false

0001507957

0001507957

2024-02-29

2024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 29, 2024

IDEAL POWER INC.

(Exact name of registrant as specified in Charter)

|

Delaware

|

|

001-36216

|

|

14-1999058

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File No.)

|

|

(IRS Employee Identification No.)

|

5508 Highway 290 West, Suite 120

Austin, Texas, 78735

(Address of Principal Executive Offices)

512-264-1542

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act (17 CFR 240.13(e)-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

IPWR

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 29, 2024, Ideal Power Inc. (the “Company”) issued a press release announcing its financial results for the three months and full year ended December 31, 2023. The press release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in its entirety into this Item 2.02. The press release contains forward-looking statements regarding the Company and includes cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

The Company will host a conference call with investors to discuss the results. The conference call will begin at 10:00 a.m. Eastern time on Thursday, February 29, 2024. The call may be accessed in the U.S. by dialing 1-888-506-0062 and asking to be joined to the Ideal Power Inc. call. A webcast and replay of the call may be found at https://www.webcaster4.com/Webcast/Page/2987/49960.

The information furnished under this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of that Section. The information in this Item 2.02, including Exhibit 99.1, shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: February 29, 2024

|

IDEAL POWER INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Timothy Burns

|

|

| |

|

Timothy Burns

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Ideal Power Reports Fourth Quarter and Full Year 2023 Financial Results

AUSTIN, TX – February 29, 2024 -- Ideal Power Inc. (“Ideal Power,” the “Company,” “we,” “us” or “our”) (Nasdaq: IPWR), pioneering the development and commercialization of the highly efficient and broadly patented B-TRAN™ bidirectional semiconductor power switch, reports results for its fourth quarter and full year ended December 31, 2023.

“We made great progress delivering against our B-TRAN™ commercial roadmap in 2023 and that progress has continued into 2024,” said Dan Brdar, President and Chief Executive Officer of Ideal Power. “Strong momentum continues with participants in our test and evaluation program, particularly for solid-state circuit breaker and hybrid and electric vehicle applications. We expect to convert large OEMs into design wins and/or additional custom development agreements this year.”

Brdar continued, “We recently completed Phase II of our development agreement with Stellantis and commenced shipment of SymCool™ power modules to fulfill customer orders. We expect industrial markets, particularly the solid-state circuit breaker market served by our SymCool™ power module, to be the earliest source of our product sales ramp.”

Key Fourth Quarter and Recent Operational Highlights

| |

●

|

Commenced commercial shipment of SymCool™ power modules to fulfill customer orders. The SymCool™ power module targets several applications including solid-state switchgear and circuit protection, renewable energy inverters for solar and wind, industrial inverters, hybrid and electric vehicles (“EVs”) and EV charging.

|

| |

●

|

Successfully completed Phase II of a product development program with Stellantis, a top 10 global automaker. All Phase II deliverables were completed ahead of schedule including a wafer run and deliveries of tested B-TRAN™ devices, drivers and a Stellantis approved comprehensive reliability test plan for automotive qualification. Ideal Power is partnering with Stellantis’ advanced technology development team to develop a custom B-TRAN™ power module for use in EV drivetrain inverters in Stellantis’ next generation EV platform.

|

| |

●

|

Stellantis recognized Ideal Power and its program with Stellantis as a finalist in the 2023 Stellantis Venture Awards, which was the result of the excellent performance of the commercial B-TRAN™ devices provided to the Stellantis team for testing and evaluation.

|

| |

●

|

Released B-TRAN™ and SymCool™ videos and application notes for the technical audience at prospective customers, resulting in the addition of new opportunities to our sales funnel. The videos demonstrate the testing of discrete B-TRAN™ devices and SymCool™ power modules and the compelling advantages B-TRAN™ offers to solid-state circuit breaker applications.

|

| |

●

|

Nearing completion of a qualification run with our second high-volume wafer fabrication partner. This wafer fab in Europe will support future revenue growth and add dual sourcing for wafer fabrication.

|

| |

●

|

B-TRAN™ Patent Estate: Currently at 82 issued B-TRAN™ patents with 36 of those issued outside of the United States and 39 pending B-TRAN™ patents. Current geographic coverage includes North America, China, Japan, South Korea, India, and Europe, with pending coverage in Taiwan.

|

Fourth Quarter and Full Year 2023 Financial Results

| |

●

|

Commercial revenue increased to $61,483 in the fourth quarter of 2023 from $0 in the fourth quarter of 2022. Commercial revenue increased to $161,483 for the full year 2023 from $0 for the full year 2022.

|

| |

●

|

Grant revenue was $0 in the fourth quarter of 2023 and $37,388 for the full year 2023 compared to $16,608 in the fourth quarter of 2022 and $203,269 for the full year 2022.

|

| |

●

|

Operating expenses in the fourth quarter of 2023 were $2.5 million compared to $2.0 million in the fourth quarter of 2022 driven primarily by higher research and development spending.

|

| |

●

|

Operating expenses in the full year 2023 were $10.4 million compared to $7.3 million in the full year 2022 driven primarily by higher research and development spending and stock-based compensation expense.

|

| |

●

|

Net loss in the fourth quarter of 2023 was $2.4 million compared to $1.9 million in the fourth quarter of 2022. Net loss in the full year 2023 was $10.0 million compared to $7.2 million in the full year 2022.

|

| |

●

|

Cash used in operating, investing and financing activities in the fourth quarter of 2023 was $2.3 million compared to $2.1 million in the fourth quarter of 2022. Cash used in operating, investing and financing activities in the full year 2023 was $7.9 million compared to $6.8 million in the full year 2022.

|

| |

●

|

Cash and cash equivalents totaled $8.5 million at December 31, 2023.

|

| |

●

|

No long-term debt was outstanding at December 31, 2023.

|

2024 Milestones

For 2024, the Company has set or achieved the following milestones:

| |

●

|

Successfully completed Phase II of development program with Stellantis

|

| |

●

|

Secure Phase III of development program with Stellantis

|

| |

●

|

Complete qualification of second high-volume production fab

|

| |

●

|

Convert large OEMs in our test and evaluation program to design wins/custom development agreements

|

| |

●

|

Add distributors for SymCool™ products

|

| |

●

|

Initial sales of SymCool™ IQ intelligent power module

|

| |

●

|

Begin third-party automotive qualification testing

|

Conference Call and Webcast: Fourth Quarter and Full Year 2023 Results

To access the call, please use the following information:

| Date: |

Thursday, February 29, 2024 |

| Time: |

10:00 AM ET |

| Toll-free dial-in number: |

888-506-0062 |

| International dial-in number: |

973-528-0011 |

| Participant Access Code: |

233198 |

Please call the conference telephone number 5-10 minutes prior to the start time to ensure a proper connection. An operator will register your name and organization.

The conference call will be webcast live and available for replay on the Company’s investor relations website under the Events tab HERE.

An audio replay of the conference call will be available one hour after the live call until Midnight on March 14, 2024.

| Toll Free Replay Number: |

877-481-4010 |

| International Replay Number: |

919-882-2331 |

| Replay ID: |

49960 |

Recent CEO Interview

Ideal Power President and CEO Dan Brdar was recently interviewed by Diane King Hall with Schwab Network. Watch the full interview HERE.

Upcoming Investor Conferences

Emerging Growth Virtual Conference on March 7, 2024

Ideal Power plans to present at the Emerging Growth Virtual Conference on March 7, 2024 at 3:40 ET. The live, interactive webcast and slide presentation will be accessible on the Company's Investor Relations website under the Events tab HERE. The webcast will be archived on the website for future viewing. Analysts and investors may submit questions during the live webcast on March 7, 2024.

Roth Capital 36th Annual Conference on March 18, 2024

Ideal Power plans to present and participate in one-on-one meetings at the Roth Conference in Dana Point, California on March 18, 2024. Conference attendees are encouraged to request a one-on-one meeting with Ideal Power on Roth's online conference platform or contact their Roth representative.

The live, interactive webcast and slide presentation will be accessible on the Company's Investor Relations website under the Events tab HERE. The timing of Ideal Power’s presentation webcast and additional information about this conference will be provided by the Company when it is available.

About Ideal Power Inc.

Ideal Power (NASDAQ: IPWR) is pioneering the development and commercialization of its broadly patented bidirectional semiconductor power switch, creating highly efficient and ecofriendly energy control solutions for electric vehicle, electric vehicle charging, renewable energy, energy storage, UPS/data center, solid-state circuit breaker and other industrial and military applications. The Company is focused on its patented Bidirectional, Bipolar Junction Transistor (B-TRAN™) semiconductor technology. B-TRAN™ is a unique double-sided bidirectional AC switch that delivers substantial performance improvements over today’s conventional power semiconductors. Ideal Power’s B-TRAN™ can reduce conduction and switching losses, complexity of thermal management and operating cost in AC power switching and control circuitry. For more information, visit the Company’s website at www.IdealPower.com, on LinkedIn, on Twitter, and on Facebook.

Safe Harbor Statement

All statements in this release that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. While Ideal Power’s management has based any forward-looking statements included in this release on its current expectations, the information on which such expectations were based may change. Such forward-looking statements include, but are not limited to, statements regarding our 2024 milestones and our expectation that we will convert large OEMs into design wins and/or additional custom development agreements this year. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties and other factors, many of which are outside of our control that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not limited to, the success of our B-TRAN™ technology, including whether the patents for our technology provide adequate protection and whether we can be successful in maintaining, enforcing and defending our patents, our inability to predict with precision or certainty the pace and timing of development and commercialization of our B-TRAN™ technology, including the timing of the completion of our wafer fabrication runs with our semiconductor fabrications partners, the rate and degree of market acceptance for our B-TRAN™, the impact of global health pandemics on our business, supply chain disruptions, and the expected performance of future products incorporating our B-TRAN™, and uncertainties set forth in our quarterly, annual and other reports filed with the Securities and Exchange Commission. Furthermore, we operate in a highly competitive and rapidly changing environment where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. We disclaim any intention to, and undertake no obligation to, update or revise forward-looking statements, except as required by applicable law.

Ideal Power Investor Relations Contact:

Jeff Christensen

Darrow Associates Investor Relations

jchristensen@darrowir.com

703-297-6917

|

IDEAL POWER INC.

|

|

Balance Sheets

|

|

(unaudited)

|

| |

|

December 31,

2023

|

|

|

December 31,

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

8,474,835 |

|

|

$ |

16,345,623 |

|

|

Accounts receivable, net

|

|

|

70,000 |

|

|

|

65,936 |

|

|

Inventory

|

|

|

81,450 |

|

|

|

- |

|

|

Prepayments and other current assets

|

|

|

482,890 |

|

|

|

491,365 |

|

|

Total current assets

|

|

|

9,109,175 |

|

|

|

16,902,924 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

359,225 |

|

|

|

200,103 |

|

|

Intangible assets, net

|

|

|

2,580,066 |

|

|

|

2,036,431 |

|

|

Right of use asset

|

|

|

186,570 |

|

|

|

248,720 |

|

|

Other assets

|

|

|

13,034 |

|

|

|

11,189 |

|

|

Total assets

|

|

$ |

12,248,070 |

|

|

$ |

19,399,367 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

405,098 |

|

|

$ |

130,503 |

|

|

Accrued expenses

|

|

|

455,112 |

|

|

|

254,218 |

|

|

Current portion of lease liability

|

|

|

70,683 |

|

|

|

64,597 |

|

|

Total current liabilities

|

|

|

930,893 |

|

|

|

449,318 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term lease liability

|

|

|

132,304 |

|

|

|

202,987 |

|

|

Other long-term liabilities

|

|

|

1,125,173 |

|

|

|

838,458 |

|

|

Total liabilities

|

|

|

2,188,370 |

|

|

|

1,490,763 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

5,998 |

|

|

|

5,926 |

|

|

Additional paid-in capital

|

|

|

107,116,362 |

|

|

|

105,011,318 |

|

|

Treasury stock

|

|

|

(13,210 |

) |

|

|

(13,210 |

) |

|

Accumulated deficit

|

|

|

(97,049,450 |

) |

|

|

(87,095,430 |

) |

|

Total stockholders’ equity

|

|

|

10,059,700 |

|

|

|

17,908,604 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

12,248,070 |

|

|

$ |

19,399,367 |

|

|

IDEAL POWER INC.

|

|

Statements of Operations

|

|

(unaudited)

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial revenue

|

|

$ |

61,483 |

|

|

$ |

- |

|

|

$ |

161,483 |

|

|

$ |

- |

|

|

Grant revenue

|

|

|

- |

|

|

|

16,608 |

|

|

|

37,388 |

|

|

|

203,269 |

|

|

Total revenue

|

|

|

61,483 |

|

|

|

16,608 |

|

|

|

198,871 |

|

|

|

203,269 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of commercial revenue

|

|

|

46,425 |

|

|

|

- |

|

|

|

123,225 |

|

|

|

- |

|

|

Cost of grant revenue

|

|

|

- |

|

|

|

16,608 |

|

|

|

37,388 |

|

|

|

203,269 |

|

|

Total cost of revenue

|

|

|

46,425 |

|

|

|

16,608 |

|

|

|

160,613 |

|

|

|

203,269 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

15,058 |

|

|

|

- |

|

|

|

38,258 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,405,957 |

|

|

|

1,029,695 |

|

|

|

5,743,211 |

|

|

|

3,366,776 |

|

|

General and administrative

|

|

|

850,432 |

|

|

|

767,309 |

|

|

|

3,533,383 |

|

|

|

3,123,852 |

|

|

Sales and marketing

|

|

|

243,563 |

|

|

|

192,307 |

|

|

|

1,113,752 |

|

|

|

852,331 |

|

|

Total operating expenses

|

|

|

2,499,952 |

|

|

|

1,989,311 |

|

|

|

10,390,346 |

|

|

|

7,342,959 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(2,484,894 |

) |

|

|

(1,989,311 |

) |

|

|

(10,352,088 |

) |

|

|

(7,342,959 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net

|

|

|

79,146 |

|

|

|

98,366 |

|

|

|

398,068 |

|

|

|

153,609 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(2,405,748 |

) |

|

$ |

(1,890,945 |

) |

|

$ |

(9,954,020 |

) |

|

$ |

(7,189,350 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share – basic and diluted

|

|

$ |

(0.39 |

) |

|

$ |

(0.31 |

) |

|

$ |

(1.61 |

) |

|

$ |

(1.17 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding – basic and diluted

|

|

|

6,206,469 |

|

|

|

6,160,803 |

|

|

|

6,190,746 |

|

|

|

6,157,866 |

|

|

IDEAL POWER INC.

|

|

Statements of Cash Flows

|

|

(unaudited)

|

| |

|

Year Ended

|

|

| |

|

December 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(9,954,020 |

) |

|

|

(7,189,350 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

271,746 |

|

|

|

187,077 |

|

|

Write-off of fixed assets

|

|

|

- |

|

|

|

937 |

|

|

Stock-based compensation

|

|

|

2,321,380 |

|

|

|

975,801 |

|

|

Stock issued for services

|

|

|

- |

|

|

|

100,100 |

|

|

Decrease (increase) in operating assets:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(4,064 |

) |

|

|

167,326 |

|

|

Inventory

|

|

|

(81,450 |

) |

|

|

- |

|

|

Prepaid expenses and other assets

|

|

|

68,780 |

|

|

|

(389,013 |

) |

|

Increase (decrease) in operating liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

274,595 |

|

|

|

3 |

|

|

Accrued expenses and other liabilities

|

|

|

(28,545 |

) |

|

|

(236,795 |

) |

|

Net cash used in operating activities

|

|

|

(7,131,578 |

) |

|

|

(6,383,914 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(240,825 |

) |

|

|

(182,651 |

) |

|

Acquisition of intangible assets

|

|

|

(282,121 |

) |

|

|

(130,089 |

) |

|

Net cash used in investing activities

|

|

|

(522,946 |

) |

|

|

(312,740 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Payment of taxes on restricted stock unit vestings

|

|

|

(216,264 |

) |

|

|

(127,872 |

) |

|

Net cash used in financing activities

|

|

|

(216,264 |

) |

|

|

(127,872 |

) |

| |

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(7,870,788 |

) |

|

|

(6,824,526 |

) |

|

Cash and cash equivalents at beginning of period

|

|

|

16,345,623 |

|

|

|

23,170,149 |

|

|

Cash and cash equivalents at end of the period

|

|

$ |

8,474,835 |

|

|

$ |

16,345,623 |

|

v3.24.0.1

Document And Entity Information

|

Feb. 29, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

IDEAL POWER INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 29, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36216

|

| Entity, Tax Identification Number |

14-1999058

|

| Entity, Address, Address Line One |

5508 Highway 290 West, Suite 120

|

| Entity, Address, City or Town |

Austin

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78735

|

| City Area Code |

512

|

| Local Phone Number |

264-1542

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

IPWR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001507957

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

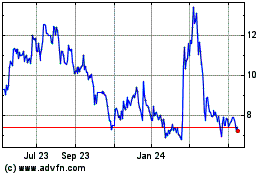

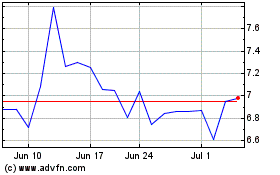

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024