Playtika Holding Corp. (NASDAQ: PLTK) today released financial

results for its third quarter for the period ending September 30,

2022.

Third Quarter 2022 Financial

Highlights:

- Third quarter revenue was $647.8

million(1) compared to $635.9 million in the prior year

period.

- Net income was $68.2 million

compared to $80.5 million in the prior year period.

- Credit Adjusted EBITDA, a non-GAAP

financial measure defined below, was $203.5 million compared to

$217.0 million in the prior year period.

- Adjusted EBITDA, a non-GAAP

financial measure defined below, was $230.7 million compared to

$247.8 million in the prior year period.

- Our cash and cash equivalents

totaled $1,255.4 million as of September 30, 2022.

- In October we purchased $600

million of shares via Tender Offer at a price of $11.58, which has

reduced outstanding shares by approximately 51.8 million

shares.

“Playtika’s casual games performed exceptionally

well. Bingo Blitz, Solitaire Grand Harvest, and June’s Journey

achieved double-digit growth year-over-year and we are very pleased

with their continued success," said Robert Antokol, Chief Executive

Officer of Playtika. “We believe we are well positioned for the

future as we develop exciting, new features for our games and drive

our strategic initiatives focused on technology and digitization to

build on our leadership position in mobile games.”

“We are encouraged by the growth of our casual

portfolio and will continue to invest responsibly in our strongest

franchises,” said Craig Abrahams, President and Chief Financial

Officer. “As we look to further optimize our business model, we are

operating our studios with a focus on innovation and efficiency

while generating robust free cash flow.”

Highlights

- Casual portfolio grew revenue 14.4%

year-over-year, comprising 54.9% of total revenue

- Social Casino portfolio revenue

declined 10.2% year-over-year, comprising 45.1% of total

revenue

- Average DPUs increased 5.8%

year-over-year

- Junes Journey grew revenue 32.5%

year-over-year

- Bingo Blitz grew revenue 14.7%

year-over-year

- Solitaire Grand Harvest grew

revenue 14.3% year-over-year

- Slotomania revenue declined 12.7%

year-over-year

(1) Comprised of $355.7 million and $292.1

million for casual and casino themed games, respectively.

Financial Outlook

For the full year 2022 the company expects

revenue to be within the previously provided range of $2.60 - $2.66

billion and Adjusted EBITDA within a range of $900 - $940

million.

Conference Call

Playtika management will host a conference call

at 5:30 a.m. Pacific Time (8:30 a.m. Eastern Time) today to discuss

the company’s results. The conference call can be accessed via a

webcast accessible at investors.playtika.com. A replay of the call

will be available through the website one hour following the call

and will be archived for one year.

Summary Operating Results of Playtika Holding

Corp.

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

(in millions of dollars, except percentages, Average DPUs,

and ARPDAU) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

$ |

647.8 |

|

|

$ |

635.9 |

|

|

$ |

1,984.3 |

|

|

$ |

1,934.0 |

|

|

Total cost and expenses |

$ |

516.4 |

|

|

$ |

481.4 |

|

|

$ |

1,641.2 |

|

|

$ |

1,483.8 |

|

| Operating

income |

$ |

131.4 |

|

|

$ |

154.5 |

|

|

$ |

343.1 |

|

|

$ |

450.2 |

|

| Net

income |

$ |

68.2 |

|

|

$ |

80.5 |

|

|

$ |

187.8 |

|

|

$ |

206.2 |

|

| Credit Adjusted

EBITDA |

$ |

203.5 |

|

|

$ |

217.0 |

|

|

$ |

602.5 |

|

|

$ |

672.6 |

|

| Adjusted

EBITDA |

$ |

230.7 |

|

|

$ |

247.8 |

|

|

$ |

690.1 |

|

|

$ |

770.2 |

|

| Net income

margin |

|

10.5 |

% |

|

|

12.7 |

% |

|

|

9.5 |

% |

|

|

10.7 |

% |

| Credit Adjusted EBITDA

margin |

|

31.4 |

% |

|

|

34.1 |

% |

|

|

30.4 |

% |

|

|

34.8 |

% |

| Adjusted EBITDA

margin |

|

35.6 |

% |

|

|

39.0 |

% |

|

|

34.8 |

% |

|

|

39.8 |

% |

| |

|

|

|

|

|

|

|

| Non-financial

performance metrics |

|

|

|

|

|

|

|

|

Average DAUs |

|

9.0 |

|

|

|

10.4 |

|

|

|

9.7 |

|

|

|

10.4 |

|

|

Average DPUs (in thousands) |

|

310 |

|

|

|

293 |

|

|

|

315 |

|

|

|

296 |

|

|

Average Daily Payer Conversion |

|

3.4 |

% |

|

|

2.8 |

% |

|

|

3.3 |

% |

|

|

2.8 |

% |

|

ARPDAU |

$ |

0.78 |

|

|

$ |

0.67 |

|

|

$ |

0.75 |

|

|

$ |

0.68 |

|

|

Average MAUs |

|

30.2 |

|

|

|

35.4 |

|

|

|

32.4 |

|

|

|

34.4 |

|

About Playtika Holding

Corp.

Playtika (NASDAQ: PLTK) is a mobile gaming

entertainment and technology market leader with a portfolio of

multiple game titles. Founded in 2010, Playtika was among the first

to offer free-to-play social games on social networks and, shortly

after, on mobile platforms. Headquartered in Herzliya, Israel, and

guided by a mission to entertain the world through infinite ways to

play, Playtika has employees across offices worldwide.

Forward Looking Information

In this press release, we make “forward-looking

statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts. Further, statements that include words

such as "anticipate," "believe," "continue," "could," "estimate,"

"expect," "intend," "may," "might," "present," "preserve,"

"project," "pursue," "will," or "would," or the negative of these

words or other words or expressions of similar meaning may identify

forward-looking statements.

Important factors that could cause actual

results to differ materially from estimates or projections

contained in the forward-looking statements include without

limitation:

- our reliance on third-party

platforms, such as the iOS App Store, Facebook, and Google Play

Store, to distribute our games and collect revenues, and the risk

that such platforms may adversely change their policies;

- our reliance on a limited number of

games to generate the majority of our revenue;

- our reliance on a small percentage

of total users to generate a majority of our revenue;

- our free-to-play business model,

and the value of virtual items sold in our games, is highly

dependent on how we manage the game revenues and pricing

models;

- our inability to complete

acquisitions and integrate any acquired businesses successfully

could limit our growth or disrupt our plans and operations;

- we may be unable to successfully

develop new games;

- our ability to compete in a highly

competitive industry with low barriers to entry;

- we have significant indebtedness

and are subject to the obligations and restrictive covenants under

our debt instruments;

- the impact of the COVID-19 pandemic

on our business and the economy as a whole;

- our controlled company status;

- legal or regulatory restrictions or

proceedings could adversely impact our business and limit the

growth of our operations;

- risks related to our international

operations and ownership, including our significant operations in

Israel, Ukraine and Belarus and the fact that our controlling

stockholder is a Chinese-owned company;

- our reliance on key personnel;

- security breaches or other

disruptions could compromise our information or our players’

information and expose us to liability; and

- our inability to protect our

intellectual property and proprietary information could adversely

impact our business.

Additional factors that may cause future events

and actual results, financial or otherwise, to differ, potentially

materially, from those discussed in or implied by the

forward-looking statements include the risks and uncertainties

discussed in our filings with the Securities and Exchange

Commission. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will

be achieved or occur, and reported results should not be considered

as an indication of future performance. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

such forward-looking statements.

Except as required by law, we undertake no

obligation to update any forward-looking statements for any reason

to conform these statements to actual results or to changes in our

expectations.

PLAYTIKA HOLDING

CORP.CONSOLIDATED BALANCE

SHEETS(In millions, except for per share

data)

| |

September 30, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| |

(Unaudited) |

|

|

| ASSETS |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

$ |

1,255.4 |

|

|

$ |

1,017.0 |

|

|

Short-term bank deposits |

|

— |

|

|

|

100.1 |

|

|

Restricted cash |

|

1.6 |

|

|

|

2.0 |

|

|

Accounts receivable |

|

128.0 |

|

|

|

143.7 |

|

|

Prepaid expenses and other current assets |

|

110.7 |

|

|

|

72.9 |

|

|

Total current assets |

|

1,495.7 |

|

|

|

1,335.7 |

|

| Property and equipment,

net |

|

108.2 |

|

|

|

103.3 |

|

| Operating lease right-of-use

assets |

|

102.9 |

|

|

|

89.4 |

|

| Intangible assets other than

goodwill, net |

|

374.6 |

|

|

|

417.3 |

|

| Goodwill |

|

802.2 |

|

|

|

788.1 |

|

| Deferred tax assets, net |

|

42.7 |

|

|

|

38.3 |

|

| Investments in unconsolidated

entities |

|

27.6 |

|

|

|

17.8 |

|

| Other non-current assets |

|

39.5 |

|

|

|

13.4 |

|

|

Total assets |

$ |

2,993.4 |

|

|

$ |

2,803.3 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

| Current

liabilities |

|

|

|

|

Current maturities of long-term debt |

$ |

12.4 |

|

|

$ |

12.2 |

|

|

Accounts payable |

|

39.8 |

|

|

|

45.7 |

|

|

Operating lease liabilities, current |

|

19.5 |

|

|

|

17.2 |

|

|

Accrued expenses and other current liabilities |

|

454.2 |

|

|

|

494.6 |

|

|

Total current liabilities |

|

525.9 |

|

|

|

569.7 |

|

| Long-term debt |

|

2,414.3 |

|

|

|

2,422.9 |

|

| Contingent consideration |

|

— |

|

|

|

28.7 |

|

| Employee related benefits and

other long-term liabilities |

|

2.8 |

|

|

|

23.7 |

|

| Operating lease liabilities,

long-term |

|

85.4 |

|

|

|

82.3 |

|

| Deferred tax liabilities |

|

53.4 |

|

|

|

53.7 |

|

|

Total liabilities |

|

3,081.8 |

|

|

|

3,181.0 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity

(deficit) |

|

|

|

|

Common stock of $0.01 par value; 1,600.0 shares authorized; 412.7

and 411.1 shares issued and outstanding at September 30, 2022 and

December 31, 2021, respectively |

|

4.1 |

|

|

|

4.1 |

|

|

Additional paid-in capital |

|

1,138.9 |

|

|

|

1,032.9 |

|

|

Accumulated other comprehensive income (loss) |

|

(1.3 |

) |

|

|

3.2 |

|

|

Accumulated deficit |

|

(1,230.1 |

) |

|

|

(1,417.9 |

) |

|

Total stockholders' deficit |

|

(88.4 |

) |

|

|

(377.7 |

) |

| Total liabilities and

stockholders’ deficit |

$ |

2,993.4 |

|

|

$ |

2,803.3 |

|

PLAYTIKA HOLDING

CORP.CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME(In millions, except for per share

data)(Unaudited)

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

$ |

647.8 |

|

|

$ |

635.9 |

|

|

$ |

1,984.3 |

|

|

$ |

1,934.0 |

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

Cost of revenue |

|

181.8 |

|

|

|

179.2 |

|

|

|

554.8 |

|

|

|

546.1 |

|

|

Research and development |

|

115.1 |

|

|

|

91.5 |

|

|

|

353.0 |

|

|

|

268.5 |

|

|

Sales and marketing |

|

145.4 |

|

|

|

141.1 |

|

|

|

476.9 |

|

|

|

427.7 |

|

|

General and administrative |

|

74.1 |

|

|

|

69.6 |

|

|

|

256.5 |

|

|

|

241.5 |

|

|

Total costs and expenses |

|

516.4 |

|

|

|

481.4 |

|

|

|

1,641.2 |

|

|

|

1,483.8 |

|

| Income from

operations |

|

131.4 |

|

|

|

154.5 |

|

|

|

343.1 |

|

|

|

450.2 |

|

|

Interest and other, net |

|

24.3 |

|

|

|

24.9 |

|

|

|

74.2 |

|

|

|

124.6 |

|

| Income before income

taxes |

|

107.1 |

|

|

|

129.6 |

|

|

|

268.9 |

|

|

|

325.6 |

|

|

Provision for income taxes |

|

38.9 |

|

|

|

49.1 |

|

|

|

81.1 |

|

|

|

119.4 |

|

| Net

income |

|

68.2 |

|

|

|

80.5 |

|

|

|

187.8 |

|

|

|

206.2 |

|

| Other comprehensive

income (loss) |

|

|

|

|

|

|

|

|

Foreign currency translation |

|

(14.5 |

) |

|

|

(5.6 |

) |

|

|

(27.8 |

) |

|

|

(12.7 |

) |

|

Change in fair value of derivatives |

|

10.5 |

|

|

|

0.8 |

|

|

|

23.3 |

|

|

|

(0.9 |

) |

|

Total other comprehensive loss |

|

(4.0 |

) |

|

|

(4.8 |

) |

|

|

(4.5 |

) |

|

|

(13.6 |

) |

| Comprehensive

income |

$ |

64.2 |

|

|

$ |

75.7 |

|

|

$ |

183.3 |

|

|

$ |

192.6 |

|

| |

|

|

|

|

|

|

|

| Net income per share

attributable to common stockholders, basic |

$ |

0.17 |

|

|

$ |

0.20 |

|

|

$ |

0.46 |

|

|

$ |

0.50 |

|

| Net income per share

attributable to common stockholders, diluted |

$ |

0.17 |

|

|

$ |

0.20 |

|

|

$ |

0.46 |

|

|

$ |

0.50 |

|

| Weighted-average

shares used in computing net income per share attributable to

common stockholders, basic |

|

412.7 |

|

|

|

409.6 |

|

|

|

412.3 |

|

|

|

408.6 |

|

| Weighted-average

shares used in computing net income per share attributable to

common stockholders, diluted |

|

412.7 |

|

|

|

411.6 |

|

|

|

412.6 |

|

|

|

410.9 |

|

PLAYTIKA HOLDING

CORP.CONSOLIDATED STATEMENTS OF CASH

FLOWS(In

millions)(Unaudited)

| |

Nine months ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from

operating activities |

$ |

316.3 |

|

|

$ |

383.8 |

|

| Cash flows from

investing activities |

|

|

|

|

Purchase of property and equipment |

|

(38.3 |

) |

|

|

(31.5 |

) |

|

Capitalization of internal use software costs |

|

(30.6 |

) |

|

|

(33.6 |

) |

|

Purchase of software for internal use |

|

(7.7 |

) |

|

|

(8.7 |

) |

|

Short-term bank deposits |

|

100.1 |

|

|

|

(100.0 |

) |

|

Payments for business combination, net of cash acquired |

|

(29.9 |

) |

|

|

(397.7 |

) |

|

Other investing activities |

|

(9.8 |

) |

|

|

2.1 |

|

|

Net cash used in investing activities |

|

(16.2 |

) |

|

|

(569.4 |

) |

| Cash flows from

financing activities |

|

|

|

|

Proceeds from bank borrowings, net |

|

— |

|

|

|

887.7 |

|

|

Repayments on bank borrowings |

|

(14.2 |

) |

|

|

(960.5 |

) |

|

Proceeds from issuance of unsecured notes, net |

|

— |

|

|

|

178.9 |

|

|

Proceeds from issuance of common stock, net |

|

— |

|

|

|

470.4 |

|

|

Payment of debt issuance costs |

|

— |

|

|

|

(12.0 |

) |

|

Net cash outflow for business acquisitions |

|

(26.9 |

) |

|

|

— |

|

|

Payment of tax withholdings on stock-based payments |

|

(2.1 |

) |

|

|

— |

|

|

Net cash provided by (used in) financing activities |

|

(43.2 |

) |

|

|

564.5 |

|

| Effect of exchange

rate changes on cash and cash equivalents |

|

(18.9 |

) |

|

|

(6.3 |

) |

| Net change in cash,

cash equivalents and restricted cash |

|

238.0 |

|

|

|

372.6 |

|

| Cash, cash equivalents

and restricted cash at the beginning of the period |

|

1,019.0 |

|

|

|

523.6 |

|

| Cash, cash equivalents

and restricted cash at the end of the period |

$ |

1,257.0 |

|

|

$ |

896.2 |

|

Non-GAAP Financial Measures

Credit Adjusted EBITDA is a non-GAAP financial

measure and should not be construed as an alternative to net income

as an indicator of operating performance, nor as an alternative to

cash flow provided by operating activities as a measure of

liquidity, or any other performance measure in each case as

determined in accordance with GAAP.

Below is a reconciliation of Credit Adjusted

EBITDA to net income, the closest GAAP financial measure. Our

Credit Agreement defines Adjusted EBITDA (which we call “Credit

Adjusted EBITDA”) as net income before (i) interest expense, (ii)

interest income, (iii) provision for income taxes, (iv)

depreciation and amortization expense, (v) stock-based

compensation, (vi) contingent consideration, (vii) acquisition and

related expenses, and (viii) certain other items. We calculate

Credit Adjusted EBITDA Margin as Credit Adjusted EBITDA divided by

revenues.

Credit Adjusted EBITDA and Credit Adjusted

EBITDA Margin as calculated herein may not be comparable to

similarly titled measures reported by other companies within the

industry and are not determined in accordance with GAAP. Our

presentation of Credit Adjusted EBITDA and Credit Adjusted EBITDA

Margin should not be construed as an inference that our future

results will be unaffected by unusual or unexpected items.

RECONCILIATION OF NET INCOME TO CREDIT

ADJUSTED EBITDA(In millions)

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net

income |

$ |

68.2 |

|

|

$ |

80.5 |

|

|

$ |

187.8 |

|

|

$ |

206.2 |

|

|

Provision for income taxes |

|

38.9 |

|

|

|

49.1 |

|

|

|

81.1 |

|

|

|

119.4 |

|

|

Interest and other, net |

|

24.3 |

|

|

|

24.9 |

|

|

|

74.2 |

|

|

|

124.6 |

|

|

Depreciation and amortization |

|

39.6 |

|

|

|

36.5 |

|

|

|

121.7 |

|

|

|

103.0 |

|

| EBITDA |

|

171.0 |

|

|

|

191.0 |

|

|

|

464.8 |

|

|

|

553.2 |

|

|

Stock-based compensation(1) |

|

31.6 |

|

|

|

23.0 |

|

|

|

106.8 |

|

|

|

72.8 |

|

|

Contingent consideration |

|

(11.4 |

) |

|

|

— |

|

|

|

(14.1 |

) |

|

|

— |

|

|

Acquisition and related expenses(2) |

|

6.1 |

|

|

|

1.2 |

|

|

|

19.7 |

|

|

|

43.2 |

|

|

Other one-time items(3) |

|

6.2 |

|

|

|

1.8 |

|

|

|

25.3 |

|

|

|

3.4 |

|

| Credit Adjusted

EBITDA(4) |

$ |

203.5 |

|

|

$ |

217.0 |

|

|

$ |

602.5 |

|

|

$ |

672.6 |

|

| Net income

margin |

|

10.5 |

% |

|

|

12.7 |

% |

|

|

9.5 |

% |

|

|

10.7 |

% |

| Credit Adjusted EBITDA

margin |

|

31.4 |

% |

|

|

34.1 |

% |

|

|

30.4 |

% |

|

|

34.8 |

% |

| _________ |

|

(1) |

|

Reflects, for the three and nine months ended September 30,

2022 and 2021, stock-based compensation expense related to the

issuance of equity awards to certain of our employees. |

| (2) |

|

Amounts for the three and nine

months ended September 30, 2022, primarily relates to expenses

incurred by the Company in connection with the evaluation of

strategic alternatives for the Company. Amount for the nine months

ended September 30, 2021 primarily relates to bonus expenses paid

as a result of the successful initial public offering of the

Company’s stock in January 2021. |

| (3) |

|

Amounts for the three and nine

months ended September 30, 2022, consists of $1.9 million

and $12.1 million, respectively, incurred by the Company for

severance and for the nine months ended September 30, 2022,

$4.0 million incurred by the Company for relocation and

support provided to employees due to the war in Ukraine. Amounts

for the three and nine months ended September 30, 2022 also

include $2.7 million and $6.1 million, respectively,

incurred related to the announced restructuring activities. |

| (4) |

|

Executive management is

compensated, in part, based upon achieving certain Adjusted EBITDA

targets as more completely described in our proxy statement.

Adjusted EBITDA for these purposes represents Credit Adjusted

EBITDA shown above, further adjusted to reflect certain elements of

cash-based compensation and other items as shown below. |

| |

Three months endedSeptember

30, |

|

Nine months endedSeptember

30, |

|

(in millions) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Credit Adjusted

EBITDA |

$ |

203.5 |

|

|

$ |

217.0 |

|

|

$ |

602.5 |

|

|

$ |

672.6 |

|

|

Long-term cash compensation(a) |

|

27.0 |

|

|

|

28.5 |

|

|

|

79.9 |

|

|

|

88.5 |

|

|

M&A related retention payments(b) |

|

0.2 |

|

|

|

2.3 |

|

|

|

7.7 |

|

|

|

9.1 |

|

| Adjusted

EBITDA |

$ |

230.7 |

|

|

$ |

247.8 |

|

|

$ |

690.1 |

|

|

$ |

770.2 |

|

| Adjusted EBITDA

margin |

|

35.6 |

% |

|

|

39.0 |

% |

|

|

34.8 |

% |

|

|

39.8 |

% |

|

Adjusted EBITDA and Adjusted EBITDA Margin are key operating

measures used by our management to assess our financial performance

and to supplement GAAP measures of performance in the evaluation of

the effectiveness of our business strategies, to make budgeting

decisions, and to compare our performance against other peer

companies using similar measures. We evaluate Adjusted EBITDA and

Adjusted EBITDA Margin in conjunction with our results according to

GAAP because we believe they provide investors and analysts a more

complete understanding of factors and trends affecting our business

than GAAP measures alone. |

|

(a) |

|

Includes expenses recognized for grants of annual cash awards to

employees pursuant to our Retention Plans, which awards are

incremental to salary and bonus payments, and which plans expire in

2024. For more information, see notes to our consolidated financial

statements. |

| (b) |

|

Includes retention awards to key

individuals associated with acquired companies as an incentive to

retain those individuals on a long-term basis. The income amount

for the three and nine months ended September 30, 2022,

primarily relates to the reduction of contingent consideration

payable to employees of the Company that were also selling

Shareholders of Reworks. This portion of the contingent

consideration is being accounted for as an M&A retention

payment to these employees, with changes in the amounts recognized

as compensation expense. |

Contacts

|

Investor Relations |

|

Press Contact |

| David Niederman |

|

Darlan Monterisi |

| VP, Investor Relations and

Capital Markets |

|

EVP, Global Head of

Communications |

| davidni@playtika.com |

|

darlanm@playtika.com |

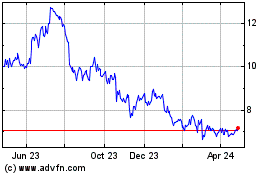

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Apr 2023 to Apr 2024