As filed with the Securities and Exchange Commission on March 8, 2024

Registration No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LivePerson, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 13-3861628 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 530 7th Avenue, Floor M1 |

| New York, New York 10018 |

| (Address of Principal Executive Offices) (Zip Code) |

LivePerson, Inc. 2018 Inducement Plan, as amended

(Full title of the Plans)

Monica L. Greenberg, Esq.

Executive Vice President of Policy and General Counsel

LivePerson, Inc.

530 7th Avenue, Floor M1

New York, New York 10018

(212) 609-4200

(Name, address, including zip code, and telephone number, including area code, of Agent for Service)

Copy to:

Mark Hayek, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, NY 10004-1980

(212) 859-8000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ¨ | Accelerated filer ☒ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

On February 13, 2024, the Board of Directors of LivePerson, Inc. (the “Registrant”), approved an amendment of the Registrant’s 2018 Inducement Plan, as amended (the “Inducement Plan”), which provides for grants of equity awards to induce individuals to accept employment with the Registrant and its affiliates. Under the amendment, the number of shares of Common Stock that may be issued pursuant to the Inducement Plan was increased by 5,300,000 shares of Common Stock. This registration statement on Form S-8 (this “Registration Statement”) relates to the additional 5,300,000 shares of Common Stock authorized for future issuance under the Inducement Plan, and the associated rights to Purchase Series A Junior Participating Preferred Stock (the “Purchase Rights”).

Pursuant to General Instruction E to Form S-8, the contents of the registration statements on Form S-8 with respect to the Inducement Plan (File No. 333-224059) filed with the Securities and Exchange Commission (the “Commission”) on March 30, 2018, February 1, 2019, November 13, 2019, and May 12, 2022, including the information contained therein, are hereby incorporated by reference in this Registration Statement, except to the extent supplemented, amended or superseded by the information set forth herein.

PART I

As permitted by the rules of the Commission, this Registration Statement omits the information specified in Part I of Form S-8. The documents containing the information specified in Part I will be sent or given to the participants in the Inducement Plan, as required by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). Such documents are not being filed with the Commission as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration Statement pursuant to General Instruction E to Form S-8, taken together, constitute a prospectus, for the Inducement Plan, that meets the requirements of Section 10(a) of the Securities Act.

PART II

Item 3. Incorporation of Documents by Reference.

The Registrant is subject to the informational and reporting requirements of Sections 13(a), 14, and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files reports, proxy statements and other information with the Commission. The following documents, which are on file with the Commission, are incorporated in the Registration Statement by reference:

(a) The Registrant’s latest annual report filed pursuant to Sections 13(a) or 15(d) of the Exchange Act or the latest prospectus filed pursuant to Rule 424(b) under the Securities Act that contains audited financial statements for the Registrant’s latest fiscal year for which such statements have been filed.

(b) All other reports filed pursuant to Sections 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s documents referred to in (a) above.

(c) The description of the Registrant’s Common Stock contained in the Registrant’s registration statement on Form 8-A12G filed with the Commission under the Exchange Act on March 28, 2000, including any amendment or report filed for the purpose of updating such description.

(d) The description of the Purchase Rights contained in the Registrant’s registration statement on Form 8- A12B filed with the Commission under the Exchange Act on January 22, 2024, including any amendment or report filed for the purpose of updating such description.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of the filing of such documents, except as to specific sections of such statements as set forth therein. Unless expressly incorporated into this Registration Statement, a report furnished on Form 8-K prior or subsequent to the date hereof shall not be incorporated by reference into this Registration Statement. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Not applicable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed herewith:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exhibit Number | | | | Incorporated by Reference | | Filed Herewith |

| Exhibit Description | | Form | | File No. | | Exhibit | | Filing Date | |

| | | | | | | | | | | | |

| 4.1 | | | | 10-K | | 000-30141 | | 3.1 | | March 30, 2001 | | |

| | | | | | | | | | | |

| 4.2 | | | | S-8 | | 333-234676 | | 4.2 | | November 13, 2019 | | |

| | | | | | | | | | | | |

| 4.3 | | | | 8-K | | 000-30141 | | 3.1 | | June 12, 2023 | | |

| | | | | | | | | | | | |

| 4.4 | | | | 8-K | | 000-30141 | | 3.1 | | January 22, 2024 | | |

| | | | | | | | | | | | |

| 4.5 | | | | 8-K | | 000-30141 | | 4.1 | | January 22, 2024 | | |

| | | | | | | | | | | | |

| 4.6 | | | | 8-K | | 000-41926 | | 4.1 | | February 16, 2024 | | |

| | | | | | | | | | | | |

| 5.1* | | | | | | | | | | | | X |

| | | | | | | | | | | |

| 23.1* | | | | | | | | | | | | X |

| | | | | | | | | | | | |

| 23.2* | | Consent of Fried, Frank, Harris, Shriver & Jacobson LLP (included in Exhibit 5.1 to this Registration Statement). | | | | | | | | | | X |

| | | | | | | | | | | |

| 24.1* | | Power of Attorney authorizing signature (on behalf of each officer and director included on the signature page to this Registration Statement). | | | | | | | | | | X |

| | | | | | | | | | | | |

| 99.1 | | | | S-8 | | 333-264897 | | 99.1 | | May 12, 2022 | | |

| | | | | | | | | | | | |

| 99.2* | | | | | | | | | | | | X |

| | | | | | | | | | | | |

| 107* | | | | | | | | | | | | X |

* Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on the 8th day of March, 2024.

| | | | | | | | |

| LIVEPERSON, INC. |

Date: March 8, 2024 | | |

| | |

| By: | /s/ John Collins |

| Name: | John Collins |

| Title: | Chief Financial Officer and Chief Operating Officer |

POWER OF ATTORNEY

We, the undersigned officers and directors of LivePerson, Inc. (the "Company"), hereby severally constitute and appoint John Collins, Jeffrey Ford and Monica L. Greenberg, and each of them singly, as our true and lawful attorneys with full power to them, and each of them singly, to sign for us and in our names in the capacities indicated below, the registration statement on Form S-8 filed herewith and any and all subsequent amendments to said registration statement, and generally to do all such things in our names and on our behalf in our capacities as officers and directors to enable the Company to comply with the provisions of the Securities Act of 1933, as amended, and all requirements of the Securities and Exchange Commission, hereby ratifying and confirming our signatures as they may be signed by our said attorneys, or any of them, to said registration statement and any and all amendments thereto.

Pursuant to the requirements of the Securities Act of 1933, the Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

Signature | | Title | | Date |

| | | |

| /s/ Anthony John Sabino | | Chief Executive Officer (Principal Executive Officer) and Director | | March 8, 2024 |

| Anthony John Sabino | | | |

| | | | |

/s/ John Collins | | Chief Financial Officer (Principal Financial Officer) and Chief Operating Officer | | March 8, 2024 |

| John Collins | | | |

| | | | |

| /s/ Jeffrey Ford | | Senior Vice President and Chief Accounting Officer (Principal Accounting Officer) | | March 8, 2024 |

| Jeffrey Ford | | | |

| | | | |

/s/ Jill Layfield | | Chair of the Board | | March 8, 2024 |

| Jill Layfield | | | | |

| | | | |

/s/ James Miller | | Director | | March 8, 2024 |

| James Miller | | | | |

| | | |

/s/ Bruce Hansen | | Director | | March 8, 2024 |

| Bruce Hansen | | | | |

| | | |

| /s/ Vanessa Pegueros | | Director | | March 8, 2024 |

| Vanessa Pegueros | | | | |

| | | |

/s/ William G. Wesemann | | Director | | March 8, 2024 |

| William G. Wesemann | | | | |

| | | |

/s/ Kevin C. Lavan | | Director | | March 8, 2024 |

| Kevin C. Lavan | | | | |

| | | | |

| /s/ Yael Zhang | | Director | | March 8, 2024 |

| Yael Zhang | | | | |

Exhibit 107

CALCULATION OF FILING FEE TABLES

FORM S-8

(Form Type)

LivePerson, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | | Proposed Maximum

Offering Price

Per Unit |

Maximum

Aggregate

Offering Price | Fee Rate | Amount of

Registration Fee |

| Equity | Common Stock, $0.001 par value per share | Rule 457(c) and Rule 457(h) | | | | | | |

| LivePerson, Inc. 2018 Inducement Plan, as amended | Rule 457(c) and Rule 457(h)

| 5,300,000(2)

| | $1.07 | $5,671,000 | $0.0001476 | $838 |

| | | | | | | | |

| Total Offering Amounts | | | $5,671,000 | | $838 |

| Total Fee Offsets | | | | | — | |

| Net Fee Due | | | | | $838 |

(1)Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act"), the registration statement on Form S-8 (the "Registration Statement") shall also cover any additional shares of common stock of LivePerson, Inc. (the "Registrant") that become issuable in respect of the securities identified in the above table by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration that results in an increase in the number of the outstanding shares of the Registrant's common stock.

(2)Represents 5,300,000 additional shares of the Registrant's common stock that were authorized for issuance under the Registrant's 2018 Inducement Plan, as amended.

(3)Estimated in accordance with Rules 457(c) and (h) of the Securities Act, solely for the purpose of calculating the registration fee. The proposed maximum offering price per share of $1.07 was computed by averaging the high and low prices of a share of the Registrant's common stock reported on NASDAQ on March 6, 2024, a date within five business days prior to the date of the filing of this Registration Statement.

FRIED, FRANK, HARRIS, SHRIVER & JACOBSON LLP

Exhibit 5.1

March 8, 2024

LivePerson, Inc.

530 7th Ave., Floor M1

New York, New York 10018

Re: LivePerson, Inc. Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to LivePerson, Inc., a Delaware corporation (the “Company”), in connection with the Company’s Registration Statement on Form S-8 (together with any amendments thereto, the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of an aggregate of 5,300,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), together with the rights to Purchase Series A Junior Participating Preferred Stock (the “Rights”) associated therewith, issuable under the LivePerson, Inc. 2018 Inducement Plan, as amended (the “2018 Inducement Plan”) (such shares of Common Stock issuable under the 2018 Inducement Plan, the “Shares”). The terms of the Rights are set forth in the Tax Benefits Preservation Plan, dated as of January 22, 2024, between the Company and Equiniti Trust Company, LLC as rights agent, as amended by Amendment No. 1 thereto, dated as of February 16, 2024, to the Tax Benefits Preservation Plan, between LivePerson, Inc. and Equiniti Trust Company, LLC (such Tax Benefits Preservation Plan, as so amended, the “Rights Agreement”). With your permission, all assumptions and statements of reliance herein have been made without any independent investigation or verification on our part and we express no opinion with respect to the subject matter or accuracy of such assumptions or items relied upon.

In connection with this opinion, we have (i) investigated such questions of law, (ii) examined the originals or certified, conformed, electronic or reproduction copies of such agreements, instruments, documents and records of the Company, such certificates of public officials and such other documents and (iii) received such information from officers and representatives of the Company and others as we have deemed necessary or appropriate for the purposes of this opinion.

In all such examinations, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of original and certified documents and the conformity to original or certified documents of all copies submitted to us as conformed, electronic or reproduction copies. As to various questions of fact relevant to the opinion expressed herein, we have relied upon, and assume the accuracy of, certificates and oral or written statements and other information of or from public officials and officers and representatives of the Company. We have further assumed that the Rights Agreement has been duly authorized, executed and delivered by the Rights Agent.

Based upon the foregoing and subject to the limitations, qualifications and assumptions set forth herein, we are of the opinion that:

1.The Shares registered pursuant to the Registration Statement to be issued by the Company have been duly authorized and, when issued, delivered and paid for in accordance with the terms of the 2018 Inducement Plan, and the applicable award agreement, as applicable, for

consideration in an amount at least equal to the par value of such Shares, will be validly issued, fully paid and nonassessable.

2.The Right associated with each Share has been duly authorized and will be a valid and legally binding obligation of the Company when (i) such associated Share shall have been duly issued as set forth in paragraph 1 above and (ii) such Right shall have been duly issued in accordance with the terms of the Rights Agreement.

In rendering the opinion in paragraph 2 above, we (i) have further assumed that the members of the board of directors of the Company (the “Board”) have acted in a manner consistent with their fiduciary duties as required under applicable law in adopting the Rights Agreement; and (ii) express no opinion as to the determination that a court of competent jurisdiction may make regarding whether the Board may be required to redeem or terminate, or take other action with respect to, the Rights in the future based on the facts and circumstances then existing. The opinion expressed in paragraph (2) above addresses the Rights and the Rights Agreement in their entirety, and it should be understood that it is not settled whether the invalidity of any particular provision of a rights agreement or the purchase rights issued thereunder would invalidate such rights in their entirety.

The opinions expressed herein are limited to the applicable provisions of the General Corporation Law of the State of Delaware, as currently in effect, and no opinion is expressed with respect to any other laws or any effect that such other laws may have on the opinion expressed herein. The opinions expressed herein are limited to the matters stated herein and no opinion is implied or may be inferred beyond the matters expressly stated herein. We undertake no responsibility to update or supplement this letter after the effectiveness of the Registration Statement.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

| | |

| Very truly yours, |

|

| /s/ FRIED, FRANK, HARRIS, SHRIVER & JACOBSON LLP |

|

| FRIED, FRANK, HARRIS, SHRIVER & JACOBSON LLP |

|

|

|

|

|

| | |

Tel: 212-371-4446 Fax: 212-371-9374 www.bdo.com

|

| | |

200 Park Ave, 38th Floor New York, NY 10166

|

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in this Registration Statement of our reports dated March 4, 2024, relating to the consolidated financial statements and the effectiveness of internal control over financial reporting, of LivePerson, Inc. (the "Company") appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

/s/ BDO USA, P.C.

BDO USA, P.C.

New York, New York

March 8, 2024

BDO USA, P.C., a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms.

BDO is the brand name for the BDO network and for each of the BDO Member Firms.

Amendment to the LivePerson, Inc. 2018 Inducement Plan (as amended through

February 9, 2022)

This Amendment (this “Amendment”) of the LivePerson, Inc. 2018 Inducement Plan (as amended through February 9, 2022), is dated as of February 13, 2024.

WHEREAS, the Board of Directors of LivePerson, Inc. (the “Company”) has adopted and subsequently amended the LivePerson, Inc. 2018 Inducement Plan (as amended through February 9, 2022) (the “Plan”); and

WHEREAS, the Board of Directors of the Company deems it to be in the best interest of the Company to amend the Plan to increase the number of shares available for issuance under the Plan by 5,300,000 shares.

NOW, THEREFORE, the Plan shall be amended as follows:

1.Stock Available for Awards. Subsection 4(a)(1) of the Plan shall be deleted in its entirety and the following substituted in lieu thereof:

(a)(1) Number of Shares. Subject to adjustment under Section 9, Awards may be made under the Plan for up to the number of shares of common stock, $0.001 par value per share, of the Company (the “Common Stock”) that is equal to 11,459,009 shares of Common Stock.

2.Except as expressly amended by this Amendment, all terms and conditions of the Plan shall remain in full force and effect.

IN WITNESS WHEREOF, the undersigned Secretary of the Company certifies that the foregoing Amendment to the Plan was duly adopted by the Board of Directors.

LIVEPERSON, INC.

/s/ Monica Greenberg

_______________________

By: Monica Greenberg

Title: General Counsel

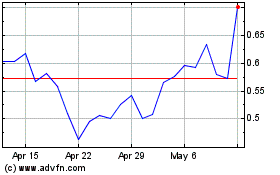

LivePerson (NASDAQ:LPSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

LivePerson (NASDAQ:LPSN)

Historical Stock Chart

From Apr 2023 to Apr 2024