UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of: February 2024 (Report No.

2)

Commission File Number: 001-38428

PolyPid Ltd.

(Translation of registrant’s name into

English)

18 Hasivim Street

Petach Tikva 495376, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F

☐ Form 40-F

CONTENTS

Attached hereto and incorporated

herein is PolyPid Ltd.’s (the “Registrant”) press release issued on February 14, 2024, titled “PolyPid Provides

Corporate Update and Reports Fourth Quarter and Full Year 2023 Financial Results.”

The bullet points under the

section titled “Recent Corporate Highlights,” “Financial results for the three months ended December 31, 2023,”

“Financial results for the full year ended December 31, 2023,” “Balance Sheet Highlights,” and “Forward-looking

Statements” and the financial statements in the press release are incorporated by reference

into the Registrant’s registration statements on Form F-3 (File No. 333-257651

and File No. 333-276826) and

Form S-8 (File No. 333-239517 and

File No. 333-271060), filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report

is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

POLYPID LTD. |

| |

|

|

| Date: February 14, 2024 |

By: |

/s/ Dikla Czaczkes Akselbrad |

| |

|

Name: |

Dikla Czaczkes Akselbrad |

| |

|

Title: |

Chief Executive Officer |

3

Exhibit 99.1

PolyPid

Provides Corporate Update and Reports Fourth Quarter and Full Year 2023 Financial Results

More

Than 100 Patients Enrolled in Ongoing SHIELD II Phase 3 Trial of D-PLEX100 for the Prevention of Abdominal Colorectal

Surgical Site Infections

Unblinded

Interim Analysis to be Conducted Once Approximately 400 Patients Complete Their 30-Day Follow-up;

Top-line Results Expected in Second

Half of 2024

New Preclinical Data Showed OncoPLEX

Injected Intratumorally Reduced Tumor Volume and Improved Survival in New Animal Models

Recent

Successful $16 Million Financing Extends Company’s Cash Runway Through Late Third Quarter 2024 and Beyond Expected Timing of Unblinded

Interim Analysis; Potential Additional $19 Million if Warrants are Exercised to Fund PolyPid to the Start of a Planned

New Drug Application Submission for D-PLEX100

Conference

Call Scheduled for Today at 8:30 AM ET

PETACH

TIKVA, Israel, February

14, 2024 – PolyPid Ltd. (Nasdaq:

PYPD) (“PolyPid” or the “Company”), a late-stage biopharma company aiming to improve surgical outcomes, today

provided a corporate update and reported financial results for the three months and full year ended December 31, 2023.

Recent

Corporate Highlights:

| ● | More

than 100 patients have been enrolled to date in the ongoing SHIELD II Phase 3 trial that is recruiting patients undergoing colorectal

abdominal surgery with large incisions. |

| o | Approximately

40 centers are currently open. |

| o | Unblinded

interim analysis is planned to be conducted once a total of approximately 400 patients complete their 30-day follow-up, which is expected

to occur in mid-2024. |

| o | Top-line

results are anticipated in the second half of 2024. |

| ● | Generated

new preclinical data with OncoPLEX injected intratumorally |

| o | OncoPLEX

single intratumoral injection significantly reduced tumor growth and increased survival in two well established and commonly used tumor

animal models: murine melanoma and murine colon carcinoma. |

| o | The

intratumoral injection of the PLEX platform could be used as an interventional oncology treatment with additional chemotherapies or other

types of molecules, such as monoclonal antibodies, bispecific antibodies and nucleic acids. |

| ● | Closed

a private placement financing (the “PIPE”) for $16 million of gross proceeds, which extends

the Company’s cash runway through late in the third quarter of 2024 and beyond the expected timing of the planned unblinded

interim analysis. |

| o | PIPE

syndicate was comprised of new and existing investors, including participation from new U.S. life sciences-focused investors, DAFNA Capital

Management and Rosalind Advisors. |

| o | Company

has the potential to secure an additional $19 million if the results of the unblinded interim analysis are positive and all warrants

issued in the recent financing are exercised, which would fund PolyPid to the start of a planned New Drug Application (“NDA”)

submission for D-PLEX100. |

“We

are thrilled with the significant progress recently achieved throughout our business,” stated Dikla Czaczkes Akselbrad, PolyPid’s

Chief Executive Officer. “As we expected, enrollment in our ongoing SHIELD II Phase 3 pivotal trial for D-PLEX100 has

begun to ramp up, and we continue to anticipate top-line results from this study in the second half of 2024. We have also generated new

highly compelling preclinical data with OncoPLEX that demonstrate its potential in oncology and beyond.”

“Moreover,

in order to support our robust clinical development efforts, we successfully completed a $16 million financing that included participation

from multiple new U.S. life sciences-focused investors,” continued Ms. Czaczkes Akselbrad. “Importantly, we also have the

potential to secure an additional $19 million if the warrants associated with this transaction are exercised, which would fund PolyPid

to the start of a planned New Drug Application submission for D-PLEX100.”

Financial

results for three months ended December 31, 2023

| ● | Research

and development (R&D) expenses, net for the three months ended December 31, 2023, were $4.6 million, compared to $4.7 million in

the same three-month period of 2022. R&D expenses in the most recently completed quarter were driven by the ramp up of the ongoing

SHIELD II Phase 3 trial. |

| ● | General

and administrative (G&A) expenses for the three months ended December 31, 2023, were $1.2 million, compared to $1.6 million for the

same period of 2022. |

| ● | Marketing

and business development expenses for the three months ended December 31, 2023, were $0.2 million, compared to $0.4 million for the same

period of 2022. |

| ● | For the three months ended December 31, 2023, the Company had a net

loss of $6.4 million, or ($3.97) per diluted share, compared to a net loss of $6.6 million, or ($9.90) per diluted share, in the

three-month period ended December 31, 2022. |

Financial

results for the full year ended December 31, 2023

| ● | R&D

expenses, net for the year ended December 31, 2023, were $16.1 million, compared to $28 million in 2022. The decrease in R&D expenses

resulted primarily from the completion of the SHIELD I Phase 3 clinical trial. |

| ● | G&A

expenses for the year ended December 31, 2023, were $5.5 million, compared to $8.0 million for 2022. |

| ● | Marketing

and business development expenses for the year ended December 31, 2023, were $1.2 million, compared to $2.9 million for 2022. |

| ● | The

decreases in G&A and marketing and business development expenses were primarily due to the

Company’s cost reduction plan announced in October 2022 and further cost savings initiatives implemented during full

year 2023. |

| ● | For the year ended December 31, 2023, the Company had a net loss of $23.9

million, or ($16.93) per diluted share, compared to a net loss of $39.6 million, or ($61.09) per diluted share, for 2022. |

Balance

Sheet Highlights

| ● | As

of December 31, 2023, the Company had cash and cash equivalents in the amount of $5.3 million. This does not include the net

proceeds of approximately $15 million generated from the PIPE financing closed in January 2024. PolyPid expects that its pro forma cash

balance will be sufficient to fund operations into late third quarter 2024. |

Conference

Call Dial-In & Webcast Information:

| Date: |

Wednesday, February 14, 2024 |

| Time: |

8:30 AM Eastern Time |

| Q&A

Participants: |

https://register.vevent.com/register/BI8900a42f492b4240a3bba8285558d15f |

| Webcast: |

https://edge.media-server.com/mmc/p/7iigty2s |

About

PolyPid

PolyPid

Ltd. (Nasdaq: PYPD) is a late-stage biopharma company aiming to improve surgical outcomes. Through locally administered, controlled,

prolonged-release therapeutics, PolyPid’s proprietary PLEX (Polymer-Lipid Encapsulation matriX) technology pairs with Active Pharmaceutical

Ingredients (APIs), enabling precise delivery of drugs at optimal release rates over durations ranging from several days to months. PolyPid’s

lead product candidate D-PLEX100 is in Phase 3 clinical trial for the prevention of abdominal colorectal surgical site

infections. In addition, the Company is currently in preclinical stages to test the efficacy of OncoPLEX for the treatment of solid tumors,

beginning with glioblastoma.

For

additional Company information, please visit http://www.polypid.com and follow us on Twitter and LinkedIn.

Forward-looking

Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act and

other securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking

statements. For example, the Company is using forward-looking statements when it discusses the expected timing for top-line results from

the SHIELD II trial and of the unblinded interim analysis, the planned NDA submission for

D-PLEX100, the potential impacts and uses for OncoPLEX and the PLEX platform,

the Company’s expected cash runway, and the potential to receive additional funds if warrants are exercised. Forward-looking statements

are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their

nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However, there can be no assurance

that management’s expectations, beliefs and projections will be achieved, and actual results may differ materially from what is

expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could

cause actual performance or results to differ materially from those expressed in the forward-looking statements. For a more detailed

description of the risks and uncertainties affecting the Company, reference is made to the Company’s reports filed from time to

time with the SEC, including, but not limited to, the risks detailed in the Company’s Annual Report on Form 20-F filed on March

31, 2023. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking

statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting

forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking

statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other

forward-looking statements.

References

and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference

into this press release. PolyPid is not responsible for the contents of third-party websites.

Contacts:

PolyPid

Ltd.

Ori

Warshavsky

COO

– US

908-858-5995

IR@Polypid.com

Investors:

Brian

Ritchie

LifeSci

Advisors

212-915-2578

britchie@lifesciadvisors.com

CONSOLIDATED

BALANCE SHEETS

U.S. dollars

in thousands

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 5,309 | | |

$ | 8,552 | |

| Restricted deposits | |

| 300 | | |

| 511 | |

| Short-term deposits | |

| - | | |

| 4,042 | |

| Prepaid expenses and other current assets | |

| 458 | | |

| 1,089 | |

| | |

| | | |

| | |

| Total current assets | |

| 6,067 | | |

| 14,194 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Property and equipment, net | |

| 7,621 | | |

| 9,247 | |

| Operating lease right-of-use assets | |

| 1,597 | | |

| 2,431 | |

| Other long-term assets | |

| 87 | | |

| 99 | |

| | |

| | | |

| | |

| Total long-term assets | |

| 9,305 | | |

| 11,777 | |

| | |

| | | |

| | |

| Total assets | |

$ | 15,372 | | |

$ | 25,971 | |

CONSOLIDATED

BALANCE SHEETS

U.S. dollars

in thousands (except share and per share data)

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | |

| |

| | |

| | |

| |

| CURRENT LIABILITIES: | |

| | |

| |

| Current maturities of long-term debt | |

$ | 4,003 | | |

$ | 4,024 | |

| Accrued expenses and other current liabilities | |

| 1,971 | | |

| 2,429 | |

| Trade payables | |

| 772 | | |

| 1,141 | |

| Current maturities of operating lease liabilities | |

| 540 | | |

| 959 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 7,286 | | |

| 8,553 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Long-term debt | |

| 6,379 | | |

| 7,574 | |

| Deferred revenues | |

| 2,548 | | |

| 2,548 | |

| Long-term operating lease liabilities | |

| 857 | | |

| 1,173 | |

| Other liabilities | |

| 398 | | |

| 294 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 10,182 | | |

| 11,589 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENT LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS' EQUITY: | |

| | | |

| | |

Ordinary shares, no par value *)-

Authorized: 107,800,000 and 47,800,000 shares at December 31, 2023 and 2022, respectively; Issued and outstanding: 1,653,559 and 669,605 shares at December 31, 2023 and 2022, respectively | |

| - | | |

| - | |

| Additional paid-in capital | |

| 236,213 | | |

| 220,273 | |

| Accumulated deficit | |

| (238,309 | ) | |

| (214,444 | ) |

| | |

| | | |

| | |

| Total shareholders' equity (deficit) | |

| (2,096 | ) | |

| 5,829 | |

| | |

| | | |

| | |

| Total liabilities and shareholders' equity (deficit) | |

$ | 15,372 | | |

$ | 25,971 | |

| *) | Prior period results have been retroactively adjusted to reflect the

1-for-30 reverse share split affected on September 18, 2023. |

CONSOLIDATED

STATEMENTS OF OPERATIONS

U.S. dollars

in thousands (except share and per share data)

| | |

Year

Ended December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| | |

(Unaudited) | | |

| | |

| |

| Operating expenses: | |

| | |

| | |

| |

| Research and development, net | |

$ | 16,148 | | |

$ | 27,990 | | |

$ | 30,553 | |

| Marketing and business development | |

| 1,196 | | |

| 2,888 | | |

| 2,983 | |

| General and administrative | |

| 5,523 | | |

| 8,010 | | |

| 9,609 | |

| | |

| | | |

| | | |

| | |

| Operating loss | |

| 22,867 | | |

| 38,888 | | |

| 43,145 | |

| Financial (income) expense, net | |

| 929 | | |

| 540 | | |

| (544 | ) |

| | |

| | | |

| | | |

| | |

| Loss before income tax | |

| 23,796 | | |

| 39,428 | | |

| 42,601 | |

| Income tax expense | |

| 69 | | |

| 129 | | |

| - | |

| | |

| | | |

| | | |

| | |

| Net loss | |

$ | 23,865 | | |

$ | 39,557 | | |

$ | 42,601 | |

| | |

| | | |

| | | |

| | |

| Loss per share: | |

| | | |

| | | |

| | |

| Basic | |

$ | 16.99 | | |

$ | 61.09 | | |

$ | 68.27 | |

| Diluted | |

$ | 16.93 | | |

$ | 61.09 | | |

$ | 68.27 | |

| | |

| | | |

| | | |

| | |

| Weighted-average Ordinary shares outstanding: | |

| | | |

| | | |

| | |

| Basic | |

| 1,404,368 | | |

| 647,556 | | |

| 624,051 | |

| Diluted | |

| 1,421,308 | | |

| 647,556 | | |

| 624,051 | |

CONSOLIDATED

STATEMENTS OF OPERATIONS

U.S. dollars

in thousands (except share and per share data)

| | |

Three Months Ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Operating expenses: | |

| | |

| |

| Research and development, net | |

$ | 4,588 | | |

$ | 4,655 | |

| Marketing and business development expenses | |

| 193 | | |

| 350 | |

| General and administrative | |

| 1,218 | | |

| 1,607 | |

| | |

| | | |

| | |

| Operating loss | |

| 5,999 | | |

| 6,612 | |

| Financial expense (income), net | |

| 348 | | |

| (100 | ) |

| | |

| | | |

| | |

| Loss before income tax | |

| 6,347 | | |

| 6,512 | |

| Income tax expense | |

| 9 | | |

| 55 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | 6,356 | | |

$ | 6,567 | |

| | |

| | | |

| | |

| Loss per share: | |

| | | |

| | |

| Basic | |

$ | 3.84 | | |

$ | 9.90 | |

| Diluted | |

$ | 3.97 | | |

$ | 9.90 | |

| | |

| | | |

| | |

| Weighted average number of Ordinary shares used in computing basic and diluted loss per share | |

| 1,653,559 | | |

| 663,145 | |

8

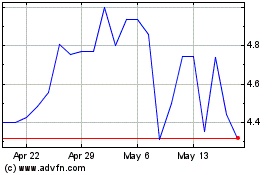

PolyPid (NASDAQ:PYPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

PolyPid (NASDAQ:PYPD)

Historical Stock Chart

From Apr 2023 to Apr 2024