0000924168FALSEENERGY FOCUS, INC/DE00009241682023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 10, 2023

ENERGY FOCUS, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-36583 | | 94-3021850 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | |

| 32000 Aurora Road Suite B | Solon, | OH | 44139 |

| (Address of principal executive offices) | (Zip Code) |

(440) 715-1300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share | EFOI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 10, 2023, Energy Focus, Inc. issued a press release announcing its financial results for the three and six months ended June 30, 2023, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This information, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit | |

| Number | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: August 10, 2023 | | |

| | |

| | |

| ENERGY FOCUS, INC. |

| |

| |

| By: | /s/ Lesley A. Matt |

| Name: | Lesley A. Matt |

| Title: | Chief Executive Officer |

Exhibit 99.1

Energy Focus, Inc. Reports Second Quarter 2023 Financial Results

Conference Call to be Held Today at 11 a.m. ET

SOLON, Ohio, August 10, 2023 -- Energy Focus, Inc. (NASDAQ:EFOI), a leader in energy-efficient lighting and control system products for the commercial market and military maritime market (“MMM”), today announced financial results for its second quarter ended June 30, 2023.

Second Quarter 2023 Financial Highlights:

•Net sales of $1.1 million, decreased 28.7% compared to the second quarter of 2022, reflecting a decrease of $0.5 million, or 54.7%, in commercial sales, partially offset by a $0.1 million, or 21.4%, increase in military sales period-over-period. Sequentially, net sales increased by 13.4%, primarily reflecting a $0.1 million increase in commercial sales, with military sales remaining flat, as compared to the first quarter of 2023.

•Gross profit margin of 17.0% increased from 7.4% in the second quarter of 2022, and 1.8% in the first quarter of 2023. The period-over-period increase, as compared to the second quarter of 2022, was driven mainly by a favorable impact from lower fixed costs, offset slightly by an unfavorable impact from the change in inventory reserves. Sequentially, the increase quarter-over-quarter, as compared to the first quarter of 2023, primarily relates to a favorable impact from the change in inventory reserves due to orders received in the second quarter of 2023 that are expected to be fulfilled during the third quarter of 2023.

•Loss from operations of $1.1 million improved as compared to loss from operations of $2.2 million in the second quarter of 2022, and $1.2 million in the first quarter of 2023.

•Net loss of $1.2 million, or $(0.42) per basic and diluted share of common stock, compared to a net loss of $2.5 million, or $(2.43) per basic and diluted share of common stock, in the second quarter of 2022. Sequentially, the net loss decreased by $0.2 million compared to a net loss of $1.3 million, or $(0.58) per basic and diluted share of common stock, in the first quarter of 2023.

•Cash of $1.3 million, included in total availability (as defined under “Non-GAAP Measures” below) of $1.5 million, each as of June 30, 2023, as compared to cash of $52 thousand and $938 thousand and total availability of $107 thousand and $2.5 million as of December 31, 2022 and June 30, 2022, respectively.

•Subsequent to approval by the Company’s stockholders and pursuant to the ratio approved by the Company’s Board of Directors on June 15, 2023, a 1-for-7 reverse stock split became effective on June 16, 2023 wherein every seven shares of common stock issued and outstanding automatically combined into one validly issued, fully paid and non-assessable share of common stock. No fractional shares were issued as a result of the reverse stock split.

•Private placement of additional $1.3 million of common stock was completed during the second quarter of 2023.

“We believe the second quarter has been the start of a true turn around for Energy Focus,” said Lesley Matt, Chief Executive Officer. “The arrival of fresh inventory late in the quarter allowed for us to begin showing

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

improvement in both our topline sales and gross profit. As more inventory continues to arrive, we are optimistic to continue this trend. Additionally, we have made changes to our sales team structure to better align with growth and the future. As we march towards increasing revenue by providing customers with innovative energy solution products, we continue to look at ways to improve our overall operation.”

Second Quarter 2023 Financial Results:

Net sales of $1.1 million for the second quarter of 2023 decreased $0.4 million, or 28.7%, compared to second quarter of 2022 net sales of $1.5 million, primarily driven by a decrease in commercial sales of $0.5 million, or 54.7%, that was partially offset by an increase in MMM product sales of $0.1 million, or 21.4%. MMM sales have increased due to improved sales pipeline as management replaced the head of MMM sales mid-year 2022. The MMM sales cycle is prolonged and started to reverse its negative trend in the middle of the fourth quarter of 2022. Net commercial product sales decreased in the second quarter of 2023 compared to the same period in 2022, primarily due to the lack of availability in high-margin, high-demand commercial products as a result of supply chain interruptions. Sequentially, net sales were up 13.4% compared to $0.9 million in the first quarter of 2023, reflecting a slight increase in commercial sales with the sales in MMM orders flat.

Gross profit was $0.2 million, or 17.0% of net sales, for the second quarter of 2023. This compares with gross profit of $0.1 million, or 7.4% of net sales, in the second quarter of 2022. The period-over-period increase in gross profit was driven mainly by a favorable impact from lower fixed costs of $0.2 million, or 15.3% of net sales. The $0.1 million favorable impact from product mix was offset by an unfavorable impact of $0.1 million from lower sales. Additionally, there was an overall net unfavorable impact from the change in inventory reserves of $0.1 million, or 7.5% of net sales, versus the second quarter of 2022, which included a one-time adjustment from a scrap write-off.

Sequentially, gross profit of $0.2 million for the second quarter of 2023 compares with gross profit of $17 thousand, or 1.8% of net sales, in the first quarter of 2023. The increase quarter-over-quarter primarily relates to a favorable net impact of approximately $0.1 million, or 8.1% of net sales, related to the change in inventory reserves and favorable impacts of $0.1 million in sales and product mix, together. The change in inventory reserves relates mainly to orders received during the second quarter of 2023 that are expected to be fulfilled during the third quarter of 2023.

Adjusted gross margin, as defined under “Non-GAAP Measures” below, was 6.8% for the second quarter of 2023, compared to (5.1)% in the second quarter of 2022, primarily driven by lower fixed costs during the second quarter of 2023 as compared to the second quarter of 2022. Sequentially, this compares to adjusted gross margin of (0.6)% in the first quarter of 2023. The improvement from the first quarter of 2023 was primarily driven by higher variable margins and lower fixed costs in the second quarter of 2023.

Operating loss was $1.1 million for the second quarter of 2023, an improvement as compared to an operating loss of $2.2 million in the second quarter of 2022, and an operating loss of $1.2 million in the first quarter of 2023. Net loss was $1.2 million, or $(0.42) per basic and diluted share of common stock, for the second quarter of 2023, compared with a net loss of $2.5 million, or $(2.43) per basic and diluted share of common stock, in the second quarter of 2022. Sequentially, this compares with a net loss of $1.3 million, or $(0.58) per basic and diluted share of common stock, in the first quarter of 2023.

Adjusted EBITDA, as defined under “Non-GAAP Measures” below, was a loss of $1.0 million for the second quarter of 2023, compared with a loss of $2.1 million in the second quarter of 2022 and a loss of $1.2 million in the first quarter of 2023. The smaller adjusted EBITDA loss in the second quarter of 2023, as compared to the second quarter of 2022, was primarily due to improved margins and lower operating expenses.

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Cash was $1.3 million as of June 30, 2023. This compares with cash of $52 thousand and $938 thousand as of December 31, 2022 and June 30, 2022, respectively. As of June 30, 2023, the Company had total availability, as defined under “Non-GAAP Measures” below, of $1.5 million, which consisted of $1.3 million of cash and $0.2 million of additional borrowing availability under its credit facilities. This compares to total availability of $107 thousand as of December 31, 2022 and $2.5 million as of June 30, 2022. Our net inventory balance of $5.3 million as of June 30, 2023 decreased $0.2 million and $1.9 million from our net inventory balance as of December 31, 2022 and June 30, 2022, respectively.

Earnings Conference Call:

The Company will host a conference call and webcast today, August 10, 2023, at 11 a.m. ET to discuss the second quarter 2023 results, followed by a Q & A session.

You can access the live conference call by dialing the following phone numbers:

•Toll free 1-877-451-6152 or

•International 1-201-389-0879

•Conference ID# 13739842

The conference call will be simultaneously webcast. To listen to the webcast, log onto it at: https://viavid.webcasts.com/starthere.jsp?ei=1623732&tp_key=af4459857f. The webcast will be available at this link through August 25, 2023. Financial information presented on the call, including this earnings press release, will be available on the investors section of Energy Focus’ website, investors.energyfocus.com.

About Energy Focus

Energy Focus is an industry-leading innovator of sustainable light-emitting diode (“LED”) lighting and lighting control technologies and solutions. As the creator of the first flicker-free LED lamps, Energy Focus develops high quality LED lighting products and controls that provide extensive energy and maintenance savings, as well as aesthetics, safety, health and sustainability benefits over conventional lighting. In 2023, EFOI announced plans to add high efficiency GaN (gallium nitride) power supply products to its product portfolio. Energy Focus is headquartered in Solon, Ohio. For more information, visit our website at www.energyfocus.com.

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Forward-Looking Statements:

Forward-looking statements in this release are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “feels,” “seeks,” “forecasts,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could” or “would” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, capital expenditures, and the industry in which we operate. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we base these forward-looking statements on assumptions that we believe are reasonable when made in light of the information currently available to us, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this release. We believe that important factors that could cause our actual results to differ materially from forward-looking statements include, but are not limited to: (i) our need for and ability to obtain additional financing in the near term, on acceptable terms or at all, to continue our operations; (ii) our ability to maintain compliance with the continued listing standards of The Nasdaq Stock Market (iii) our ability to refinance or extend maturing debt on acceptable terms or at all; (iv) our ability to continue as a going concern for a reasonable period of time; (v) our ability to realize synergies with our strategic investor; (vi) instability in the U.S. and global economies and business interruptions experienced by us, our customers and our suppliers, particularly in light of supply chain constraints and other long-term impacts of the coronavirus pandemic; (vii) the competitiveness and market acceptance of our LED lighting and control technologies and products; (viii) our ability to compete effectively against companies with lower prices or cost structures, greater resources, or more rapid development capabilities, and new competitors in our target markets; (ix) our ability to extend our product portfolio into new applications and end markets; (x) our ability to increase demand in our targeted markets and to manage sales cycles that are difficult to predict and may span several quarters; (xi) the timing of large customer orders, significant expenses and fluctuations between demand and capacity as we manage inventory and invest in growth opportunities; (xii) our ability to successfully scale our network of sales representatives, agents, distributors and other channel partners to compete with the sales reach of larger, established competitors; (xiii) our ability to implement plans to increase sales and control expenses; (xiv) our reliance on a limited number of customers for a significant portion of our revenue, and our ability to maintain or grow such sales levels; (xv) our ability to add new customers to reduce customer concentration; (xviii) our ability to attract and retain a new chief financial officer; (xvii) our ability to manage the size of our workforce while continuing to attract, develop and retain qualified personnel, and to do so in a timely manner; (xviii) our ability to diversify our reliance on a limited number of third-party suppliers and development partners, our ability to manage third-party product development and obtain critical components and finished products on acceptable terms and of acceptable quality despite ongoing global supply chain challenges, and the impact of our fluctuating demand on the stability of such suppliers; (xix) our ability to timely, efficiently and cost-effectively transport products from our third-party suppliers by ocean marine and other logistics channels despite global supply chain and logistics disruptions; (xx) the impact of any type of legal inquiry, claim or dispute; (xxi) the macro-economic conditions, including rising interest rates and recessionary trends, in the United States and in other markets in which we operate or secure products, which could affect our ability to obtain raw materials, component parts, freight, energy, labor, and sourced finished goods in a timely and cost-effective manner; (xxii) our dependence on military maritime customers and on the levels and timing of government funding available to such customers, as well as the funding resources of our other customers in the public sector and commercial markets; (xxix) business interruptions resulting from geopolitical

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

actions such as war and terrorism, natural disasters, including earthquakes, typhoons, floods and fires, or from health epidemics, or pandemics or other contagious outbreaks; (xxx) our ability to respond to new lighting and control technologies and market trends; (xxxi) our ability to fulfill our warranty obligations with safe and reliable products; (xxxii) any delays we may encounter in making new products available or fulfilling customer specifications; (xxxiii) any flaws or defects in our products or in the manner in which they are used or installed; (xxix) our ability to protect our intellectual property rights and other confidential information, and manage infringement claims by others; (xxx) our compliance with government contracting laws and regulations, through both direct and indirect sale channels, as well as other laws, such as those relating to the environment and health and safety; (xxxi) risks inherent in international markets, such as economic and political uncertainty, changing regulatory and tax requirements and currency fluctuations, including tariffs and other potential barriers to international trade; and (xxix) our ability to maintain effective internal controls and otherwise comply with our obligations as a public company. For additional factors that could cause our actual results to differ materially from the forward-looking statements, please refer to our most recent annual report on Form 10-K and quarterly reports on Form 10-Q filed with the Securities and Exchange Commission.

###

Investor Contact:

Lesley A. Matt

Chief Executive Officer

(216) 715-1300

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | |

| June 30, 2023 | December 31, 2022 |

| (Unaudited) | |

| ASSETS | | |

| Current assets: | | |

| Cash | $ | 1,316 | | $ | 52 | |

| Trade accounts receivable, less allowances of $79 and $26, respectively | 841 | | 445 | |

| Inventories, net | 5,304 | | 5,476 | |

| Short-term deposits | 630 | | 592 | |

| Prepaid and other current assets | 217 | | 232 | |

| Receivable for claimed Employee Retention Tax Credit | — | | 445 | |

| Total current assets | 8,308 | | 7,242 | |

| | |

| Property and equipment, net | 60 | | 76 | |

| Operating lease, right-of-use asset | 1,034 | | 1,180 | |

| | |

| | |

| Total assets | $ | 9,402 | | $ | 8,498 | |

| | |

| LIABILITIES | | |

| Current liabilities: | | |

| Accounts payable | $ | 2,908 | | $ | 2,204 | |

| Accrued liabilities | 116 | | 145 | |

| Accrued legal and professional fees | 89 | | — | |

| Accrued payroll and related benefits | 268 | | 261 | |

| Accrued sales commissions | 32 | | 76 | |

| | |

| | |

| Accrued warranty reserve | 146 | | 183 | |

| | |

| Operating lease liabilities | 210 | | 198 | |

| | |

| | |

| Promissory notes payable, net of discounts and loan origination fees | 1,335 | | 2,618 | |

| Related party promissory notes payable | — | | 814 | |

| | |

| | |

| | |

| Credit line borrowings, net of loan origination fees | 284 | | 1,447 | |

| Total current liabilities | 5,388 | | 7,946 | |

| | |

(continued on next page)

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | |

| June 30, 2023 | December 31, 2022 |

| (Unaudited) | |

| | |

| Operating lease liabilities, net of current portion | 915 | | 1,029 | |

| | |

| | |

| | |

| | |

| Total liabilities | 6,303 | | 8,975 | |

| | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | |

| Preferred stock, par value $0.0001 per share: | | |

Authorized: 5,000,000 shares (3,300,000 shares designated as Series A Convertible Preferred Stock) at June 30, 2023 and December 31, 2022 | | |

Issued and outstanding: 876,447 at June 30, 2023 and December 31, 2022 | — | | — | |

| Common stock, par value $0.0001 per share: | | |

Authorized: 50,000,000 shares at June 30, 2023 and December 31, 2022 | | |

Issued and outstanding: 3,495,924 at June 30, 2023 and 1,406,920* at December 31, 2022 | — | | 1 | |

| Additional paid-in capital | 154,624 | | 148,545 | |

| Accumulated other comprehensive loss | (3) | | (3) | |

| Accumulated deficit | (151,522) | | (149,020) | |

| Total stockholders' equity (deficit) | 3,099 | | (477) | |

| Total liabilities and stockholders' equity (deficit) | $ | 9,402 | | $ | 8,498 | |

| * Shares outstanding for prior periods have been restated for the 1-for-7 reverse stock split effective June 16, 2023. |

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended | Six months ended June 30, |

| June 30, 2023 | March 31, 2023 | June 30, 2022 | 2023 | 2022 |

| | |

| Net sales | $ | 1,055 | | $ | 930 | | $ | 1,480 | | $ | 1,985 | | $ | 3,541 | |

| Cost of sales | 876 | | 913 | | 1,371 | | 1,789 | | 3,458 | |

| Gross profit | 179 | | 17 | | 109 | | 196 | | 83 | |

| | | | | |

| Operating expenses: | | | | | |

| Product development | 147 | | 154 | | 353 | | 301 | | 856 | |

| Selling, general, and administrative | 1,132 | | 1,066 | | 1,964 | | 2,198 | | 4,091 | |

| | | | | |

| Total operating expenses | 1,279 | | 1,220 | | 2,317 | | 2,499 | | 4,947 | |

| Loss from operations | (1,100) | | (1,203) | | (2,208) | | (2,303) | | (4,864) | |

| | | | | |

| Other expenses (income): | | | | | |

| Interest expense, net | 69 | | 123 | | 260 | | 192 | | 444 | |

| | | | | |

| | | | | |

| Other income | (16) | | — | | — | | (16) | | (30) | |

| | | | | |

| Other expenses | 14 | | 7 | | 18 | | 21 | | 29 | |

| | | | | |

| | | | | |

| | | | | |

| Net loss | $ | (1,167) | | $ | (1,333) | | $ | (2,486) | | $ | (2,500) | | $ | (5,307) | |

| | | | | |

| Net loss per common share - basic and diluted: | | | | | |

| Net Loss | $ | (0.42) | | $ | (0.58) | | $ | (2.43) | | $ | (0.98) | | $ | (5.45) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Weighted average shares of common stock outstanding: | | | | | |

| Basic and diluted* | 2,766 | 2,310 | 1,024 | 2,539 | 973 |

| * Shares outstanding for prior periods have been restated for the 1-for-7 reverse stock split effective June 16, 2023. |

| | | | | |

| | | | | |

|

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended | Six months ended

June 30, |

| | June 30, 2023 | March 31, 2023 | June 30, 2022 | 2023 | 2022 |

| | |

| Cash flows from operating activities: | | | | | |

| Net loss | $ | (1,167) | | $ | (1,333) | | $ | (2,486) | | $ | (2,500) | | $ | (5,307) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Other income | — | | — | | — | | — | | (30) | |

| | | | | |

| Depreciation | 8 | | 8 | | 43 | | 16 | | 87 | |

| Stock-based compensation | 23 | | 26 | | 54 | | 49 | | 98 | |

| | | | | |

| Provision for doubtful accounts receivable | 21 | | 29 | | 5 | | 50 | | (4) | |

| Provision for slow-moving and obsolete inventories | (107) | | (23) | | (185) | | (130) | | (56) | |

| Provision for warranties | 3 | | (40) | | 51 | | (37) | | 21 | |

| | | | | |

| Amortization of loan discounts and origination fees | 47 | | 62 | | 91 | | 109 | | 160 | |

| | | | | |

| Changes in operating assets and liabilities (sources / (uses) of cash): | | | | | |

| Accounts receivable | 93 | | (496) | | 184 | | (403) | | 101 | |

| Inventories | (259) | | 562 | | 384 | | 303 | | 754 | |

| Short-term deposits | — | | (23) | | 47 | | (23) | | 59 | |

| Prepaid and other assets | 454 | | 6 | | 96 | | 460 | | 116 | |

| Accounts payable | 884 | | (27) | | (777) | | 857 | | (716) | |

| Accrued and other liabilities | (152) | | 66 | | (149) | | (86) | | (360) | |

| Deferred revenue | — | | — | | — | | — | | (268) | |

| Total adjustments | 1,015 | | 150 | | (156) | | 1,165 | | (38) | |

| Net cash used in operating activities | (152) | | (1,183) | | (2,642) | | (1,335) | | (5,345) | |

| Cash flows from investing activities: | | | | | |

| Acquisitions of property and equipment | — | | — | | (2) | | — | | (37) | |

| | | | | |

| Net cash used in investing activities | — | | — | | (2) | | — | | (37) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

(continued on next page)

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Statements of Cash Flows - continued

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended | Six months ended

June 30, |

| June 30, 2023 | March 31, 2023 | June 30, 2022 | 2023 | 2022 |

| | |

| Cash flows from financing activities (sources / (uses) of cash): | | | | | |

| Proceeds from the issuance of common stock and warrants | 1,304 | | 3,025 | | 3,500 | | 4,329 | | 3,500 | |

| | | | | |

| | | | | |

Offering costs paid on the issuance of common stock and warrants | — | | — | | (334) | | — | | (334) | |

| Costs related to reverse stock-split | (16) | | — | | — | | (16) | | — | |

| | | | | |

| Principal payments under finance lease obligations | — | | — | | — | | — | | (1) | |

| Proceeds from exercise of stock options and employee stock purchase plan purchases | — | | — | | 5 | | — | | 5 | |

| | | | | |

| | | | | |

| | | | | |

| Payments on the 2021 Streeterville Note | — | | — | | (410) | | — | | (1,025) | |

| Proceeds from the 2022 Streeterville Note | — | | — | | 2,000 | | — | | 2,000 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Payments on the 2022 Streeterville Note | — | | (500) | | — | | (500) | | — | |

| Deferred financing costs | — | | — | | (234) | | — | | (234) | |

| | | | | |

| | | | | |

| Net payments on proceeds from the credit line borrowings - Credit Facilities | (121) | | (1,093) | | (1,170) | | (1,214) | | (273) | |

| Net cash provided by financing activities | 1,167 | | 1,432 | | 3,357 | | 2,599 | | 3,638 | |

| | | | | |

| | | | | |

| Net increase (decrease) in cash | 1,015 | | 249 | | 713 | | 1,264 | | (1,744) | |

| Cash, beginning of period | 301 | | 52 | | 225 | | 52 | | 2,682 | |

| Cash, end of period | $ | 1,316 | | $ | 301 | | $ | 938 | | $ | 1,316 | | $ | 938 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Sales by Product

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended | Six months ended

June 30, |

| June 30, 2023 | March 31, 2023 | June 30, 2022 | 2023 | 2022 |

| | |

| Net sales: | | | | | |

| Commercial | $ | 442 | | $ | 321 | | $ | 975 | | $ | 763 | | $ | 2,109 | |

| Military maritime products | 613 | | 609 | | 505 | | 1,222 | | 1,432 | |

| Total net sales | $ | 1,055 | | $ | 930 | | $ | 1,480 | | $ | 1,985 | | $ | 3,541 | |

Non-GAAP Measures

In addition to the results in this release that are presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), we provide certain non-GAAP measures, which present operating results on an adjusted basis. These non-GAAP measures are supplemental measures of performance that are not required by or presented in accordance with U.S. GAAP and, include:

•total availability, which we define as our ability on the period end date to access additional cash if necessary under our short-term credit facilities, plus the amount of cash on hand on that same date;

•adjusted EBITDA, which we define as net income (loss) before giving effect to financing charges, income taxes, non-cash depreciation, stock non-cash compensation, accrued incentive compensation, non-routine charges to other income or expense; and

•adjusted gross margins, which we define as our gross profit margins during the period without the impact from excess and obsolete, in-transit and net realizable value inventory reserve movements that do not reflect current period inventory decisions.

We believe that our use of these non-GAAP financial measures permits investors to assess the operating performance of our business relative to our performance based on U.S. GAAP results and relative to other companies within the industry by isolating the effects of items that may vary from period to period without correlation to core operating performance or that vary widely among similar companies, and to assess liquidity, cash flow performance of the operations, and the product margins of our business relative to our U.S. GAAP results and relative to other companies in the industry by isolating the effects of certain items that do not have a current period impact. However, our presentation of these non-GAAP measures should not be construed as an indication that our future results will be unaffected by unusual or infrequent items or that the items for which we have made adjustments are unusual or infrequent or will not recur. Further, there are limitations on the use of these non-GAAP measures to compare our results to other companies within the industry because they are not necessarily standardized or comparable to similarly titled measures used by other companies. We believe that the disclosure of these non-GAAP measures is useful to investors as they form part of the basis for how our management team and Board of Directors evaluate our operating performance.

Total availability, adjusted EBITDA and adjusted gross margins do not represent cash generated from operating activities in accordance with U.S. GAAP, are not necessarily indicative of cash available to fund cash needs and are not intended to and should not be considered as alternatives to cash flow, net income and gross profit margins, respectively, computed in accordance with U.S. GAAP as measures of liquidity or operating performance. Reconciliations of these non-GAAP measures to the most directly comparable financial

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

measures calculated and presented in accordance with U.S. GAAP are provided below for total availability, adjusted EBITDA and adjusted gross margins, respectively.

| | | | | | | | | | | |

| As of |

| (in thousands) | June 30, 2023 | December 31, 2022 | June 30, 2022 |

| Total borrowing capacity under credit facilities | $ | 500 | | $ | 1,567 | | $ | 3,568 | |

Less: Credit line borrowings, gross(1) | (296) | | (1,512) | | (2,015) | |

Excess availability under credit facilities(2) | 204 | | 55 | | 1,553 | |

| Cash | 1,316 | | 52 | | 938 | |

Total availability(3) | $ | 1,520 | | $ | 107 | | $ | 2,491 | |

(1) Forms 10-Q and 10-K Balance Sheets reflect the Line of credit net of debt financing costs of $12, $65 and $23, respectively. |

(2) Excess availability under credit facilities - represents difference between maximum borrowing capacity of credit facilities and actual borrowings. |

(3) Total availability - represents Company’s ‘access’ to cash if needed at point in time. |

| | | | | | | | | | | | | | | | | |

| Three months ended | Six months ended

June 30, |

| (in thousands) | June 30, 2023 | March 31, 2023 | June 30, 2022 | 2023 | 2022 |

| Net loss | $ | (1,167) | | $ | (1,333) | | $ | (2,486) | | $ | (2,500) | | $ | (5,307) | |

| | | | | |

| | | | | |

| Interest | 69 | | 123 | | 260 | | 192 | | 444 | |

| | | | | |

| | | | | |

| Other income | — | | — | | — | | (16) | | (30) | |

| | | | | |

| Depreciation | 8 | | 8 | | 43 | | 16 | | 87 | |

| Stock-based compensation | 23 | | 26 | | 54 | | 49 | | 98 | |

| | | | | |

| Other incentive compensation | 23 | | (28) | | 33 | | (5) | | 28 | |

| Adjusted EBITDA | $ | (1,044) | | $ | (1,204) | | $ | (2,096) | | $ | (2,264) | | $ | (4,680) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (in thousands) | June 30, 2023 | March 31, 2023 | June 30, 2022 | | | | |

| ($) | (%) | ($) | (%) | ($) | (%) | | | | | | |

| Net sales | $1,055 | | $930 | | $1,480 | | | | | | | |

| Actual gross profit | $179 | 17.0 | % | $17 | 1.8 | % | $109 | 7.4 | % | | | | | | |

| E&O, in-transit and net realizable value inventory reserve changes, net of scrap write-off for inventory reduction | (107) | (10.1) | % | (23) | (2.5) | % | (185) | (12.5) | % | | | | | | |

| Adjusted gross profit (loss) | $72 | 6.8 | % | $(6) | (0.6) | % | $(76) | (5.1) | % | | | | | | |

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity Registrant Name |

ENERGY FOCUS, INC/DE

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36583

|

| Entity Tax Identification Number |

94-3021850

|

| Entity Address, Address Line One |

32000 Aurora Road Suite B

|

| Entity Address, City or Town |

Solon,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44139

|

| City Area Code |

440

|

| Local Phone Number |

715-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

EFOI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000924168

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

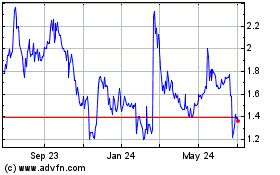

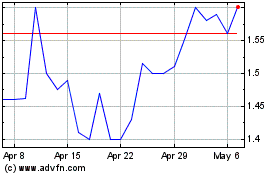

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Apr 2023 to Apr 2024