UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 12, 2024

Date of Report (Date of earliest event reported)

GSE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-14785

|

52-1868008

|

|

(State of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

6940 Columbia Gateway Dr., Suite 470, Columbia, MD 21046

|

|

(Address of principal executive offices and zip code)

|

|

(410) 970-7800

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instructions A.2 below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

|

GVP

|

|

The NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On February 12, 2024, GSE Systems, Inc. (the “Company”) and Lind Global Fund II LP (“Lind Global”) entered into that certain (a) Second Amendment to

Senior Convertible Promissory Note (“Note Amendment”), amending the Company’s existing Promissory Note, dated June 23, 2023 (as amended by that certain First Amendment, dated October 6, 2023) in the original principal amount of $1,800,000 (the

“Note”), and (b) Second Amendment to Amended and Restated Senior Convertible Promissory Note (“A&R Note Amendment”), amending the Company’s existing Amended and Restated Promissory Note, dated June 23, 2023 (as amended by that certain First

Amendment, dated October 6, 2023), in the original principal amount of $2,747,228 (the “A&R Note”).

The Note Amendment amended Section 2.1 pertaining to events of default by deleting and replacing Section 2.1(r), which previously provided for an event

of default under the Note in the event that, after January 31, 2024, the Company’s Market Capitalization (as defined in the Note) was below $7 million for ten (10) consecutive days. As amended, the Note provides that, at any time after June 1,

2024, an event of default will occur in the event that the Company’s Market Capitalization is below $7 million for ten (10) consecutive days. Prior to the Note Amendment, the “Conversion Price” in the Note meant “$0.50, and shall be subject to

adjustment as provided herein.” The Note Amendment amended the definition of “Conversion Price” to mean “the lower of (i) $5.00 and (ii) eighty-five percent (85%) of the

average of the three (3) lowest daily VWAPs during the twenty (20) Trading Days prior to the delivery by the Holder of the applicable notice of conversion.” The change from “$0.50” to “$5.00” in the amended definition of “Conversion Price” was

necessary to reflect the ten-for-one reverse stock split of the Company’s common stock, effective October 25, 2023.

The A&R Note Amendment amended Section 2.1 pertaining to events of default by deleting and replacing Section 2.1(r), which previously provided for an

event of default under the Note in the event that, after January 31, 2024, the Company’s Market Capitalization (as defined in the A&R Note) was below $7 million for ten (10) consecutive days. As amended, the A&R Note provides that, at any

time after June 1, 2024, an event of default will occur in the event that the Company’s Market Capitalization is below $7 million for ten (10) consecutive days.

The Company also made customary reaffirmations, representations and warranties typical for an amendment of a financing of this type.

The foregoing description of the Note Amendment, the A&R Note Amendment, and the transactions contemplated thereby does not purport to be

complete and is subject to, and qualified in its entirety by reference to, the full text of the Note Amendment and the A&R Note Amendment, which are included in this Current Report as Exhibits 10.1 and 10.2, respectively, and are incorporated

herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

10.1

|

Second Amendment to Senior Convertible Promissory Note, dated February 12, 2024.

|

|

10.2

|

Second Amendment to Amended and Restated Senior Convertible Promissory Note, dated February 12, 2024.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

GSE SYSTEMS, INC.

By:

/s/ Emmett Pepe

Emmett Pepe

Chief Financial Officer

February 13, 2024

Exhibit 10.1

THIS AMENDMENT TO NOTE HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES

COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, IN CONNECTION WITH THE UNDERLYING NOTE, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN

EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS

EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THIS NOTE AND THE SECURITIES ISSUABLE UPON CONVERSION OF THIS NOTE MAY BE PLEDGED IN CONNECTION WITH A

BONA FIDE MARGIN ACCOUNT SECURED BY SUCH SECURITIES.

SECOND AMENDMENT TO

SENIOR CONVERTIBLE

PROMISSORY NOTE

THIS SECOND AMENDMENT TO SENIOR CONVERTIBLE PROMISSORY NOTE (this “Amendment”), is dated as of February 12, 2024, by and among GSE Systems, Inc., a Delaware corporation (the “Maker” or the “Company”), and Lind

Global Fund II LP, a Delaware limited partnership (together with its successors and representatives, the “Holder”).

WHEREAS, Maker is party to that certain Senior Convertible Promissory Note, dated as of June 23, 2023, in the

original principal amount of $1,800,000, made in favor of Holder (as amended by that certain First Amendment to Senior Convertible Promissory Note, dated as of October 6, 2023, and as further amended, restated, amended and restated, supplemented, or

modified from time to time, the “Note”); all capitalized terms used but not defined herein shall have the meanings ascribed thereto in the Note;

and

WHEREAS, the parties wish to clarify that the Holder would have the current ability to exercise rights under Section 2.1(r), and Section 3.1(b) of the Note based upon events

preceding the date hereof and to deem the amount owing under the Note to be the amount provided for in Section 5.13(d); and

WHEREAS, the parties wish to extend the date of effectiveness under Section 2.1(r) of the Note; and

WHEREAS, Maker and Holder now desire to enter into this Amendment to amend the Note to make certain provisions

consistent with those of the mutual understanding of the parties.

NOW, THEREFORE, for and in consideration of the mutual covenants and agreements contained herein, and for other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto (intending to be legally bound) hereby agree as follows:

1. Amendments to the Note. Subject to the terms and conditions contained herein, Maker and Holder hereby amend the Note to:

(a) delete the existing Section 2.1(r) thereof in its

entirety and replace the same with the following:

(r) at any time after June 1, 2024, the Company’s Market Capitalization is below $7 million for ten (10) consecutive

days.

(b) delete the existing Section 3.1(b) thereof in its entirety and replace the same with the following:

(b)

Conversion Price. The “Conversion Price” means the

lower of (i) $5.00 and(ii) eighty-five percent (85%) of the average of the three (3) lowest daily VWAPs during the twenty (20) Trading Days prior to the delivery by the Holder of the applicable notice of conversion.

2. Representations and Warranties of Maker. After giving effect to Section 1

above, Maker hereby represents and warrants to and in favor of Holder, which representations and warranties shall survive the execution and delivery

hereof, as follows:

(a) Each of the representations and warranties of Maker contained in the Note is true and correct in all material respects (without duplication of any materiality carve out already

provided therein) on and as of the date hereof, in each case as if made on and as of such date, other than representations and warranties that expressly relate solely to an earlier date (in which case such representations and warranties were true

and correct on and as of such earlier date);

(b) This Amendment has been duly authorized, validly executed, and delivered by one or more duly authorized officers of Maker, and each of this Amendment and the Note as amended

hereby constitutes the legal, valid, and binding obligations of Maker, enforceable against Maker in accordance with their respective terms, subject to bankruptcy, insolvency, or other similar laws affecting the enforcement of creditor's rights and

remedies generally; and

(c) No default or Event of Default exists before or will result after giving effect to this Amendment.

3. No Other Amendments. Maker

acknowledges and expressly agrees that this Amendment is limited to the extent expressly set forth herein and shall not constitute a modification or amendment of the Note or any other Transaction Document or a course of dealing at variance with the

terms or conditions of the Note or any other Transaction Document (other than as expressly set forth in this Amendment).

4. Conditions Precedent to Effectiveness of this Amendment. The

amendments contained in Section 1 of this Amendment

and the other agreements contained herein shall become effective on the date hereof as long as each of the following conditions precedent is satisfied:

(a) all of the representations and warranties of Maker under Section 2 hereof, which are

made as of the date hereof, are true and correct; and

(b) receipt by Holder of duly executed signature page(s) to this Amendment from Maker.

5. Reaffirmation; References to Note; Etc.

(a) Maker acknowledges and agrees that its obligations and liabilities under the Note and the other Transaction Documents, as amended hereby, are and shall be valid and enforceable

and shall not be impaired or limited by the execution or effectiveness of this Amendment.

(b) Upon the effectiveness of this Amendment, each reference in the Note to "this Note," "hereunder," "hereof," "herein" or words of like import shall mean and be a reference to the

Note, as amended by this Amendment.

(c) The Note and all of the other Transaction Documents shall remain unaltered, and the Note and all of the other Transaction Documents shall remain in full force and effect and are

hereby ratified and confirmed in all respects, as modified by this Amendment.

6. Titles. Titles and section headings herein shall be without substantive meaning and

are provided solely for the convenience of the parties.

7. Severability; Etc. In case any

provision of or obligation under this Amendment

shall be invalid, illegal, or unenforceable in any jurisdiction, the validity, legality, and enforceability of the remaining provisions or obligations, or of

such provision or obligation in any other jurisdiction, shall not in any way be affected or impaired thereby.

8. Successors and Assigns. This

Amendment shall be binding upon and inure to the

benefit of the parties hereto and their respective successors and assigns; provided,

however, Maker may not assign any of its respective rights or responsibilities under this Amendment without the prior written consent of Holder.

9. Governing Law. This Amendment shall be governed by and construed in

accordance with the Laws of the State of Delaware, without reference to principles of conflict of laws or choice of laws.

10. Counterparts. This Amendment

may be executed in multiple counterparts, each

of which shall be deemed to be an original and all of which when taken together shall constitute one and the same agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have caused this Amendment to be executed and delivered by their duly authorized officers as of the date

first above written.

| |

GSE SYSTEMS, INC.

By: /s/ Emmett Pepe

Name: Emmett Pepe

Title: Treasurer and Chief Financial Officer

|

| |

LIND GLOBAL FUND II LP

By: Lind Global Partners II LLC, its General Partner

By: /s/ Jeff Easton

Name: Jeff Easton

Title: Managing Member

|

Exhibit 10.2

THIS AMENDMENT TO NOTE HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES

COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, IN CONNECTION WITH THE UNDERLYING NOTE, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN

EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS

EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THIS NOTE AND THE SECURITIES ISSUABLE UPON CONVERSION OF THIS NOTE MAY BE PLEDGED IN CONNECTION WITH A

BONA FIDE MARGIN ACCOUNT SECURED BY SUCH SECURITIES.

SECOND AMENDMENT TO

AMENDED AND RESTATED SENIOR

CONVERTIBLE PROMISSORY NOTE

THIS SECOND AMENDMENT TO AMENDED AND RESTATED SENIOR CONVERTIBLE PROMISSORY NOTE (this “Amendment”), is dated as of February 12, 2024, by and among GSE Systems, Inc., a Delaware corporation (the “Maker” or the “Company”), and Lind Global Fund II LP, a Delaware limited partnership (together with its successors and representatives, the “Holder”).

WHEREAS, Maker is party to that certain Amended and Restated Senior Convertible Promissory Note, dated as of June

23, 2023, in the original principal amount of $2,747,228, made in favor of Holder (as amended by that certain First Amendment to Amended and Restated Senior Convertible Promissory Note, dated as of October 6, 2023, and as further amended, restated,

amended and restated, supplemented, or modified from time to time, the “Amended and Restated Note”); all capitalized terms used but not defined

herein shall have the meanings ascribed thereto in the Amended and Restated Note; and

WHEREAS, the parties wish to extend the date of effectiveness under Section 2.1(r) of the Amended and Restated Note; and

WHEREAS, Maker and Holder now desire to enter into this Amendment to amend the Amended and Restated Note to make

certain provisions consistent with the mutual understanding of the parties.

NOW, THEREFORE, for and in consideration of the mutual covenants and agreements contained herein, and for other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto (intending to be legally bound) hereby agree as follows:

1. Amendment to the Amended and Restated Note. Subject to the terms and conditions contained herein, Maker and Holder hereby amend the Amended and Restated Note to delete the existing Section 2.1(r) thereof in its entirety and replace the same with the following:

(r) at any time after June 1, 2024, the Company’s Market Capitalization is below $7 million for ten (10) consecutive

days.

2. Representations and Warranties of Maker.

After giving effect to Section 1

above, Maker hereby represents and warrants to and in favor of Holder, which representations and warranties shall survive the execution and delivery

hereof, as follows:

(a) Each of the representations and warranties of Maker contained in the Amended and Restated Note is true and correct in all material respects (without duplication of any

materiality carve out already provided therein) on and as of the date hereof, in each case as if made on and as of such date, other than representations and warranties that expressly relate solely to an earlier date (in which case such

representations and warranties were true and correct on and as of such earlier date);

(b) This Amendment has been duly authorized, validly executed, and delivered by one or more duly authorized officers of Maker, and each of this Amendment and the Amended and

Restated Note as amended hereby constitutes the legal, valid, and binding obligations of Maker, enforceable against Maker in accordance with their respective terms, subject to bankruptcy, insolvency, or other similar laws affecting the enforcement

of creditor's rights and remedies generally; and

(c) No default or Event of Default exists before or will result after giving effect to this Amendment.

3. No Other Amendments. Maker

acknowledges and expressly agrees that this Amendment is limited to the extent expressly set forth herein and shall not constitute a modification or amendment of the Amended and Restated Note or any other Transaction Document or a course of dealing

at variance with the terms or conditions of the Amended and Restated Note or any other Transaction Document (other than as expressly set forth in this Amendment).

4. Conditions Precedent to Effectiveness of this Amendment. The

amendments contained in Section 1 of this Amendment

and the other agreements contained herein shall become effective on the date hereof as long as each of the following conditions precedent is satisfied:

(a) all of the representations and warranties of Maker under Section 2 hereof, which are

made as of the date hereof, are true and correct; and

(b) receipt by Holder of duly executed signature page(s) to this Amendment from Maker.

5. Reaffirmation; References to Amended and Restated Note; Etc.

(a) Maker acknowledges and agrees that its obligations and liabilities under the Amended and Restated Note and the other Transaction Documents, as amended hereby, are and shall be

valid and enforceable and shall not be impaired or limited by the execution or effectiveness of this Amendment.

(b) Upon the effectiveness of this Amendment, each reference in the Amended and Restated Note to "this Note," "hereunder," "hereof," "herein" or words of like import shall mean and

be a reference to the Amended and Restated Note, as amended by this Amendment.

(c) The Amended and Restated Note and all of the other Transaction Documents shall remain unaltered, and the Amended and Restated Note and all of the other Transaction Documents

shall remain in full force and effect and are hereby ratified and confirmed in all respects, as modified by this Amendment.

6. Titles. Titles and section headings herein shall be without substantive meaning and

are provided solely for the convenience of the parties.

7. Severability; Etc. In case any

provision of or obligation under this Amendment

shall be invalid, illegal, or unenforceable in any jurisdiction, the validity, legality, and enforceability of the remaining provisions or obligations, or of

such provision or obligation in any other jurisdiction, shall not in any way be affected or impaired thereby.

8. Successors and Assigns. This

Amendment shall be binding upon and inure to the

benefit of the parties hereto and their respective successors and assigns; provided,

however, Maker may not assign any of its respective rights or responsibilities under this Amendment without the prior written consent of Holder.

9. Governing Law. This Amendment shall be governed by and construed in

accordance with the Laws of the State of Delaware, without reference to principles of conflict of laws or choice of laws.

10. Counterparts. This Amendment may

be executed in multiple counterparts, each

of which shall be deemed to be an original and all of which when taken together shall constitute one and the same agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have caused this Amendment to be executed and delivered by their duly authorized officers as of the date

first above written.

| |

GSE SYSTEMS, INC.

By: /s/ Emmett Pepe

Name: Emmett Pepe

Title: Treasurer and Chief Financial Officer

|

| |

LIND GLOBAL FUND II LP

By: Lind Global Partners II LLC, its General Partner

By: /s/ Jeff Easton

Name: Jeff Easton

Title: Managing Member

|

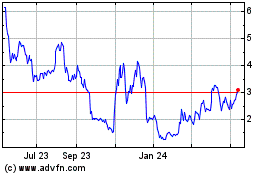

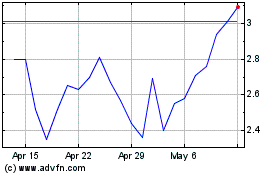

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Apr 2023 to Apr 2024