As filed with the Securities and Exchange

Commission on November 9, 2023

Registration No. 333-274495

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

INTELLIGENT LIVING

APPLICATION GROUP INC.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

N/A |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Unit 2, 5/F, Block A, Profit Industrial Building

1-15 Kwai Fung Crescent, Kwai Chung

New Territories, Hong Kong

Tel: + (852) 2481 7938

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

Phone: (800) 221-0102

Fax: (800) 944-6607

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Jeffrey Li

FisherBroyles, LLP

1200 G Street NW, Suite 800

Washington, D.C. 20005

(202) 830-5905

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of the registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company x

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ¨

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

November 9, 2023

PRELIMINARY PROSPECTUS

INTELLIGENT LIVING APPLICATION GROUP INC.

$80,000,000

Ordinary Shares

Preferred Shares

Warrants

Rights and

Units

We may, from time to

time in one or more offerings, offer and sell up to $80,000,000 in the aggregate of Ordinary Shares, Preferred Shares, warrants to

purchase Ordinary Shares or Preferred Shares, rights or any combination of the foregoing, either individually or as units comprised

of one or more of the other securities. The prospectus supplement for each offering of securities will describe in detail the plan

of distribution for that offering. For general information about the distribution of securities offered, please see “Plan of

Distribution” in this prospectus.

This prospectus provides a

general description of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements

to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings.

The prospectus supplement and any related free writing prospectus may add, update or change information contained in this prospectus.

You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the

documents incorporated or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus

may not be used to offer or sell any securities unless accompanied by the applicable prospectus supplement.

We are a Cayman

Islands holding company without any operation; our operations are conducted by our wholly owned subsidiaries in Hong Kong and China.

There are legal and operational risks associated with being based in and having our operations in Hong Kong and China. Recently, the

PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance

notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies

listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and

expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist Party of China Central

Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the

securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant

governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision

over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC

securities laws. On December 28, 2021, Cybersecurity Review Measures were published by Cyberspace Administration of China or the

CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security,

Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration of Radio

and Television, China Securities Regulatory Commission (“CSRC”), State Secrecy Administration and State Cryptography

Administration and became effective on February 15, 2022, which provides that, Critical Information Infrastructure Operators

(“CIIOs”) that purchase internet products and services and Online Platform Operators engaging in data processing

activities that affect or may affect national security shall be subject to the cybersecurity review by the Cybersecurity Review

Office. On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the

“Cyber Data Security Measure (Draft)”, which requires cyberspace operators with personal information of more than 1

million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. On July 7, 2022, CAC

promulgated the Measures for the Security Assessment of Data Cross-border Transfer, effective on September 1, 2022, which requires

the data processors to apply for data cross-border security assessment coordinated by the CAC under the following circumstances: (i)

any data processor transfers important data to overseas; (ii) any critical information infrastructure operator or data processor who

processes personal information of over 1 million people provides personal information to overseas; (iii) any data processor who

provides personal information to overseas and has already provided personal information of more than 100,000 people or sensitive

personal information of more than 10,000 people to overseas since January 1st of the previous year; and (iv) other

circumstances under which the data cross-border transfer security assessment is required as prescribed by the CAC. On February 17,

2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises (the

“New Overseas Listing Rules”) with five interpretive guidelines, which took effect on March 31, 2023. The New Overseas

Listing Rules require Chinese domestic enterprises to complete filings with relevant governmental authorities and report related

information under certain circumstances, such as: a) an issuer making an application for initial public offering and listing in an

overseas market; b) an issuer making an overseas securities offering after having been listed on an overseas market; c) a domestic

company seeking an overseas direct or indirect listing of its assets through single or multiple acquisition(s), share swap, transfer

of shares or other means. According to the Notice on Arrangements for Overseas Securities Offering and Listing by Domestic

Enterprises, published by the CSRC on February 17, 2023, a company that (i) has already completed overseas listing or (ii) has

already obtained the approval for the offering or listing from overseas securities regulators or exchanges but has not completed

such offering or listing before effective date of the new rules and also completes the offering or listing before September 30, 2023

will be considered as an existing listed company and is not required to make any filing until it conducts a new offering in the

future. Furthermore, upon the occurrence of any of the material events specified below after an issuer has completed its offering

and listed its securities on an overseas stock exchange, the issuer shall submit a report thereof to the CSRC within 3 business days

after the occurrence and public disclosure of the event: (i) change of control; (ii) investigations or sanctions imposed by overseas

securities regulatory agencies or other competent authorities; (iii) change of listing status or transfer of listing segment; or

(iv) voluntary or mandatory delisting. The New Overseas Listing Rules provide that the determination as to whether a

domestic company is indirectly offering and listing securities on an overseas market shall be made on a substance over form basis,

and if the issuer meets the following conditions, the offering and listing shall be determined as an indirect overseas offering and

listing by a Chinese domestic company: (i) any of the revenue, profit, total assets or net assets of the Chinese domestic entity is

more than 50% of the related financials in the issuer’s audited consolidated financial statements for the most recent fiscal

year; and (ii) the senior managers in charge of business operation and management of the issuer are mostly Chinese citizens or with

regular domicile in China, the main locations of its business operations are in China or main business activities are conducted in

China. The New Overseas Listing Rules also stipulate the legal consequences to the companies for breaches, including

failure to fulfill filing obligations or filing documents having false statement or misleading information or material omissions,

which may result in a fine ranging from RMB1 million to RMB10 million, and in cases of severe violations, the relevant responsible

persons may also be barred from entering the securities market. On February 24, 2023, the CSRC, the Ministry of Finance, the

National Administration of State Secretes Protection and the National Archives Administration released the Provisions on

Strengthening the Confidentiality and Archives Administration Related to the Overseas Securities Offering and Listing by Domestic

Companies, or the Confidentiality and Archives Administration Provisions, which took effect on March 31, 2023. PRC domestic

enterprises seeking to offer securities and list in overseas markets, either directly or indirectly, shall establish and improve the

system of confidentiality and archives work, and shall complete approval and filing procedures with competent authorities, if such

PRC domestic enterprises or their overseas listing entities provide or publicly disclose documents or materials involving state

secrets and work secrets of state organs to relevant securities companies, securities service institutions, overseas regulatory

agencies and other entities and individuals. It further stipulates that (i) providing or publicly disclosing documents and materials

which may adversely affect national security or public interests, and accounting records or photocopies thereof to relevant

securities companies, securities service institutions, overseas regulatory agencies and other entities and individuals shall be

subject to corresponding procedures in accordance with relevant laws and regulations; and (ii) any working papers formed in the

territory of the PRC by securities companies and securities service agencies that provide domestic enterprises with securities

services relating to overseas securities issuance and listing shall be stored in the territory of the PRC, the outbound transfer of

which shall be subject to corresponding procedures in accordance with relevant laws and regulations. As of the date of this

prospectus, these new laws and guidelines have not impacted the Company’s ability to conduct its business, accept foreign

investments, or list and trade on a U.S. We are headquartered in Hong Kong and our major operational activities are carried out in

Hong Kong, our main places of business is located in Hong Kong, and none of the senior managers in charge of operation and

management of the Company is Chinese citizen or domiciled in China. Hong Kong is a special administrative region of the PRC and

the basic policies of the PRC regarding Hong Kong are reflected in the Basic Law of the Hong Kong Special Administrative

Region of the People’s Republic of China, or the Basic Law, providing Hong Kong with a high degree of autonomy and

executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one

country, two systems”. Also, all the senior managers in charge of business operation and management of the Company and

its manufacturing subsidiary in China are non- Chinese citizens and and do not have regular domicile in China, the main location of

the business operations or business activities of the Company are in Hong Kong instead of mainland China and our manufacturing

subsidiary in China only supplies its products to its affiliates in Hong Kong and does not sell them in mainland

China. According to the advices by our Chinese legal counsel Guangdong Wesley Law Firm, we believe the New Overseas

Listing Rules by CSRC do not apply to the Company. The Company owns 100% equity interest of all its subsidiaries including the

manufacturing subsidiary in China and does not have a VIE structure. Our subsidiary in China manufactures and sells locksets to its

affiliate in Hong Kong and is not a cyberspace operator with personal information of more than 1 million users or activities that

affect or may affect national security and it does not have documents and materials which may adversely affect national security or

public interests. However, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which

could materially and adversely impact our business and financial outlook, may impact our ability to accept foreign investments,

offer our securities to investors or continue to list on a U.S. or other foreign exchange, and could impact our ability to conduct

our business. If there is significant change to current political arrangements between mainland China and Hong Kong, companies

operated in Hong Kong may face similar regulatory risks as mainland Chinese companies. Any change in foreign investment

regulations, and other policies in China or related enforcement actions by China government could result in a material change in our

operations and the value of our securities and could significantly limit or completely hinder our ability to offer our securities to

investors or cause the value of our securities to significantly decline or be worthless. The Holding Foreign Companies Accountable

Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any

registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited

if the PCAOB determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years

beginning in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On December 29, 2022, a

legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was

signed into law by President Biden, which has shortened the Holding Foreign Companies Accountable Act’s timeline for a

potential trading prohibition from three years to two years, thus reducing the time period before our securities may be prohibited

from trading or delisted if our auditor is unable to meet the PCAOB inspection requirement. The Company’s auditor, Wei, Wei

& Co., LLP is headquartered in the U.S. and the Public Company Accounting Oversight Board (United States) (the

“PCAOB”) currently has access to inspect the working papers of our auditor and our auditor is not subject to the

determinations announced by the PCAOB on December 16, 2021, which determinations were vacated on December 15, 2022. The Holding

Foreign Companies Accountable Act and related regulations currently does not affect the Company as the Company’s auditor is

subject to PCAOB’s inspection and investigation.

We are a holding company incorporated

in the Cayman Islands. As a holding company with no material operations of our own, we conduct a substantial majority of our business

through our operating subsidiaries in Hong Kong and China. The securities offered in this prospectus are securities of our Cayman

Islands holding company, not our operating subsidiaries.

As of the date of this

prospectus, no dividends or distributions have been made between the holding company, its subsidiaries or to investors including

U.S. investors. The holding company and its subsidiaries do not have any plan to distribute dividend in the foreseeable future. We

mainly conduct our marketing and sales, research and development and design activities through our wholly owned subsidiaries in Hong

Kong and manufacturing activities through our wholly owned subsidiary in China, Dongguan Xingfa Hardware Products Co., Limited

(“Xingfa”). As a result, almost all of our sales revenues are received by our Hong Kong subsidiaries which make payment

to Xingfa for the cost of products and reasonable markups. Transfers of funds among our Hong Kong subsidiaries or from our Hong Kong

subsidiaries to the holding company are free of restrictions. Remittances of funds from our Hong Kong subsidiaries to Xingfa are

subject to review and conversion of Hong Kong dollars (“HK$”) or U.S. dollars (“US$”) to Renminbi Yuan

(“RMB”) through Xingfa’s bank in China, which represents the State Administration of Foreign Exchange

(“SAFE”) to monitor foreign exchange activities. Under the existing PRC foreign exchange regulations, payments of

current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in

foreign currencies without prior approval from SAFE by complying with certain procedural requirements with the banks. The cash

transfer among the holding company and its subsidiaries is typically transferred through payment for intercompany product sales and

services or intercompany loans between holding company and subsidiaries. As of the date of

this prospectus, we do not anticipate any difficulties or limitations on our ability to transfer cash between subsidiaries, except

for the transfer from or to Xingfa, which is subject to review and procedures according to the requirements of the SAFE.

As of the date of this prospectus,

we do not have cash management policies and procedures in place that dictate how funds are transferred through our organization. Rather,

the funds can be transferred in accordance with the applicable laws and regulations.

The Company, we, us, our company,

Intelligent Living, ILAG, Registrant or similar terms used in this prospectus refer to Intelligent Living Application Group Inc., a company

incorporated under the laws of the Cayman Islands, including its consolidated subsidiaries, unless the context otherwise indicates. We

currently conduct our business through Intelligent Living Application Group Limited, a holding company incorporated under the laws of

the British Virgin Islands (“ILAG BVI”) and its subsidiaries Kambo Locksets Limited (“Kambo Locksets”), Kambo

Hardware Limited (“Kambo Hardware”), Bamberg (HK) Limited (“Bamberg”), and Hing Fat Industrial Limited (“Hing

Fat”) in Hong Kong and its subsidiary Dongguan Xingfa Hardware Products Co. Ltd. (“Xingfa”) in China.

As a holding company, we

may rely principally on dividends and other distributions on equity paid by our subsidiaries in Hong Kong and China for our cash and

financing requirements we may have. If any of our subsidiaries incur debt on their own behalf in the future, the instruments

governing such debt may restrict their ability to pay dividends to us. Under existing PRC foreign exchange regulations, payments of

current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in

foreign currencies without prior approval from State Administration of Foreign Exchange or SAFE by complying with certain procedural

requirements. However, approval from or registration with appropriate government authorities is required where the RMB is to be

converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in

foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current

account transactions. For our Hong Kong subsidiaries, our subsidiary in British Virgin Islands

and the holding company (“Non-PRC Entities”), there is no restrictions on foreign exchange for such entities and they

are able to transfer cash among these entities, across borders and to US investors. Also, there is no restrictions and limitations

on the abilities of Non-PRC Entities to distribute earnings from their businesses, including from subsidiaries to the parent company

or from the holding company to the U.S. investors as well as the abilities to settle amounts owed. However, PRC may impose greater

restrictions on our Hong Kong subsidiaries’ abilities to transfer cash out of Hong Kong and to the holding company, which

could adversely affect our business, financial condition and results of operations. However, none of our subsidiaries has

made any dividends or other distributions to our holding company or any U.S. investors as of the date of this prospectus. In the

future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our

subsidiaries via capital contribution or shareholder loans, as the case may be.

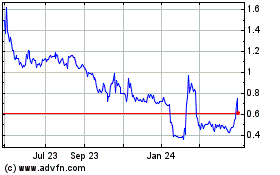

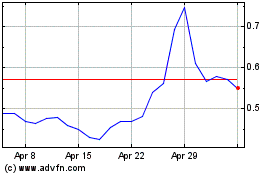

Pursuant to General Instruction

I.B.5. of Form F-3, in no event we will sell the securities covered hereby in a public primary offering with a value more than one-third

of the aggregate market value of our Ordinary Shares held by non-affiliates of the Company in any 12-month period so long as the aggregate

market value of our outstanding Ordinary Shares held by non-affiliates remains below $75,000,000. The aggregate market value of our outstanding

voting and non-voting common equity held by non-affiliates is approximately $8.18 million based on the closing price of $0.94 per ordinary

share on November 8, 2023 and 8,700,000 ordinary shares held by non-affiliates. During the 12 calendar months prior to and including

the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Our Ordinary Shares are listed

on the Nasdaq Capital Market under the symbol “ILAG.” The applicable prospectus supplement will contain information, where

applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the prospectus

supplement.

Investing in our

securities involves a high degree of risk. See “Risk Factors” on page 11 of this prospectus and in the documents

incorporated by reference in this prospectus, as updated in the applicable prospectus supplement, any related free writing

prospectus and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this

prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

We may sell these securities

directly to investors, through agents designated from time to time or to or through underwriters or dealers. For additional information

on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus. If any underwriters

are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and

any applicable commissions or discounts will be set forth in a prospectus supplement. The price to the public of such securities and the

net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is _____, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, under the Securities Act of 1933,

as amended, or the Securities Act, using a “shelf” registration process. Under this shelf registration process, we may

from time to time sell Ordinary Shares, Preferred Shares, warrants to purchase Ordinary Shares or Preferred Shares, rights or any

combination of the foregoing, either individually or as units comprised of one or more of the other securities, in one or more

offerings up to a total dollar amount of $80,000,000. We have provided to you in this prospectus a general description of the

securities we may offer. Each time we sell securities under this shelf registration, we will, to the extent required by law, provide

a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more

free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus

supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change

information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus. To the

extent there is a conflict between the information contained in this prospectus and the prospectus supplement or any related free

writing prospectus, you should rely on the information in the prospectus supplement or the related free writing prospectus; provided

that if any statement in one of these documents is inconsistent with a statement in another document having a later date – for

example, a document filed after the date of this prospectus and incorporated by reference into this prospectus or any prospectus

supplement or any related free writing prospectus – the statement in the document having the later date modifies or supersedes

the earlier statement.

We have not authorized any

dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference

in this prospectus and any accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided

to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an accompanying

prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. This prospectus and the accompanying

prospectus supplement, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the

registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement constitute an offer to sell

or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. You should not assume that the information contained in this prospectus, any applicable prospectus supplement or

any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of such document or that any

information we have incorporated by reference is correct on any date subsequent to the date of such document incorporated by reference

(as our business, financial condition, results of operations and prospects may have changed since that date), even though this prospectus,

any applicable prospectus supplement or any related free writing prospectus is delivered or securities are sold on a later date.

As permitted by SEC rules

and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this

prospectus. You may read the registration statement and the other reports we file with the SEC at its website or at its offices described

below under “Where You Can Find More Information.”

Unless the context otherwise

requires, all references in this prospectus to “Intelligent Living”, “ILAG,” “we,” “us,”

“our,” “the Company,” “the “Registrant”, “holding company” or similar words refer

to Intelligent Living Application Group Inc., together with its subsidiaries.

“China” or

the “PRC” are to the mainland China, excluding Taiwan and the special administrative regions of Hong Kong and Macau

for the purposes of this prospectus only.

PROSPECTUS SUMMARY

Overview

Our

mission is to make life safer and smarter by designing and producing affordable, high-quality locksets and smart security systems.

Headquartered

in Hong Kong, we manufacture and sell high quality mechanical locksets to customers mainly in the United States (US) and Canada and have

continued to diversify and refine our product offerings in the past 40 years to meet our customers’ needs. We believe Xingfa

is one of the pioneers of mechanical lockset manufacturing in China. Since inception, to cope with our development and increase customer

satisfaction in quality, we keep investing in self-designed automated product lines, new craftsmanship and developing new products including

smart locks. In order to obtain the confidence of our customers, Xingfa has obtained the ISO9001quality assurance certificate.

Starting

in 2000, we offer products that comply with the American National Standards Institute (ANSI) Grade 2 and Grade 3 standards that are

developed by the Builders Hardware Manufacturing Association (BHMA) for ANSI. Our focus in producing mechanical locksets -

including locksets for outdoors (such as main entrances and gates) and indoors - has resulted in sustainable growth in our

business and raised our competitiveness. To maintain our growth, our products are beyond a simple lockset for security purposes, we

offer a wide range of Original Design Manufacturer (“ODM”) door locksets to various customer segments from

“Premium Series” to “Economy-oriented Series” with classic to contemporary looks, functions and colors.

To

meet increasing consumer needs for smart locks and smart home products, Hing Fat been researching and developing smart locks in the past

couple years. Hing Fat has been working on smart locks functions, communication protocols, available designs and have internally

worked out a general solution plan including mechanical and electronic parts but still need to further develop the software related parts

for such locks which we need external help. Most of our research and development on smart locks have been done internally by our technician

and engineers, except that Hing Fat hired outside services for approximately $25,000 in 2017. Because of tariff war and outbreak of COVID-19,

we did not further progress on the software for our smart locks until early 2023. Since then, we have initiated the process to develop

devices and software applications for our smart locks.

Currently,

approximately 96% of our revenues are from products sold to the US market, and the remaining products are sold to the Canadian market.

We build our distribution network by working together with our large and small business partners in different geographic areas to sell

our products.

For

40 years, we manufacture and sell high quality mechanical locksets and continue to grow and increase our product offerings. The predecessor

of Hing Fat commenced our business of selling door locksets in 1981. In 1983, we started processing door locksets to fulfill orders from

US customers with imported materials at a small manufacturing workshop in China which becomes our current manufacturing subsidiary, Xingfa.

Since then, our mission is to “produce high quality lockset products at affordable prices.”

Our

products comply with American National Standards Institute (ANSI) Grade 2 and Grade 3 standards, which were developed by the Builders

Hardware Manufacturing Association (BHMA) for ANSI. Our focus is to offer a variety of mechanical locksets for outdoor (such as main

entrances, gates) and indoor that we believe promotes sustainable growth and our competitiveness.

We

sell our products mainly to the US and Canada (“North America”) through one of our Hong Kong registered subsidiaries, Kambo

Locksets. Another Hong Kong registered subsidiary, Kambo Hardware, targets and distributes locksets and related hardware to countries

other than the US and Canada. And it mainly serves our customers in Asian countries.

We

are a holding company incorporated in the Cayman Islands. Our securities offered in this prospectus are securities of our Cayman Islands

holding company. As a holding company with no material operations of our own, we conduct our business through our operating subsidiaries

in Hong Kong and China.

Our

wholly owned subsidiary Xingfa is incorporated and operating in mainland China and it has received all permission required to obtain

from Chinese authorities to operate its current business in China, including Business license, Customs Registration Certificate,

Bank Account Open Permit and Approval regarding Environmental Protection. The Chinese government may intervene or influence our

operations in China or any securities offering at any time, which could result in a material change in our operations and our

ordinary shares could decline in value or become worthless. Other than these permits, we are not required to obtain permit and

approval from Chinese authorities to operate our business and to offer the Company’s securities being registered to foreign

investors. We or our subsidiaries are not covered by permissions requirements from the China Securities Regulatory Commission

(CSRC), Cyberspace Administration of China (CAC) or any other governmental agency that is required to approve our business and

operations. We manufacture and sell lockset products and our products and services do not pose national security risks, based on the

advice of our PRC counsel, we are not subject to the report requirement under Cybersecurity Review Measures published by Cyberspace

Administration of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of

Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State

Administration of Radio and Television, China Securities Regulatory Commission, State Secrecy Administration and State Cryptography

Administration on December 28, 2021, which became effective on February 15, 2022.

As of the date of this

prospectus, we (1) are not required to obtain permissions from any PRC authorities to issue our ordinary shares to foreign investors,

(2) are not subject to permission requirements from CSRC, CAC or any other entity that is required to approve of our operations in

China, and (3) have not received or were denied such permissions by any PRC authorities. We are headquartered in Hong Kong with our

chief executive officer, chief financial officer, chief operating officer and all members of the board of directors based in Hong Kong

who are not Chinese citizens and most of our revenues and profits are generated by our subsidiaries in Hong Kong. Although we don’t

believe we are a Chinese domestic entity as defined in the New Overseas Listing Rules published by CSRC on February 17, 2023,

it is not certain whether we might be determined as a Chinese entity under new rules, which will require us to file the offering related

documents with CSRC. Also, the General Office of the Central Committee of the Communist Party of China and the General Office of the State

Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the

Opinions, which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration

over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Given the

current PRC regulatory environment, it is uncertain when and whether our PRC subsidiary, will be required to obtain permission from the

PRC government in connection with our listing on U.S. exchanges in the future, and even when such permission is obtained, whether it will

be denied or rescinded. If we or our subsidiaries do not receive or maintain such permissions or approvals, inadvertently conclude that

such permissions or approvals are not required, or applicable laws, regulations, or interpretations change and we are required to obtain

such permissions or approvals in the future, it could significantly limit or completely hinder our ability to offer or continue to offer

our securities to investors and cause the value of our securities to significantly decline or become worthless.

There are legal and operational

risks associated with being based in and having all our operations in Hong Kong and China. These risks could result in a material change

in our operations and/or the value of our securities or could significantly limit or completely hinder our ability to offer or continue

to offer securities to investors and cause the value of such securities to significantly decline or be worthless. The enforcement of laws

and that rules and regulations in China can change quickly with little advance notice and the risk that the Chinese government may intervene

or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-

based issuers, could result in a material change in our operations and/or the value of our securities we are registering for sale. Any

actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors

and cause the value of such securities to significantly decline or be worthless.

Recently, the PRC

government initiated a series of regulatory actions and statements to regulate business operations in China with little advance

notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies

listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and

expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist Party of China Central

Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the

securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant

governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision

over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC

securities laws. On December 28, 2021, Cybersecurity Review Measures were published by Cyberspace Administration of China or the

CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security,

Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration of Radio

and Television, China Securities Regulatory Commission (“CSRC”), State Secrecy Administration and State Cryptography

Administration and became effective on February 15, 2022, which provides that, Critical Information Infrastructure Operators

(“CIIOs”) that purchase internet products and services and Online Platform Operators engaging in data processing

activities that affect or may affect national security shall be subject to the cybersecurity review by the Cybersecurity Review

Office. On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the

“Cyber Data Security Measure (Draft)”, which requires cyberspace operators with personal information of more than 1

million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. On July 7, 2022, CAC

promulgated the Measures for the Security Assessment of Data Cross-border Transfer, effective on September 1, 2022, which requires

the data processors to apply for data cross-border security assessment coordinated by the CAC under the following circumstances: (i)

any data processor transfers important data to overseas; (ii) any critical information infrastructure operator or data processor who

processes personal information of over 1 million people provides personal information to overseas; (iii) any data processor who

provides personal information to overseas and has already provided personal information of more than 100,000 people or sensitive

personal information of more than 10,000 people to overseas since January 1st of the previous year; and (iv) other

circumstances under which the data cross-border transfer security assessment is required as prescribed by the CAC. On February 17,

2023, the CSRC released the New Overseas Listing Rules with five interpretive guidelines, which took effect on March 31, 2023. The

New Overseas Listing Rules require Chinese domestic enterprises to complete filings with relevant governmental authorities and

report related information under certain circumstances, such as: a) an issuer making an application for initial public offering and

listing in an overseas market; b) an issuer making an overseas securities offering after having been listed on an overseas market;

c) a domestic company seeking an overseas direct or indirect listing of its assets through single or multiple acquisition(s), share

swap, transfer of shares or other means. According to the Notice on Arrangements for Overseas Securities Offering and Listing by

Domestic Enterprises, published by the CSRC on February 17, 2023, a company that (i) has already completed overseas listing or (ii)

has already obtained the approval for the offering or listing from overseas securities regulators or exchanges but has not completed

such offering or listing before effective date of the new rules and also completes the offering or listing before September 30, 2023

will be considered as an existing listed company and is not required to make any filing until it conducts a new offering in the

future. Furthermore, upon the occurrence of any of the material events specified below after an issuer has completed its offering

and listed its securities on an overseas stock exchange, the issuer shall submit a report thereof to the CSRC within 3 business days

after the occurrence and public disclosure of the event: (i) change of control; (ii) investigations or sanctions imposed by overseas

securities regulatory agencies or other competent authorities; (iii) change of listing status or transfer of listing segment; or

(iv) voluntary or mandatory delisting. The New Overseas Listing Rules provide that the determination as to whether a

domestic company is indirectly offering and listing securities on an overseas market shall be made on a substance over form basis,

and if the issuer meets the following conditions, the offering and listing shall be determined as an indirect overseas offering and

listing by a Chinese domestic company: (i) any of the revenue, profit, total assets or net assets of the Chinese domestic entity is

more than 50% of the related financials in the issuer’s audited consolidated financial statements for the most recent fiscal

year; and (ii) the senior managers in charge of business operation and management of the issuer are mostly Chinese citizens or with

regular domicile in China, the main locations of its business operations are in China or main business activities are conducted in

China. The New Overseas Listing Rules also stipulate the legal consequences to the companies for breaches, including

failure to fulfill filing obligations or filing documents having false statement or misleading information or material omissions,

which may result in a fine ranging from RMB1 million to RMB10 million, and in cases of severe violations, the relevant responsible

persons may also be barred from entering the securities market. On February 24, 2023, the CSRC, the Ministry of Finance, the

National Administration of State Secretes Protection and the National Archives Administration released the Provisions on

Strengthening the Confidentiality and Archives Administration Related to the Overseas Securities Offering and Listing by Domestic

Companies, or the Confidentiality and Archives Administration Provisions, which took effect on March 31, 2023. PRC domestic

enterprises seeking to offer securities and list in overseas markets, either directly or indirectly, shall establish and improve the

system of confidentiality and archives work, and shall complete approval and filing procedures with competent authorities, if such

PRC domestic enterprises or their overseas listing entities provide or publicly disclose documents or materials involving state

secrets and work secrets of state organs to relevant securities companies, securities service institutions, overseas regulatory

agencies and other entities and individuals. It further stipulates that (i) providing or publicly disclosing documents and materials

which may adversely affect national security or public interests, and accounting records or photocopies thereof to relevant

securities companies, securities service institutions, overseas regulatory agencies and other entities and individuals shall be

subject to corresponding procedures in accordance with relevant laws and regulations; and (ii) any working papers formed in the

territory of the PRC by securities companies and securities service agencies that provide domestic enterprises with securities

services relating to overseas securities issuance and listing shall be stored in the territory of the PRC, the outbound transfer of

which shall be subject to corresponding procedures in accordance with relevant laws and regulations. As of the date of this

prospectus, these new laws and guidelines have not impacted the Company’s ability to conduct its business, accept foreign

investments, or list and trade on a U.S. We are headquartered in Hong Kong and our major operational activities are carried out in

Hong Kong, our main places of business is located in Hong Kong, and none of the senior managers in charge of operation and

management of the Company is Chinese citizen or domiciled in China. Hong Kong is a special administrative region of the PRC and

the basic policies of the PRC regarding Hong Kong are reflected in the Basic Law of the Hong Kong Special Administrative

Region of the People’s Republic of China, or the Basic Law, providing Hong Kong with a high degree of autonomy and

executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one

country, two systems”. Also, all the senior managers in charge of business operation and management of the Company and

its manufacturing subsidiary in China are non- Chinese citizens and and do not have regular domicile in China, the main location of

the business operations or business activities of the Company are in Hong Kong instead of mainland China and our manufacturing

subsidiary in China only supplies its products to its affiliates in Hong Kong and does not sell them in mainland

China. According to the advices by our Chinese legal counsel Guangdong Wesley Law Firm, we believe the New Overseas

Listing Rules by CSRC do not apply to the Company. The Company owns 100% equity interest of all its subsidiaries including the

manufacturing subsidiary in China and does not have a VIE structure. Our subsidiary in China manufactures and sells locksets to its

affiliates in Hong Kong and is not a cyberspace operator with personal information of more than 1 million users or activities that

affect or may affect national security and it does not have documents and materials which may adversely affect national security or

public interests. However, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which

could materially and adversely impact our business and financial outlook, may impact our ability to accept foreign investments,

offer our securities to investors or continue to list on a U.S. or other foreign exchange, and could impact our ability to conduct

our business. If there is significant change to current political arrangements between mainland China and Hong Kong, companies

operated in Hong Kong may face similar regulatory risks as mainland Chinese companies. Any change in foreign investment

regulations, and other policies in China or related enforcement actions by China government could result in a material change in our

operations and the value of our securities and could significantly limit or completely hinder our ability to offer our securities to

investors or cause the value of our securities to significantly decline or be worthless.

Our independent

registered public accounting firm that issues the audit report included in our annual report which is incorporated by reference in

this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is

subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the

applicable professional standards. Our auditor is headquartered in New York City, and has been inspected by the PCAOB on a regular

basis with the last inspection in 2020 and is not subject to the determinations announced by the PCAOB on December 16, 2021, which

determinations were vacated on December 15, 2022. However, we cannot assure you whether Nasdaq or regulatory authorities would apply

additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality

control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach, or experience as it relates

to our auditor. If it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a

position taken by an authority in a foreign jurisdiction or any other reasons, the lack of inspection could cause the trading in our

securities to be prohibited under the Holding Foreign Companies Accountable Act and related regulations, and as a result Nasdaq may

delist our securities. If our securities are unable to be listed on another securities exchange, such a delisting would

substantially impair your ability to sell or purchase our securities when you wish to do so, and the risk and uncertainty associated

with a potential delisting would have a negative impact on the price of our ordinary shares. Further, new laws and regulations or

changes in laws and regulations in both the United States and China could affect our ability to list and trade our ordinary shares

on Nasdaq, which could materially impair the market price for our securities.

Transfer of Cash To and From Our Subsidiaries

We

mainly conduct our marketing and sales, research and development and design activities through our wholly owned subsidiaries in Hong Kong

and manufacturing activities through our wholly owned subsidiary in China, Dongguan Xingfa Hardware Products Co., Limited. As a result,

almost all of our sales revenues are received by our Hong Kong subsidiaries which make payment to Xingfa for the cost of products and

reasonable markups. Transfers of funds among our Hong Kong subsidiaries or from our Hong Kong subsidiaries to the holding company are

free of restrictions. Remittances of funds from our Hong Kong subsidiaries to Xingfa are subject to review and conversion of HK$ or US$

to Renminbi Yuan (“RMB”) through Xingfa’s bank in China, which represents the SAFE to monitor foreign exchange activities.

Under the existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related

foreign exchange transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural

requirements with the banks. Currently, we don’t have any intentions to distribute earnings or settle amounts owed under our operating

structure other than the agreements entered under normal business operation as discussed above.

Intelligent

Living Application Group Inc. is incorporated in Cayman Islands as a holding company with no actual operations and it currently

conducts its business through its subsidiaries in Hong Kong and China. There has been no cash flows and transfers of other assets

between the holding company and its subsidiaries, other than that as of December 31, 2022, Kabmo Locksets and Intelligent

Living Application Group Limited (BVI), both wholly owned subsidiaries of ILAG had paid approximately $1,671,000 for expenses

related to this public offering of ILAG as intercompany loans and not as the dividend payment or distribution. None of our

subsidiaries has made any dividend payment or distribution to our holding company as of the date this prospectus and they have no

plans to make any distribution or dividend payment to the holding company in the near future. Neither the Company nor any of its

subsidiaries has made any dividends or distributions to U.S. investors as of the date of this prospectus.

All

transfers of cash are related to the operations of the subsidiaries in the ordinary course of business. For our Hong Kong subsidiaries,

our subsidiary in British Virgin Islands and the holding company (“Non-PRC Entities”), there is no restrictions on foreign

exchange for such entities and they are able to transfer cash among these entities, across borders and to US investors. Also, there is

no restrictions and limitations on the abilities of Non-PRC Entities to distribute earnings from their businesses, including from subsidiaries

to the parent company or from the holding company to the U.S. investors as well as the abilities to settle amounts owed. However, PRC

may impose greater restrictions on our Hong Kong subsidiaries’ abilities to transfer cash out of Hong Kong and to the holding company,

which could adversely affect our business, financial condition and results of operations.

Regarding

cash transfer to and from Xingfa, we are able to have such transfer through banks in China under current account items, such as

profit distributions and trade and service-related foreign exchange transactions, which can be made in foreign currencies without

prior approval from SAFE by complying with certain procedural requirements with the banks. However, approval from or registration

with appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to

pay capital expenses such as the repayment of loans denominated in foreign currencies. PRC laws and regulations allow an offshore

holding company to provide funding to our wholly owned subsidiary in China only through loans or capital contributions, subject to

the filing or approval of government authorities and limits on the amount of capital contributions and loans. Subject to

satisfaction of applicable government registration and approval requirements, we may extend inter-company loans to our wholly owned

subsidiary in China or make additional capital contributions to fund Xingfa’s capital expenditures or working capital. For an

increase of its registered capital, Xingfa needs to file such change of registered capital with the MOFCOM or its local

counterparts. If the holding company provide funding to Xingfa through loans, the total amount of such loans may not exceed the

difference between the entity’s total investment as approved by the foreign investment authorities and its registered capital.

Such loans must be registered with SAFE or its local branches. Under PRC law, Xingfa is also required to set aside at least 10% of

its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its

registered capital.

Summary of Risk Factors

Investing

in our securities involves significant risks. You should carefully consider all of the information in this prospectus before making an

investment in our securities. Below please find a summary of the principal risks we face, organized under relevant headings. These risks

are discussed more fully in “Item 3. Key Information—D. Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended December 31, 2022 filed on April 28, 2023 (the “2022 Form 20-F”), which is incorporated

herein by reference.

Risks Related to Our Business

| · | The global coronavirus COVID-19 pandemic

has caused significant disruptions to our business, which we expect will continue to have material negative impact on our business, results

of operations and financial condition. |

| · | The Chinese government’s recent enforcement

of “dual control of energy consumption” policy has caused disruptions to Xingfa manufacturing and our business and might continue

to have negative impact on our business, results of operations and financial condition. The enforcement was lifted by central government

in 2022 with occasional enforcement by local government when power consumption has reached peak capacity of local power plants. |

| · | We may not be successfully introducing smart

lock products that are currently under research and development. |

| · | We incurred net losses for the year ended December

31, 2022 and the past two years and may not be able to generate sufficient operating cash flows and working capital. As we completed our

public offering with net proceeds approximately $16.86 million in July 2022, we believe we have sufficient working capital to continue

as a going concern over the next 12 months. However, failure to manage our liquidity and cash flows may materially and adversely affect

our financial condition and results of operations. As a result, we may need additional capital, and financing may not be available on

terms acceptable to us, or at all. |

| · | Fluctuations in the price, availability or quality

of raw materials used in our products could cause manufacturing delays, adversely affecting our ability to provide goods to our customers

or increase costs, any of which could decrease our sales or earnings. |

| · | Xingfa may experience material disruptions to

its manufacturing operations in China that could result in material delays, quality control issues, increased costs and loss of business

opportunities, which may negatively impact our sales and financial results. |

| · | Changes in U.S. trade policies could significantly

reduce the volume of export goods into the United States, which may materially reduce our profit margin and our sales in the United States. |

| · | Environmental regulations impose substantial

costs and limitations on our operations and violation of environmental regulations might subject us to fines, penalties or suspension

of production which could have material negative impact on our financial results. |

| · | If we fail to implement and maintain an effective

system of internal control, we may be unable to accurately report our operating results, meet our reporting obligations or prevent fraud. |

| · | We do not have any business insurance coverage. |

Risks Related to Doing Business in China

| · | Changes in China’s economic, political

or social conditions or government policies could have a material adverse effect on our business and results of operations. |

| · | Uncertainties and quick change in the interpretation

and enforcement of Chinese laws and regulations with little advance notice could result in a material and negative impact on our business

operation, decrease the value of our ordinary shares and limit the legal protections available to us. |

| · | Any failure to comply with PRC regulations regarding

the registration requirements for employee stock incentive plans may subject the PRC plan participants or us to fines and other legal

or administrative sanctions. |

| · | Regulatory bodies of the United States may be

limited in their ability to conduct investigations or inspections of our operations in China. |

| · | The Holding Foreign Companies Accountable Act,

or the HFCA Act, and the related regulations are evolving quickly. Further implementations and interpretations of or amendments to the

HFCA Act or the related regulations, or a PCOAB’s determination of its lack of sufficient access to inspect our auditor, might pose

regulatory risks to and impose restrictions on us because of our operations in mainland China. A potential consequence is that our ordinary

shares may be delisted by the exchange. The delisting of our ordinary shares, or the threat of our ordinary shares being delisted, may

materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct full inspections of

our auditor deprives our investors of the benefits of such inspections. |

| · | Substantial uncertainties exist with respect

to the interpretation and implementation of the newly enacted PRC Foreign Investment Law and how it may impact the viability of our current

corporate structure, corporate governance, business operations and financial results. |

| · | Any change of regulations and rules by Chinese

government, including the limitations on usage of power, additional environmental protection requirements, moving technology in and out

of the PRC or restriction on cash transfer out of PRC, may intervene or influence our operations in China at any time and any additional

control over offerings conducted overseas and/or foreign investment in issuers with Chinese operations could result in a material change

in our business operations and/or the value of our ordinary shares and could significantly limit or completely hinder our ability to offer

our ordinary shares to investors and cause the value of such securities to significantly decline or be worthless. |

Risks Related to Doing Business in Hong

Kong

| · | It will be difficult to acquire jurisdiction

and enforce liabilities against us, our officers, directors and assets based in Hong Kong and China. |

| · | The Hong Kong legal system embodies uncertainties

which could negatively affect our listing on Nasdaq and limit the legal protections available to you and us. |

Risks Related to Our Ordinary Shares

| · | Our ordinary shares may be thinly traded and

you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate

your shares. |

| · | You may face difficulties in protecting your

interests as a shareholder, as Cayman Islands law provides substantially less protection when compared to the laws of the United States

and it may be difficult for a shareholder of ours to effect service of process or to enforce judgements obtained in the United States

courts. |

| · | Future sales or other dilution of our equity could depress the market price of our ordinary shares. Sales

of our ordinary shares, preferred shares, warrants, rights, units or any combination of the foregoing in the public

market, or the perception that such sales could occur, could negatively impact the price of our ordinary shares. If one or more of our

shareholders were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing

market price of our ordinary shares could be negatively affected. |

Our Organizational Structure

The Company’s organizational

chart as of the date of this prospectus is as follows:

Corporate Information

Our

principal executive office is located at Unit 2, 5/F, Block A, Profit Industrial Building, 1-15 Kwai Fung Crescent, Kwai

Chung, New Territories, Hong Kong. Our telephone number at this address is +852 2481 7938. Our registered office in the Cayman

Islands is located at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111. Our agent for service of process

in the United States is Cogency, located at 122 East 42nd Street,

18th Floor, New York, NY 10168, United States. We

maintain a website at www. i-l-a-g.com that contains information about our Company,

though no information contained on our website is part of this prospectus.

Transfer Agent and Registrar

The transfer agent and registrar

for our Ordinary Shares is VStock Transfer, LLC at 18 Lafayette Place, Woodmere, New York 11598.

NASDAQ Capital Market Listing

Our Ordinary Shares are listed

on the NASDAQ Capital Market under the symbol “ILAG”.

The Offering

| Issuer |

Intelligent Living Application Group Inc. |

| |

|

| Securities We May Offer |

We may offer up to $80,000,000 in aggregate amount of our ordinary shares and preferred shares, warrants, rights, either individually or in units. |

| |

|

| Use of Proceeds |

We will use the net proceeds from the sale of our securities for growth and general corporate purposes. |

| |

|

| Risk Factors |

See “Risk Factors” on page 11 and other information we include or incorporate by reference in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

| |

|

| NASDAQ Market Symbol |

ILAG |

RISK FACTORS

Investing in our

securities involves risk. Before you decide to buy our securities, you should carefully consider the risks described under “Item

3. Key Information—D. Risk Factors” in our 2022 Form 20-F, which is incorporated herein by reference, as well

as the risks that are described in the applicable prospectus supplement and in other documents incorporated by reference into this prospectus.

If any of these risks actually occurs, our business, financial condition and results of operations could suffer, and you may lose all

or part of your investment.

Please

see “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” for information

on where you can find the documents we have filed with or furnished to the SEC and which are incorporated into this prospectus by reference.

FORWARD-LOOKING STATEMENTS

Some

of the statements contained or incorporated by reference in this prospectus may be “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Exchange Act and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the

use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,”

“anticipate,” “intend,” “plan,” “estimate” and similar words, although some forward-looking

statements are expressed differently.

Although

we believe that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future

performance and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and results

to differ materially from what is expressed or forecasted in such forward-looking statements. These forward-looking statements speak only

as of the date on which they are made and except as required by law, we undertake no obligation to publicly release the results of any

revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update

or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect

thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual

results and events to differ materially from our forward-looking statements is included in our periodic reports filed with the SEC and

in the risk factors disclosed in this prospectus, in the documents incorporated by reference herein

or in any applicable prospectus supplement.

USE OF PROCEEDS

Except as described in any

prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds

from the sale of the securities offered under this prospectus to fund the development and growth of our business, primarily working

capital, and for general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in technologies and/or

businesses that we believe will enhance the value of our Company, although we have no current commitments or agreements with respect to

any such transactions as of the date of this prospectus. We have not determined the amount of net proceeds to be used specifically for

the foregoing purposes. As a result, our management will have broad discretion in the allocation of the net proceeds and investors will

be relying on the judgment of our management regarding the application of the proceeds of any sale of the securities.

DESCRIPTION OF SHARE CAPITAL

The following is a summary

of our share capital and certain provisions of our Amended and Restated Memorandum and Articles of Association. This summary does not

purport to be complete and is qualified in its entirety by the provisions of our Amended and Restated Memorandum and Articles of Association

and applicable provisions of the laws of the Cayman Islands. You are encouraged to read the relevant provisions of the Companies Act and

of our Amended and Restated Memorandum and Articles of Association as they relate to the following summary.

See “Where You Can Find

More Information” elsewhere in this prospectus for information on where you can obtain copies of our Second Amended and Restated

Memorandum and Articles of Association (the “Current M&A”), which have been filed with and are publicly available

from the SEC.

Our authorized share capital

is $50,000.00 divided into 500,000,000 shares comprising of (i) 450,000,000 ordinary shares of a nominal or par value of $0.0001 each;

and (ii) 50,000,000 preferred shares of a nominal or par value of $0.0001 each.

DESCRIPTION OF ORDINARY SHARES

As of the date of this

prospectus, 18,060,000 ordinary shares are outstanding and listing on Nasdaq Capital Market under symbol “ILAG”.

Dividends. Subject

to any rights and restrictions of any other class or series of shares, our board of directors may, from time to time, declare dividends

on the shares issued and authorize payment of the dividends out of our lawfully available funds. Dividends may be declared and paid out

of the profits of the Company, realized or unrealized, or from any reserve set aside from profits which the Directors determine is no

longer needed. The Board may also declare and pay dividends out of share premium account or any other fund or account which can be authorized

for this purpose in accordance with the Companies Act (as revised) of the Cayman Islands (the “Companies Act”). “Share

premium account,” represents the excess of the price paid to our company on issue of its shares over the par or “nominal”

value of those shares, which is similar to the U.S. concept of additional paid in capital.

No dividend shall bear interest

against the Company.

Voting Rights. The

holders of our ordinary shares are entitled to (in a poll) one vote per share, including the election of directors. Voting at any meeting

of shareholders is by show of hands unless a poll is demanded. On a show of hands every shareholder present in person or by proxy shall

have one vote. On a poll every shareholder entitled to vote (in person or by proxy) and shall have one vote for each fully paid share

for which he/she is the holder. A poll may be demanded by the chairman of such meeting or by any one or more shareholders who together

hold not less than ten percent (10%) of the votes attached to the then issued share capital of the Company, present in person or

in the case of a shareholder being a corporation by its duly authorized representative or by proxy for the time being entitled to vote

at the meeting. At any general meeting of the Company, two (2) shareholders entitled to vote and present in person or by proxy or