Form 8-K - Current report

March 08 2024 - 7:00AM

Edgar (US Regulatory)

falseUSD000154641700015464172024-03-052024-03-05iso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) March 5, 2024

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35625 | 20-8023465 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, FL 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | $0.01 par value

| | BLMN | | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On March 5, 2024, OSI Restaurant Partners, LLC (“OSI”), a subsidiary of Bloomin’ Brands, Inc. (the “Company”), entered into five interest rate swap agreements with five counterparties (the “Swap Transactions”) to manage its exposure to fluctuations in variable interest rates. The Swap Transactions have two-year tenors with the following terms:

| | | | | | | | | | | | | | | | | | | | |

| AGGREGATE NOTIONAL AMOUNT | | WEIGHTED AVERAGE FIXED INTEREST RATE (1) | | EFFECTIVE DATE | | TERMINATION DATE |

| $ | 175,000,000 | | | 4.40% | | March 29, 2024 | | March 31, 2026 |

| | | | | | |

____________________

(1)The weighted averaged fixed interest rate excludes the term SOFR adjustment and interest rate spread described below.

In connection with the Swap Transactions, the Company effectively converted $175 million of its outstanding indebtedness from the Secured Overnight Financing Rate (“SOFR”), plus a term SOFR adjustment of 0.10% and a spread of 150 to 250 basis points to the weighted average fixed interest rate within the table above, plus a term SOFR adjustment of 0.10% and a spread of 150 to 250 basis points. The Swap Transactions have an embedded floor of minus 0.10%.

Forward-Looking Statements

Certain statements contained herein are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws. Generally, these statements can be identified by the use of words such as “guidance,” “believes,” “estimates,” “anticipates,” “expects,” “on track,” “feels,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the Company’s forward-looking statements. These risks and uncertainties include, but are not limited to: consumer reaction to public health and food safety issues; increases in labor costs and fluctuations in the availability of employees; increases in unemployment rates and taxes; competition; interruption or breach of our systems or loss of consumer or employee information; price and availability of commodities and other impacts of inflation; our dependence on a limited number of suppliers and distributors; political, social and legal conditions in international markets and their effects on foreign operations and foreign currency exchange rates; our ability to address corporate citizenship and sustainability matters and investor expectations; local, regional, national and international economic conditions; changes in patterns of consumer traffic, consumer tastes and dietary habits; the effects of changes in tax laws; costs, diversion of management attention and reputational damage from any claims or litigation; government actions and policies; challenges associated with our remodeling, relocation and expansion plans; our ability to preserve the value of and grow our brands; consumer confidence and spending patterns; the effects of a health pandemic, weather, acts of God and other disasters and the ability or success in executing related business continuity plans; the Company’s ability to make debt payments and planned investments and the Company’s compliance with debt covenants; the cost and availability of credit; interest rate changes; and any impairments in the carrying value of goodwill and other assets. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its most recent Form 10-K and subsequent filings with the Securities and Exchange Commission. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this release. All forward-looking statements are qualified in their entirety by this cautionary statement.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | |

| | Exhibit Number | | Description |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | BLOOMIN’ BRANDS, INC. |

| | | (Registrant) |

| | | |

| Date: | March 8, 2024 | By: | /s/ Christopher Meyer |

| | | Christopher Meyer |

| | | Executive Vice President and Chief Financial Officer

(Principal Financial Officer) |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe par value per share of security quoted in same currency as Trading currency. Example: '0.01'.

| Name: |

dei_EntityListingParValuePerShare |

| Namespace Prefix: |

dei_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency in which the security is quoted. Example: 'USD'

| Name: |

dei_EntityListingSecurityTradingCurrency |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

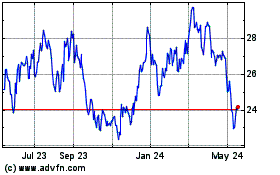

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

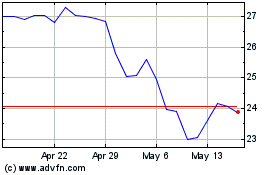

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024