false

0001069533

0001069533

2024-03-06

2024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 6, 2024

RGC RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

Virginia

|

|

000-26591

|

|

54-1909697

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

519 Kimball Ave., N.E. Roanoke, Virginia

|

|

24016

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 540-777-4427

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $5 Par Value

|

RGCO

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 if the Securities Exchange Act of 1934.

| |

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

ITEM 1.01.

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT |

On March 6, 2024, RGC Midstream, LLC (“Midstream”), a wholly owned subsidiary of RGC Resources, Inc. (“Resources”), entered into the Sixth Amendment to Credit Agreement (the "Amendment") with Atlantic Union Bank (the "Bank"). As part of the Amendment, Truist Bank, a Lender under the original Credit Agreement and prior amendments, assigned their outstanding portion to the Bank. Additionally, the Amendment modifies the original Credit Agreement and prior amendments between Midstream and the Bank by increasing the availability from $23 million to $25 million and extending the maturity date to December 31, 2025. The interest rate currently remains unchanged at Term SOFR plus 2.00%, however, the Amendment allows for a reduction in the interest rate to Term SOFR plus 1.75% upon operation of the Mountain Valley Pipeline ("MVP") and a further reduction to Term SOFR plus 1.55% once distributions from MVP have commenced. All other terms and requirements of the Credit Agreement were retained.

Also, on March 6, 2024, Midstream entered into a Note Modification Agreement (the "Agreement") with the Bank related to the unsecured Promissory Note (the "Note") with an original principal amount of $8,000,000 dated November 1, 2021, as amended. Under the Agreement, principal payments have been halted until April 1, 2025, at which time payments of $400,000 will commence and be due each April 1, July 1, October 1 and January 1. All other terms and requirements of the Note, including maturity on January 1, 2028 and interest rate at Daily Simple SOFR plus 126.448 basis points, were retained.

The Guaranty previously entered into by Resources in favor of the Bank remains in effect, as well as all previous representations, warranties and covenants.

|

ITEM 2.03.

|

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT |

The information required by this Item 2.03 is set forth in Item 1.01 above in respect of the Note, which is incorporated herein by reference.

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

| |

|

|

|

|

RGC RESOURCES, INC. |

| |

|

|

|

|

|

|

Date: March 7, 2024

|

|

|

|

By:

|

/s/ Timothy J. Mulvaney

|

| |

|

|

|

|

Timothy J. Mulvaney |

| |

|

|

|

|

Vice President, Treasurer and Chief Financial Officer |

| |

|

|

|

|

(Principal Financial Officer) |

| |

|

|

|

|

|

Exhibit 10.1

SIXTH AMENDMENT TO CREDIT AGREEMENT

THIS SIXTH AMENDMENT TO CREDIT AGREEMENT (this “Amendment”) is entered into as of March 6, 2024, among:

RGC MIDSTREAM, LLC (“Borrower”),

ATLANTIC UNION BANK as a Lender (“Atlantic Union”), and ATLANTIC UNION BANK as Administrative Agent (“Agent”), and

joined by RGC RESOURCES, INC. (“Guarantor”).

Recitals

Agent, Borrower, Truist Bank as a Lender, Atlantic Union, and Guarantor previously executed a Credit Agreement dated as of December 29, 2015, as amended by First Amendment dated as of April 11, 2018, by Second Amendment dated as of February 19, 2019, by Third Amendment dated as of December 23, 2019, by Fourth Amendment dated as of June 30, 2022, and by Fifth Amendment dated as of July 28, 2023 (the “Credit Agreement”).

Truist Bank has assigned to Atlantic Union, and Atlantic Union has accepted and assumed, all the rights and obligations of Truist Bank as a Lender under the Credit Agreement and any other documents or instruments delivered pursuant to it.

Agent, Borrower, Atlantic Union and Guarantor are the only parties to the Credit Agreement.

Borrower has requested, and Atlantic Union and Agent have agreed, to amend the Credit Agreement to increase the Aggregate Commitments and to extend the Maturity Date, as provided in this Amendment.

Guarantor joins this Amendment to acknowledge its terms and to confirm that its Guaranty applies to the Obligations under the Credit Agreement as amended by this Amendment.

In consideration of the mutual covenants and agreements in this Amendment, the parties covenant and agree as follows:

Section 1. Definitions. Capitalized terms used but not otherwise defined in this Amendment have the meanings given them in the Credit Agreement.

Section 2. Amendments to Credit Agreement.

(a) The definitions of “Applicable Margin,” “Commitment” and “Maturity Date” in Section 1.01 of the Credit Agreement are amended to read as follows:

“Applicable Margin” means 2.00% per annum, subject to adjustment in accordance with the following: when Borrower has provided Agent evidence satisfactory to Agent that the pipeline of Mountain Valley Pipeline, LLC is operational the Applicable Margin will be 1.75% per annum until Borrower has provided Agent evidence satisfactory to Agent that the distributions from Mountain Valley Pipeline, LLC to Borrower have commenced, at which time the Applicable Margin will be 1.55% per annum, with the fact of the adjustment of the Applicable Margin and its effective date established by written notice from Agent to Borrower.

“Commitment” means, as to each Lender at any time, its obligation to make Committed Loans to Borrower pursuant to Section 2.01, in an aggregate principal amount at any one time outstanding not to exceed such Lender’s Applicable Percentage of $25,000,000.00.

“Maturity Date” means December 31, 2025, except that if such date is not a Business Day, the Maturity Date shall be the next Business Day.

(b) Section 2.07 (b) of the Credit Agreement is amended to read as follows:

(b) Agent’s Fees. Borrower shall pay to Agent for Agent’s own account, an annual fee in the amount of $20,000, commencing on March 6, 2025, and on each anniversary of that date. Such fee shall be fully earned when paid and shall be nonrefundable for any reason whatsoever.

(c) Schedule 2.01 of the Credit Agreement is amended to read as follows:

SCHEDULE 2.01

COMMITMENTS

AND APPLICABLE PERCENTAGES

|

Lender

|

Commitment

|

Applicable Percentage

|

|

Atlantic Union Bank

|

$25,000,000.00

|

100.000000000%

|

Section 3. Representations and Warranties of Borrower.

As an inducement to Agent and Atlantic Union to execute this Amendment, Borrower incorporates into this Amendment, and restates to Agent and Atlantic Union as of the Effective Date of this Amendment, each of Borrower’s representations and warranties in Article V of the Credit Agreement, with the following changes:

For purposes of the representations and warranties in Section 5.05 of the Credit Agreement, “Audited Financial Statements” means the audited consolidated balance sheet of Guarantor and its Subsidiaries for the fiscal year ended September 30, 2023, and the related consolidated statements of income or operations, shareholders’ equity and cash flows for such fiscal year of Guarantor and its Subsidiaries, including the notes thereto;

The representations and warranties in Section 5.05 (b) of the Credit Agreement are with respect to the unaudited balance sheets, statements of income or operations, shareholder’s equity and cash flows as of or for the period ending December 31, 2023;

The representation and warranty in Section 5.06 that there has been no adverse change in the status, or financial effect on any Loan Party or any Subsidiary thereof is with respect to the period since September 30, 2023;

The representation and warranty in Section 5.12 (c) (ii) that no Pension Plan had an Unfunded Pension Liability exceeding $6,000,000 and no post-retirement benefit Plan had an unfunded liability exceeding $6,000,000 is as of September 30, 2023; and

For purposes of the representations and warranties, “Loan Documents” means the Credit Agreement, each Note, the Guaranty and this Amendment.

Section 4. Effective Date.

This Amendment will become effective on the first date on which each of the following conditions is satisfied (the “Effective Date”):

(a) Agent’s receipt of the following, each of which shall be originals or telecopies (followed promptly by originals) unless otherwise specified, each properly executed by a Responsible Officer of the signing Loan Party, each dated the date of this Amendment (or, in the case of certificates of governmental officials, a recent date before such date) and each in form and substance satisfactory to Agent and each of the Lenders:

(i) executed counterparts of this Amendment, sufficient in number for distribution to Agent, each Lender and Borrower;

(ii) a consolidated, amended and restated Note executed by Borrower in favor of Atlantic Union;

(iii) such certificates of resolutions or other action, incumbency certificates and other certificates of Responsible Officers of each Loan Party as Agent may require evidencing the identity, authority and capacity of each Responsible Officer thereof authorized to act as a Responsible Officer in connection with this Amendment and the other Loan Documents to which such Loan Party is a party;

(iv) such documents and certifications as Agent may reasonably require to evidence that each Loan Party is duly organized or formed, and that each Loan Party is validly existing, in good standing (if such Loan Party is a corporation) and qualified to engage in business in each jurisdiction where its ownership, lease or operation of properties or the conduct of its business requires such qualification, except to the extent that failure to do so could not reasonably be expected to have a Material Adverse Effect;

(v) a favorable opinion of counsel to the Loan Parties acceptable to Agent addressed to Agent and each Lender, as to the matters set forth concerning the Loan Parties and the Loan Documents in form and substance satisfactory to Agent; and

(vi) a certificate of a Responsible Officer of each Loan Party either (A) attaching copies of all consents, licenses and approvals required in connection with the execution, delivery and performance by such Loan Party and the validity against such Loan Party of the Loan Documents to which it is a party, and such consents, licenses and approvals shall be in full force and effect, or (B) stating that no such consents, licenses or approvals are so required.

(b) Borrower has paid to Agent, for the account of each Lender in accordance with its Applicable Percentage, a commitment fee in the amount of $25,000. The commitment fee shall be due and payable, and deemed to be fully earned and nonrefundable, on the date of this Amendment.

(c) Unless waived by Agent, Borrower has paid all reasonable fees, charges and disbursements of counsel to Agent (directly to such counsel if requested by Agent) to the extent invoiced prior to or on the Closing Date, plus such additional amounts of such fees, charges and disbursements as shall constitute its reasonable estimate of such fees, charges and disbursements incurred or to be incurred by it through the closing proceedings (provided that such estimate shall not thereafter preclude a final settling of accounts between Borrower and Agent).

Section 5. Deposit Account. Promptly after commencement of distributions to Borrower regarding its joint venture for the Mountain Valley Pipeline, Borrower will establish and maintain with Agent a deposit account into which it will deposit the distributions and from which interest payments on the Loans may be made.

Section 6. Miscellaneous.

6.1 This Amendment amends the Credit Agreement and accords with Section 10.01 of the Credit Agreement. This Amendment is a part of the Credit Agreement and will (unless otherwise expressly indicated in this Amendment) be construed, administered and applied in accordance with the terms and provisions of the Credit Agreement.

6.2 Neither the execution by the Agent or Atlantic Union of this Amendment, nor any other act or omission by the Agent or Atlantic Union or their officers in connection with this Amendment, shall be deemed a waiver by the Agent or Atlantic Union of any defaults which may exist or which may occur in the future under the Credit Agreement or the other Loan Documents, or any future defaults of the same provision waived under this Amendment (collectively “Violations”). Similarly, nothing in this Amendment shall directly or indirectly in any way whatsoever either: (a) impair, prejudice or otherwise adversely affect the Agent’s or Atlantic Union’s right at any time to exercise any right, privilege or remedy in connection with the Loan Documents with respect to any Violations; (b) except as expressly stated in this Amendment, amend or alter any provision of the Credit Agreement, the other Loan Documents, or any other contract or instrument; or (c) constitute any course of dealing or other basis for altering any obligation of the Borrower or any right, privilege or remedy of the Agent or Atlantic Union under the Credit Agreement, the other Loan Documents, or any other contract or instrument. Nothing in this Amendment shall be construed to be a consent by the Agent or Atlantic Union to any Violations.

6.3 As of the date of this Amendment, the aggregate principal outstanding under the Credit Agreement is $22,999,999.92, and a total of $2,000,000.08 is now available to borrow under the Credit Agreement.

6.4 Guarantor acknowledges the terms of this Amendment and reaffirms its obligations under the Guaranty. Guarantor acknowledges and agrees that the Guaranty remains in full force and effect, without defense, offset, or counterclaim, and that the Guaranty applies to the Obligations under the Credit Agreement as amended by this Amendment. Although Guarantor has been informed of the terms of this Amendment, Guarantor understands and agrees that Agent and Lenders have no duty to so notify Guarantor or to seek from Guarantor this or any future acknowledgment, consent or reaffirmation, and nothing contained in this Amendment shall create or imply any such duty as to any transactions, past or future.

IN WITNESS WHEREOF, the parties have caused this Amendment to be duly executed as of the date first above written.

[Remainder of Page Intentionally Left Blank – Signature Pages Follow]

| |

RGC MIDSTREAM, LLC |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Paul W. Nester |

|

| |

Name: |

Paul W. Nester |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Timothy J. Mulvaney |

|

| |

Name: |

Timothy J. Mulvaney |

|

| |

Title: |

Vice President, Treasurer and Chief Financial Officer |

| |

RGC RESOURCES, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Paul W. Nester |

|

| |

Name: |

Paul W. Nester |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Timothy J. Mulvaney |

|

| |

Name: |

Timothy J. Mulvaney |

|

| |

Title: |

Vice President, Treasurer and Chief Financial Officer |

| |

ATLANTIC UNION BANK, as Administrative Agent |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Aaron Metrick |

|

| |

Name: |

Aaron Metrick |

|

| |

Title: |

Senior Vice President |

|

| |

|

|

|

| |

|

|

|

| |

ATLANTIC UNION BANK, as a Lender |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Aaron Metrick |

|

| |

Name: |

Aaron Metrick |

|

| |

Title: |

Senior Vice President |

|

7

Exhibit 10.2

NOTE MODIFICATION AGREEMENT

This Note Modification Agreement (“Agreement”) is made as of March 6, 2024, between ATLANTIC UNION BANK (“Lender”) and RGC MIDSTREAM, LLC (“Borrower”), and joined by RGC RESOURCES, INC. (“Guarantor”) and provides as follows:

The Borrower has previously executed and delivered to the Bank a promissory note dated November 1, 2021, in the original principal amount of $8,000,000.00, as amended by letter dated June 5, 2023, between Lender and Borrower (the “Note”), and the parties desire to modify certain terms of the Note, as stated in this Agreement.

NOW, THEREFORE, in consideration of the mutual benefits to be derived under this Modification Agreement, and other good and valuable consideration, the receipt and sufficiency of which are acknowledged, Borrower, Guarantor and Bank agree as follows:

1. Despite anything in the Note to the contrary, no payment of principal of the Note will be due on April 1, 2024, July 1, 2024, October 1, 2024, or January 1, 2025. On each April 1, July 1, October 1, and January 1, commencing April 1, 2025, Borrower shall pay an installment of principal in the amount of $400,000.00. On January 1, 2028, the entire indebtedness evidenced by the Note, including all outstanding principal and accrued but unpaid interest, shall be due and payable.

2. This Agreement is made a part of, and amends, the Note and is not a novation of the Note. As amended by this Note Modification Agreement, the Note is ratified and confirmed and deemed to be in full force and effect.

3. Except as expressly modified by this Agreement, the terms and provisions of the Note and related documents are ratified and confirmed and shall continue in full force and effect. Borrower represents and warrants that such loan documents and this Agreement shall continue to be legal, valid, binding and enforceable in accordance with their respective terms.

4. Guarantor acknowledges the terms of this Agreement and reaffirms its obligations under the Guaranty. Guarantor acknowledges and agrees that the Guaranty remains in full force and effect, without defense, offset, or counterclaim, and that the Guaranty applies to the obligations under the Note as amended by this Agreement. Although Guarantor has been informed of the terms of this Agreement, Guarantor understands and agrees that Lender has no duty to so notify Guarantor or to seek from Guarantor this or any future acknowledgment, consent or reaffirmation, and nothing contained in this Agreement shall create or imply any such duty as to any transactions, past or future.

5. This Agreement represents the entire expression of the parties with respect to the subject matter of this Agreement.

IN WITNESS WHEREOF, the parties have executed this Note Modification Agreement as of the day first above written.

Remainder of page intentionally left blank. Signature pages follow.

| |

ATLANTIC UNION BANK |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/Aaron Metrick |

|

| |

Name: |

Aaron Metrick |

|

| |

Title: |

Senior Vice President |

|

| |

RGC MIDSTREAM, LLC |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Paul W. Nester |

|

| |

Name: |

Paul W. Nester |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Timothy J. Mulvaney |

|

| |

Name: |

Timothy J. Mulvaney |

|

| |

Title: |

Vice President, Treasurer and Chief Financial Officer |

| |

RGC RESOURCES, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Paul W. Nester |

|

| |

Name: |

Paul W. Nester |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Timothy J. Mulvaney |

|

| |

Name: |

Timothy J. Mulvaney |

|

| |

Title: |

Vice President, Treasurer and Chief Financial Officer |

3

v3.24.0.1

Document And Entity Information

|

Mar. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

RGC RESOURCES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 06, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

000-26591

|

| Entity, Tax Identification Number |

54-1909697

|

| Entity, Address, Address Line One |

519 Kimball Ave., N.E.

|

| Entity, Address, City or Town |

Roanoke

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

24016

|

| City Area Code |

540

|

| Local Phone Number |

777-4427

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

RGCO

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001069533

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

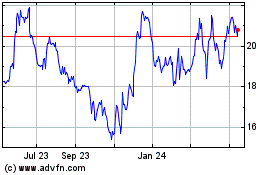

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

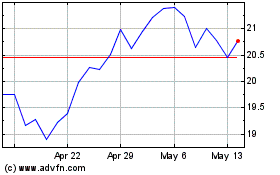

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From Apr 2023 to Apr 2024