Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405

February 29 2024 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

Commission File Number 001-40234

CUSIP Number (Common Stock): 74623V 103

CUSIP Number (Units): 74623V 202

CUSIP Number (Warrants): 74623V 111

(Check One): x Form 10-K ¨ Form 20-F ¨ Form 11-K ¨ Form 10-Q ¨ Form N-SAR ¨ Form N-CSR

For Period Ended: December 31, 2022

| | | | | | | | | | | | | | |

| ¨ | Transition Report on Form 10-K | | ¨ | Transition Report on Form 10-Q |

| ¨ | Transition Report on Form 20-F | | ¨ | Transition Report on Form N-SAR |

| ¨ | Transition Report on Form 11-K | | | |

For the Transition Period Ended: ________________________________

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates: ____________________________________________.

PART I

REGISTRANT INFORMATION

| | | | | | | | | | | |

Full Name of Registrant: | | PureCycle Technologies, Inc. | |

| | | |

Address of Principal Executive

Office (Street and number): | | 5950 Hazeltine National Drive, Suite 300 | |

| | | |

City, State and Zip Code: | | Orlando, Florida 32822 | |

PART II

RULE 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate.)

| | | | | | | | |

| ☒ | (a) | The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

| (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

| (c) | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III

NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

PureCycle Technologies, Inc. (the “Company”) has determined that it is unable, without unreasonable effort or expense, to file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Form 10-K”) by the prescribed due date for the reasons described below.

On October 7, 2020, the Southern Ohio Port Authority (“SOPA”) issued certain revenue bonds (the “Revenue Bonds”) pursuant to an Indenture of Trust dated as of October 1, 2020, between SOPA and UMB Bank, N.A., as trustee (“Trustee”) (as amended, restated, supplemented or otherwise modified from time to time, the “Indenture”), and loaned the proceeds from their sale to PureCycle: Ohio LLC, an Ohio limited liability company and indirect wholly-owned subsidiary of the Company (“PCO”), pursuant to a loan agreement dated as of October 1, 2020 between SOPA and PCO (“Loan Agreement”), to be used to, among other things, acquire, construct and equip the Company’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”).

On February 10, 2024, PCO reached an agreement in principle with holders of a majority (the “Majority Holders”) of the SOPA Exempt Facility Revenue Bonds (PureCycle Project), Tax-Exempt Series 2020A (the “Series 2020A Bonds”), to purchase bonds held by the Majority Holders, as well as additional holders of the Series 2020A Bonds, the SOPA Subordinate Exempt Facility Revenue Bonds (PureCycle Project), Tax-Exempt Series 2020B (the “Series 2020B Bonds), and the SOPA Subordinate Exempt Facility Revenue Bonds (PureCycle Project), Taxable Series 2020C (the “Series 2020C Bonds” and, together with the Series 2020A Bonds and the Series 2020B Bonds, the “Bonds”).

On February 23, 2024, PCO and the Majority Holders reached agreement on the form of Bond Purchase Agreement and Consent (“Purchase Agreement”) and Third Supplemental Indenture related to the purchase of the Bonds (the “Purchase”). The Third Supplemental Indenture will amend and supplement the Indenture, the Loan Agreement, and certain of the other financing documents entered into in connection with the Indenture and Loan Agreement by, among other things and without limitation, eliminating

substantially all covenants and Events of Default contained in the Indenture, the Loan Agreement and certain of such other financing documents. The Purchase is expected to close by March 4, 2024.

As a result of the expected timing of the closing of the Purchase and the entry into the Purchase Agreement and Third Supplemental Indenture, as well as the need to determine the precise amount of Bonds purchased to understand the impact on the financial statements and related information included in the Form 10-K, the Company requires additional time to finalize the financial statements and related information included in the Form 10-K. The Company is working diligently to complete the Form 10-K as soon as possible; however, the Company is unable to complete and file the Form 10-K by the required due date of February 29, 2024 without unreasonable effort and expense.

PART IV

OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification

| | | | | | | | | | | | | | |

| Brad S. Kalter | | (877) 648-3565 | |

| (Name) | | (Area Code) (Telephone Number) | |

(2) Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

x Yes ¨ No

(3) Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

¨Yes x No

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

Safe Harbor for Forward-Looking Statements

Information in this Form 12b-25 report regarding the Company’s expectations and beliefs are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. All forward-looking statements included in this report, including expectations about the timing of the completion of the Form 10-K and the timing, form and content of the Form 10-K are based upon information available to the Company as of the date of this report, which may change, and the Company assumes no obligation to update any such forward-looking statements.

PureCycle Technologies, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: February 29, 2024 | By: /s/ Brad S. Kalter |

| Brad S. Kalter General Counsel and Corporate Secretary |

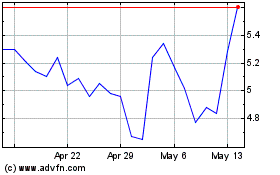

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

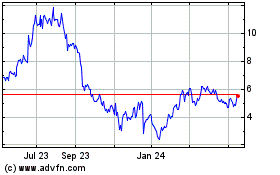

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Apr 2023 to Apr 2024