0001692412false00016924122024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________

FORM 8-K

____________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

____________________________________________________________

PLAYA HOTELS & RESORTS N.V.

(Exact Name of Registrant as Specified in Charter)

____________________________________________________________

| | | | | | | | | | | | | | |

| | | | |

The Netherlands | | 1-38012 | | 98-1346104 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

Nieuwezijds Voorburgwal 104 1012 SG Amsterdam, the Netherlands | | Not Applicable |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: Tel: + 31 20 571 12 02

_____________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

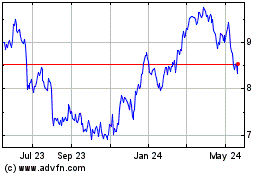

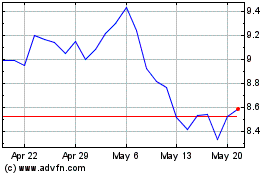

Ordinary Shares, €0.10 par value | PLYA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, Playa Hotels & Resorts N.V. (“Playa” or the “Company”) issued a press release reporting the Company’s financial results for the three months and year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL Document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Playa Hotels & Resorts N.V. |

| | | | |

| Date: | February 22, 2024 | By: | /s/ Ryan Hymel |

| | | | Ryan Hymel |

| | | | Chief Financial Officer |

Exhibit 99.1

Company Contact

Ryan Hymel, EVP and Chief Financial Officer

(571) 529-6113

| | | | | | | | |

| Playa Hotels & Resorts N.V. Reports Fourth

Quarter and Full Year 2023 Results | |

| |

Fairfax, VA, February 22, 2024 – Playa Hotels & Resorts N.V. (the “Company”) (NASDAQ: PLYA) today announced results of operations for the three months and year ended December 31, 2023.

Three Months Ended December 31, 2023 Results ▪Net Income was $1.0 million compared to a Net Loss of $14.3 million in 2022

▪Adjusted Net Income(1) was $6.0 million compared to $20.6 million in 2022

▪Net Package RevPAR increased 13.2% versus 2022 to $301.47, driven by a 4.8% increase in Net Package ADR and a 5.5 percentage point increase in Occupancy

▪Owned Resort EBITDA(1) increased 2.3% versus 2022 to $73.6 million

▪Owned Resort EBITDA Margin(1) decreased 2.9 percentage points versus 2022 to 32.9%, inclusive of:

•a negative impact of approximately 250 basis points due to the appreciation of the Mexican Peso; and

•a positive impact of 40 basis points for the three months ended December 31, 2023 and 360 basis points for the three months ended December 31, 2022 from business interruption insurance proceeds and recoverable expenses

•Excluding these impacts, Owned Resort EBITDA Margin would have been 34.9%, an increase of 2.7 percentage points compared to 2022

▪Adjusted EBITDA(1) increased 2.9% versus 2022 to $60.8 million, inclusive of:

•a negative impact of approximately $5.6 million due to the appreciation of the Mexican Peso; and

•a positive impact of $0.9 million from business interruption insurance proceeds and recoverable expenses related to the disruption caused by Hurricane Fiona in our Dominican Republic segment in the second half of 2022

▪Adjusted EBITDA Margin(1) decreased 2.4 percentage points versus 2022 to 26.8%, inclusive of:

•a negative impact of approximately 240 basis points due to the appreciation of the Mexican Peso; and

•a positive impact of 40 basis points for the three months ended December 31, 2023 and 350 basis points for the three months ended December 31, 2022 from business interruption insurance proceeds and recoverable expenses

•Excluding these impacts, Adjusted EBITDA Margin would have been 28.8%, an increase of 3.2 percentage points compared to 2022

Year Ended December 31, 2023 Results ▪Net Income was $53.9 million compared to $56.7 million in 2022

▪Adjusted Net Income(1) was $66.3 million compared to $83.2 million in 2022

▪Net Package RevPAR increased 14.3% versus 2022 to $309.50, driven by a 14.6% increase in Net Package ADR, partially offset by a 0.2 percentage point decrease in Occupancy

▪Owned Resort EBITDA(1) increased 10.1% versus 2022 to $318.9 million

▪Owned Resort EBITDA Margin(1) decreased 0.7 percentage points versus 2022 to 34.6%, inclusive of:

•a negative impact of approximately 260 basis points due to the appreciation of the Mexican Peso; and

•a positive impact of 70 basis points for the year ended December 31, 2023 and 90 basis points for the year ended December 31, 2022 from business interruption insurance proceeds and recoverable expenses

•Excluding these impacts, Owned Resort EBITDA Margin would have been 36.6%, an increase of 2.1 percentage points compared to 2022

▪Adjusted EBITDA(1) increased 12.1% versus 2022 to $271.9 million, inclusive of:

•a negative impact of approximately $24.7 million due to the appreciation of the Mexican Peso; and

•a positive impact of $6.1 million from business interruption insurance proceeds and recoverable expenses related to the disruption caused by Hurricane Fiona in our Dominican Republic segment in the second half of 2022.

▪Adjusted EBITDA Margin(1) decreased 0.3 percentage points versus 2022 to 29.1%, inclusive of:

•a negative impact of 260 basis points due to the appreciation of the Mexican Peso; and

•a positive impact of 70 basis points for the year ended December 31, 2023 and 80 basis points for the year ended December 31, 2022 from business interruption insurance proceeds and recoverable expenses

•Excluding these impacts, Adjusted EBITDA Margin would have been 31.0%, an increase of 2.6 percentage points compared to the year ended December 31, 2022.

(1)See “Definitions of Non-U.S. GAAP Measures and Operating Statistics” for a description of how we compute Adjusted Net Income/(Loss), Owned Resort EBITDA, Owned Resort EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Comparable Adjusted EBITDA, Comparable Adjusted EBITDA Margin and other non-GAAP financial figures included in this press release, as well as reconciliations of such non-GAAP financial figures to the most directly comparable financial measures calculated in accordance with GAAP.

“The fourth quarter capped off a record year for Playa. Our fourth quarter results exceeded our expectations, as demand accelerated through the quarter, with December Occupancy in the Yucatán and Jamaica exceeding the December 2018 and 2019 average. We were effectively able to drive ADR as demand accelerated, leading to higher than anticipated Adjusted EBITDA for the fourth quarter. While foreign exchange rate headwinds persisted, our operations teams continued to improve our efficiency efforts in procurement and staffing. Excluding the impact of foreign exchange rates, the Jewel resorts in the Dominican Republic, business interruption proceeds and other hurricane-related expenses, fourth quarter Owned Resort EBITDA grew year-over-year in all of our segments.

The Yucatán segment led the way on Occupancy in the fourth quarter and was able to expand margins by approximately 100 basis points year-over-year on a currency neutral basis despite ongoing inflationary pressure and normalizing ADR growth. Our legacy Dominican Republic resorts continue to be the preeminent leaders in the market, delivering double digit underlying Owned Resort EBITDA growth, adjusted for hurricane-related impacts on the financials, in the fourth quarter.

The high season momentum has carried into 2024, with our pacing remaining steady as we begin the new year driven by strength in MICE groups. For FY 2024, we are anticipating Adjusted EBITDA to be $250-275 million with continued growth in ADR and Occupancy year-over-year but we expect ongoing headwinds from foreign exchange rates as well as higher construction disruption related to our renovation work we began in 2023. With our net leverage at a modest 3x and our expectation of continuing to generate a meaningful amount of free cash flow in 2024, we remain committed to returning cash to shareholders via share repurchases while pursuing growth opportunities within our footprint.”

– Bruce D. Wardinski, Chairman and CEO of Playa Hotels & Resorts

Financial and Operating Results

The following table sets forth information with respect to the operating results of our total portfolio and comparable portfolio for the three months and years ended December 31, 2023 and 2022 ($ in thousands):

Total Portfolio

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Occupancy | 72.9 | % | | 67.4 | % | | 5.5 | pts | | 72.0 | % | | 72.2 | % | | (0.2) | pts |

Net Package ADR (1) | $ | 413.66 | | | $ | 394.77 | | | 4.8 | % | | $ | 430.12 | | | $ | 375.33 | | | 14.6 | % |

| Net Package RevPAR | $ | 301.47 | | | $ | 266.27 | | | 13.2 | % | | $ | 309.50 | | | $ | 270.83 | | | 14.3 | % |

Total Net Revenue (2) | $ | 227,147 | | | $ | 202,581 | | | 12.1 | % | | $ | 934,444 | | | $ | 826,241 | | | 13.1 | % |

Owned Net Revenue (3) | $ | 223,869 | | | $ | 201,065 | | | 11.3 | % | | $ | 921,444 | | | $ | 819,661 | | | 12.4 | % |

Owned Resort EBITDA (4) | $ | 73,630 | | | $ | 71,977 | | | 2.3 | % | | $ | 318,928 | | | $ | 289,697 | | | 10.1 | % |

| Owned Resort EBITDA Margin | 32.9 | % | | 35.8 | % | | (2.9) | pts | | 34.6 | % | | 35.3 | % | | (0.7) | pts |

| Other corporate | $ | 15,452 | | | $ | 14,062 | | | 9.9 | % | | $ | 57,653 | | | $ | 52,658 | | | 9.5 | % |

| The Playa Collection Revenue | $ | 1,037 | | | 541 | | | 91.7 | % | | $ | 3,642 | | | 1,752 | | | 107.9 | % |

| Management Fee Revenue | 1,610 | | | $ | 642 | | | 150.8 | % | | 7,030 | | | $ | 3,828 | | | 83.6 | % |

| Adjusted EBITDA | $ | 60,825 | | | $ | 59,098 | | | 2.9 | % | | $ | 271,947 | | | $ | 242,619 | | | 12.1 | % |

| Adjusted EBITDA Margin | 26.8 | % | | 29.2 | % | | (2.4) | pts | | 29.1 | % | | 29.4 | % | | (0.3) | pts |

Comparable Portfolio (5)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Occupancy | 75.6 | % | | 77.7 | % | | (2.1) | pts | | 77.6 | % | | 74.5 | % | | 3.1 | pts |

| Net Package ADR | $ | 418.10 | | | $ | 405.33 | | | 3.2 | % | | $ | 459.81 | | | $ | 415.86 | | | 10.6 | % |

| Net Package RevPAR | $ | 316.25 | | | $ | 315.11 | | | 0.4 | % | | $ | 356.65 | | | $ | 310.02 | | | 15.0 | % |

Total Net Revenue (2) | $ | 169,457 | | | $ | 168,251 | | | 0.7 | % | | $ | 680,744 | | | $ | 595,269 | | | 14.4 | % |

Owned Net Revenue (3) | $ | 166,179 | | | $ | 166,735 | | | (0.3) | % | | $ | 667,744 | | | $ | 588,689 | | | 13.4 | % |

| Owned Resort EBITDA | $ | 54,127 | | | $ | 58,847 | | | (8.0) | % | | $ | 238,850 | | | $ | 212,843 | | | 12.2 | % |

| Owned Resort EBITDA Margin | 32.6 | % | | 35.3 | % | | (2.7) | pts | | 35.8 | % | | 36.2 | % | | (0.4) | pts |

| Other corporate | $ | 15,452 | | | $ | 14,062 | | | 9.9 | % | | $ | 57,653 | | | $ | 52,658 | | | 9.5 | % |

| The Playa Collection Revenue | $ | 1,037 | | | 541 | | | 91.7 | % | | 3,642 | | | 1,752 | | | 107.9 | % |

| Management Fee Revenue | $ | 1,610 | | | $ | 642 | | | 150.8 | % | | $ | 7,030 | | | $ | 3,828 | | | 83.6 | % |

| Adjusted EBITDA | $ | 41,322 | | | $ | 45,968 | | | (10.1) | % | | $ | 191,869 | | | $ | 165,765 | | | 15.7 | % |

| Adjusted EBITDA Margin | 24.4 | % | | 27.3 | % | | (2.9) | pts | | 28.2 | % | | 27.8 | % | | 0.4 | pts |

(1)For the three months and year ended December 31, 2022, Net Package ADR includes $2.3 million and $10.1 million, respectively, of on-property room upgrade revenue that was reclassified from non-package revenue to package revenue to conform with current period presentation.

(2)Total Net Revenue represents revenue from the sale of all-inclusive packages, which include room accommodations, food and beverage services and entertainment activities, net of compulsory tips paid to employees, as well as revenue from other goods, services and amenities not included in the all-inclusive package. Government mandated compulsory tips in the Dominican Republic are not included in this adjustment as they are already excluded from revenue in accordance with U.S. GAAP. A description of how we compute Total Net Revenue and a reconciliation of Total Net Revenue to total revenue can be found in the section “Definitions of Non-U.S. GAAP Measures and Operating Statistics” below. Total Net Revenue also includes all Management Fee Revenue.

(3)Owned Net Revenue excludes Management Fee Revenue, other corporate revenue and The Playa Collection revenue (which is a third-party owned and operated membership program).

(4)Owned Resort EBITDA for the years ended December 31, 2023 and 2022 includes $6.1 million and $7.2 million, respectively, of business interruption insurance proceeds and recoverable expenses due to the impact of Hurricane Fiona in 2022.

(5)For the three months ended December 31, 2023, our comparable portfolio excludes the Jewel Punta Cana, which was sold in December 2023, the Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana, which were closed for a portion of the third and fourth quarters of 2022 for necessary clean up and repair work as a result of Hurricane Fiona. For the year ended December 31, 2023, the comparable portfolio also excludes the Jewel Palm Beach, which was closed for a majority of the first quarter of 2023 as we transitioned the management of the resort to us from a third-party.

Balance Sheet

As of December 31, 2023, the Company held $272.5 million in cash and cash equivalents, with no restricted cash. Total interest-bearing debt was $1,089.0 million, comprised of our Term Loan due 2029. As of December 31, 2023, there was no balance outstanding on our $225.0 million Revolving Credit Facility. Effective April 15, 2023, we entered into two interest rate swaps to mitigate the floating interest rate risk on our Term Loan due 2029, which incurs interest based on SOFR. The interest rate swaps each have a fixed notional amount of $275.0 million and are not for trading purposes. The fixed rates paid by us on the interest rate swaps are 4.05% and 3.71%, and the variable rate received resets monthly to the one-month SOFR rate. The interest rate swaps mature on April 15, 2025 and April 15, 2026, respectively. On December 22, 2023, we entered into the First Amendment to our Second Amended and Restated Credit Agreement (the “First Amendment”) to decrease the interest rate applicable to the Term Loan due 2029 by 0.75% or 1.00% to, at our option, either a base rate plus a margin of either 2.25% to 2.50% or SOFR plus a margin of either 3.25% or 3.50%, in each case, depending on the level of our consolidated net leverage ratio in effect from time to time. All other terms of our Credit Facility remain in effect.

Earnings Call

The Company will host a conference call to discuss its fourth quarter and annual results on Friday, February 23, 2024 at 8:30 a.m. (Eastern Standard Time). The conference call can be accessed by dialing (888) 317-6003 for domestic participants and (412) 317-6061 for international participants. The conference ID number is 4865148. Additionally, interested parties may listen to a taped replay of the entire conference call commencing two hours after the call’s completion on Friday, February 23, 2024. This replay will run through Friday, March 1, 2024. The access number for a taped replay of the conference call is (877) 344-7529 or (412) 317-0088 using the following conference ID number: 6105801. There will also be a webcast of the conference call accessible on the Company’s investor relations website at investors.playaresorts.com.

About the Company

Playa is a leading owner, operator and developer of all-inclusive resorts in prime beachfront locations in popular vacation destinations in Mexico and the Caribbean. As of December 31, 2023, Playa owned and/or managed a total portfolio consisting of 24 resorts (9,027 rooms) located in Mexico, Jamaica, and the Dominican Republic. In Mexico, we own and manage Hyatt Zilara Cancún, Hyatt Ziva Cancún, Wyndham Alltra Cancún, Wyndham Alltra Playa del Carmen, Hilton Playa del Carmen All-Inclusive Resort, Hyatt Ziva Puerto Vallarta, and Hyatt Ziva Los Cabos. In Jamaica, we own and manage Hyatt Zilara Rose Hall, Hyatt Ziva Rose Hall, Hilton Rose Hall Resort & Spa, Jewel Grande Montego Bay Resort & Spa and Jewel Paradise Cove Beach Resort & Spa. In the Dominican Republic, we own and manage the Hilton La Romana All-Inclusive Family Resort, the Hilton La Romana All-Inclusive Adult Resort, Hyatt Zilara Cap Cana, Hyatt Ziva Cap Cana and Jewel Palm Beach. We also manage seven resorts on behalf of third-party owners. Playa’s strategy is to leverage our globally recognized brand partnerships and proprietary in-house direct booking capabilities to capitalize on the growing popularity of the all-inclusive resort model and reach first-time all-inclusive resort consumers in a cost-effective manner. We believe that this strategy should position us to generate attractive returns for our shareholders, build lasting relationships with our guests, and enhance the lives of our associates and the communities in which we operate.

Forward-Looking Statements

This press release contains “forward-looking statements,” as defined by federal securities laws. Forward-looking statements reflect Playa’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” “optimistic,” and the negatives of these words and other similar expressions generally identify forward looking statements. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in Playa’s Annual

Report on Form 10-K, filed with the SEC on February 22, 2024, as such factors may be updated from time to time in Playa’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in Playa’s filings with the SEC. While forward-looking statements reflect Playa’s good faith beliefs, they are not guarantees of future performance. Playa disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this press release, except as required by applicable law. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to Playa (or to third parties making the forward-looking statements). Definitions of Non-U.S. GAAP Measures and Operating Statistics

Occupancy

“Occupancy” represents the total number of rooms sold for a period divided by the total number of rooms available during such period. The total number of rooms available excludes any rooms considered “Out of Order” due to renovation or a temporary problem rendering them inadequate for occupancy for an extended period of time. Occupancy is a useful measure of the utilization of a resort’s total available capacity and can be used to gauge demand at a specific resort or group of properties during a given period. Occupancy levels also enable us to optimize Net Package ADR (as defined below) by increasing or decreasing the stated rate for our all-inclusive packages as demand for a resort increases or decreases.

Net Package Average Daily Rate (“Net Package ADR”)

“Net Package ADR” represents total Net Package Revenue for a period divided by the total number of rooms sold during such period. Net Package ADR trends and patterns provide useful information concerning the pricing environment and the nature of the guest base of our portfolio or comparable portfolio, as applicable. Net Package ADR is a commonly used performance measure in the all-inclusive segment of the lodging industry, and is commonly used to assess the stated rates that guests are willing to pay through various distribution channels.

Net Package Revenue per Available Room (“Net Package RevPAR”)

“Net Package RevPAR” is the product of Net Package ADR and the average daily occupancy percentage. Net Package RevPAR does not reflect the impact of Net Non-package Revenue. Although Net Package RevPAR does not include this additional revenue, it generally is considered the key performance statistic in the all-inclusive segment of the lodging industry to identify trend information with respect to net room revenue produced by our portfolio or comparable portfolio, as applicable, and to evaluate operating performance on a consolidated basis or a regional basis, as applicable.

Net Package Revenue, Net Non-package Revenue, Owned Net Revenue, Management Fee Revenue, Cost Reimbursements and Total Net Revenue

“Net Package Revenue” is derived from the sale of all-inclusive packages, which include room accommodations and premium room upgrades, food and beverage services, and entertainment activities, net of compulsory tips paid to employees. Government mandated compulsory tips in the Dominican Republic are not included in this adjustment, as they are already excluded from revenue. Revenue is recognized, net of discounts and rebates, when the rooms are occupied and/or the relevant services have been rendered. Advance deposits received from guests are deferred and included in trade and other payables until the rooms are occupied and/or the relevant services have been rendered, at which point the revenue is recognized.

“Net Non-package Revenue” includes revenue associated with premium services and amenities that are not included in net package revenue, such as dining experiences, wines and spirits, and spa packages, net of compulsory tips paid to employees. Government mandated compulsory tips in the Dominican Republic are not included in this adjustment, as they are already excluded from revenue. Net Non-package Revenue is recognized after the completion of the sale when the product or service is transferred to the customer. Food and beverage revenue not included in a guest's all-inclusive package is recognized when the goods are consumed.

“Owned Net Revenue” represents Net Package Revenue and Net Non-Package Revenue. Owned Net Revenue represents a key indicator to assess the overall performance of our business and analyze trends, such as consumer demand, brand preference and competition. In analyzing our Owned Net Revenues, our management differentiates between Net Package Revenue and Net Non-package Revenue. Guests at our resorts purchase packages at stated rates, which include room accommodations, food and beverage services and entertainment activities, in contrast to other lodging business models, which typically only include the room accommodations in the stated rate. The amenities at all-inclusive resorts typically include a variety of buffet and á la carte restaurants, bars, activities, and shows and entertainment throughout the day.

“Management Fee Revenue” is derived from fees earned for managing resorts owned by third-parties. The fees earned are typically composed of a base fee, which is computed as a percentage of resort revenue, and an incentive fee, which is computed as a percentage of resort profitability. Management Fee Revenue was a minor contributor to our operating results for the three months and years ended December 31, 2023 and 2022, but we expect Management Fee Revenue to be a more relevant indicator to assess the overall performance of our business in the future to the extent we are successful in entering into more management contracts.

“Total Net Revenue” represents Net Package Revenue, Net Non-package Revenue, Management Fee Revenue, The Playa Collection revenue and certain Other revenues. “Cost Reimbursements” is excluded from Total Net Revenue as it is not considered a key indicator of financial and operating performance. Cost reimbursements is derived from the reimbursement of certain costs incurred by Playa on behalf of resorts managed by Playa and owned by third parties. This revenue is fully offset by reimbursable costs and has no net impact on operating income or net income. Contract termination fees, which are recorded as Other revenues, are also excluded from Total Net Revenue as they are not an indicator of the performance of our ongoing business.

The following table shows a reconciliation of Total Net Revenue, Net Package Revenue, Net Non-Package Revenue, Management Fee Revenue and Total Net Revenue to total revenue for the three months and years ended December 31, 2023 and 2022 ($ in thousands):

Total Portfolio

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net Package Revenue | | | | | | | |

| Comparable Net Package Revenue | $ | 144,895 | | | $ | 144,371 | | | $ | 583,198 | | | $ | 506,947 | |

| Non-comparable Net Package Revenue | 49,514 | | | 30,143 | | | 218,309 | | | 197,283 | |

| Net Package Revenue | 194,409 | | | 174,514 | | | 801,507 | | | 704,230 | |

| | | | | | | |

| Net Non-package Revenue | | | | | | | |

| Comparable Net Non-package Revenue | 21,284 | | | 22,364 | | | 84,546 | | | 81,742 | |

| Non-comparable Net Non-package Revenue | 8,176 | | | 4,187 | | | 35,391 | | | 33,689 | |

| Net Non-package Revenue | 29,460 | | | 26,551 | | | 119,937 | | | 115,431 | |

| | | | | | | |

| The Playa Collection Revenue | 1,037 | | | 541 | | | 3,642 | | | 1,752 | |

| Management Fee Revenue | 1,610 | | | 642 | | | 7,030 | | | 3,828 | |

| Other Revenues | 631 | | | 333 | | | 2,328 | | | 1,000 | |

| | | | | | | |

| Total Net Revenue | | | | | | | |

| Comparable Total Net Revenue | 169,457 | | | 168,251 | | | 680,744 | | | 595,269 | |

| Non-comparable Total Net Revenue | 57,690 | | | 34,330 | | | 253,700 | | | 230,972 | |

| Total Net Revenue | 227,147 | | | 202,581 | | | 934,444 | | | 826,241 | |

| Compulsory tips | 5,737 | | | 5,381 | | | 24,100 | | | 20,316 | |

| Cost Reimbursements | 3,148 | | | 2,838 | | | 12,475 | | | 9,706 | |

| Contract termination fees | 6,485 | | | — | | 6,485 | | — |

| Total revenue | $ | 242,517 | | | $ | 210,800 | | | $ | 977,504 | | | $ | 856,263 | |

For the three months ended December 31, 2023, our comparable portfolio excludes the Jewel Punta Cana, which was sold in December 2023, the Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana, which were closed for a portion of the third and fourth quarters of 2022 for necessary clean up and repair work as a result of Hurricane Fiona. For the year ended December 31, 2023, the comparable portfolio also excludes the Jewel Palm Beach, which was closed for a majority of the first quarter of 2023 as we transitioned the management of the resort to us from a third-party.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Owned Resort EBITDA and Owned Resort EBITDA Margin

We define EBITDA, a non-U.S. GAAP financial measure, as net income or loss, determined in accordance with U.S. GAAP, for the period presented, before interest expense, income tax and depreciation and amortization expense. EBITDA and Adjusted EBITDA include corporate expenses, which are overhead costs that are essential to support the operation of the Company, including the operations and development of our resorts. We define Adjusted EBITDA, a non-U.S. GAAP financial measure, as EBITDA further adjusted to exclude the following items:

▪Other miscellaneous non-operating income or expense

▪Pre-opening expense

▪Losses or gains on sales of assets

▪Share-based compensation

▪Other tax expense

▪Transaction expenses

▪Severance expense for employee terminations resulting from non-recurring or unusual events, such as the departure of an executive officer or the disposition of a resort

▪Gains from property damage insurance proceeds (i.e., property damage insurance proceeds in excess of repair and clean up costs incurred)

▪Repairs from hurricanes and tropical storms (i.e., significant repair and clean up costs incurred which are not offset by property damage insurance proceeds)

▪Loss on extinguishment of debt

▪Other items which may include, but are not limited to the following: contract termination fees; gains or losses from legal settlements; and impairment losses.

We include the non-service cost components of net periodic pension cost or benefit recorded within other income or expense in the Consolidated Statements of Operations in our calculation of Adjusted EBITDA as they are considered part of our ongoing resort operations.

“Adjusted EBITDA Margin” represents Adjusted EBITDA as a percentage of Total Net Revenue.

“Owned Resort EBITDA” represents Adjusted EBITDA before corporate expenses and Management Fee Revenue.

“Owned Resort EBITDA Margin” represents Owned Resort EBITDA as a percentage of Owned Net Revenue.

Adjusted Net Income

“Adjusted Net Income” is a non-GAAP performance measure. We define Adjusted Net Income as net income attributable to Playa Hotels & Resorts, determined in accordance with U.S. GAAP, excluding special items which are not reflective of our core operating performance, such as one-time expenses related to debt extinguishment and transaction expenses.

Adjusted Net Income is not a substitute for net income or any other measure determined in accordance with U.S. GAAP. There are limitations to the utility of non-U.S. GAAP financial measures, such as Adjusted Net Income. For example, other companies in our industry may define Adjusted Net Income differently than we do. As a result, it may be difficult to use Adjusted Net Income or similarly named non-U.S. GAAP financial measures that other companies publish to compare the performance of those companies to our performance. Because of these and other limitations, Adjusted Net Income should not be considered as a measure of the income or loss generated by our

business or discretionary cash available for investment in our business, and investors should carefully consider our U.S. GAAP results presented in this release.

Usefulness and Limitation of Non-U.S. GAAP Measures

We believe that each of Net Package Revenue, Net Non-package Revenue, Owned Net Revenue, Total Net Revenue, Net Package ADR and Net Package RevPAR are all useful to investors as they more accurately reflect our operating results by excluding compulsory tips. These tips have a margin of zero and do not represent our operating results.

We also believe that Adjusted EBITDA is useful to investors for two principal reasons. First, we believe Adjusted EBITDA assists investors in comparing our performance over various reporting periods on a consistent basis by removing from our operating results the impact of items that do not reflect our core operating performance. For example, changes in foreign exchange rates (which are the principal driver of changes in other income or expense), and expenses related to capital raising, strategic initiatives and other corporate initiatives, such as expansion into new markets (which are the principal drivers of changes in transaction expenses), are not indicative of the operating performance of our resorts. The other adjustments included in our definition of Adjusted EBITDA relate to items that occur infrequently and therefore would obstruct the comparability of our operating results over reporting periods. For example, revenue from insurance policies, other than business interruption insurance policies, is infrequent in nature, and we believe excluding these expense and revenue items permits investors to better evaluate the core operating performance of our resorts over time. We believe Adjusted EBITDA Margin provides our investors a useful measurement of operating profitability for the same reasons we find Adjusted EBITDA useful.

The second principal reason that we believe Adjusted EBITDA is useful to investors is that it is considered a key performance indicator by our board of directors (our “Board”) and management. In addition, the compensation committee of our Board determines a portion of the annual variable compensation for certain members of our management, including our executive officers, based, in part, on consolidated Adjusted EBITDA. We believe that Adjusted EBITDA is useful to investors because it provides investors with information utilized by our Board and management to assess our performance and may (subject to the limitations described below) enable investors to compare the performance of our portfolio to our competitors.

We believe that Owned Resort EBITDA and Owned Resort EBITDA Margin are useful to investors as they allow investors to measure resort-level performance and profitability by excluding expenses not directly tied to our resorts, such as corporate expenses, and excluding ancillary revenues not derived from our resorts, such as management fee revenue. We believe Owned Resort EBITDA is also helpful to investors that use it in estimating the value of our resort portfolio. Management uses these measures to monitor property-level performance and profitability.

A reconciliation of EBITDA, Adjusted EBITDA and Owned Resort EBITDA to net income or loss as computed under U.S. GAAP is presented below.

Adjusted Net Income is non-GAAP performance measure that provides meaningful comparisons of ongoing operating results by removing from net income or loss the impact of items that do not reflect our normalized operations. A reconciliation of net income or loss as computed under U.S. GAAP to Adjusted Net Income is presented below.

Our non-U.S. GAAP financial measures are not substitutes for revenue, net income or any other measure determined in accordance with U.S. GAAP. There are limitations to the utility of non-U.S. GAAP financial measures, such as Adjusted EBITDA. For example, other companies in our industry may define Adjusted EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA or similarly named non-U.S. GAAP financial measures that other companies publish to compare the performance of those companies to our performance. Because of these limitations, our non-U.S. GAAP financial measures should not be considered as a measure of the income or loss generated by our business or discretionary cash available for investment in our business, and investors should carefully consider our U.S. GAAP results presented.

Comparable Non-U.S. GAAP Measures

We believe that presenting Adjusted EBITDA, Owned Resort EBITDA, Total Net Revenue, Net Package Revenue, and Net Non-package Revenue on a comparable basis is useful to investors because these measures include only the results of resorts owned and in operation for the entirety of the periods presented and thereby eliminate disparities in results due to the acquisition or disposition of resorts or the impact of resort closures or re-openings in connection with redevelopment or renovation projects. As a result, we believe these measures provide more consistent metrics for comparing the performance of our operating resorts. We calculate Comparable Adjusted EBITDA, Comparable Owned Resort EBITDA, Comparable Total Net Revenue, Comparable Net Package Revenue and Comparable Net Non-package Revenue as the total amount of each respective measure less amounts attributable to non-comparable resorts, by which we mean resorts that were not owned or in operation during some or all of the relevant reporting period.

For the three months ended December 31, 2023, our comparable portfolio excludes the Jewel Punta Cana, which was sold in December 2023, the Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana, which were closed for a portion of the third and fourth quarters of 2022 for necessary clean up and repair work as a result of Hurricane Fiona. For the year ended December 31, 2023, the comparable portfolio also excludes the Jewel Palm Beach, which was closed for a majority of the first quarter of 2023 as we transitioned the management of the resort to us from a third-party.

A reconciliation of net income or loss as computed under U.S. GAAP to comparable Adjusted EBITDA is presented below. For a reconciliation of Comparable Net Package Revenue, Comparable Net Non-package Revenue, Comparable Management Fee Revenue and Comparable Total Net Revenue to total revenue as computed under U.S. GAAP, see “Net Package Revenue, Net Non-package Revenue, Owned Net Revenue, Management Fee Revenue, Cost Reimbursements and Total Net Revenue” in this section.

Playa Hotels & Resorts N.V.

Reconciliation of Net Income to EBITDA, Adjusted EBITDA and Owned Resort EBITDA

($ in thousands)

The following is a reconciliation of our U.S. GAAP net income to EBITDA, Adjusted EBITDA and Owned Resort EBITDA for the three months and years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 1,004 | | | $ | (14,337) | | | $ | 53,852 | | | $ | 56,706 | |

| Interest expense | 25,847 | | | 24,272 | | | 108,184 | | | 64,164 | |

| Income tax provision (benefit) | 6,874 | | | (8,721) | | | 11,714 | | | (5,553) | |

| Depreciation and amortization | 20,772 | | | 19,742 | | | 81,827 | | | 78,372 | |

| EBITDA | $ | 54,497 | | | $ | 20,956 | | | $ | 255,577 | | | $ | 193,689 | |

Other expense (income) (a) | 32 | | | 3,993 | | | 353 | | | (3,857) | |

| Share-based compensation | 3,256 | | | 2,849 | | | 13,207 | | | 11,892 | |

Transaction expense (b) | 2,598 | | | 13,726 | | | 4,705 | | | 15,110 | |

Severance expense (c) | 1,655 | | | — | | | 1,655 | | | — | |

Other tax (income) expense (d) | (34) | | | 502 | | | (34) | | | 502 | |

| Contract termination fees | (6,485) | | | — | | | (6,485) | | | — | |

| Loss on extinguishment of debt | 894 | | | 18,307 | | | 894 | | | 18,307 | |

| | | | | | | |

Repairs from hurricanes and tropical storms (e) | (8) | | | (776) | | | (823) | | | 8,074 | |

| Loss (gain) on sale of assets | 5,052 | | | (5) | | | 5,069 | | | 6 | |

| Non-service cost components of net periodic pension cost | (632) | | | (454) | | | (2,171) | | | (1,104) | |

| Adjusted EBITDA | 60,825 | | | 59,098 | | | 271,947 | | | 242,619 | |

Other corporate (f)(g) | 15,452 | | | 14,062 | | | 57,653 | | | 52,658 | |

| The Playa Collection Revenue | (1,037) | | | (541) | | | (3,642) | | | (1,752) | |

| Management Fee Revenue | (1,610) | | | (642) | | | (7,030) | | | (3,828) | |

Owned Resort EBITDA(h) | 73,630 | | | 71,977 | | | 318,928 | | | 289,697 | |

Less: Non-comparable Owned Resort EBITDA (i) | 19,503 | | | 13,130 | | | 80,078 | | | 76,854 | |

| Comparable Owned Resort EBITDA | $ | 54,127 | | | $ | 58,847 | | | $ | 238,850 | | | $ | 212,843 | |

(a) Represents changes in foreign exchange rates and other miscellaneous non-operating expenses or income.

(b) Represents expenses incurred in connection with corporate initiatives, such as: system implementations; debt refinancing costs; other capital raising efforts; and strategic initiatives, like the launch of a new resort or possible expansion into new markets. For the three months and year ended December 31, 2022, our transaction expenses included $12.9 million of costs specifically related to our debt refinancing in December 2022.

(c) Includes severance expenses for employee terminations resulting from non-recurring or unusual events, such as the departure of an executive officer or the disposition of a resort. It does not include severance expenses for employee terminations resulting from our ongoing resort operations. For the year ended December 31, 2023, represents severance expenses for terminated employees related to the sale of the Jewel Punta Cana.

(d) Relates primarily to a Dominican Republic asset tax, which is an alternative tax that is similar to income tax in the Dominican Republic. We eliminate this expense from Adjusted EBITDA because it is similar to the income tax provision or benefit we eliminate from our calculation of EBITDA.

(e) Includes significant repair and clean-up expenses incurred from natural events which are not expected to be offset by property damage insurance proceeds. It does not include repair and clean-up costs from natural events that are not considered significant. For the three months and year ended December 31, 2023, represents changes in the expected repair and clean-up expenses for the Jewel Punta Cana related to the impact of Hurricane Fiona.

(f) For the three months ended December 31, 2023 and 2022, represents corporate salaries and benefits of $10.1 million for 2023 and $9.2 million for 2022, professional fees of $3.5 million for 2023 and $2.8 million for 2022, corporate rent and insurance of $1.0 million for 2023 and $0.9 million for 2022, and corporate travel, software licenses, board fees and other miscellaneous corporate expenses of $0.9 million for 2023 and $1.1 million for 2022.

(g) For the years ended December 31, 2023 and 2022, represents corporate salaries and benefits of $40.1 million for 2023 and $35.9 million for 2022, professional fees of $9.7 million for 2023 and $9.1 million for 2022, corporate rent and insurance of $3.9 million for 2023 and $3.9 million for 2022, and corporate travel, software licenses, board fees and other miscellaneous corporate expenses of $4.0 million for 2023 and $3.8 million for 2022.

(h) Owned Resort EBITDA for the three months ended December 31, 2023 and 2022 includes $0.9 million and $7.2 million, respectively, and for the years ended December 31, 2023 and 2022 includes $6.1 million and $7.2 million, respectively, of business interruption insurance proceeds and recoverable expenses due to the impact of Hurricane Fiona in 2022.

(i) For the three months ended December 31, 2023, our comparable portfolio excludes the Jewel Punta Cana, which was sold in December 2023, the Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana, which were closed for a portion of the third and fourth quarters of 2022 for necessary clean up and repair work as a result of Hurricane Fiona. For the year ended December 31, 2023, the comparable portfolio also excludes the Jewel Palm Beach, which was closed for a majority of the first quarter of 2023 as we transitioned the management of the resort to us from a third-party.

Playa Hotels & Resorts N.V.

Reconciliation of Net Income to Adjusted Net Income

($ in thousands)

The following table reconciles our U.S. GAAP net income to Adjusted Net Income for the three months and years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 1,004 | | | $ | (14,337) | | | $ | 53,852 | | | $ | 56,706 | |

| Reconciling items | | | | | | | |

| Transaction expense | 2,598 | | | 13,726 | | | 4,705 | | | 15,110 | |

| Loss on extinguishment of debt | 894 | | | 18,307 | | | 894 | | | 18,307 | |

Change in fair value of interest rate swaps (a) | — | | | 4,490 | | | 6,335 | | | (14,187) | |

| Repairs from hurricanes and tropical storms | (8) | | | (776) | | | (823) | | | 8,074 | |

| Severance expense | 1,655 | | | — | | | 1,655 | | | — | |

| Total reconciling items before tax | 5,139 | | | 35,747 | | | 12,766 | | | 27,304 | |

| Income tax provision for reconciling items | (95) | | | (825) | | | (283) | | | (825) | |

| Total reconciling items after tax | 5,044 | | | 34,922 | | | 12,483 | | | 26,479 | |

Adjusted Net Income | $ | 6,048 | | | $ | 20,585 | | | $ | 66,335 | | | $ | 83,185 | |

(a) Represents the change in fair value, excluding interest paid and accrued, of our prior LIBOR-based interest rate swaps recognized as interest expense in our Consolidated Statements of Operations.

The following table presents the impact of Adjusted Net Income on diluted earnings (loss) per share for the three months and years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Adjusted Net Income | | $ | 6,048 | | | $ | 20,585 | | | $ | 66,335 | | | $ | 83,185 | |

| | | | | | | | |

| Earnings (loss) per share - Diluted | | $ | 0.01 | | | $ | (0.09) | | | $ | 0.36 | | | $ | 0.34 | |

| Total reconciling items impact per diluted share | | 0.03 | | | 0.22 | | | 0.08 | | | 0.16 | |

| Adjusted earnings per share - Diluted | | $ | 0.04 | | | $ | 0.13 | | | $ | 0.44 | | | $ | 0.50 | |

Playa Hotels & Resorts N.V.

Consolidated Balance Sheets

($ in thousands, except share data)

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 272,520 | | | $ | 283,945 | |

| Trade and other receivables, net | 74,762 | | | 62,946 | |

| Insurance recoverable | 9,821 | | | 34,191 | |

| Accounts receivable from related parties | 5,861 | | | 8,806 | |

| Inventories | 19,963 | | | 20,046 | |

| Prepayments and other assets | 54,294 | | | 44,177 | |

| Property and equipment, net | 1,415,572 | | | 1,536,567 | |

| Derivative financial instruments | 2,966 | | | 3,510 | |

| Goodwill, net | 60,642 | | | 61,654 | |

| Other intangible assets | 4,357 | | | 6,556 | |

| Deferred tax assets | 12,967 | | | 7,422 | |

| Total assets | $ | 1,933,725 | | | $ | 2,069,820 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Trade and other payables | $ | 196,432 | | | $ | 231,652 | |

| Payables to related parties | 10,743 | | | 6,852 | |

| Income tax payable | 11,592 | | | 990 | |

| Debt | 1,061,376 | | | 1,065,453 | |

| Other liabilities | 33,970 | | | 30,685 | |

| Deferred tax liabilities | 64,815 | | | 69,326 | |

| Total liabilities | 1,378,928 | | | 1,404,958 | |

| Commitments and contingencies | | | |

| Shareholders' equity | | | |

| Ordinary shares (par value €0.10; 500,000,000 shares authorized, 169,423,980 shares issued and 136,081,891 shares outstanding as of December 31, 2023, and 168,275,504 shares issued and 158,228,508 shares outstanding as of December 31, 2022) | 18,822 | | | 18,700 | |

| Treasury shares (at cost, 33,342,089 shares as of December 31, 2023 and 10,046,996 shares as of December 31, 2022) | (248,174) | | | (62,953) | |

| Paid-in capital | 1,202,175 | | | 1,189,090 | |

| Accumulated other comprehensive income (loss) | 1,112 | | | (6,985) | |

| Accumulated deficit | (419,138) | | | (472,990) | |

| Total shareholders' equity | 554,797 | | | 664,862 | |

| Total liabilities and shareholders' equity | $ | 1,933,725 | | | $ | 2,069,820 | |

Playa Hotels & Resorts N.V.

Consolidated Statements of Operations

($ in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Package | $ | 199,773 | | | $ | 179,637 | | | $ | 824,122 | | | $ | 723,375 | |

| Non-package | 29,833 | | | 26,809 | | | 121,422 | | | 116,602 | |

| The Playa Collection | 1,037 | | | 541 | | | 3,642 | | | 1,752 | |

| Management fees | 1,610 | | | 642 | | | 7,030 | | | 3,828 | |

| Cost reimbursements | 3,148 | | | 2,838 | | | 12,475 | | | 9,706 | |

| Other revenues | 7,116 | | | 333 | | | 8,813 | | | 1,000 | |

| Total revenue | 242,517 | | | 210,800 | | | 977,504 | | | 856,263 | |

| Direct and selling, general and administrative expenses | | | | | | | |

| Direct | 128,519 | | | 115,732 | | | 516,449 | | | 459,030 | |

| Selling, general and administrative | 51,255 | | | 56,205 | | | 192,822 | | | 186,608 | |

| Depreciation and amortization | 20,772 | | | 19,742 | | | 81,827 | | | 78,372 | |

| Reimbursed costs | 3,148 | | | 2,838 | | | 12,475 | | | 9,706 | |

| Loss (gain) on sale of assets | 5,052 | | | (5) | | | 5,069 | | | 6 | |

| Gain on insurance proceeds | (867) | | | — | | | (5,580) | | | — | |

| Business interruption insurance recoveries | (13) | | | (7,226) | | | (555) | | | (7,226) | |

| Direct and selling, general and administrative expenses | 207,866 | | | 187,286 | | | 802,507 | | | 726,496 | |

| Operating income | 34,651 | | | 23,514 | | | 174,997 | | | 129,767 | |

| Interest expense | (25,847) | | | (24,272) | | | (108,184) | | | (64,164) | |

| Loss on extinguishment of debt | (894) | | | (18,307) | | | (894) | | | (18,307) | |

| Other (expense) income | (32) | | | (3,993) | | | (353) | | | 3,857 | |

| Net income (loss) before tax | 7,878 | | | (23,058) | | | 65,566 | | | 51,153 | |

| Income tax (provision) benefit | (6,874) | | | 8,721 | | | (11,714) | | | 5,553 | |

| Net income (loss) | $ | 1,004 | | | $ | (14,337) | | | $ | 53,852 | | | $ | 56,706 | |

| | | | | | | |

| Earnings (loss) per share | | | | | | | |

| Basic | $ | 0.01 | | | $ | (0.09) | | | $ | 0.36 | | | $ | 0.34 | |

| Diluted | $ | 0.01 | | | $ | (0.09) | | | $ | 0.36 | | | $ | 0.34 | |

| Weighted average number of shares outstanding during the period - Basic | 137,757,679 | | | 161,546,492 | | | 148,063,358 | | | 164,782,886 | |

| Weighted average number of shares outstanding during the period - Diluted | 140,477,293 | | | 161,546,492 | | | 150,309,674 | | | 166,077,802 | |

Playa Hotels & Resorts N.V.

Consolidated Debt Summary - As of December 31, 2023

($ in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maturity | | | | Applicable

Rate | | LTM Cash Interest (6) |

| Debt | | Date | | # of Years | | Balance | | |

Revolving Credit Facility (1) | | Jan-28 | | 4.0 | | $ | — | | | — | % | | $ | 1.0 | |

Term Loan (2)(3) | | Jan-29 | | 5.0 | | 1,089.0 | | | 8.59 | % | | 96.2 | |

Total debt (4) | | | | | | $ | 1,089.0 | | | 8.59 | % | | $ | 97.2 | |

Less: cash and cash equivalents (5) | | | | | | (272.5) | | | | | |

| Net debt | | | | | | $ | 816.5 | | | | | |

(1)Undrawn balances bear interest between 0.25% and 0.50% depending on certain leverage ratios. We had $225.0 million available as of December 31, 2023 and 2022.

(2)Our Term Loan currently incurs interest based on SOFR + 325 bps (where SOFR is subject to a 0.50% floor). The effective interest rate was 8.59% as of December 31, 2023.

(3)Effective April 15, 2023, we entered into two interest rate swaps to mitigate the floating interest rate risk on out Term Loan due 2029. The interest rate swaps each have a fixed notional amount of $275.0 million and are not for trading purposes. The fixed rates paid by us on the interest rate swaps are 4.05% and 3.71%, and the variable rate received resets monthly to the one-month SOFR rate. The interest rate swaps mature on April 15, 2025 and April 15, 2026, respectively.

(4)Excludes $26.5 million of unamortized discounts, $6.4 million of unamortized deferred financing costs, and a $5.2 million financing lease obligation as of December 31, 2023.

(5)Represents cash balances on hand as of December 31, 2023.

(6)Represents last twelve months' cash paid for interest on the outstanding balance of our Term Loan and commitment fees on the unused balance of our Revolving Credit Facility. The impact of amortization of deferred financing costs and discounts, capitalized interest, and the change in fair market value of our prior LIBOR-based interest rate swaps is excluded.

Playa Hotels & Resorts N.V.

Reportable Segment Operating Statistics - Three Months Ended December 31, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Occupancy | | Net Package ADR | | Net Package RevPAR | | Owned Net Revenue | | Owned Resort EBITDA | | Owned Resort EBITDA Margin |

| Total Portfolio | Rooms | | 2023 | 2022 | Pts

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | Pts

Change |

| Yucatán Peninsula | 2,126 | | 83.7 | % | 81.2 | % | 2.5 | pts | | $ | 421.94 | | $ | 420.41 | | 0.4 | % | | $ | 353.24 | | $ | 341.54 | | 3.4 | % | | $ | 77,482 | | $ | 75,961 | | 2.0 | % | | $ | 25,734 | | $ | 28,367 | | (9.3) | % | | 33.2 | % | 37.3 | % | (4.1) | pts |

| Pacific Coast | 926 | | 65.5 | % | 73.4 | % | (7.9) | pts | | 522.20 | | 496.15 | | 5.3 | % | | 341.82 | | 363.93 | | (6.1) | % | | 34,055 | | 35,309 | | (3.6) | % | | 13,156 | | 14,182 | | (7.2) | % | | 38.6 | % | 40.2 | % | (1.6) | pts |

Dominican Republic (1) | 2,529 | | 65.2 | % | 50.1 | % | 15.1 | pts | | 353.15 | | 295.77 | | 19.4 | % | | 230.27 | | 148.31 | | 55.3 | % | | 62,662 | | 41,258 | | 51.9 | % | | 18,577 | | 13,716 | | 35.4 | % | | 29.6 | % | 33.2 | % | (3.6) | pts |

| Jamaica | 1,428 | | 75.2 | % | 75.1 | % | 0.1 | pts | | 431.59 | | 411.63 | | 4.8 | % | | 324.35 | | 309.27 | | 4.9 | % | | 49,670 | | 48,537 | | 2.3 | % | | 16,163 | | 15,712 | | 2.9 | % | | 32.5 | % | 32.4 | % | 0.1 | pts |

| Total Portfolio | 7,009 | | 72.9 | % | 67.4 | % | 5.5 | pts | | $ | 413.66 | | $ | 394.77 | | 4.8 | % | | $ | 301.47 | | $ | 266.27 | | 13.2 | % | | $ | 223,869 | | $ | 201,065 | | 11.3 | % | | $ | 73,630 | | $ | 71,977 | | 2.3 | % | | 32.9 | % | 35.8 | % | (2.9) | pts |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Owned Net Revenue for the three months ended December 31, 2022 includes a $2.1 million adjustment due to a reduction in accrued non-income based taxes and gratuities based on a change in the expected Advanced Pricing Agreements (“APA”) rates for our Dominican Republic entities. Without this adjustment, Owned Net Revenue for the three months ended December 31, 2023 would have increased $23.6 million, or 60.2%, Net Package ADR would have increased $74.98, or 27.0%, Owned Resort EBITDA would have increased $7.0 million, or 60.6%, and Owned Resort EBITDA margin would have been flat compared to the three months ended December 31, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Occupancy | | Net Package ADR | | Net Package RevPAR | | Owned Net Revenue | | Owned Resort EBITDA | | Owned Resort EBITDA Margin |

Comparable Portfolio (1) | Rooms | | 2023 | 2022 | Pts

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | Pts

Change |

| Yucatán Peninsula | 2,126 | | 83.7 | % | 81.2 | % | 2.5 | pts | | $ | 421.94 | | $ | 420.41 | | 0.4 | % | | $ | 353.24 | | $ | 341.54 | | 3.4 | % | | $ | 77,482 | | $ | 75,961 | | 2.0 | % | | $ | 25,734 | | $ | 28,367 | | (9.3) | % | | 33.2 | % | 37.3 | % | (4.1) | pts |

| Pacific Coast | 926 | | 65.5 | % | 73.4 | % | (7.9) | pts | | 522.20 | | 496.15 | | 5.3 | % | | 341.82 | | 363.93 | | (6.1) | % | | 34,055 | | 35,309 | | (3.6) | % | | 13,156 | | 14,182 | | (7.2) | % | | 38.6 | % | 40.2 | % | (1.6) | pts |

| Dominican Republic | 500 | | 61.6 | % | 78.4 | % | (16.8) | pts | | 143.81 | | 164.44 | | (12.5) | % | | 88.53 | | 129.00 | | (31.4) | % | | 4,972 | | 6,928 | | (28.2) | % | | (926) | | 586 | | (258.0) | % | | (18.6) | % | 8.5 | % | (27.1) | pts |

| Jamaica | 1,428 | | 75.2 | % | 75.1 | % | 0.1 | pts | | 431.59 | | 411.63 | | 4.8 | % | | 324.35 | | 309.27 | | 4.9 | % | | 49,670 | | 48,537 | | 2.3 | % | | 16,163 | | 15,712 | | 2.9 | % | | 32.5 | % | 32.4 | % | 0.1 | pts |

| Total Comparable Portfolio | 4,980 | | 75.6 | % | 77.7 | % | (2.1) | pts | | $ | 418.10 | | $ | 405.33 | | 3.2 | % | | $ | 316.25 | | $ | 315.11 | | 0.4 | % | | $ | 166,179 | | $ | 166,735 | | (0.3) | % | | $ | 54,127 | | $ | 58,847 | | (8.0) | % | | 32.6 | % | 35.3 | % | (2.7) | pts |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Comparable portfolio for the three months ended December 31, 2023 excludes the following resorts: Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana, which were closed for a portion of the third and fourth quarters of 2022 for necessary clean up and repair work as a result of Hurricane Fiona, and Jewel Punta Cana, which was sold in December 2023. |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Occupancy | | Net Package ADR | | Net Package RevPAR | | Owned Net Revenue | | Owned Resort EBITDA | | Owned Resort EBITDA Margin |

Excluding DR Jewels (1) | Rooms | | 2023 | 2022 | Pts

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | Pts

Change |

| Yucatán Peninsula | 2,126 | | 83.7 | % | 81.2 | % | 2.5 | pts | | $ | 421.94 | | $ | 420.41 | | 0.4 | % | | $ | 353.24 | | $ | 341.54 | | 3.4 | % | | $ | 77,482 | | $ | 75,961 | | 2.0 | % | | $ | 25,734 | | $ | 28,367 | | (9.3) | % | | 33.2 | % | 37.3 | % | (4.1) | pts |

| Pacific Coast | 926 | | 65.5 | % | 73.4 | % | (7.9) | pts | | 522.20 | | 496.15 | | 5.3 | % | | 341.82 | | 363.93 | | (6.1) | % | | 34,055 | | 35,309 | | (3.6) | % | | 13,156 | | 14,182 | | (7.2) | % | | 38.6 | % | 40.2 | % | (1.6) | pts |

| Dominican Republic | 1,524 | | 71.7 | % | 36.9 | % | 34.8 | pts | | 463.78 | | 494.47 | | (6.2) | % | | 332.32 | | 182.60 | | 82.0 | % | | 54,182 | | 28,778 | | 88.3 | % | | 21,427 | | 12,845 | | 66.8 | % | | 39.5 | % | 44.6 | % | (5.1) | pts |

| Jamaica | 1,428 | | 75.2 | % | 75.1 | % | 0.1 | pts | | 431.59 | | 411.63 | | 4.8 | % | | 324.35 | | 309.27 | | 4.9 | % | | 49,670 | | 48,537 | | 2.3 | % | | 16,163 | | 15,712 | | 2.9 | % | | 32.5 | % | 32.4 | % | 0.1 | pts |

| Total Portfolio Excluding DR Jewels | 6,004 | | 75.8 | % | 67.3 | % | 8.5 | pts | | $ | 447.61 | | $ | 441.12 | | 1.5 | % | | $ | 339.30 | | $ | 296.97 | | 14.3 | % | | $ | 215,389 | | $ | 188,585 | | 14.2 | % | | $ | 76,480 | | $ | 71,106 | | 7.6 | % | | 35.5 | % | 37.7 | % | (2.2) | pts |

(1) Portfolio for the three months ended December 31, 2023 excludes the following resorts: Jewel Punta Cana, which was sold in December 2023, and Jewel Palm Beach. |

Yucatán Peninsula

•Owned Net Revenue for the three months ended December 31, 2023 increased $1.5 million, or 2.0%, compared to the three months ended December 31, 2022. The increase was driven by:

•an increase in Occupancy of 2.5 percentage points compared to the three months ended December 31, 2022;

•an increase in Net Package ADR of 0.4%; partially offset by

•a decrease in Net Non-package Revenue of $0.8 million.

•Net Non-package Revenue per sold room decreased 11.1%, partially as a result of a lower meetings, incentives, conventions and events (“MICE”) group contribution to our guest mix.

•Owned Resort EBITDA for the three months ended December 31, 2023 decreased $2.6 million, or 9.3%, compared to the three months ended December 31, 2022. The decrease was driven by:

•an unfavorable impact of $4.0 million due to the appreciation of the Mexican Peso;

•an increase in labor and related expenses, which were partially due to union-negotiated and government-mandated wage benefit increases; and

•an increase in insurance premiums.

•Owned Resort EBITDA Margin for the three months ended December 31, 2023 was 33.2%, a decrease of 4.1 percentage points compared to the three months ended December 31, 2022. Owned Resort EBITDA Margin was negatively impacted by 510 basis points due to the appreciation of the Mexican Peso and by 30 basis points due to increases in labor and related expenses, excluding the aforementioned impact due to the change in exchange rates. Excluding the impact from the appreciation of the Mexican Peso, Owned Resort EBITDA Margin would have been 38.3%, an increase of 1.0 percentage point compared to the three months ended December 31, 2022.

Pacific Coast

•Owned Net Revenue for the three months ended December 31, 2023 decreased $1.3 million, or 3.6%, compared to the three months ended December 31, 2022. The decrease was driven by:

•a decrease in Occupancy of 7.9 percentage points for the three months ended December 31, 2023 due to renovations at the two resorts in this segment; partially offset by:

•an increase in Net Package ADR of 5.3%; and

•an increase in Net Non-package Revenue of $0.6 million.

•Net Non-package Revenue per sold room increased 28.4%, primarily driven by an increase in cancellation revenue as a result of Hurricane Norma and Hurricane Lidia in the Pacific during the three months ended December 31, 2023.

•Owned Resort EBITDA for the three months ended December 31, 2023 decreased $1.0 million, or 7.2%, compared to the three months ended December 31, 2022 and was driven by:

•an unfavorable impact of $1.5 million due to the appreciation of the Mexican Peso;

•an increase in labor and related expenses, which were partially due to union-negotiated and government-mandated wage and benefit increases; and

•an increase in insurance premiums and energy costs.

•Owned Resort EBITDA Margin for the three months ended December 31, 2023 was 38.6%, a decrease of 1.6 percentage points compared to the three months ended December 31, 2022. Owned Resort EBITDA Margin was negatively impacted by 450 basis points due to the appreciation of the Mexican Peso. Excluding the impact from the appreciation of the Mexican Peso, Owned Resort EBITDA Margin would have been 43.1%, an increase of 2.9 percentage points compared to the three months ended December 31, 2022.

Dominican Republic excluding Jewel Punta Cana and Jewel Palm Beach

•Owned Net Revenue for the three months ended December 31, 2023 increased $25.4 million, or 88.3%, compared to the three months ended December 31, 2022. The comparability of the segment for the three months ended December 31, 2023 was heavily impacted by the temporary closure of Hilton La Romana All-Inclusive Resort and

Hyatt Ziva and Hyatt Zilara Cap Cana for a portion of the fourth quarter of 2022 to expedite necessary clean up and repair work as a result of Hurricane Fiona. The increase was driven by:

•an increase in Occupancy of 34.8 percentage points; and

•an increase in Net Non-package Revenue of $4.4 million, or 138.8%.

•Net Non-package Revenue per sold room increased 23.1%, as a result of a higher MICE group contribution to our guest mix.; partially offset by:

•a decrease in Net Package ADR of 6.2%.

•Owned Resort EBITDA for the three months ended December 31, 2023 increased $8.6 million, or 66.8%, compared to the three months ended December 31, 2022. As previously mentioned, results were heavily impacted by the temporary closure of Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana in 2022.

•Owned Resort EBITDA Margin for the three months ended December 31, 2023 was 39.5%, a decrease of 5.1 percentage points compared to the three months ended December 31, 2022.

•Owned Resort EBITDA and Owned Resort EBITDA Margin for the three months ended December 31, 2023 and 2022 include $0.9 million and $7.2 million, respectively, from business interruption proceeds and recoverable expenses related to Hurricane Fiona that impacted the Dominican Republic in the second half of 2022. Excluding these benefits, Owned Resort EBITDA increased $14.9 million, or 265.7%, compared to the three months ended December 31, 2022, and Owned Resort EBITDA Margin was 37.9%, an increase of 18.4 percentage points compared to the three months ended December 31, 2022.

Jamaica

•Owned Net Revenue for the three months ended December 31, 2023 increased $1.1 million, or 2.3%, compared to the three months ended December 31, 2022 and was driven by:

•an increase in Occupancy of 0.1 percentage points; and

•an increase in Net Package ADR of 4.8%; partially offset by

•a decrease in Net Non-package Revenue of $0.8 million.

•Net Non-package Revenue per sold room decreased 10.7% as a result of a lower MICE group contribution to our guest mix.

•Owned Resort EBITDA for the three months ended December 31, 2023 increased $0.5 million, or 2.9%, compared to the three months ended December 31, 2022. The increase was a result of Net Package ADR growth, partially offset by increases in insurance premiums compared to the three months ended December 31, 2022.

•Owned Resort EBITDA Margin for the three months ended December 31, 2023 increased 0.1 percentage points compared to the three months ended December 31, 2022.

Playa Hotels & Resorts N.V.

Reportable Segment Operating Statistics - Years Ended December 31, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Occupancy | | Net Package ADR | | Net Package RevPAR | | Owned Net Revenue | | Owned Resort EBITDA | | Owned Resort EBITDA Margin |

| Total Portfolio | Rooms | | 2023 | 2022 | Pts

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | Pts

Change |

| Yucatán Peninsula | 2,126 | | 79.5 | % | 76.3 | % | 3.2 | pts | | $ | 440.13 | | $ | 413.49 | | 6.4 | % | | $ | 349.99 | | $ | 315.53 | | 10.9 | % | | $ | 306,259 | | $ | 280,161 | | 9.3 | % | | $ | 104,841 | | $ | 105,416 | | (0.5) | % | | 34.2 | % | 37.6 | % | (3.4) | pts |

| Pacific Coast | 926 | | 70.2 | % | 71.9 | % | (1.7) | pts | | 522.94 | | 464.66 | | 12.5 | % | | 367.23 | | 334.20 | | 9.9 | % | | 141,582 | | 128,210 | | 10.4 | % | | 53,509 | | 51,148 | | 4.6 | % | | 37.8 | % | 39.9 | % | (2.1) | pts |

Dominican Republic (1) | 2,615 | | 62.3 | % | 68.1 | % | (5.8) | pts | | 366.83 | | 300.15 | | 22.2 | % | | 228.71 | | 204.43 | | 11.9 | % | | 253,700 | | 230,972 | | 9.8 | % | | 80,078 | | 76,854 | | 4.2 | % | | 31.6 | % | 33.3 | % | (1.7) | pts |

| Jamaica | 1,428 | | 79.4 | % | 73.6 | % | 5.8 | pts | | 452.96 | | 388.61 | | 16.6 | % | | 359.71 | | 286.14 | | 25.7 | % | | 219,903 | | 180,318 | | 22.0 | % | | 80,500 | | 56,279 | | 43.0 | % | | 36.6 | % | 31.2 | % | 5.4 | pts |

| Total Portfolio | 7,095 | | 72.0 | % | 72.2 | % | (0.2) | pts | | $ | 430.12 | | $ | 375.33 | | 14.6 | % | | $ | 309.50 | | $ | 270.83 | | 14.3 | % | | $ | 921,444 | | $ | 819,661 | | 12.4 | % | | $ | 318,928 | | $ | 289,697 | | 10.1 | % | | 34.6 | % | 35.3 | % | (0.7) | pts |

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Occupancy | | Net Package ADR | | Net Package RevPAR | | Owned Net Revenue | | Owned Resort EBITDA | | Owned Resort EBITDA Margin |

Comparable Portfolio (1) | Rooms | | 2023 | 2022 | Pts

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | Pts

Change |

| Yucatán Peninsula | 2,126 | | 79.5 | % | 76.3 | % | 3.2 | pts | | $ | 440.13 | | $ | 413.49 | | 6.4 | % | | $ | 349.99 | | $ | 315.53 | | 10.9 | % | | $ | 306,259 | | $ | 280,161 | | 9.3 | % | | $ | 104,841 | | $ | 105,416 | | (0.5) | % | | 34.2 | % | 37.6 | % | (3.4) | pts |

| Pacific Coast | 926 | | 70.2 | % | 71.9 | % | (1.7) | pts | | 522.94 | | 464.66 | | 12.5 | % | | 367.23 | | 334.20 | | 9.9 | % | | 141,582 | | 128,210 | | 10.4 | % | | 53,509 | | 51,148 | | 4.6 | % | | 37.8 | % | 39.9 | % | (2.1) | pts |

| Dominican Republic | — | | — | % | — | % | — | pts | | — | | — | | — | % | | — | | — | | — | % | | — | | — | | — | % | | — | | — | | — | % | | — | % | — | % | — | pts |

| Jamaica | 1,428 | | 79.4 | % | 73.6 | % | 5.8 | pts | | 452.96 | | 388.61 | | 16.6 | % | | 359.71 | | 286.14 | | 25.7 | % | | 219,903 | | 180,318 | | 22.0 | % | | 80,500 | | 56,279 | | 43.0 | % | | 36.6 | % | 31.2 | % | 5.4 | pts |

| Total Comparable Portfolio | 4,480 | | 77.6 | % | 74.5 | % | 3.1 | pts | | $ | 459.81 | | $ | 415.86 | | 10.6 | % | | $ | 356.65 | | $ | 310.02 | | 15.0 | % | | $ | 667,744 | | $ | 588,689 | | 13.4 | % | | $ | 238,850 | | $ | 212,843 | | 12.2 | % | | 35.8 | % | 36.2 | % | (0.4) | pts |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Comparable portfolio for the year ended December 31, 2023 excludes the following resorts: Hilton La Romana All-Inclusive Resort and Hyatt Ziva and Hyatt Zilara Cap Cana, which were closed for a portion of the third and fourth quarters of 2022 for necessary clean up and repair work as a result of Hurricane Fiona, Jewel Palm Beach, which was closed for a majority of the first quarter of 2023 as we transitioned the management of the resort to us from a third-party, and Jewel Punta Cana, which was sold in December 2023. |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Occupancy | | Net Package ADR | | Net Package RevPAR | | Owned Net Revenue | | Owned Resort EBITDA | | Owned Resort EBITDA Margin |

Excluding DR Jewels (1) | Rooms | | 2023 | 2022 | Pts

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | %

Change | | 2023 | 2022 | Pts

Change |

| Yucatán Peninsula | 2,126 | | 79.5 | % | 76.3 | % | 3.2 | pts | | $ | 440.13 | | $ | 413.49 | | 6.4 | % | | $ | 349.99 | | $ | 315.53 | | 10.9 | % | | $ | 306,259 | | $ | 280,161 | | 9.3 | % | | $ | 104,841 | | $ | 105,416 | | (0.5) | % | | 34.2 | % | 37.6 | % | (3.4) | pts |

| Pacific Coast | 926 | | 70.2 | % | 71.9 | % | (1.7) | pts | | 522.94 | | 464.66 | | 12.5 | % | | 367.23 | | 334.20 | | 9.9 | % | | 141,582 | | 128,210 | | 10.4 | % | | 53,509 | | 51,148 | | 4.6 | % | | 37.8 | % | 39.9 | % | (2.1) | pts |

| Dominican Republic | 1,524 | | 73.9 | % | 62.1 | % | 11.8 | pts | | 471.83 | | 417.98 | | 12.9 | % | | 348.73 | | 259.73 | | 34.3 | % | | 225,207 | | 167,784 | | 34.2 | % | | 95,468 | | 64,918 | | 47.1 | % | | 42.4 | % | 38.7 | % | 3.7 | pts |

| Jamaica | 1,428 | | 79.4 | % | 73.6 | % | 5.8 | pts | | 452.96 | | 388.61 | | 16.6 | % | | 359.71 | | 286.14 | | 25.7 | % | | 219,903 | | 180,318 | | 22.0 | % | | 80,500 | | 56,279 | | 43.0 | % | | 36.6 | % | 31.2 | % | 5.4 | pts |

| Total Portfolio Excluding DR Jewels | 6,004 | | 76.6 | % | 71.4 | % | 5.2 | pts | | $ | 462.75 | | $ | 416.33 | | 11.1 | % | | $ | 354.64 | | $ | 297.26 | | 19.3 | % | | $ | 892,951 | | $ | 756,473 | | 18.0 | % | | $ | 334,318 | | $ | 277,761 | | 20.4 | % | | 37.4 | % | 36.7 | % | 0.7 | pts |

(1) Portfolio for the year ended December 31, 2023 excludes the following resorts: Jewel Punta Cana, which was sold in December 2023, and Jewel Palm Beach. |

Yucatán Peninsula

•Owned Net Revenue for the year ended December 31, 2023 increased $26.1 million, or 9.3%, compared to the year ended December 31, 2022 and was driven by:

•an increase in Occupancy of 3.2 percentage points; and

•an increase in Net Package ADR of 6.4%; partially offset by

•a decrease in Net Non-package Revenue of $0.6 million.

•Net Non-package Revenue per sold room decreased 5.8% due to a decrease of $1.0 million from the expiration of our Extended Stay Program late in the second quarter of 2022 as COVID-19-related travel restrictions were no longer in effect.

•Owned Resort EBITDA for the year ended December 31, 2023 decreased $0.6 million, or 0.5%, compared to the year ended December 31, 2022, and was driven by:

•an unfavorable impact of $17.0 million due to the appreciation of the Mexican Peso;

•an increase in labor and related expenses, which were partially due to union-negotiated and government-mandated wage benefit increases; and

•an increase in insurance premiums.

•These increases were partially offset due to us leveraging a majority of our direct expenses given the Net Package ADR growth compared to the year ended December 31, 2022.

•Owned Resort EBITDA Margin for the year ended December 31, 2023 was 34.2%, a decrease of 3.4 percentage points compared to the year ended December 31, 2022. Owned Resort EBITDA Margin was negatively impacted by 560 basis points due to the appreciation of the Mexican Peso and by 220 basis points due to increases in labor and related expenses. Excluding the impact from the appreciation of the Mexican Peso, Owned Resort EBITDA Margin would have been 39.8%, an increase of 2.2 percentage points compared to the year ended December 31, 2022.

Pacific Coast

•Owned Net Revenue for the year ended December 31, 2023 increased $13.4 million, or 10.4%, compared to the year ended December 31, 2022 and was driven by:

•an increase in Net Package ADR of 12.5%; and

•an increase in Net Non-package Revenue of $2.2 million, or 14.5%.

•Net Non-package Revenue per sold room increased 17.2% despite a decrease of $0.7 million from the expiration of our Extended Stay Program late in the second quarter of 2022 as COVID-19-related travel restrictions were no longer in effect. Excluding this impact, Net Non-package Revenue per sold room increased 22.9% compared to the year ended December 31, 2022 as a result of a higher MICE group contribution to our guest mix; partially offset by

•a decrease in Occupancy of 1.7 percentage points compared to the year ended December 31, 2022 driven by renovations at the two resorts in this segment and higher demand for European travel destinations from American sourced guests, which were partially offset by an increase in guests sourced from Mexico.

•Owned Resort EBITDA for the year ended December 31, 2023 increased $2.4 million, or 4.6%, compared to the year ended December 31, 2022. The increase in Owned Resort EBITDA compared to the year ended December 31, 2022 was driven by

•an unfavorable impact of $7.1 million due to the appreciation of the Mexican Peso;

•an increase in labor and related expenses, which were partially due to union-negotiated and government-mandated wage and benefit increases; and

•an increase in insurance premiums and energy costs compared to the year ended December 31, 2022.

•These increases were partially offset due to us leveraging a majority of our direct expenses given the Net Package ADR growth compared to the year ended December 31, 2022.