false000178453500017845352024-02-092024-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2024

PORCH GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39142 | | 83-2587663 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

411 1st Avenue S., Suite 501 | |

Seattle, Washington | 98104 |

| (Address of principal executive offices) | (Zip Code) |

(855) 767-2400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 | | PRCH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On February 12, 2024, Porch Group, Inc. (the “Company”), in connection with the repurchase of its 0.75% Senior Unsecured Convertible Notes due September 2026 (“2026 Notes”), issued a press release announcing preliminary financial information for the quarter ended December 31, 2023. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On February 9, 2024, the Company entered into an agreement to repurchase $8 million aggregate principal amount of its 2026 Notes in a private transaction that is expected to close on February 15, 2024, subject to customary closing conditions. The Company will pay $3 million, or 37.5% of par, in the repurchase transaction. This transaction will reduce the Company’s medium term debt maturity from $225 million to $217 million.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, including the expected closing of the repurchase transaction. Forward-looking statements are inherently subject to risks, uncertainties, assumptions, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management at the time they are made, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the Company’s ability to satisfy the conditions to closing of the repurchase transaction; and (2) other risks and uncertainties discussed in Part I, Item 1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K (“Annual Report”) for the year ended December 31, 2022, in Part II, Item 1A, “Risk Factors,” in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, as well as those discussed in subsequent reports filed with the Securities and Exchange Commission (“SEC”), all of which are available on the SEC’s website at www.sec.gov.

Nothing in this Current Report on Form 8-K should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Current Report on Form 8-K. Unless specifically indicated otherwise, the forward-looking statements in this Current Report on Form 8-K do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this Current Report on Form 8-K. The Company does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events or otherwise, except as may be required by law.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| PORCH GROUP, INC. |

| | |

| By: | /s/ Shawn Tabak |

| | Name: | Shawn Tabak |

| | Title: | Chief Financial Officer |

Date: February 12, 2024

Exhibit 99.1

Exhibit 99.1

Porch Group to Release Fourth Quarter 2023 Earnings on March 7, 2024

SEATTLE, Feb 12, 2024 (BUSINESS WIRE) – Porch Group, Inc. (“Porch Group,” “Porch” or “the Company”) (NASDAQ: PRCH), a leading vertical software company reinventing the home services and insurance industries, today announced it will report fourth quarter financial results ended December 31, 2023, after markets close on Thursday, March 7, 2024. The business performed well in the fourth quarter, with 2023 Revenue and Adjusted EBITDA expected to be ahead of guidance1.

Conference Call

Porch management will host a live webinar to discuss the financial results and business followed by Q&A on Thursday, March 7, 2024, at 5:00 p.m. Eastern time (2:00 p.m. Pacific time). A presentation to accompany the discussion will be posted on the company website along with a press release and other supplemental financial information.

All are invited to listen to the event by registering for the webinar here. https://events.q4inc.com/attendee/966290444. A replay of the webinar will also be available in the Investors section of Porch’s corporate website.

1 The Company’s previously provided full year 2023 guidance, was Revenue of $415 million and Adjusted EBITDA of $(52) million.

About Porch Group

Seattle-based Porch Group, Inc., the vertical software and insurance platform for the home, provides software and services to approximately 30,700 home services companies such as home inspectors, mortgage companies and loan officers, title companies, moving companies, real estate agencies, utility companies, and warranty companies. Through these relationships and its multiple brands, Porch Group provides a moving concierge service to homebuyers, helping them save time and make better decisions on critical services, including insurance, warranty, moving, security, TV/internet, home repair and improvement, and more. To learn more about Porch Group, visit porchgroup.com or porch.com.

Investor Relations Contact:

Lois Perkins, Head of Investor Relations

Porch Group

loisperkins@porch.com

Forward-Looking Statements

Certain statements in this release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Although the Company believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, assumptions, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Generally, statements that are not historical facts, including statements concerning the Company’s preliminary results for the fourth quarter

and year ended December 31, 2023, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or similar expressions. The preliminary financial information presented in this release are estimates based on information available to management as of the date of this release, have not been reviewed or audited by our independent registered accounting firm, and are subject to change. There can be no assurance that the Company’s actual results will not differ from the preliminary financial information presented in this release. The preliminary financial information presented in this release should not be viewed as a substitute for full financial statements prepared in accordance with GAAP.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management at the time they are made, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) expansion plans and opportunities, and managing growth, to build a consumer brand; (2) the incidence, frequency, and severity of weather events, extensive wildfires, and other catastrophes; (3) economic conditions, especially those affecting the housing, insurance, and financial markets; (4) expectations regarding revenue, cost of revenue, operating expenses, and the ability to achieve and maintain future profitability; (5) existing and developing federal and state laws and regulations, including with respect to insurance, warranty, privacy, information security, data protection, and taxation, and management’s interpretation of and compliance with such laws and regulations; (6) the Company’s reinsurance program, which includes the use of a captive reinsurer, the success of which is dependent on a number of factors outside management’s control, along with reliance on reinsurance to protect against loss; (7) the uncertainty and significance of the known and unknown effects on the Company's insurance carrier subsidiary, Homeowners of America Insurance Company (“HOA”), and the Company due to the termination of a reinsurance contract following the allegations of fraud against Vesttoo Ltd. (“Vesttoo”), including, but not limited to, the outcome of Vesttoo’s Chapter 11 bankruptcy proceedings; the Company's ability to successfully pursue claims arising out of the alleged fraud, the costs associated with pursuing the claims, and the timeframe associated with any recoveries; HOA's ability to obtain and maintain adequate reinsurance coverage against excess losses; HOA’s ability to stay out of regulatory supervision and maintain its financial stability rating; and HOA’s ability to maintain a healthy surplus; (8) uncertainties related to regulatory approval of insurance rates, policy forms, insurance products, license applications, acquisitions of businesses, or strategic initiatives, including the reciprocal restructuring, and other matters within the purview of insurance regulators; (9) reliance on strategic, proprietary relationships to provide the Company with access to personal data and product information, and the ability to use such data and information to increase transaction volume and attract and retain customers; (10) the ability to develop new, or enhance existing, products, services, and features and bring them to market in a timely manner; (11) changes in capital requirements, and the ability to access capital when needed to provide statutory surplus; (12) the increased costs and initiatives required to address new legal and regulatory requirements arising from developments related to cybersecurity, privacy, and data governance and the increased costs and initiatives to protect against data breaches, cyber-attacks, virus or malware attacks, or other infiltrations or incidents affecting system integrity, availability, and performance; (13) retaining and attracting skilled and experienced employees; (14) costs related to being a public company; and (15) other risks and uncertainties discussed in Part I, Item 1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K (“Annual Report”) for the year ended December 31, 2022, in Part II, Item 1A, “Risk Factors,” in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023,

June 30, 2023, and September 30, 2023, as well as those discussed in subsequent reports filed with the Securities and Exchange Commission (“SEC”), all of which are available on the SEC’s website at www.sec.gov.

Nothing in this release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. Unless specifically indicated otherwise, the forward-looking statements in this release do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this release. The Company does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events or otherwise, except as may be required by law.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures, such as Adjusted EBITDA (Loss).

We define Adjusted EBITDA (Loss) as net income (loss) adjusted for interest expense; income taxes; depreciation and amortization; gain or loss on extinguishment of debt; other expense (income), net; impairments of intangible assets and goodwill; provision for doubtful accounts related to reinsurance, or related recoveries; impairments of property, equipment, and software; stock-based compensation expense; mark-to-market gains or losses recognized on changes in the value of contingent consideration arrangements, earnouts, warrants, and derivatives; restructuring costs; acquisition and other transaction costs; and non-cash bonus expense.

Our management uses these non-GAAP financial measures as supplemental measures of our operating and financial performance, for internal budgeting and forecasting purposes, to evaluate financial and strategic planning matters, and to establish certain performance goals for incentive programs. We believe that the use of these non-GAAP financial measures provides investors with useful information to evaluate our operating and financial performance and trends and in comparing our financial results with competitors, other similar companies and companies across different industries, many of which present similar non-GAAP financial measures to investors. However, our definitions and methodology in calculating these non-GAAP measures may not be comparable to those used by other companies. In addition, we may modify the presentation of these non-GAAP financial measures in the future, and any such modification may be material.

You should not consider these non-GAAP financial measures in isolation, as a substitute to or superior to financial performance measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude specified income and expenses, some of which may be significant or material, that are required by GAAP to be recorded in our consolidated financial statements. We may also incur future income or expenses similar to those excluded from these non-GAAP financial measures, and the presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or non-recurring items. In addition, these non-GAAP financial measures reflect the exercise of management judgment about which income and expense are included or excluded in determining these non-GAAP financial measures.

We have not provided reconciliations of non-GAAP financial measures for future periods to the most directly comparable measures prepared in accordance with GAAP. We are unable to provide these reconciliations without unreasonable effort because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of our control.

v3.24.0.1

Document and Entity Information

|

Feb. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 09, 2024

|

| Entity Registrant Name |

PORCH GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39142

|

| Entity Tax Identification Number |

83-2587663

|

| Entity Address, Address Line One |

411 1st Avenue S.

|

| Entity Address, Address Line Two |

Suite 501

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98104

|

| City Area Code |

855

|

| Local Phone Number |

767-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001

|

| Trading Symbol |

PRCH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001784535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

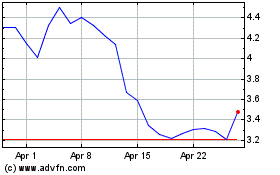

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Apr 2023 to Apr 2024