Amended Tender Offer Statement by Issuer (sc To-i/a)

October 03 2022 - 7:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Amendment No. 4

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Rule 14d-100)

Playtika

Holding Corp.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, $0.01 par value

(Title of Class of Securities)

72815L 107

(CUSIP Number

of Class of Securities)

Robert Antokol

Chief Executive Officer

c/o Playtika Ltd.

HaChoshlim St 8

Herzliya

Pituach, Israel

972-73-316-3251

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with copies to:

|

|

|

| Michael A. Treska

Darren Guttenberg

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, CA 92626 (714) 540-1235 |

|

Michael Cohen

Chief Legal Officer and

Secretary c/o Playtika Ltd.

HaChoshlim St 8 Herzliya

Pituach, Israel

972-73-316-3251

|

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ |

third-party tender offer subject to Rule 14d-1. |

| ☒ |

issuer tender offer subject to Rule 13e-4. |

| ☐ |

going-private transaction subject to Rule 13e-3. |

| ☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Amendment No. 4 (this “Amendment”) amends and supplements the Tender Offer

Statement on Schedule TO initially filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 29, 2022 (together with any amendments and supplements thereto, the “Schedule TO”) by Playtika

Holding Corp., a Delaware corporation (the “Company”), relating to the offer by the Company to purchase up to 51,813,472 shares of its common stock, par value $0.01 per share (the “Shares”), at a price of $11.58 per

Share, as defined in the Offer to Purchase (defined below), to the seller in cash, less any applicable withholding taxes and without interest. The Company’s offer is being made upon the terms and subject to the conditions set forth in the Offer

to Purchase, dated August 29, 2022 (together with any amendments or supplements thereto, the “Offer to Purchase”), filed as Exhibit (a)(1)(A) to the Schedule TO, and the related Letter of Transmittal (together with any

amendments or supplements thereto) filed as Exhibit (a)(1)(B) to the Schedule TO.

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby amended and supplemented by adding the following exhibit:

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

|

|

Playtika Holding Corp. |

|

|

|

|

| Date: September 30, 2022 |

|

|

|

By: |

|

/s/ Craig Abrahams |

|

|

|

|

Craig Abrahams |

|

|

|

|

President and Chief Financial Officer |

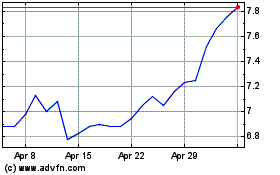

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Aug 2024 to Sep 2024

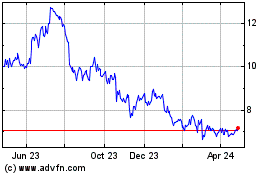

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Sep 2023 to Sep 2024