Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

March 04 2024 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2024

Commission File Number 001-39349

DoubleDown Interactive Co., Ltd.

(Translation of registrant’s name into English)

Joseph A.

Sigrist, Chief Financial Officer

c/o DoubleDown Interactive, LLC

605 5th Avenue, Suite 300

Seattle, WA 98104

+1-206-408-4545

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Public Notice for Convocation of the 16th Annual General Meeting of DoubleDown Interactive Co., Ltd.

On March 4, 2024, the Board of Directors of DoubleDown Interactive Co., Ltd. (the “Company”) approved and ratified to convene the 16th Annual

General Meeting of Shareholders (the “AGM”) of the Company as set forth below:

| |

1. |

Date and Time: March 29, 2024, 11:00 a.m. (Korea Standard Time) / March 28, 2024, 9:00 p.m. (Eastern

Time, US) |

| |

2. |

Who Can Attend: Holders of the Company’s common shares as of December 31, 2023 (the “Record

Date”). Holders of American Depositary Shares (“ADSs”), each representing 0.05 share of a common share, may not attend in person or vote at the AGM. Instead, holders of record of ADSs as of the Record Date shall instruct Citibank,

N.A., the depositary of the ADSs (the “Depositary”), as to how to vote the common shares represented by the ADSs. Any ADS holder who wishes to attend the AGM or vote directly must cancel their ADSs in exchange for common shares and shall

make arrangements to deliver their ADSs to the Depositary for cancellation with sufficient time to allow for the delivery and exchange of their ADSs for the underlying common shares before the date of the AGM. |

| |

3. |

Venue: Meeting room, 13th floor, 152 Teheran-Ro, Gangnam-gu, Seoul

|

| |

4. |

Methods of Attending: Holders of the ADSs should send the Depositary their voting instructions using the ADS

voting card as separately instructed. |

| |

5. |

Reports and Proposals to be presented and considered at the AGM: |

| |

• |

|

Reports: audit report, business report, and the report on the operating status of the internal accounting

management system |

|

|

|

| Proposal No. 1: |

|

Approval of the 16th financial statements and consolidated financial statements for the fiscal year ended December 31, 2023 |

|

|

| Proposal No. 2 |

|

(Shareholder Proposal*): Approval of the amendment to the Company’s Articles of Incorporation as proposed by STIC Special Situation Diamond Limited |

|

|

| Proposal No. 3 |

|

(Shareholder Proposal*): Election of non-executive directors as proposed by STIC Special Situation Diamond Limited |

Proposal No. 3-1: Election of Il Sung Kang as a non-executive director

Proposal No. 3-2: Election of Suk

Ho Yun as a non-executive director

|

|

|

| Proposal No. 4: |

|

Approval of the remuneration limit for independent directors and executive officers |

|

|

| Proposal No. 5: |

|

Amendment to the Regulations on Executive Retirement Payment |

| |

* |

In accordance with Article 363-2 of the Commercial Act of Korea, shareholders who hold no less than 3% of the

total number of issued and outstanding shares, excluding non-voting shares, may make a proposal to directors that certain matters be raised as agenda items for a general meeting of shareholders. |

Proposal No. 2 (Shareholder Proposal): Approval of the amendment to the Company’s Articles of Incorporation as proposed by STIC

Special Situation Diamond Limited

|

|

|

|

|

| Before |

|

After |

|

Note |

| CHAPTER V DIRECTORS, BOARD OF DIRECTORS, REPRESENTATIVE DIRECTOR |

|

|

|

| Article 28 (Number of Directors)

The Company shall have not less than three (3), but not more than eight (8) directors.

<Amended on May 20, 2020> |

|

Article 28 (Number of Directors)

The Company shall have not less than three (3), but not more than ten (10) directors.

< Amended on March 29, 2024> |

|

To increase the number of directors |

|

|

|

| Article 29 (Election of Directors)

...elision...

③In case two (2) or more directors are elected, the cumulative vote stipulated in Article 382-2 of the

Commercial Act shall not apply. <Amended on May 20, 2020>

...elision... |

|

Article 29 (Election of Directors)

...elision...

③In case two (2) or more directors are elected, the cumulative vote stipulated in Article 382-2 of the

Commercial Act shall apply. < Amended on March 29,

2024> ...elision... |

|

To apply the cumulative voting system for election of the directors under certain circumstances |

| CHAPTER VI AUDIT COMMITTEE |

|

|

|

|

|

| Before |

|

After |

|

Note |

| Article 41 (Composition of the Audit Committee)

...elision...

② The audit committee of the Company shall consist of three (3) or more directors; provided, however, that at least 2/3 of the members of the audit

committee shall be outside directors. ...elision... |

|

Article 41 (Composition of the Audit Committee)

...elision...

2. The audit committee of the Company shall consist of three (3) or more directors; provided,

however, that at least 2/3 of the members of the audit committee shall be outside directors. In addition, separate from other directors, at least one member of the audit committee must be appointed by resolution of the general

shareholders’ meeting. In the election and dismissal of directors who become members of the audit committee, shareholders holding more than 3/100 of the total number of issued shares, excluding

non-voting shares, cannot exercise voting rights in excess of the 3/100 shares owned by such shareholders. (In the case of the Company’s largest shareholder, when appointing or dismissing an audit

committee member who is not an outside director, the shares owned by his or her specially related persons and other persons as defined by the Enforcement Decree of the Commercial Act are combined.)

<Amended on March 29, 2024> |

|

Changes in Audit Committee Appointment Method.

In accordance with Nasdaq Listing Rule 5605(c)(2)(A), the audit committee of the board of directors of a foreign private issuer listed on Nasdaq shall consist

of independent directors, expect for exceptional and limited circumstances. |

|

| Supplementary Provisions |

|

|

|

| <New article> |

|

Addendum <March 29, 2024, Article 1 (Enforcement date)

These Articles of Incorporation shall come into effect on March 29, 2024,

from the date of the resolution of the 16th Annual General Meeting. |

|

Establishment of supplementary provisions such as effective date |

Proposal No. 3 (Shareholder Proposal): Election of non-executive

directors as proposed by STIC Special Situation Diamond Limited

|

|

|

|

|

|

|

|

|

| Name |

|

Date of Birth |

|

Term |

|

New

Appointment |

|

Professional Experience |

| Il Sung Kang |

|

February 17, 1972 |

|

3/29/2024 – 3/28/2027 |

|

No |

|

Heungkuk Asset Management Management Division

Deputy Manager, Daewoo Securities STIC Investment

Partner |

|

|

|

|

|

| Suk Ho Yun |

|

December 19, 1977 |

|

3/29/2024 – 3/28/2027 |

|

No |

|

KPMG Samjong Accounting Corporation Audit Headquarters

Head of Investment Division, Woori Private Equity Opus Private

Equity Investment Team Managing Director |

Proposal No. 4: To approve the continuance of the aggregate remuneration limit for independent directors

and executive officers at 5 billion won for the fiscal year ending December 31, 2024.

|

|

|

|

|

| Title |

|

2023 |

|

2024 |

| Independent Directors and Executive Officers’ remuneration limit |

|

5 billion won |

|

5 billion won |

Proposal No. 5: Amendment to the Regulations on Executive Retirement Payment

|

|

|

|

|

| Before |

|

After |

|

Note |

| Article 4 [Calculation of Executive Retirement Payment]

...elision...

② The average annual salary shall be the average annualized amount of the total salary paid in the last three years retroactive to the date of

retirement. If the period of service is less than 3 years, it shall be the period of service

...elision... |

|

Article 4 [Calculation of Executive Retirement Payment]

...elision...

② The average annual salary shall be the average annualized amount of the base salary paid in the last three years retroactive to the date

of retirement. If the period of service is less than 3 years, it shall be the period of service. This Article also applies to the period of service prior to the enforcement date of Article 3 of the Supplementary Provisions of this

Regulation during the recent three-year period retroactive to the date of retirement. <Amended on March 29, 2024>

...elision... |

|

Change in severance pay calculation standards |

| Supplementary Provisions |

|

|

|

| <New article> |

|

Article 3 [Effective Date]

These rules are effective March 29, 2024. |

|

Establishment of supplementary provisions such as effective date |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

DOUBLEDOWN INTERACTIVE CO., LTD. |

| Date: March 4, 2024 |

|

|

|

|

|

|

|

|

By: |

|

/s/ Joseph A. Sigrist |

|

|

|

|

|

|

Name: Joseph A. Sigrist |

|

|

|

|

|

|

Title: Chief Financial Officer |

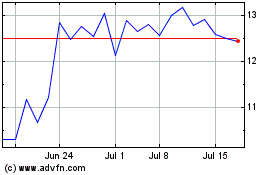

DoubleDown Interactive (NASDAQ:DDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

DoubleDown Interactive (NASDAQ:DDI)

Historical Stock Chart

From Apr 2023 to Apr 2024