Additional Proxy Soliciting Materials (definitive) (defa14a)

December 04 2019 - 2:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange

Act of 1934

|

Filed by the Registrant

|

☒

|

|

Filed by a Party other than the Registrant

|

☐

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

Definitive Additional Materials

|

|

|

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

PREDICTIVE ONCOLOGY INC.

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

i

PREDICTIVE ONCOLOGY INC.

2915 Commers Drive, Suite 900

Eagan, Minnesota 55121

Telephone: (651) 389-4800

AMENDMENT TO

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 18, 2019

The following section of the Proxy Statement dated November 25, 2019 entitled “Related

Party Transactions” is hereby amended and restated to correct certain typographical errors.

RELATED PARTY TRANSACTIONS

One of the Company’s directors, Richard L. Gabriel, is the Chief Operating Officer

and serves as a director of GLG Pharma (“GLG”). Another Company director, Tim Krochuk, is on the supervisory board

for GLG. The Company and GLG have a partnership agreement with the Company’s wholly owned subsidiary Helomics Holding Corporation

for the purpose of bringing together their proprietary technologies to build out personalized medicine platform for the diagnosis

and treatment of women’s cancer. There has been no revenue or expenses generated by this partnership to date.

On May 1, 2019, Mr. Gabriel executed a one-year contract with renewable three-month periods

to continue as Chief Operating Officer for TumorGenesis, the Company’s wholly owned subsidiary. Mr. Gabriel will receive

$13,500 in monthly cash payments.

On November 30, 2018, our CEO, Carl Schwartz, made an investment of $370,000 in the Company

and received a note and a common stock purchase warrant for 22,129 warrant shares at $8.36 per share. Effective as of January 8,

2019, Dr. Schwartz made an additional investment of $950,000 and received an amended and restated note in the original principal

amount of $1,320,000 and an amended and restated warrant, which added a second tranche of 74,219 warrant shares at an exercise

price of $7.04. Each tranche is exercisable beginning on the sixth month anniversary of the date of the related investment through

the fifth-year anniversary of the date of the related investment.

On January 8, 2019, Dr. Schwartz also purchased 7,813 shares of the Company’s common

stock in a private investment for $50,000, representing a price of $6.40 per share, pursuant to a subscription agreement.

1

On February 6, 2019, Dr. Schwartz made an additional investment of $300,000 in the Company

and received an amended and restated note in the original principal amount of $1,620,000 and an amended and restated warrant, which

added a third tranche of 13,889 warrant shares at an exercise price of $11.88 per share. On May 21, 2019, the Company issued a

third amended and restated common stock purchase warrant to Dr. Schwartz the Company’s CEO for value received in connection

with the funding of all or a portion of the purchase price of his second amended and restated promissory note in the principal

amount of $1,620,000. On February 1, 2019 and the first day of each calendar month thereafter while the mote and the warrant remain

outstanding, a number of additional shares will be added to the warrant shares (“Additional Warrant Shares”) equal

to (1) one-half percent (1/2%) of the outstanding principal balance of the note on such date, divided by (2) $7.04, with the number

of Additional Warrant Shares to be rounded to the nearest number of whole shares. The principal change effected by the third amended

and restated common stock purchase warrant was to clarify the formula for the calculation of the Additional Warrant Shares. The

current principal balance of the note is $1,620,000, and therefore, under the amended formula, Dr. Schwartz is currently receiving

rights under the warrant to purchase Additional Warrant Shares on the first day of each month equal to 1,151 shares of common stock

at $7.04 per share.

On May 9, 2019, Dr. Schwartz advanced $75,000 to the Company, on May 30, 2019, he advanced

$200,000 to the Company, and on July 15, 2019 he advanced $25,000 to the Company. The loan earns 8% interest and was due on September

13, 2019, pursuant to an amended and restated note. Dr. Schwartz agreed to extend the maturity date until December 31, 2019. The

loan is not connected to the previous note payable due to Dr. Schwartz and does not affect the warrant calculations regarding that

note’s interest.

4817-0567-9790, v. 1

2

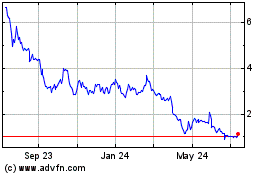

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Aug 2024 to Sep 2024

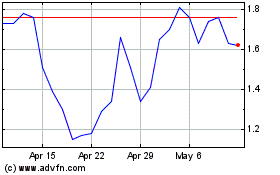

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Sep 2023 to Sep 2024