false0001609809DEF 14A0001609809ecd:NonPeoNeoMembermcrb:IncreaseBasedOnAsc718FairValueOfAwardsGrantedDuringApplicableFyThatVestedDuringApplicableFyMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:DeductionOfAsc718FairValueOfAwardsGrantedDuringPriorFyThatWereForfeitedMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:TotalAdjustmentsMember2023-01-012023-12-3100016098092023-01-012023-12-310001609809mcrb:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereVestedMemberecd:PeoMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:IncreaseBasedOnIncrementalFairValueOfOptionsSarsModifiedDuringApplicableFyMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:IncreaseBasedOnAsc718FairValueOfAwardsGrantedDuringApplicableFyThatRemainUnvestedAsOfApplicableFyEndMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:DeductionForChangeInTheActuarialPresentValuesReportedUnderTheChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:IncreaseForServiceCostAndIfApplicablePriorServiceCostForPensionPlansMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:IncreaseBasedOnIncrementalFairValueOfOptionsSarsModifiedDuringApplicableFyMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:IncreaseForServiceCostAndIfApplicablePriorServiceCostForPensionPlansMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:TotalAdjustmentsMember2023-01-012023-12-3100016098092021-01-012021-12-3100016098092022-01-012022-12-310001609809ecd:PeoMembermcrb:IncreaseBasedOnAsc718FairValueOfAwardsGrantedDuringApplicableFyThatVestedDuringApplicableFyMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFyPriorToVestingDateMember2023-01-012023-12-310001609809mcrb:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereOutstandingAndUnvestedMemberecd:PeoMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:DeductionUnderTheStockAwardsAndOptionAwardsInTheSummaryCompensationTableForApplicableFyMember2023-01-012023-12-310001609809mcrb:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:DeductionForChangeInTheActuarialPresentValuesReportedUnderTheChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereOutstandingAndUnvestedMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:IncreaseBasedOnAsc718FairValueOfAwardsGrantedDuringApplicableFyThatRemainUnvestedAsOfApplicableFyEndMember2023-01-012023-12-310001609809mcrb:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFyPriorToVestingDateMemberecd:PeoMember2023-01-012023-12-310001609809ecd:NonPeoNeoMembermcrb:DeductionUnderTheStockAwardsAndOptionAwardsInTheSummaryCompensationTableForApplicableFyMember2023-01-012023-12-310001609809ecd:PeoMembermcrb:DeductionOfAsc718FairValueOfAwardsGrantedDuringPriorFyThatWereForfeitedMember2023-01-012023-12-31iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under § 240.14a-12 |

SERES THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

|

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

|

Seres Therapeutics, Inc. |

|

|

|

|

|

PROXY STATEMENT |

|

|

|

Annual Meeting of Stockholders April 4, 2024 8:00 a.m. Eastern Time |

|

SERES THERAPEUTICS, INC.

101 CAMBRIDGEPARK DRIVE

CAMBRIDGE, MASSACHUSETTS 02140

March 5, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Seres Therapeutics, Inc. at 8:00 a.m. Eastern time, on Thursday, April 4, 2024 (the “Annual Meeting”). The Annual Meeting will be held online. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/MCRB2024.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who Can Attend the 2024 Annual Meeting of Stockholders?” on page 3 of the proxy statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting webcast, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy via the Internet or by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. Instructions regarding how you can vote are contained on the proxy card. You may also vote online during the Annual Meeting. Instructions on how to vote during the meeting will be available at www.virtualshareholdermeeting.com/MCRB2024.

Thank you for your support.

Sincerely,

Eric D. Shaff

President and Chief Executive Officer

Notice of Annual Meeting of Stockholders

To Be Held Thursday, April 4, 2024

SERES THERAPEUTICS, INC.

101 CAMBRIDGEPARK DRIVE

CAMBRIDGE, MASSACHUSETTS 02140

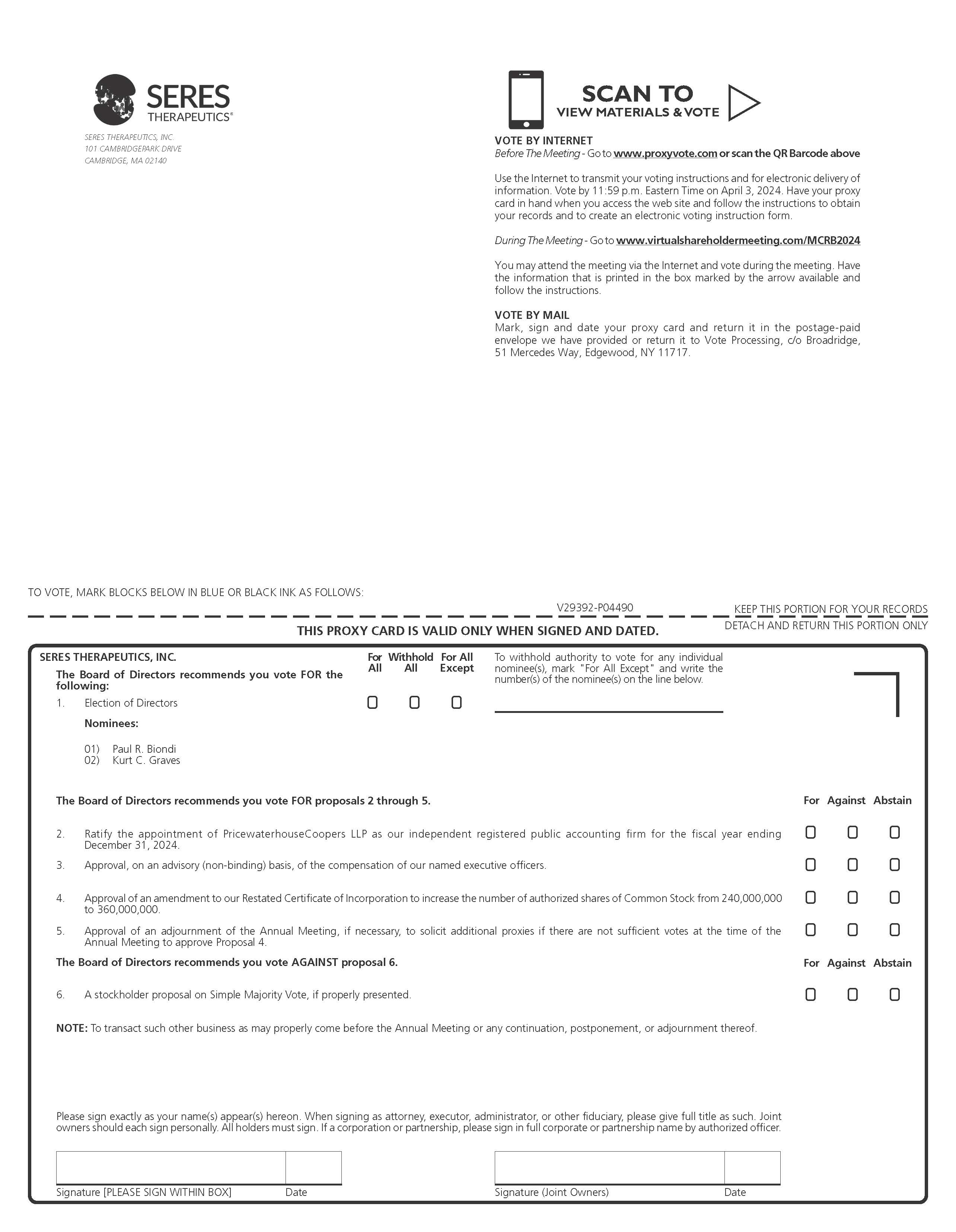

The Annual Meeting of Stockholders (the “Annual Meeting”) of Seres Therapeutics, Inc., a Delaware corporation (the “Company”), will be held at 8:00 a.m. Eastern time on Thursday, April 4, 2024. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/MCRB2024 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

1.To elect Paul R. Biondi and Kurt C. Graves as Class III Directors to serve until the 2027 Annual Meeting of Stockholders, and until their respective successors have been duly elected and qualified;

2.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

3.To approve, on an advisory (non-binding) basis, the compensation of our named executive officers;

4.To approve an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of our common stock, par value $0.001 per share (our "Common Stock") from 240,000,000 to 360,000,000;

5.To approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4;

6.If properly presented at the Annual Meeting, to vote upon a stockholder proposal on simple majority vote; and

7.To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our Common Stock as of the close of business on February 12, 2024 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. To participate in the Annual Meeting, including to vote via the Internet, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. A complete list of stockholders entitled to vote at the Annual Meeting will be open to the examination of any stockholder for a purpose germane to the meeting by sending an email to info@serestherapeutics.com, stating the purpose of the request and providing proof of ownership of our Common Stock for a period of ten days ending on the day before the Annual Meeting. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting webcast, we urge you to vote your shares via the Internet, as described in the enclosed materials. If you have received a printed copy of your proxy card by mail, you may alternatively sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

Thomas J. DesRosier

Secretary

Cambridge, Massachusetts

March 5, 2024

Proxy Statement

SERES THERAPEUTICS, INC.

101 CAMBRIDGEPARK DRIVE

CAMBRIDGE, MASSACHUSETTS 02140

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Seres Therapeutics, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, April 4, 2024 (the “Annual Meeting”), at 8:00 a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/ MCRB2024 and entering the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. Holders of record of shares of our common stock (our “Common Stock”), as of the close of business on February 12, 2024 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 145,557,567

shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and our Annual Report to Stockholders for the year ended December 31, 2023 (the “2023 Annual Report”) will be released on or about March 5, 2024 to our stockholders on the Record Date.

In this proxy statement, “Seres”, “Company”, “we”, “us”, and “our” refer to Seres Therapeutics, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, APRIL 4, 2024

This Proxy Statement and our 2023 Annual Report to Stockholders are available at http://www.proxyvote.com/.

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

•Proposal 1: To elect Paul R. Biondi and Kurt C. Graves as Class III Directors to serve until the 2027 Annual Meeting of Stockholders, and until their respective successors have been duly elected and qualified;

•Proposal 2: To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

•Proposal 3: To approve, on an advisory (non-binding) basis, the compensation of our named executive officers;

•Proposal 4: To approve an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 240,000,000 to 360,000,000;

•Proposal 5: To approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4;

•Proposal 6: If properly presented at the Annual Meeting, to vote upon a stockholder proposal on simple majority vote; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Stockholders at an annual meeting will only be able to consider proposals or nominations specified in the Notice of Annual Meeting or brought before the meeting by or at the direction of our Board of Directors or by a stockholder of record on the Record Date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our Corporate Secretary of the stockholder’s intention to bring such business before the meeting. As of the date of this proxy statement, we know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD

Our Board of Directors (the “Board of Directors” or the “Board”) recommends that you vote your shares of Common Stock as indicated below. If you return a properly completed proxy card, or vote your shares by Internet, your shares will be

voted on your behalf as you direct. If not otherwise specified, shares of Common Stock represented by proxies will be voted, and the Board of Directors recommends that you vote:

•FOR the election of Paul R. Biondi and Kurt C. Graves as Class III Directors;

•FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

•FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers;

•FOR the approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 240,000,000 to 360,000,000;

•FOR the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4; and

•AGAINST the stockholder proposal.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

INFORMATION ABOUT THIS PROXY STATEMENT

Why you Received this Proxy Statement. You are viewing or have received these proxy materials because our Board is soliciting your proxy to vote your shares of Common Stock at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares. Instructions regarding how you can vote are contained on the proxy card included in the proxy materials.

Householding. The SEC’s rules permit us and banks, brokers, or other agents to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we and certain banks, brokers, or other agents have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at 1-866-540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

Questions and Answers about the 2024 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is February 12, 2024. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 145,557,567 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a "Record Holder" and holding shares in "Street Name"?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in "Street Name"?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in “street name” and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person, or by remote communication, or represented by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the 2024 Annual Meeting of Stockholders?

You may attend the Annual Meeting online only if you are a Seres stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. You may attend and participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/MCRB2024.

The meeting webcast will begin promptly at 8:00 a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 7:55 a.m. Eastern Time, and you should allow sufficient time for the check-in procedures.

To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your bank or broker holds your shares in street name, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote or ask questions.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

Why hold a virtual meeting?

We believe that hosting a virtual meeting is in the best interest of the Company and its stockholders and enables increased stockholder attendance and participation because stockholders can participate from any location around the world. Stockholders will have the same rights and opportunities to participate as they would have at an in-person meeting.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, (i) the Chairperson of the Annual Meeting, or a person designated by the Chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled

to vote thereon, present in person, or by remote communication, if applicable, or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning each enclosed proxy card in the enclosed envelope.

How do I vote?

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically. Your most recent proxy card or Internet proxy is the one that is counted.

Stockholders of Record. If you are a stockholder of record, you may vote:

•By Internet before the Annual Meeting—You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card;

•By Mail—You can vote by mail by signing, dating and mailing the printed proxy card, which you may have received by mail; or

•Electronically at the Annual Meeting—If you attend the meeting online, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the Annual Meeting.

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on April 3, 2024 (other than the voting that occurs during the Annual Meeting). To participate in the Annual Meeting, including to vote via the Internet, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in street name through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker.

If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote or ask questions. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date prior to the Annual Meeting;

•by granting a subsequent proxy through the Internet prior to the Annual Meeting;

•by giving written notice of revocation to the Secretary of Seres at 101 Cambridgepark Drive, Cambridge, MA 02140, as long as it is received prior to the Annual Meeting; or

•by voting online during the Annual Meeting.

Your most recent proxy card or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online during the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online during the Annual Meeting by obtaining your 16-digit control number or otherwise voting through the bank or broker.

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted by stockholders during the meeting that are pertinent to the Company and the meeting matters. The Company will endeavor to answer as many questions submitted by stockholders as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who Can Attend the 2024 Annual Meeting of Stockholders?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

•irrelevant to the business of the Company or to the business of the Annual Meeting;

•related to material non-public information of the Company, including the status or results of our business since our last Annual Report on Form 10-K;

•related to any pending, threatened or ongoing litigation;

•related to personal grievances;

•derogatory references to individuals or that are otherwise in bad taste;

•substantially repetitious of questions already made by another stockholder;

•in excess of the two question limit;

•in furtherance of the stockholder’s personal or business interests; or

•out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Secretary in their reasonable judgment.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who Can Attend the 2024 Annual Meeting of Stockholders?”.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of our Board of Directors. Our Board of Directors’ recommendations are indicated on page 1 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

|

|

|

Proposal |

Votes required |

Effect of Votes Withheld / Abstentions and Broker Non-Votes |

Proposal 1: Election of Directors |

The plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. |

Votes withheld and broker non-votes will have no effect. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. |

Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

Proposal 3: Approval, on an Advisory (Non- Binding) Basis, of the Compensation of Our Named Executive Officers |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. |

Abstentions and broker non-votes will have no effect. |

Proposal 4: Approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock |

The affirmative vote of the holders of a majority of the stock of the Company entitled to vote at the Annual Meeting. |

Abstentions will have the same effect as votes against. We do not expect any broker non-votes on this proposal. |

Proposal 5: Approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4 |

The affirmative vote of the holders of a majority of voting power of the votes cast affirmatively or negatively. |

Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

Proposal 6: Vote upon a stockholder proposal on simple majority vote |

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. |

Abstentions and broker non-votes will have no effect. |

What is an abstention and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” with respect to the other proposals, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors (Proposal 1), abstentions will have the same effect as a vote against the approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock (Proposal 4), and abstentions have no effect on the other proposals (Proposals 2, 3, 5 and 6).

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm (Proposal 2), the approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock (Proposal 4), and the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4 (Proposal 5) without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors (Proposal 1), the approval on an advisory (non-binding) basis of the compensation of our named executive officers (Proposal 3), and the stockholder proposal on simple majority vote (Proposal 6). Those items for which your broker cannot vote result in broker non-votes if you do not provide your broker with voting instructions on such items. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the 2024 Annual Meeting of Stockholders?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

Proposals to be Voted On

PROPOSAL 1

Election of Directors

At the Annual Meeting, two (2) Class III Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2027 and until such director’s successor is elected and qualified.

We currently have eight (8) directors on our Board, including two (2) current Class III Directors. Our current Class III Directors are Paul R. Biondi, who has served on our Board since March 2020, and Kurt C. Graves, who has served on our Board since November 2015. The Board has nominated each of Paul R. Biondi and Kurt C. Graves for election as Class III Directors at the Annual Meeting.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

As set forth in our Restated Certificate of Incorporation, the Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The members of the classes are divided as follows:

•the Class I Directors are Dennis A. Ausiello, M.D., Willard H. Dere, M.D., and Eric D. Shaff, and their term will expire at the 2025 Annual Meeting of Stockholders;

•the Class II Directors are Stephen A. Berenson, Richard N. Kender, and Claire M. Fraser, Ph.D., and their term will expire at the 2026 Annual Meeting of Stockholders; and

•the Class III Directors are Paul R. Biondi and Kurt C. Graves, and their term will expire at the Annual Meeting, and if elected, their subsequent term will expire at the 2027 Annual Meeting of Stockholders.

Our Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of our Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors. There are no family relationships among any of our executive officers or directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented thereby for the election as Class III Directors of the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by our Board of Directors or our Board of Directors may elect to reduce its size. The Board of Directors has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

VOTE REQUIRED

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the election of the below Class III Director nominees.

DIRECTOR NOMINEES AND CONTINUING DIRECTORS

|

|

|

|

|

Name |

Age |

Served as a Director Since |

Position with Seres |

Class and Year Term Ending |

Director Nominees |

|

|

|

|

Paul R. Biondi |

54 |

2020 |

Director |

Class III (Subsequent Term Ending 2027 if elected at the Annual Meeting) |

Kurt C. Graves |

56 |

2015 |

Director |

Class III (Subsequent Term Ending 2027 if elected at the Annual Meeting) |

Continuing Directors |

|

|

|

|

Dennis A. Ausiello, M.D. |

78 |

2015 |

Director |

Class I (Term Ending 2025) |

Stephen A. Berenson |

63 |

2019 |

Chairman of the Board of Directors |

Class II (Term Ending 2026) |

Willard H. Dere, M.D. |

70 |

2017 |

Director |

Class I (Term Ending 2025) |

Claire M. Fraser, Ph.D. |

68 |

2023 |

Director |

Class II (Term Ending 2026) |

Richard N. Kender |

68 |

2014 |

Director |

Class II (Term Ending 2026) |

Eric D. Shaff |

48 |

2019 |

President, Chief Executive

Officer and Director |

Class I (Term Ending 2025) |

The principal occupations and business experience, for at least the past five years, of each Director (including the Class III Director nominees) are as follows:

Paul R. Biondi has served as a member of our Board of Directors since March 2020. Mr. Biondi is an Executive Partner and President of Pioneering Medicines at Flagship Pioneering, a life sciences innovation firm which conceives, creates, resources and develops first-in-category bioplatform companies, roles he has held since November 2019. Mr. Biondi joined Flagship Pioneering following a seventeen-year tenure at Bristol-Myers Squibb, or BMS, a pharmaceutical company, where he was most recently the Senior Vice President of Strategy and Business Development from October 2015 to November 2019. Prior to serving in the role of Senior Vice President of Strategy, from 2002 to 2015, Mr. Biondi held a series of other leadership roles within BMS’ Research and Development organization overseeing strategy, portfolio, and project management, as well as clinical and business operations. Mr. Biondi holds a bachelor’s degree from Dartmouth College and an M.B.A. from the J.L. Kellogg School of Management at Northwestern University. We believe that Mr. Biondi is qualified to serve on our Board of Directors because of his extensive experience in biopharmaceutical strategy and corporate development.

Kurt C. Graves has served as a member of our Board of Directors since November 2015. Mr. Graves has served as the Chairman, President and Chief Executive Officer of i20 Therapeutics, Inc., a biotechnology company, since August 2023, and he previously served as the Executive Chairman of its board of directors from August 2021 to August 2023. Mr. Graves was previously the Chairman, President and Chief Executive Officer of Intarcia Therapeutics, Inc., a biotechnology company, from September 2010 to December 2020, and on its board of directors from August 2010 to December 2020. Previously, he served as Executive Vice President, Chief Commercial Officer and Head of Strategic Development at Vertex Pharmaceuticals Inc., or Vertex, from July 2007 to October 2009. Prior to joining Vertex, Mr. Graves held various senior leadership positions at Novartis Pharmaceuticals Corporation, or Novartis Corp., from 1999 to June 2007, including the Global General Medicines Business Unit Head and Global Chief Marketing Officer for the pharmaceuticals division of Novartis Corp. from September 2003 to June 2007. Prior to Novartis Corp., Mr. Graves held senior leadership positions at Merck and Astra-Merck where he led the U.S. Business Unit responsible for Prilosec, Nexium and Prilosec OTC over a 10-year period. He served as Chairman on the board of directors of Radius Health, Inc. from May 2011 to March 2020, and as a director on Achillion Pharmaceuticals, Inc., or Achillion, from June 2012 to January 2020, when Achillion was acquired. Mr. Graves received a B.S. in Biology from Hillsdale College. We believe Mr. Graves is qualified to serve as a member of our Board of Directors because of his extensive experience in the life sciences industry, membership on various boards of directors and his leadership and management experience.

|

|

|

|

DENNIS A. AUSIELLO, M.D. |

Age 78 |

Dennis A. Ausiello, M.D., has served as a member of our Board of Directors since April 2015. Dr. Ausiello has served as the Jackson Distinguished Professor of Clinical Medicine at Harvard Medical School and Director, Emeritus of Harvard Medical School’s M.D./Ph.D. Program since 1996, Chair of Medicine, Emeritus, and Director of the Center for Assessment Technology and Continuous Health (CATCH) at Massachusetts General Hospital, which he co-founded, since 2012, and

Physician-in-Chief Emeritus at Massachusetts General Hospital since 2013. From 1996 to April 2013, Dr. Ausiello served as the Chief of Medicine at Massachusetts General Hospital. Dr. Ausiello is a member of the Institute of Medicine of the National Academy of Sciences and a fellow of the American Academy of Arts and Sciences. Dr. Ausiello has served on the board of directors of Alnylam Pharmaceuticals since April 2012 and as Vice Chairman of the board of directors of Spexis AG, a clinical-stage biopharmaceutical company, since December 2021, and previously served on the board of directors of Pfizer Inc. from 2006 to 2020, where he currently serves on the advisory board since 2019. Dr. Ausiello also serves on the boards of directors of numerous privately held companies. Dr. Ausiello received a B.A. in Biochemistry from Harvard College and an M.D. from the University of Pennsylvania. We believe that Dr. Ausiello is qualified to serve on our Board of Directors because of his extensive experience as a physician and as a director of pharmaceutical companies.

|

|

|

|

STEPHEN A. BERENSON |

Age 63 |

Stephen A. Berenson has served as Chairman of our Board of Directors since December 2019 and as a member of our Board of Directors since August 2019. Mr. Berenson has been a Managing Partner at Flagship Pioneering, a life sciences innovation firm which conceives, creates, resources and develops first-in-category bioplatform companies, since June 2017. Prior to Flagship, Mr. Berenson spent 33 years in various roles as an investment banker at J.P. Morgan, most recently serving in the role of Vice Chairman of Investment Banking from 2005 to April 2017, where he focused on providing high-touch strategic advice and complex transaction execution to leading companies across all industries globally. He was co-founder of J.P. Morgan’s Global Strategic Advisory Council and co-founder of the firm’s Board Initiative. Mr. Berenson has served as chairman of the board of directors of Cellarity, a privately held pharmaceutical company, since July 2021, and has served on the board of directors of Moderna, Inc., a pharmaceutical and biotechnology company, since October 2017. Mr. Berenson received an S.B. in Mathematics from the Massachusetts Institute of Technology. We believe that Mr. Berenson is qualified to serve on our Board of Directors because of his extensive experience working with rapidly-growing companies across various industries.

|

|

|

|

WILLARD H. DERE, M.D. |

Age 70 |

Willard H. Dere, M.D., has served as a member our Board of Directors since July 2017. Dr. Dere has been Professor Emeritus, Department of Internal Medicine, at the University of Utah School of Medicine since July 2022. Prior to retirement, and beginning in November 2014, Dr. Dere held multiple roles at the University of Utah Health Sciences Center, including Associate Vice President for Research, Co-Director of the Utah Clinical and Translational Science Institute, and Co-Director of the Center for Genomic Medicine. Prior to his professorship, from 2003 until 2014, Dr. Dere worked at Amgen, where he was Senior Vice President and head of Global Development, and led development programs in multiple therapeutic areas. From 1989 to 2014, he worked at Eli Lilly and led multiple development programs, and also worked in clinical pharmacology, regulatory affairs and safety. Dr. Dere has served on the boards of directors of BioMarin Pharmaceutical, Inc. since 2016, Mersana Therapeutics, Inc. since 2018, and Metagenomi, Inc. since August 2021, and previously served on the boards of directors of Ocera Therapeutics and Radius Health. Dr. Dere received his B.A. in History and Zoology and M.D. from the University of California, Davis, completed his internal medicine residency training at the University of Utah, and his postdoctoral training in endocrinology and metabolism at the University of California, San Francisco. We believe Dr. Dere is qualified to serve on our Board of Directors due to his extensive academic experience and his knowledge of the biotechnology industry.

|

|

|

|

CLAIRE M. FRASER, PH.D. |

Age 68 |

Claire M. Fraser, Ph.D., has served as a member of our Board of Directors since January 2023. Since 2007, Dr. Fraser has been the director of the Institute for Genome Sciences and a Professor of Medicine and Microbiology and Immunology at the University of Maryland School of Medicine in Baltimore, Maryland. From 1998 to 2007, she served as president and director of The Institute for Genomic Research, a not-for-profit research organization engaged in human and microbial genomics studies. Dr. Fraser has served on the board of directors of Becton, Dickinson, and Company, a medical technology company, since 2006, and previously served as the Chair of the Board and a director of the American Association for the Advancement of Science. Dr. Fraser received her bachelor’s degree in Biology from Rensselaer Polytechnic Institute and her Ph.D. in Pharmacology from State University of New York-Buffalo. We believe Dr. Fraser is qualified to serve on our Board of Directors due to her extensive academic experience and her knowledge of the microbiome industry.

Richard N. Kender has served as a member of our Board of Directors since October 2014. From October 1978 to September 2013, Mr. Kender held positions in a variety of corporate areas at Merck & Co., Inc., or Merck, a pharmaceutical company, most recently serving as Senior Vice President of Business Development and Corporate Licensing. Mr. Kender has served on the boards of directors of Poxel S.A., a clinical stage biopharmaceutical company, since March 2015 and Bicycle Therapeutics PLC since July 2019. He previously served on the boards of directors of INC Research Holdings, Inc. (now known as Syneos Health) between December 2014 and August 2017, Abide Therapeutics, Inc., a privately held company, between December 2015 and May 2019, and ReViral Ltd., a privately held company, from November 2019 to June 2022. Mr. Kender received a B.S. in Accounting from Villanova University and an M.B.A. from Fairleigh Dickinson University. We believe Mr. Kender is qualified to serve on our Board of Directors because of his finance experience and knowledge of the biotechnology industry.

Eric D. Shaff has served as our President and Chief Executive Officer and a member of our Board of Directors since January 2019. Previously, he served as our Chief Operating and Financial Officer and Executive Vice President from January 2018 until January 2019 and as our Chief Financial Officer from November 2014 until January 2019. From January 2012 to November 2014, Mr. Shaff was Vice President of Corporate Finance for Momenta Pharmaceuticals, or Momenta, a biotechnology company, where he helped manage Momenta’s accounting, finance, planning, and procurement functions, as well as contributing to Momenta’s investor relations efforts. Prior to Momenta, Mr. Shaff held a number of corporate development and finance positions with Genzyme Corporation, a biotechnology company, most recently as Vice President of Finance/Controller for the Personalized Genetic Health division. Mr. Shaff previously served on the board of directors of Sigilon Therapeutics, Inc. from 2017 to August 2023. Mr. Shaff received his B.A. from the University of Pennsylvania and his M.B.A. from Cornell University. We believe Mr. Shaff is qualified to serve on our Board of Directors because of his extensive business and finance experience and his knowledge of the biotechnology industry.

|

|

|

|

Board Diversity Matrix (as of March 5, 2024) |

Board Size (Total Number of Directors): 8 |

|

Female |

Male |

Non-Binary |

Part I: Gender Identity |

Directors |

1 |

7 |

- |

Part II: Demographic Background |

Asian |

- |

2 |

- |

White |

1 |

6 |

- |

Two or More Races or Ethnicities |

- |

1 |

- |

PROPOSAL 2

Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors (the “Audit Committee”) has appointed PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Our Board of Directors has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of PricewaterhouseCoopers LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

PricewaterhouseCoopers LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2023. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of PricewaterhouseCoopers LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of PricewaterhouseCoopers LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2025. Even if the appointment of PricewaterhouseCoopers LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of our Company.

VOTE REQUIRED

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of PricewaterhouseCoopers LLP, we do not expect any broker non-votes in connection with this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm.

PROPOSAL 3

Approval, on an Advisory (Non-Binding) Basis, of the Compensation of Our Named Executive Officers

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Rule 14a-21 under the Exchange Act, we request that our stockholders cast a non-binding, advisory vote to approve the compensation of our named executive officers identified in the section titled “Executive and Director Compensation” set forth below in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, by a non-binding advisory vote, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative discussion.”

We believe that our compensation programs and policies for the year ended December 31, 2023 were an effective incentive for the achievement of our goals, aligned with stockholders’ interest and worthy of stockholder support. Additional details concerning how we structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Executive Compensation” set forth below in this proxy statement. In particular, we discuss how we design performance-based compensation programs and set compensation targets and other objectives to maintain a close correlation between Company and individual achievement.

This vote is merely advisory and will not be binding upon us, our Board of Directors or our Compensation and Talent Committee, nor will it create or imply any change in the duties of us, our Board of Directors or our Compensation and Talent Committee. The Compensation and Talent Committee will, however, take into account the outcome of the vote when considering future executive compensation decisions. At our 2023 Annual Meeting of Stockholders, approximately 99.4% of the votes cast on the “say-on-pay” proposal were voted “FOR” the proposal. The Board of Directors values constructive dialogue on executive compensation and other significant governance topics with our stockholders and encourages all stockholders to vote their shares on this important matter.

At our 2021 Annual Meeting of Stockholders held on June 16, 2021, our stockholders recommended, on an advisory basis, that the stockholder vote on the compensation of our named executive officers occur every year. In light of the foregoing recommendation, our board of directors determined to hold a “say-on-pay” advisory vote every year. Accordingly, our next advisory say-on-pay vote (following the non-binding advisory vote at this Annual Meeting) is expected to occur at the 2025 Annual Meeting of Stockholders.

VOTE REQUIRED

The approval, on an advisory (non-binding) basis, of the compensation of our named executive officers will require the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers.

PROPOSAL 4

Approval of an Amendment to Our Restated Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock

Our Restated Certificate of Incorporation, as amended (our “Restated Certificate of Incorporation”), currently authorizes the issuance of 240,000,000 shares of Common Stock, par value $0.001 per share. On February 22, 2024, our Board adopted a resolution to amend the Restated Certificate of Incorporation, subject to stockholder approval, by increasing the number of authorized shares of our Common Stock to 360,000,000 shares (the “Share Increase Amendment”). The additional 120,000,000 shares of Common Stock authorized for issuance pursuant to the proposed Share Increase Amendment would be part of the existing class of Common Stock and, if and when issued, would have the same rights and privileges as the shares of Common Stock presently issued and outstanding. The holders of Common Stock are not entitled to preemptive rights or cumulative voting.

The Share Increase Amendment will not affect the number of authorized shares of preferred stock of the Company, par value $0.001 per share, which is 10,000,000 shares. Currently, there are no shares of preferred stock issued and outstanding.

If our stockholders approve this proposal, then the first sentence of Article FOURTH of our Restated Certificate of Incorporation will be deleted and replaced in its entirety to read as follows:

“The total number of shares of all classes of stock that the Corporation shall have authority to issue is 370,000,000 shares, consisting of (a) 360,000,000 shares of Common Stock, $0.001 par value per share (“Common Stock”), and (b) 10,000,000 shares of Preferred Stock, $0.001 par value per share (“Preferred Stock”).”

Purpose of Share Increase Amendment

Our Board believes it is in the best interests of the Company and our stockholders to increase our authorized shares of Common Stock in order to have additional shares available for use as our Board deems appropriate or necessary. As such, the primary purpose of the Share Increase Amendment is to provide the Company with greater flexibility with respect to managing its Common Stock in connection with such corporate purposes as may, from time to time, be considered advisable by our Board. These corporate purposes could include, without limitation, financing activities, public or private offerings of Common Stock, stock dividends or splits, conversions of convertible securities, issuance of options and other equity awards pursuant to our incentive plans, establishing a strategic relationship with a corporate collaborator and acquisition transactions. Having an increased number of authorized but unissued shares of Common Stock would allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in our capitalization. Our Board will determine whether, when and on what terms the issuance of shares of Common Stock may be warranted in connection with any of the foregoing purposes.

Effect of Approval of Proposed Amendment

The following table illustrates the effect the proposed Share Increase Amendment would have on the number of shares of Common stock available for issuance, if approved by our stockholders:

|

|

|

|

|

|

|

|

|

As of March 1, 2024 |

|

|

Upon Effectiveness of Amendment |

|

TOTAL AUTHORIZED SHARES OF COMMON STOCK |

|

240,000,000 |

|

|

|

360,000,000 |

|

Outstanding shares of Common Stock |

|

151,009,462 |

|

|

|

151,009,462 |

|

Shares of Common Stock authorized for future issuance under the Company’s incentive plans |

|

3,458,907 |

|

|

|

3,458,907 |

|

Shares of Common Stock authorized for future issuance under the Company’s employee stock purchase plan |

|

2,666,512 |

|

|

|

2,666,512 |

|

Shares of Common Stock subject to outstanding equity awards under the Company’s incentive plans |

|

17,633,793 |

|

|

|

17,633,793 |

|

Shares of Common Stock issuable upon exercise of outstanding warrants |

|

1,177,433 |

|

|

|

1,177,433 |

|

Total outstanding shares of Common Stock and shares of Common Stock Reserved |

|

175,946,107 |

|

|

|

175,946,107 |

|

Unreserved shares of Common Stock available for issuance(1) |

|

64,053,893 |

|

|

|

184,053,893 |

|

(1) Includes shares of Common Stock, if any, that may be issued under the “at the market" equity offering program.

Other than shares that will be reserved for issuance under our existing incentive plans, employee stock purchase plan, and "at the market" equity offering program, we do not currently have any arrangements, agreements or understandings that would require the issuance of additional shares of Common Stock . Because our directors and executive officers have outstanding equity awards under our incentive plans, and may be granted additional equity awards under these plans, they may be deemed to have an indirect interest in the Share Increase Amendment because, absent the amendment, the Company may not have sufficient authorized shares to make future awards.

The Share Increase Amendment will not have any immediate effect on the rights of existing stockholders. However, our Board will have the authority to issue authorized Common Stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or rules of the Nasdaq Stock Market. Future issuances of Common Stock or securities convertible into or exchangeable for Common Stock could have a dilutive effect on our earnings per share, book value per share and the voting power and interest of current stockholders.

If the Share Increase Amendment is approved by stockholders, all other sections of the Restated Certificate of Incorporation would be maintained in their current form. The Share Increase Amendment would become effective upon the filing of a Certificate of Amendment to our Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, which the Company intends to do promptly after the Annual Meeting if this Proposal is approved by stockholders. In the event that the Share Increase Amendment is not approved by our stockholders at the Annual Meeting, the current Restated Certificate of Incorporation would remain in effect in its entirety. Our Board reserves the right, notwithstanding stockholder approval of the Share Increase Amendment and without further action by our stockholders, not to proceed with the Share Increase Amendment at any time before it becomes effective.

Potential Anti-Takeover Effect

Our Board has not proposed the Share Increase Amendment with the intention of discouraging tender offers or takeover attempts of the Company. However, the availability of additional authorized shares for issuance could, under certain circumstances, discourage or make more difficult efforts to obtain control of our company. This proposal is not being presented with the intent that it be used to prevent or discourage any acquisition attempt, but nothing would prevent our Board from taking any appropriate actions not inconsistent with its fiduciary duties.

Dissenters’ Rights of Appraisal

Under Delaware law, stockholders are not entitled to appraisal rights with respect to the Share Increase Amendment, and we will not independently provide our stockholders with any such right.

VOTE REQUIRED

The approval of the Share Increase Amendment will require the affirmative vote of the holders of a majority of the stock of the Company entitled to vote at the Annual Meeting. Abstentions will have the same effect as votes against this Proposal. Because brokers have discretionary authority to vote on this Proposal, we do not expect any broker non-votes in connection with this Proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock.

PROPOSAL 5

Approval of an Adjournment of the Annual Meeting

Our stockholders are being asked to approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4.

VOTE REQUIRED

The approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4 will require the affirmative vote of the holders of a majority of voting power of the votes cast affirmatively or negatively. Abstentions will have no effect on this Proposal. Because brokers have discretionary authority to vote on this Proposal, we do not expect any broker non-votes in connection with this Proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “FOR” the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 4.

PROPOSAL 6

Stockholder Proposal on Simple Majority Vote

Kenneth Steiner, whose listed address is 14 Stoner Avenue, 2M, Great Neck, New York 11021, has notified us of his intent to present the following proposal at the Annual Meeting. The stockholder proposal is required to be voted upon at our Annual Meeting only if properly presented by or on behalf of Mr. Steiner. Mr. Steiner has provided his proxy for John Chevedden to act on Mr. Steiner’s behalf with respect to the proposal. We are not responsible for the accuracy or content of the proposal or supporting statement, which are presented below as received from the stockholder proponent in accordance with SEC rules. We will promptly provide you with the number of voting securities held by Mr. Steiner, to our knowledge, upon receiving a written or oral request at c/o Secretary, Seres Therapeutics, Inc., 101 Cambridgepark Drive, Cambridge, MA 02140, or by phone at: (617) 945-9626.

If properly presented at the Annual Meeting by or on behalf of the stockholder proponent, our Board of Directors opposes and unanimously recommends that you vote “AGAINST” the Stockholder Proposal for the reasons stated under “Statement in Opposition to the Stockholder Proposal.”

STOCKHOLDER PROPOSAL

Proposal 6 – Simple Majority Vote

Shareholders request that our board take each step necessary so that each voting requirement in our charter and bylaws (that is explicit or implicit due to default to state law) that calls for a greater than simple majority vote be replaced by a requirement for a majority of the votes cast for and against applicable proposals, or a simple majority in compliance with applicable laws. If necessary this means the closest standard to a majority of the votes cast for and against such proposals consistent with applicable laws. This includes making the necessary changes in plain English.

Shareholders are willing to pay a premium for shares of companies that have excellent corporate governance. Supermajority voting requirements have been found to be one of 6 entrenching mechanisms that are negatively related to company performance according to "What Matters in Corporate Governance" by Lucien Bebchuk, Alma Cohen and Allen Ferrell of the Harvard Law School. Supermajority requirements are used to block initiatives supported by most shareowners but opposed by a status quo management.

This proposal topic won from 74% to 88% support at Weyerhaeuser, Alcoa, Waste Management, Goldman Sachs, FirstEnergy, McGraw-Hill and Macy’s. These votes would have been higher than 74% to 88% if more shareholders had access to independent proxy voting advice. This proposal topic also received overwhelming 98%-support each at the 2023 annual meetings of American Airlines (AAL) and The Carlyle Group (CG).

Please vote yes:

Simple Majority Vote – Proposal 6.

STATEMENT IN OPPOSITION TO THE STOCKHOLDER PROPOSAL

This stockholder proposal broadly requests that every voting requirement in our Restated Certificate of Incorporation or Amended and Restated Bylaws that calls for a greater than simple majority vote, regardless of what the voting requirement is or what it addresses, be replaced by a blanket “majority of vote cast” standard or “a simple majority in compliance with applicable laws”. The Board has given careful consideration to the stockholder proposal and, for the following reasons, does not believe that this stockholder proposal would enhance the Company’s corporate governance or be in the best interests of the Company or its stockholders.

Existing Supermajority Voting Thresholds Apply in Limited Circumstances

Apart from the election of directors, the Company’s current governance documents require the vote of a majority of the shares present and entitled to vote for all matters submitted for stockholder approval, except in certain limited circumstances, including approving the removal of directors or modifying the Amended and Restated Bylaws or certain sections of the Company’s Restated Certificate of Incorporation. Under the proposed standard, however, only a “majority

of the votes cast” or “a simple majority in compliance with applicable laws” would be required to approve such fundamental corporate actions.

The Board believes that in certain limited circumstances, the higher voting requirements are appropriate and desirable, because certain fundamental matters should require the support of a broad consensus of the Company’s stockholders, rather than a simple majority of the votes present at a meeting. The Board believes that the limited supermajority requirements the Company has in place are appropriate to maintain the stability of our operations, while striking an appropriate balance that allows for fundamental changes where there is strong stockholder consensus. In this manner, supermajority thresholds also assist in maximizing long-term value to all stockholders and have the effect of deterring hostile takeovers of our Company that may not be in the best interests of the Company and our stockholders.

Existing Supermajority Voting Thresholds Benefit a Wide Base of Stockholders

The stockholder proposal’s request to eliminate all supermajority provisions would leave our stockholders vulnerable to self-interested and potentially abusive actions proposed by small groups of stockholders who hold a large number of shares and who may seek to, and with a simple majority standard be more easily able to, advance their own interests over the interests of all of the Company’s other stockholders.

For example, if the stockholder proposal were implemented and a quorum of 50.1% of the Company’s outstanding shares was present at a stockholders meeting, certain fundamental matters, such as amending the Company’s Amended and Restated Bylaws, could be adopted by stockholders who hold 25.1% of the Company’s outstanding shares. As of February 1, 2024, based on publicly available information filed pursuant to Section 13 of the Exchange Act, four of the Company’s largest stockholders held an aggregate of approximately 40% of the Company’s outstanding shares. If this stockholder proposal were implemented, it would be possible for just two of our largest stockholders to, without any other stockholder support, approve a proposal amending our Amended and Restated Bylaws. As such, if this stockholder proposal is approved, a very small group of stockholders, who are not bound by a fiduciary duty to act in the best interests of the Company and its stockholders, would have outsized power to act in their own respective self-interests, potentially to the detriment of the Company and the Company’s other stockholders.

Our Current Governance Structure Promotes Effective Board Oversight

The stockholder proposal is both vague and overbroad in that it does not specify which provisions that the stockholder proponent is seeking to change. The Board and the Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating and Corporate Governance Committee”) do not believe that indiscriminate elimination of all supermajority voting requirements and the imposition of a blanket “majority of votes cast” or “simple majority in compliance with applicable laws” standard, without regard for how such a voting requirement would apply to each provision it impacts, or how that, in turn, would impact the Company’s stockholders, would be in the best interests of our stockholders. Our Board is committed to effective corporate governance and has adopted a wide range of practices and procedures that promote effective Board oversight. For example:

•we have an independent Chairman of the Board;

•the Board is comprised of a substantial majority of independent directors (7 of 8 directors are independent), and all of the Board’s standing committees are comprised entirely of independent directors;

•we have adopted anti-hedging and anti-pledging policies that align our directors’ and executive officers’ interests with those of our stockholders;

•the Nominating and Corporate Governance Committee oversees an annual evaluation process of the Board and its standing committees;

•all director nominees are evaluated in the same manner by the Nominating and Corporate Governance Committee, without regard to the source of the nominee recommendation;

•executive sessions of independent directors are held at every regular Board meeting and each standing committee meeting;

•we disclose a clear mechanism that enables stockholders to communicate directly with the Board;

•the Nominating and Corporate Governance Committee and the Board engage in an ongoing review and refreshment of Board membership; and

•we hold an annual say-on-pay vote.

Consistent with its current practice, the Board will continue to evaluate the future implementation of appropriate corporate governance changes.

However, the Board strongly urges an AGAINST vote on this stockholder proposal that risks:

•disrupting an appropriate balance between safeguarding the stability of our operations while allowing fundamental changes where there is wide stockholder consensus;

•providing a small minority of stockholders who hold a large amount of the Company’s outstanding shares and who have no fiduciary duty to the Company and its stockholders with the ability to, without wide stockholder consensus, act in their own respective self-interests, potentially to the detriment of the Company and the Company’s other stockholders; and

•indiscriminately eliminating all supermajority voting requirements in our Restated Certificate of Incorporation and Amended and Restated Bylaws, without regard for how such a voting requirement would apply to each provision it impacts, or how such a change would impact the Company’s stockholders.

For these reasons, the Board does not believe it is in the best interests of stockholders to implement the stockholder proposal’s request.

VOTE REQUIRED

The approval of the stockholder proposal on simple majority vote will require the affirmative vote of the holders of a majority of voting power of the votes cast affirmatively or negatively. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote “AGAINST” the stockholder proposal on simple majority vote.

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2023 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm the matters that they are required to provide to the Audit Committee, including the matters required to be discussed by the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from the Company.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Richard N. Kender (Chair)

Claire M. Fraser, Ph.D.

Willard H. Dere, M.D.

Independent Registered Public Accounting Firm Fees and Other Matters