Faricy as Chief Executive Officer, Principal Executive Officer and Director

On February 26, 2024, the Board of Directors (the “Board”) of SunPower Corporation (the “Company”) accepted the resignation of Peter Faricy, the Company’s Chief Executive Officer and principal executive officer, effective as of February 26, 2024. In connection with resignation from his employment, Mr. Faricy also resigned from his position as a member of the Board. The resignation was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

The Company determined that Mr. Faricy’s resignation from employment was a resignation for “good reason” pursuant to the Employment Agreement, dated as of March 20, 2021 (the “Employment Agreement”), by and between the Company and Mr. Faricy. Accordingly, Mr. Faricy will receive the severance benefits set forth in the Employment Agreement as further set forth in his Separation Agreement and Release, dated as of February 26, 2024 (the “Separation Agreement”), by and between the Company and Mr. Faricy, subject to his satisfaction of the release conditions therein. The description of the Separation Agreement is qualified in its entirety by the terms of the Separation Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Appointment of Thomas H. Werner as Principal Executive Officer

On February 26, 2024, the Board appointed Thomas H. Werner, the Company’s Executive Chairman, to serve as the Company’s principal executive officer.

The information required by Items 401(b), (d), (e) and Item 404(a) of Regulation S-K regarding Mr. Werner is set forth in the Company’s Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission on February 20, 2024 under “Item 5.02—Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers” and is incorporated herein by reference. Mr. Werner has not entered into any other material plan, contract, arrangement, or amendment in connection with his appointment as the Company’s principal executive officer.

Departure of Nathalie Portes-Laville as Director

On February 26, 2024, Nathalie Portes-Laville notified the Company of her intent to resign as a member of the Board, effective immediately. Ms. Portes-Laville has served as a designee of Sol Holding, LLC, a Delaware limited liability company (“Sol Holding”), pursuant to the Amended and Restated Affiliation Agreement (as amended, the “Affiliation Agreement”), dated February 14, 2024, by and between the Company and Sol Holding. Ms. Portes-Laville’s resignation is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

On February 27, 2024, the Company issued a press release announcing the matters described in Item 5.02 hereof. A copy of the press release is attached hereto and filed as Exhibit 99.1 and incorporated by reference herein.

The information under this Item 7.01 and Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| SUNPOWER CORPORATION |

| | |

| February 27, 2024 | By: | /S/ ELIZABETH EBY |

| Name: | Elizabeth Eby |

| Title: | Chief Financial Officer |

SEPARATION AGREEMENT AND RELEASE

This Separation Agreement and Release (this “Agreement and Release”) constitutes a binding agreement between you Peter Faricy, and SunPower Corporation (“SunPower” or the “Company”). Please review the terms carefully. We advise you to consult with an attorney concerning its terms. By signing below, you are agreeing to the terms described below in return for the benefits provided herein.

Your separation date will be February 26, 2024 (“Separation Date”).

1.You understand and agree that, whether or not you sign this Agreement and Release:

A.Your employment with SunPower will terminate no later than the Separation Date. All of your SunPower benefits terminate by the end of the month of your Separation Date, except as specifically provided in this Agreement and Release.

B.Within 30 days after your Separation Date, or as earlier required by law, you will receive the Accrued Obligations and Other Benefits, as those terms are defined in the Employment Agreement between you and the Company dated March 20, 2021 (the “Employment Agreement”), which includes your 2023 bonus of $112,563.

C.As of your Separation Date, you will effectively resign from any and all corporate offices, directorships, powers of attorney, committee memberships, and any and all other corporate roles with SunPower, as reflected on the document separately provided to you, if applicable.

2.You understand that if you choose not to sign this Agreement and Release, you are not and will not be entitled to any severance payments or benefits from SunPower under this Agreement and Release, but you still will receive the payments and benefits described in Section 1 above.

3.In addition to the payments and benefits provided to you as described in Section 1 above, and provided you sign this Agreement and Release on or within twenty-one (21) days after receiving it and do not revoke it under Section 4(D) below, SunPower will provide you the severance payments and benefits pursuant to Section 4(a) of the Employment Agreement as further described in Appendix A hereto.

4.In exchange for the severance payments and benefits described in Section 3 of this Agreement and Release, you agree to, and agree to abide by, the following terms:

A.Release. You hereby release (i.e., give up) all known and unknown claims that you presently have or may have against SunPower, all current and former, direct and indirect parents, subsidiaries, brother-sister companies, and all other affiliates and related partnerships, joint ventures, or other entities, and, with respect to each of them, their predecessors and successors; and, with respect to each such entity, all of its past, present, and future employees, officers, directors, stockholders, owners, representatives, assigns, attorneys, agents, insurers, employee benefit programs (and the trustees, administrators, fiduciaries, and insurers of such programs), and any other persons acting by, through, under or in concert with any of the persons or entities listed in this section, and their successors (Released Parties). For example, you are releasing all common law contract, tort, or other claims you might have, any claims for attorney’s fees, any claims relating to your employment with and separation from SunPower,

claims for compensation, breach of contract, termination in violation of public policy, wrongful or retaliatory discharge, claims for additional benefits under the Employment Agreement, as well as all claims you might have under the Age Discrimination in Employment Act (ADEA), the Worker Adjustment & Retraining Notification Act (WARN Act), Title VII of the Civil Rights Act of 1964, Sections 1981 and 1983 of the Civil Rights Act of 1866, the Americans With Disabilities Act (ADA) as amended, the Employee Retirement Income Security Act of 1974 (ERISA), the Family and Medical Leave Act (FMLA), the Fair Credit Reporting Act, and any similar domestic or foreign laws, such as the California Fair Employment and Housing Act, the California Labor Code (including but not limited to the California Worker Adjustment and Retraining Notification Act and Labor Code §203), any applicable California Industrial Welfare Commission order, and the California Business & Professions Code. Notwithstanding the foregoing, you are not releasing any (i) claims that the law does not permit you to waive by signing this Agreement and Release, (ii) claims with respect to the right to enforce this Agreement and Release, (iii) claims with respect to any rights that the Executive has to indemnification (and advancement of expenses) under the Company’s by-laws or other agreement or plan or at law, (iv) rights under any directors and officers indemnification policy or liability insurance coverage obtained by the Company to cover Executive, (v) claims with respect to any employee benefits that are vested as of your Separation Date pursuant to the terms of any Company sponsored employee benefit plan, (vi) claims with respect to the Company’s breach on or after the date you sign this Release of any non-disparagement provision under the Employment Agreement, or (vii) claims that the termination of employment is “In connection with a Change in Control” under Section 3(d) of the Employment Agreement if a Change in Control is consummated within the requisite periods under Section 3(d) following your Separation Date.

B.Release of Unknown Claims. You are intentionally releasing claims that you do not know that you might have and that, with hindsight, you might regret having released. You have not assigned or given away any of the claims you are releasing. You expressly waive the protection of section 1542 of the Civil Code of California, or comparable provision of another state’s law, which states:

A general release does not extend to claims which the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that, if known by him or her, would have materially affected his or her settlement with the debtor or released party.

C.Express Waiver and Release of Claims Under the Age Discrimination in Employment Act. You specifically acknowledge that you are waiving and releasing any rights you may have under the Age Discrimination in Employment Act of 1967 (“ADEA”) and that this waiver and release is knowing and voluntary. You acknowledge that the consideration given for this waiver and release is in addition to anything of value to which you were already entitled, that you have been advised of your opportunity to consult with an attorney, and that nothing in this Agreement and Release prevents or precludes you from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties or costs for doing so, unless specifically authorized by federal law. You acknowledge that you were provided with twenty-one (21) days to consider this Agreement and Release. Furthermore, you

acknowledge that even if you sign this Agreement and Release before the expiration of the 21-day consideration period, that the Company provided you the entire 21-day period to consider this Agreement and Release.

D.Right to Revoke. You understand that if you sign this Agreement and Release you can change your mind and revoke it within seven (7) days after signing it by providing written revocation notice to the Company via email to askHR@sunpower.com. You understand that the release and waiver set forth above will not be effective until after this seven-day period has expired (the “Effective Date”). You understand that following the seven-day revocation period, this Agreement and Release will be final and binding.

E.Representations. When you decided to sign this Agreement and Release, you were not relying on any representations that are not in this Agreement and Release. SunPower would not have agreed to pay the severance payment and benefits and other consideration you are getting in exchange for this Agreement and Release but for the representations and promises you are making by signing it. By signing this Agreement and Release you are representing that you have properly reported all hours that you have worked and you have timely been paid for all wages, overtime, commissions, compensation, bonuses, benefits and other amounts that SunPower should have paid you in the past.

F.No Admission of Liability or Wrongdoing. This Agreement and Release is not an admission of wrongdoing by SunPower or any other Released Party; neither it nor any drafts shall be admissible evidence of wrongdoing.

G.Cooperation. For a period of 10 days following the Separation Date, you agree to provide such cooperation as the Company may reasonably request (the “Services”). The Services may include, without limitation, cooperation with (a) topics related to your former employment relationship with the Company; (b) the transitioning of your role and responsibilities to other personnel; and (c) the provision of information in response to the Company’s reasonable requests and inquiries in connection with your separation and the messaging of your transition to other parties. The Services shall include you being reasonably available to meet with and provide information to the Company and its stakeholders, vendors and customers and their respective affiliates, employees, agents, counsel and others. In exchange for providing the Services, the Company will pay you a consulting fee equal to $325 per hour. Within 30 days following the Separation Date, you shall provide the Company with an invoice detailing number of hours spent providing the Services pursuant to this Section 4.G and the Company will pay the consulting fee to you within 60 days of its receipt of such invoice. In providing the Services, you shall be an independent contractor and shall not participate in any pension or welfare benefit plans, programs or arrangements of the Company or any other Released Party unless such benefits are made available to you by operation of law and due to your former employment status with the Company. As an independent contractor, you shall be solely responsible for all taxes on the sums received by you pursuant to this Section 4.G, and you expressly agree to pay and be responsible for making all applicable tax filings and remittances with respect to amounts paid to you pursuant to this Section 4.G and to hold harmless the Released Parties for all claims, damages, costs and liabilities arising from your failure to do so. For clarity, notwithstanding any provision of the SunPower Corporation 2015 Omnibus Incentive

Plan, as amended from time to time (the “Omnibus Incentive Plan”) or any award agreement thereunder, in no event will your provision of the Services constitute or be deemed to constitute “Service” for purposes of any outstanding awards under the Omnibus Incentive Plan; accordingly, after taking into account any accelerated vesting in connection with your termination of employment as expressly provided in Appendix A, all of your outstanding unvested awards (or portions thereof) under the Omnibus Incentive Plan (and all rights arising from such awards and from being the holder thereof) shall be immediately forfeited upon the Separation Date.

H.Return of SunPower Property. You hereby agree that within 10 days following your Separation Date, you will return to SunPower all property as contemplated under Section 8(j) of the Employment Agreement; provided, however, that you may retain the computer monitor and printer that were provided to you for your home office in Hawaii. You will have repaid everything you owe to SunPower or any Released Party, paid all amounts you owe on SunPower-provided credit cards or accounts (such as cell phone accounts), and canceled or personally assumed any such credit cards or accounts. You agree not to incur any expenses, obligations, or liabilities on behalf of SunPower or any Released Party after your Separation Date. Notwithstanding the foregoing, you will have 10 days from the Separation Date to submit any expense reports that relate to the period prior to your Separation Date and such expenses will be reimbursed in accordance with the Company’s expense reimbursement policy.

I.Post-Termination Obligations. You agree that you shall continue to comply with (i) the “Agreement Concerning Proprietary Information and Inventions,” or similarly titled agreement, you signed at the beginning of your employment with SunPower (the “Inventions Agreement”) and (ii) Section 8 of the Employment Agreement, the terms of each are incorporated herein by this reference.

J.LinkedIn and Social Media Profiles. You agree that within five (5) days of your Separation Date, you will update your LinkedIn and other social media profiles as necessary to reflect that you no longer work for SunPower.

K.Cooperation with Government Agencies. You understand that nothing in this Agreement shall be construed to prevent, limit or interfere with your ability to file a charge with, report in good faith possible violations of law to, or participate in any investigation or proceeding conducted by any government agency or governmental entity, or to provide such disclosures as may be required by law or judicial process. However, you also understand and agree that you are giving up the opportunity to recover any compensation, damages, or any other form of relief in any proceeding brought by you or on your behalf, except that nothing herein shall restrict you from applying for or receiving an award in connection with a report by you to a government entity concerning potential securities law violations. Nothing in this Agreement and Release or any other agreement between you and any Released Party prevents you from discussing or disclosing conduct, or the existence of a settlement involving conduct, that you reasonably believe under state, federal, or common law to be illegal discrimination, illegal harassment, illegal retaliation, a wage and hour violation, or sexual assault, or that is recognized as against a clear mandate of public policy.

5.You understand and agree that the provisions of this Agreement and Release, and the Inventions Agreement, and the Employment Agreement set forth the entire agreement between you and SunPower concerning your employment, separation benefits and termination of employment, and that this Agreement and Release replaces any other promises, representations or agreement between you and SunPower, whether written or oral, concerning such matters except those provisions of the Inventions Agreement and the Employment Agreement which survive your termination of employment. For the avoidance of doubt, Sections 6, 7, 8, 9, 10, 11, 12, 14 and 15 of the Employment Agreement shall survive in their entirety. Any modification of this Agreement and Release, or change to the benefits provided hereunder, must be in writing and executed by you and SunPower.

6.The Company reserves all of its rights in law, equity and otherwise to pursue claims against you to recover any of the payments and benefits provided to you under Section 3 of this Separation Agreement and Release, it being the express agreement of the parties hereto that the payments and benefits provided under such section were conditioned on and delivered in exchange for the release of claims herein, and the Company further reserves its rights to pursue all other claims against you for damages arising out of any such breach in the event that the Company has any such claims. Similarly, you reserve all of your rights in law, equity and otherwise to pursue claims against the Company and its affiliates that have not been waived under Section 4.A.

7.This Agreement and Release shall be construed and enforceable in all respects pursuant to U.S. Federal law and Texas law, to the extent not preempted by U.S. Federal law, notwithstanding conflict of laws considerations or the preference, policy or law of any other jurisdiction or forum. The terms, provisions and language of this Agreement and Release were originally drafted by the Company, and you have negotiated its terms with the advice of counsel.

8.Any dispute or action arising from or related to this Agreement and Release or otherwise relating to or arising out of your employment with SunPower or the termination of that employment shall be subject to arbitration as provided in the Employment Agreement.

9.If SunPower or you successfully assert that any provision in this Agreement and Release is void, the rest of this Agreement and Release shall remain valid and enforceable unless the other party to this Agreement and Release elects to cancel it. The foregoing sentence shall not apply in the event of challenge to the validity of this agreement under the ADEA.

10.This Agreement and Release may be executed in counterparts and each counterpart, when executed, shall have the efficacy of a second original. Photographic, scan, or facsimile copies of any such signed counterparts may be used in lieu of the original for any purpose.

[Signature Page Follows]

THIS AGREEMENT AND RELEASE WILL NOT BE EFFECTIVE UNLESS YOU SIGN AND RETURN IT WITHIN 21 DAYS FROM THE DATE YOU RECEIVED THIS AGREEMENT AND DO NOT REVOKE IT.

| | | | | | | | |

| ACKNOWLEDGED, UNDERSTOOD AND AGREED |

| | |

| By: | /s/ Peter Faricy |

| | Peter Faricy |

| | |

| Date: | February 26, 2024 |

| | | | | | | | |

| | |

| ON BEHALF OF SUNPOWER CORPORATION |

| | |

| By: | /s/ Thomas H. Werner |

| | Thomas H. Werner |

| | Executive Chairman of the Board |

| | |

| Date: | February 26, 2024 |

[Signature Page to Separation Agreement and Release]

Appendix A

Pursuant to Section 4(a) of your Employment Agreement, you will receive the following elements as consideration for your execution of this Agreement and Release (collectively, the “Severance Benefits”):

1.Within 60 days after your Separation Date, the Company shall pay to you a lump sum cash severance payment in an amount equal to $1,804,602.74, which is equal to the sum of the following:

a.$1,650,000, which represents your Base Salary plus Target Bonus; and

b.$154,602.74, which represents a pro-rated 2024 annual bonus payment at “target” performance level.

2.If you are eligible for and has made the necessary elections for continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) under a group health, dental or vision plan sponsored by the Company, the Company will pay, as and when due directly to the COBRA carrier, the COBRA premiums necessary to continue your COBRA coverage for you and your eligible dependents in effect immediately prior to the Separation Date, from the Separation Date until the earliest to occur of (A) eighteen (18) months, (B) the expiration of your eligibility for the continuation coverage under COBRA, and (C) the date on which you become eligible for health insurance coverage in connection with new employment or self-employment (provided that notwithstanding the foregoing clause relating to the Company paying for such coverage, you assume the cost, on an after- tax basis to the extent required to avoid adverse tax consequences under Section 105(h) of the Code or adverse consequences under the Affordable Care Act, as determined by the plan administrator in its sole discretion, for such continuation coverage). You further agree to promptly notify the Company as soon as you become eligible for health insurance coverage in connection with new employment or self-employment.

3.Your outstanding equity awards under the Omnibus Incentive Plan will partially accelerate and vest as follows:

| | | | | | | | |

| Summary of Treatment (provided that this column is only a summary and the Employment Agreement governs) | Award | Number of Shares of the Company’s Common Stock Received upon Settlement (prior to applicable taxes and withholdings) |

| Partial accelerated vesting of outstanding RSUs (and PSUs no longer subject to performance vesting) that would have otherwise vested during the one-year period following the Separation Date | 2022 RSUs | 26,535 |

| 2022 PSUs | 21,865 |

| 2023 RSUs | 34,102 |

| Partial accelerated vesting of outstanding PSUs based on actual performance through the Separation Date | 2023 PSUs | 0 Actual performance as of the termination date is below threshold. |

| Full accelerated vesting of the Sign-On RSUs | Sign-On RSUs | 40,269 |

SunPower Announces CEO Transition

Board establishes Office of the Chairman to lead the business operations as Peter Faricy departs

Board is conducting a comprehensive CEO search

RICHMOND, Calif., February 27, 2024 -- SunPower Corp. (NASDAQ: SPWR), (the "Company" or "SunPower"), a leading residential solar technology and energy services provider, today announced that Chief Executive Officer (CEO) Peter Faricy has departed the Company, effective February 26, 2024. The Board is conducting a comprehensive search process to identify a permanent CEO. Until a successor is named, the Board has established an Office of the Chairman, led by Tom Werner, Executive Chairman of the Board and Principal Executive Officer; and includes Elizabeth Eby, Chief Financial Officer; Eileen Evans, Chief Legal Officer; and other key members of the Executive Leadership Team.

“On behalf of the Board, I want to thank Peter for his contributions to SunPower and advancing our mission of changing the way our world is powered,” said Werner. “Over the past three years, SunPower has made strides toward expanding the footprint of residential solar, capturing a market-leading position in the new homes business and expanding consumer financing for solar through SunPower Financial. I am confident in our Office of the Chairman and our Executive Leadership Team to lead us through this transitional period while we search for a new CEO.”

Werner continued, “We remain committed to putting safety and our employees first, so that we can continue delivering the highest levels of service to our customers and partners. Importantly, we will also continue to build an even stronger operating discipline as we focus on profitability and achieving positive free cash flow. Now, following the Company’s recent capital raise, we look forward to getting back to doing what SunPower does best and building an even more sustainable, resilient, and agile business.”

Werner was recently named SunPower’s Executive Chairman of the Board. He brings valuable institutional knowledge from his nearly 18 years of service as the Company’s CEO and Chairman of the Board.

About SunPower

SunPower (NASDAQ: SPWR) is a leading residential solar, storage and energy services provider in North America. SunPower offers solar + storage solutions that give customers control over electricity consumption and resiliency during power outages while providing cost savings to homeowners. For more information, visit www.sunpower.com.

Forward Looking Statement

This release includes information that constitutes forward-looking statements. All statements, other than statements of historical fact, are forward-looking statements for purposes of the U.S. federal and state securities laws. Forward-looking statements often address expected future business and financial performance, and often contain words such as "believe," "expect," "anticipate," "intend," "plan," or "will" or the negative thereof or other variations thereof or comparable terminology. By their nature, forward-looking statements address matters that are subject to risks and uncertainties. Any such forward-looking statements may involve risk and uncertainties that could cause actual results to differ materially from any future results encompassed within the forward-looking statements. Examples of such forward-looking statements include, but are not limited to, statements regarding the Company's ability to navigate industry headwinds and the Company’s ability to build a more sustainable, resilient and agile business. Factors that could cause or contribute to such differences include, but are not limited to, the Company's ability to obtain further waivers and consents under the Company's credit facilities, and the timing and outcome thereof; the Company's ability to comply with debt covenants or cure any defaults; the Company's ability to repay our obligations as they come due; and the risks and other important factors discussed under the caption "Risk Factors" in the Company's Annual Report on Form 10-K/A for the fiscal year ended January 1, 2023 and the Quarterly Report on Form 10-Q for the quarterly period ended October 1, 2023, and the Company's other filings with the SEC. The Company cautions you that the list of important factors

included in the Company’s filings with the SEC may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this press release may not in fact occur. These forward-looking statements should not be relied upon as representing the Company's views as of any subsequent date, and the Company is under no obligation to, and expressly disclaims any responsibility to, update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law.

For further information: Investors, Mike Weinstein, 510-260-8585, Mike.Weinstein@sunpowercorp.com; Media, Sarah Spitz, 512-953-4401, Sarah.Spitz@sunpowercorp.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

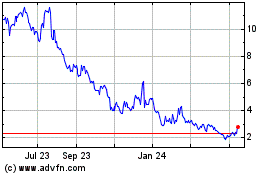

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

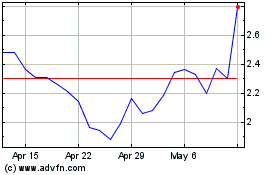

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024