Additional Proxy Soliciting Materials (definitive) (defa14a)

May 30 2019 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a)

of the Securities Exchange Act of 1934

(Amendment No. 1)

|

Filed by the Registrant

☒

|

|

Filed by a Party other than the Registrant

☐

|

|

|

Check the appropriate box:

|

|

|

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

SenesTech,

Inc.

(Name of Registrant as Specified in

its Charter)

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check in the appropriate box):

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

SENESTECH, INC.

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 18, 2019

On April 29, 2019, SentesTech, Inc. (“SenesTech”

or the “Company”) filed its definitive proxy statement (the “Proxy Statement”) with the Securities and

Exchange Commission (the “Commission”) in connection with the Company’s 2019 Annual Meeting of Stockholders to

be held on Tuesday, June 18, 2019 at 10:00 a.m., local time, at the Holiday Inn Hotel and Suites, Phoenix Airport North at 1515

N. 44th St., Phoenix, AZ 85008.

This supplement (the “Supplement”) supplements and

amends the Proxy Statement and is first being made available to Company stockholders on or about May 31, 2019. This Supplement

should be read in conjunction with the Proxy Statement. Except as specifically supplemented or amended by the information contained

in this Supplement, all information set forth in the Proxy Statement continues to apply and should be considered in voting your

shares.

Appointment of New Chief Executive Officer

As previously disclosed in the Company’s Current Report

on Form 8-K filed with the Commission on May 20, 2019, on May 15, 2019, SenesTech announced the appointment of Kenneth Siegel as

the Company’s Chief Executive Officer, effective May 16, 2019, succeeding the Company’s co-founder, Dr. Loretta Mayer,

who will remain Chair of the board of directors of the Company and Chief Scientific Officer. Mr. Siegel has been a SenesTech director

since February 2019.

Mr. Siegel, 63, has over 25 years of experience as an executive

and senior leader of major corporations. Since September 2018, Mr. Siegel has served as a Director on the board of directors of

Babcock & Wilcox Enterprises, Inc. From December 2016 to November 2018, Mr. Siegel served in key leadership roles at Diamond

Resorts International Inc., a global vacation ownership company, most recently as President since March 2017. Prior to Diamond

Resorts, he served as Chief Administrative Officer and General Counsel of Starwood Hotels & Resorts, a branded lifestyle hospitality

company. An instrumental member of the Starwood leadership team, Mr. Siegel was intimately involved in Starwood’s emergence

as an industry leader before its acquisition by Marriott International in 2016. Mr. Siegel played a pivotal role in Starwood’s

transition to an asset-light business and was the architect of transactions that drove both top- and bottom-line benefits through

industry leading initiatives. Prior to joining Starwood in 2000, Mr. Siegel spent four years as the Senior Vice President and General

Counsel of Cognizant Corporation and its successor companies.

Under the terms of an employment letter agreement between Mr.

Siegel and the Company dated May 16, 2019, Mr. Siegel will receive an annual base salary of $275,000 and will receive a one-time

signing bonus of stock options representing 700,000 shares of common stock (the “Option”), which will vest on a quarterly

basis over a three-year period, and will be subject to the terms and conditions of the Company’s 2018 Equity Incentive Plan

(the “Plan”) and standard form of option agreement. Mr. Siegel will be eligible to receive annual Incentive bonus

with a target value equal to 50% of his annual base salary, payable in cash, subject to his achievement of performance objectives

to be determined by the Company’s compensation committee or board of directors. In addition, after each full year of employment

with the Company, subject to Board approval, Mr. Siegel will receive an annual option grant (each, an “Additional Option”)

valued at 35% of his then base salary, subject to such vesting terms as determined by the Board in its discretion. The Option

and Additional Options that are granted to Mr. Siegel will remain exercisable for five (5) years following the end of his continuous

service with the Company. Mr. Siegel will also be eligible to participate in the standard benefits, vacation and expense reimbursement

plans offered to similarly situated employees, and will enter into the Company’s standard form of indemnification agreement

applicable to its directors and officers.

In the event Mr. Siegel’s termination by the Company without

Cause or Mr. Siegel resigns for Good Reason (as such terms are defined in his employment letter agreement), Mr. Siegel will be

entitled to severance benefits equal to twelve (12) months continuation of his then base salary. In addition, the Company will

reimburse Mr. Siegel for COBRA premiums in effect on the date of termination for coverage in effect for him and, if applicable,

his spouse and dependent children on such date under the Company’s group health plan(s), Finally, the vesting of Mr. Siegel’s

Option and Additional Options shall be accelerated such that he will be deemed vested in those shares subject to the Options that

would have vested in the twelve (12) month period following his separation date had his employment not ended.

Voting Matters

This Supplement does not change the proposals to be acted upon

at the Annual Meeting of Stockholders, which are described in the Proxy Statement.

If you have already submitted your proxy,

you do not need to take any action unless you wish to change your vote. If you have already submitted your proxy and wish to change

your vote based on any of the information contained in this Supplement, you may do so at any time before it is voted at the Annual

Meeting.

Proxies already returned by stockholders will remain valid and will be voted at the Annual Meeting of Stockholders

unless revoked. Information regarding how to vote your shares and how to change your vote or revoke your proxy is available in

the Proxy Statement.

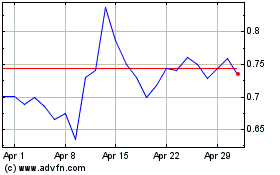

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Mar 2024 to Apr 2024

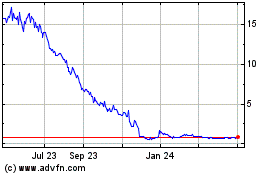

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Apr 2023 to Apr 2024