As filed with the Securities

and Exchange Commission on February 14, 2024

Registration No. 333-[***]

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

Ascent

Solar Technologies, Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

36741 |

|

20-3672603 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

12300

Grant Street

Thornton,

CO 80241

(720)

872-5000

(Address, including zip code,

and telephone number, including area code, of registrant’s principal executive offices)

Jin Jo

Ascent Solar Technologies, Inc.

12300 Grant Street

Thornton, Colorado 80241

(720) 872-5000

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

| |

|

|

| James H. Carroll,

Esq. |

|

Ralph V. Martino,

Esq. |

| |

|

Marc E. Rivera, Esq. |

| Carroll Legal LLC |

|

ArentFox Schiff L.L.P. |

| 1449 Wynkoop Street, Suite

507 |

|

1717 K Street NW |

| Denver, CO 80202 |

|

Washington, DC 20006 |

| (303) 888-4859 |

|

(202) 857-6000 |

Approximate date of commencement

of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or

an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

Emerging growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information contained in this

prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy

these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus,

Subject to Completion, dated February

14, 2024

ASCENT SOLAR TECHNOLOGIES, INC.

[***] UNITS CONSISTING OF

ONE SHARE OF COMMON STOCK,

OR ONE PRE-FUNDED WARRANT TO PURCHASE ONE SHARE

OF COMMON STOCK, AND

ONE WARRANT TO PURCHASE ONE SHARE OF COMMON STOCK

We are offering on a best efforts basis up to [***]

units, each consisting of one share of our common stock, par value $0.0001 per share, and one warrant to purchase one share of common

stock (“Common Warrants”). We intend to raise gross proceeds of approximately $3.0 million in this offering. At an assumed

offering price of $[***] per unit, which is equal to the closing price of our common stock on the Nasdaq Capital Market on February

[***], 2024, we would issue [***] units to receive gross proceeds of approximately [***] million. Each Common Warrant will

have an exercise price of $[***] per share of common stock (equal to 100% of the public offering price of each unit sold in this

offering), will be exercisable immediately, and will expire five years from the date of issuance.

We are also offering to each purchaser of units that

would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock immediately following

the consummation of this offering the opportunity to purchase units consisting of one pre-funded warrant (in lieu of one share of

common stock) (“Pre-Funded Warrant”) and one Common Warrant. A holder of pre-funded warrants will not have the right to exercise

any portion of its pre-funded warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at

the election of the holder, such limit may be increased to up to 9.99%) of the number of shares of common stock outstanding immediately

after giving effect to such exercise. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of

each unit including a Pre-Funded Warrant will be equal to the price per unit including one share of common stock, minus $0.0001, and

the remaining exercise price of each Pre-Funded Warrant will equal $0.0001 per share. The Pre-Funded Warrants will be immediately exercisable

(subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

For each unit including a Pre-Funded Warrant we sell (without regard to any limitation on exercise set forth therein), the number of units

including a share of common stock we are offering will be decreased on a one-for-one basis.

The shares of our common stock and Pre-Funded Warrants,

if any, and the accompanying Common Warrants can only be purchased together in this offering but will be issued separately and will be

immediately separable upon issuance. We are also registering the shares of common stock issuable from time to time upon exercise of the

Common Warrants and Pre-Funded Warrants included in the units offered hereby.

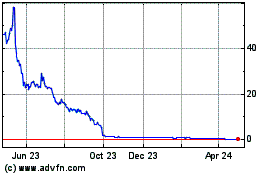

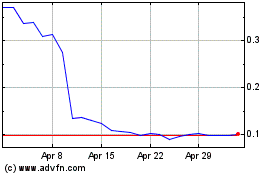

Our common stock is traded on the Nasdaq Capital

Market under the symbol “ASTI.” On February [***], 2024, the closing price for our common stock, as reported on the

Nasdaq Capital Market, was $[***] per share. The public offering price per unit will be determined at the time of pricing and

may be at a discount to the then current market price. The recent market price used throughout this prospectus may not be indicative

of the final offering price. The final public offering price will be determined through negotiation between us and investors based upon

a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results,

the previous experience of our executive officers and the general condition of the securities markets at the time of this offering.

There is no established public trading market for

the Pre-Funded Warrants or Common Warrants, and we do not expect a market to develop. Without an active trading market, the liquidity

of the Pre-Funded Warrants and Common Warrants will be limited. In addition, we do not intend to list the Pre-Funded Warrants or the

Common Warrants on the Nasdaq Capital Market, any other national securities exchange or any other trading system.

We have engaged Dawson James Securities Inc. as our

exclusive placement agent (“Dawson” or the “placement agent”) to use its reasonable best efforts to solicit offers

to purchase our securities in this offering. The placement agent is not purchasing or selling any of the securities we are offering and

is not required to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum

offering amount required as a condition to closing in this offering the actual public offering amount, placement agent’s fee, and

proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth

above and throughout this prospectus. We have agreed to pay the placement agent the placement agent fees set forth in the table below.

See “Plan of Distribution” in this prospectus for more information.

Except

as otherwise indicated, all share and per share information in this prospectus gives effect to the reverse stock split of the Company’s

outstanding common stock, which was effected at a ratio of 1-for-200 shares as of 5:00 pm Eastern Time on September 11, 2023, trading

for which began as of 9:30 am Eastern Time on September 12, 2023. However, share and per share amounts in our audited financial statements

as of and for the years ended December 31, 2022 and 2021 included

in this Prospectus have not been adjusted to give effect to the reverse stock split.

We are a “smaller reporting company”

as defined under the federal securities laws and, as such, have elected to be subject to reduced public company reporting requirements.

| |

|

Per

Unit(1) |

|

|

Total

|

|

| Public offering price |

|

$ |

|

|

|

$ |

|

|

| Placement Agent Fees (2) |

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to us |

|

$ |

|

|

|

$ |

|

|

(1) Units consist of one share of common stock, or

one Pre-Funded Warrant to purchase one share of common stock, and one Common Warrant to purchase one share of common stock.

(2) In

connection with this Offering, we have agreed to pay to Dawson as placement agent a cash fee equal to 7% of the gross proceeds received

by us in the Offering. We have also agreed to reimburse certain expenses of Dawson which are not included in the table above and to issue

Dawson a warrant to purchase 3% of the shares of common stock underlying the Units issued in this offering (including any shares underlying

the Pre-Funded Warrants, but excluding any shares purchasable under the Common Warrants). See “Plan

of Distribution” for a description of the compensation payable

to the placement agent.

We anticipate that delivery of the securities against payment will be

made on or about [***], 2024.

Investing in our securities involves a high degree

of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our securities in “Risk

Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

Dawson James Securities Inc.

The date of this prospectus is February [***],

2024

TABLE OF CONTENTS

| |

Page |

| Prospectus Summary |

1 |

| Information Regarding Forward-Looking

Statements |

3 |

| The Offering |

5 |

| Risk Factors |

7 |

| Market and Industry Data |

16 |

| Use of Proceeds |

16 |

| Market Price of and Dividends on Common

Equity and Related Stockholders Matters |

16 |

| Capitalization |

16 |

| Dilution |

18 |

| Management’s Discussion and

Analysis of Financial Condition and Results of Operations |

19 |

| Quantitative and Qualitative Disclosures

about Market Risk |

26 |

| Business |

27 |

| Property |

31 |

| Legal Proceedings |

31 |

| Directors and Executive Officers |

32 |

| Corporate Governance |

33 |

| Executive Compensation |

37 |

| Principal Stockholders |

41 |

| Certain Relationships and Related

Party Transactions |

42 |

| Description of Capital Stock |

44 |

| Description of Securities We Are Offering |

49 |

| Shares Eligible for Future Sale |

51 |

| Plan of Distribution |

52 |

| Legal Matters |

54 |

| Experts |

54 |

| Where You Can Find More Information |

54 |

| Index to Financial Statements |

F-1 |

Neither

we nor the placement agent has authorized anyone to provide any information or to make any representations other than those contained

in or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of

us or to which we have referred you. We and the placement

agent take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus is an offer to sell only the units offered hereby, but only under circumstances and in jurisdictions where it is lawful

to do so. The information contained in or incorporated by reference in this prospectus or in any applicable free writing prospectus is

current only as of its date, regardless of its time of delivery or any sale of shares of our units. Our business, financial condition,

results of operations and prospects may have changed since that date.

To the extent there is a conflict between the

information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed

with the Securities and Exchange Commission, or the SEC, before the date of this prospectus, on the other hand, you should rely on the

information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another

document incorporated by reference having a later date, the statement in the document having the late date modifies or supersedes the

earlier statement.

No action is being taken in any jurisdiction outside

the United States to permit a public offering of our units or possession or distribution of this prospectus in that jurisdiction. Persons

who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to

observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

Unless otherwise indicated, information contained

in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position,

market opportunity and market share, is based on information from our own management estimates and research, as well as from industry

and general publications and research, surveys and studies conducted by third-parties. Management estimates are derived from publicly

available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be

reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party

information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high

degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.”

These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Risk

Factors” and “Information Regarding Forward-Looking Statements.”

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

We may also provide a prospectus supplement or post-effective

amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should

read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together

with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can

Find More Information.”

iv

PROSPECTUS SUMMARY

The following summary highlights information contained

elsewhere in this prospectus and in documents incorporated by reference. This summary is not complete and may not contain all the information

you should consider before investing in our securities. You should read this entire prospectus and the documents incorporated by reference

in this prospectus carefully, especially the risks of investing in our securities discussed under the heading “Risk

Factors,” and our financial statements and related notes incorporated by reference in this prospectus before making an investment

decision. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus and the documents

incorporated by reference in this prospectus to “Ascent”, “Ascent Solar”, “the Company,” “we,”

“us” and “our” refer to Ascent Solar Technologies, Inc. This prospectus includes forward-looking statements that

involve risks and uncertainties. See “Information Regarding Forward-Looking Statements.”

This prospectus includes trademarks, service marks

and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property

of their respective owners.

Except as otherwise noted, all information in

this prospectus reflects and assumes (i) no sale of Pre-Funded Warrants in this offering, which, if sold, would reduce the number of

shares of common stock that we are offering on a one-for-one basis and (ii) no exercise of the Common Warrants issued in this offering.

Except as otherwise indicated, all share and per

share information in this prospectus gives effect to the reverse stock split of the Company’s outstanding common stock, which was

effected at a ratio of 1-for-200 shares as of 5:00 pm Eastern Time on September 11, 2023, trading for which began as of 9:30 am Eastern

Time on September 12, 2023. However, share and per share amounts in our audited financial statements as of and for the years ended December

31, 2022 and 2021 included in this Prospectus have not been adjusted to give effect to the reverse stock split.

Overview

We were incorporated in 2005 from the separation

by ITN Energy Systems, Inc. (“ITN”) of its Advanced Photovoltaic Division and all of that division’s key personnel,

core technologies, and certain trade secrets and royalty free licenses to use in connection with the manufacturing, developing marketing,

and commercializing Copper-Indium-Gallium-diSelenide (“CIGS”) photovoltaic (“PV”) products.

We are a solar technology company that manufactures

and sells PV solar modules that are flexible, durable, and possess attractive power to weight and power to area performance. Our technology

provides renewable power solutions to high-value production and specialty solar markets where traditional rigid solar panels are not

suitable, including aerospace, agrivoltaics, and niche manufacturing/construction sectors. We operate in these target markets because

they have highly specialized needs for power generation and offer attractive pricing due to the significant technological requirements.

We believe the value proposition of Ascent’s

proprietary solar technology not only aligns with the needs of customers in our target markets, but also overcomes many of the obstacles

other solar technologies face in space, aerospace and other markets. Ascent designs and develops finished products for end users in these

areas and collaborates with strategic partners to design and develop integrated solutions for products like satellites, spacecraft, airships

and fixed-wing UAVs. Ascent sees significant overlap in the needs of end users across some of these markets and believes it can achieve

economies of scale in sourcing, development, and production in commercializing products for these customers.

The integration of Ascent's

solar modules into space, near space, and aeronautic vehicles with ultra-lightweight and flexible solar modules is an important market

opportunity for the Company. Customers in this market have historically required a high level of durability, high voltage and conversion

efficiency from solar module suppliers, and we believe our products are well suited to compete in this premium market and will fill a

void in the satellite market with a lower cost, lighter module and a product that, if struck by an object in space, will create limited

space debris.

Commercialization and Manufacturing Strategy

We manufacture our products by affixing a thin CIGS

layer to a flexible, plastic substrate using a large format, roll-to-roll process that permits us to fabricate our flexible PV modules

in an integrated sequential operation. We use proprietary monolithic integration techniques which enable us to form complete PV modules

with little to no costly back-end assembly of inter-cell connections. Traditional PV manufacturers assemble PV modules by bonding or

soldering discrete PV cells together. This manufacturing step typically increases manufacturing costs and, at times, proves detrimental

to the overall yield and reliability of the finished product. By reducing or eliminating this added step, using our proprietary monolithic

integration techniques, we believe we can achieve cost savings in, and increase the reliability of, our PV modules.

Advantages of CIGS on a Flexible Plastic Substrate

Thin film PV solutions differ based on the type of

semiconductor material chosen to act as a sunlight absorbing layer, and also on the type of substrate on which the sunlight absorbing

layer is affixed. To the best of our knowledge, we believe we are the only company in the world currently focused on commercial scale

production of PV modules using CIGS on a flexible, plastic substrate with monolithic integration. We utilize CIGS as a semiconductor

material because, at the laboratory level, it has a higher demonstrated cell conversion efficiency than amorphous silicon (“a-Si”)

and cadmium telluride (“CdTe”). We also believe CIGS offers other compelling advantages over both a-Si and CdTe, including:

| |

· |

CIGS versus a-Si: Although

a-Si, like CIGS, can be deposited on a flexible substrate, its conversion efficiency, which already is generally much lower than

that of CIGS, measurably degrades when it is exposed to ultraviolet light, including natural sunlight. To mitigate such degradation,

manufacturers of a-Si solar cells are required to implement measures that add cost and complexity to their manufacturing processes. |

| |

· |

CIGS versus CdTe: Although

CdTe modules have achieved conversion efficiencies that are generally comparable to CIGS in production, we believe CdTe has never

been successfully applied to a flexible substrate on a commercial scale. We believe the use of CdTe on a rigid, transparent substrate,

such as glass, is unsuitable for a number of our applications. We also believe CIGS can achieve higher conversion efficiencies than

CdTe in production. |

We believe our choice of substrate material further

differentiates us from other thin-film PV manufacturers. We believe the use of a flexible, lightweight, insulating substrate that is

easier to install provides clear advantages for our target markets, especially where rigid substrates are unsuitable. We also believe

our use of a flexible, plastic substrate provides us significant cost advantages because it enables us to employ monolithic integration

techniques on larger components, which we believe are unavailable to manufacturers who use flexible, metal substrates. Accordingly, we

are able to significantly reduce part count, thereby reducing the need for costly back-end assembly of inter cell connections. As the

only company, to our knowledge, focused on the commercial production of PV modules using CIGS on a flexible, plastic substrate with monolithic

integration, we believe we have the opportunity to address the aerospace, agrivoltaic and other weight-sensitive markets with transformational

high-quality, value-added product applications. It is these same unique features and our overall manufacturing process that enable us

to produce extremely robust, light, and flexible products.

Competitive Strengths

We believe we possess a number of competitive strengths

that provide us with an advantage over our competitors.

| |

· |

We are a pioneer

in CIGS technology with a proprietary, flexible, lightweight, high power PV thin film product that positions us to penetrate a wide

range of attractive high value-added markets such as aerospace and agrivoltaics. In addition, we have provided renewable power solutions

for off grid, portable power, transportation, defense, and other markets. By applying CIGS to a flexible plastic substrate,

we have developed a PV module that is efficient, lightweight and flexible; with the highest power-to-weight ratio in at-scale commercially

available solar. The market for space and near-space solar power application solutions, agrivoltaics, portable power systems, and

transportation integrated applications represent a significant premium market for the Company. Relative to our thin film competitors,

we believe our advantage in thin film CIGS on plastic technology provides us with a superior product offering for these strategic

market segments. |

| |

· |

We have the ability

to manufacture PV modules for different markets and for customized applications without altering our production processes.

Our ability to produce PV modules in customized shapes and sizes, or in a variety of shapes and sizes simultaneously, without interrupting

production flow, provides us with flexibility in addressing target markets and product applications, and allows us to respond quickly

to changing market conditions. Many of our competitors are limited by their technology and/or their manufacturing processes to a

more restricted set of product opportunities. |

| |

· |

Our integrated, roll-to-roll

manufacturing process and proprietary monolithic integration techniques provide us a potential cost advantage over our competitors.

Historically, manufacturers have formed PV modules by manufacturing individual solar cells and then interconnecting them.

Our large format, roll-to-roll manufacturing process allows for integrated continuous production. In addition, our proprietary monolithic

integration techniques allow us to utilize laser patterning to create interconnects, thereby creating PV modules at the same time

we create PV cells. In so doing, we are able to reduce or eliminate an entire back end processing step, saving time as well as labor

and manufacturing costs relative to our competitors. |

| |

· |

Our lightweight,

powerful, and durable solar panels provide a performance advantage over our competitors. For applications where a premium

is placed on the weight and profile of the product, our ability to integrate our PV modules into portable packages offers the customer

a lightweight and durable solution. |

| |

· |

Our proven research

and development capabilities position us to continue the development of next generation PV modules and technologies. Our

ability to produce CIGS based PV modules on a flexible plastic substrate is the result of a concerted research and development effort

that began more than 20 years ago. We continue to pursue research and development in an effort to drive efficiency improvements in

our current PV modules and to work toward next generation technologies and additional applications. |

| |

· |

Our manufacturing

process can be differentiated into two distinct functions; a front-end module manufacturing process and a back-end packaging process.

Our ability to produce finished unpackaged rolls of CIGS material for shipment worldwide to customers for encapsulation and

integration into various products enhances our ability to work with partners internationally and domestically. |

Markets and Marketing Strategy

We target high-value specialty solar markets including

satellites, spacecraft, aerospace and agrivoltaic applications. This strategy enables us to fully leverage the unique advantages of our

technology, including flexibility, durability and attractive power to weight and power to area performance. It further enables us to

offer unique, differentiated solutions in large markets with less competition, and more attractive pricing.

We believe the value proposition of Ascent’s

proprietary solar technology not only aligns with the needs of customers in our target markets, but also overcomes many of the obstacles

other solar technologies face in space, aerospace and other markets. Ascent designs and develops finished products for end users in these

areas and collaborates with strategic partners to design and develop integrated solutions for products like satellites, spacecraft, airships

and fixed-wing UAVs. Ascent sees significant overlap in the needs of end users across some of these markets and believes it can achieve

economies of scale in sourcing, development, and production in commercializing products for these customers.

ASTI is in early discussions with several major satellite

companies, which could realize significant revenue. There is no assurance that these early discussions will ultimately lead to significant

new revenue. These opportunities would require us to make further efficiency improvements to our PV cells.

Recent

Developments

Federal Funding Opportunities

In December 2023, the Company announced that

the Company is pursuing several opportunities for federal funding through the Department of Energy (“DOE”) and the Small

Business Administration, with determination and allocation scheduled for 2024. With applications and concept papers submitted and well-received

in Q4 2023, Ascent is prepared to lead groundbreaking research primarily in agrivoltaics and in the development and manufacturing of

advanced solar cells should the proposals be selected for funding. The Company plans to do this both individually as well as in partnership

with like-minded industry players whose technologies and manufacturing processes complement Ascent’s own unique capabilities.

As encouraged by the DOE, Ascent applied

for Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator program funding on November 14, 2023, for the development of

its innovative agrivoltaic technology that would bring solar power to more remote areas around the world and optimize dual land use.

The Company has also been encouraged by the DOE to further submit for a Solar Energy Technologies Office Funding Notice: Advancing U.S.

Thin-Film Solar Photovoltaics, as part of a team, for advanced PV research and development that would enable future commercialization.

Improvements to CIGS-Based Solar Cells

The Company continues to improve its CIGS-based solar

cells. Specifically, the Company is developing a zinc oxysulfide process. Zinc oxysulfide is used as a Cd-free window layer to

improve the efficiency of CIGS-based solar cells. The newly developed process will eliminate the usage of Cadmium Sulfide making it a

more environmentally friendly process and product. These newly developed cells have been tested at Intellivation, LLC using our CIGS

rolls and achieved 10.8% efficiency.

Perovskite Manufacturing Facility

In addition to the improvements in our CIGs-based

solar cells, the Company continues to pursue Perovskite manufacturing development with partners at its Thornton facility by developing

a hybrid CIGS/Perovskite PV module. Perovskites are a novel class of materials that have been recognized for their potential to increase

PV power conversion efficiencies. As both films absorb and convert sunlight in their respective parts of the spectrum, the resulting

single hybrid module could be tailored by using a similar approach as tandem devices but with higher efficiency and simpler construction

and manufacturing process. While notable efficiency breakthroughs have been recorded in laboratories, the solar industry has been challenged

to transform them into stable, high-efficiency products at industrial scale.

H.C. Wainright Lawsuit

On August 15, 2023, H.C. Wainwright & Co., LLC

(“Wainwright”) filed an action against the Company in the New York State Supreme Court in New York County. The complaint

alleges a breach by the Company of an investment banking engagement letter entered into in October 2021. The Wainwright engagement letter

expired in April 2022 without any financing transaction having been completed. The complaint claims that Wainright is entitled, under

a “tail provision”, to an 8% fee and 7% warrant coverage on the Company’s $15 million secured convertible note financing.

The complaint seeks damages of $1.2 million, 2,169.5 common stock warrants with a per share exercise price of $605, and attorney fees.

While it is too early to predict the outcome of this

legal proceeding or whether an adverse result would have a material adverse impact on our operations or financial position, we believe

we have meritorious defenses and intend to defend this legal matter vigorously.

Risks associated with our business

Investing in our securities involves a high degree

of risk. You should carefully consider the risks described in “Risk Factors” beginning on page 8 before

making a decision to invest in our securities. If any of these risks actually occurs, our business, financial condition, results of operations

and prospects would likely be materially, adversely affected. In that event, the trading price of our common stock could decline, and

you could lose part or all of your investment.

Going Concern Opinion

Our working capital deficiency, stockholders’

deficit, and recurring losses from operations raise substantial doubt about our ability to continue as a going concern. As a result,

our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the

year ended December 31, 2022 with respect to this uncertainty. Our ability to continue as a going concern will require us to obtain additional

funding.

Smaller Reporting Company Status

We are a “smaller reporting company”

meaning that the market value of our stock held by non-affiliates is less than $700 million and our annual revenue was less than $100

million during the most recently completed fiscal year. We may continue to be a smaller reporting company if either (i) the market value

of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently

completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. As a smaller reporting company,

we may rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a

smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual

Report on Form 10-K and smaller reporting companies have reduced disclosure obligations regarding executive compensation.

We have taken advantage of these reduced reporting

requirements in this prospectus and in the documents incorporated by reference into this prospectus. Accordingly, the information contained

herein may be different from the information you receive from other public companies that are not smaller reporting companies.

Our corporate information

We were incorporated under the laws of Delaware in

October 2005. Our principal business office is located at 12300 Grant Street, Thornton, Colorado 80241, and our telephone number is (720)

872-5000. Our website address is www.AscentSolar.com. Information contained on our website or any other website does not constitute,

and should not be considered, part of this prospectus.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by

reference in this prospectus include forward-looking statements, which involve risks and uncertainties. These forward-looking statements

can be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,” “project,”

“anticipate,” “expect,” “seek,” “predict,” “continue,” “possible,”

“intend,” “may,” “might,” “will,” “could,” would” or “should”

or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters

that are not historical facts. They appear in a number of places throughout this prospectus and the documents incorporated by reference

in this prospectus, and include statements regarding our intentions, beliefs or current expectations concerning, among other things,

our product candidates, research and development, commercialization objectives, prospects, strategies, the industry in which we operate

and potential collaborations. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based

upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict

the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of

when such performance or results will be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances

discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking

statements.

Forward-looking statements speak only as of the date

of this prospectus. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except

to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other forward-looking statements.

You should read this prospectus, the documents incorporated

by reference in this prospectus, and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the

registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity,

performance and events and circumstances may be materially different from what we expect. All forward-looking statements are based upon

information available to us on the date of this prospectus.

By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition,

business and prospects may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus.

In addition, even if our results of operations, financial condition, business and prospects are consistent with the forward-looking statements

contained (or incorporated by reference) in this prospectus, those results may not be indicative of results in subsequent periods.

Forward-looking statements necessarily involve risks

and uncertainties, and our actual results could differ materially from those anticipated in the forward-looking statements due to several

factors, including those set forth below under “Risk Factors” and elsewhere in this prospectus. The

factors set forth below under “Risk Factors” and other cautionary statements made in this prospectus

should be read and understood as being applicable to all related forward-looking statements wherever they appear in this prospectus.

The forward-looking statements contained in this prospectus represent our judgment as of the date of this prospectus. We caution readers

not to place undue reliance on such statements. Except as required by law, we undertake no obligation to update publicly any forward-looking

statements for any reason, even if new information becomes available or other events occur in the future. All subsequent written and

oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary

statements contained above and throughout this prospectus.

You should read this prospectus, the documents incorporated

by reference in this prospectus, and the documents that we reference in this prospectus and have filed as exhibits to the registration

statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different

from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

THE OFFERING

| Units offered |

Up to [***] units on a best efforts basis. We

are seeking to raise gross proceeds of approximately $3.0 million in this offering. At an assumed offering price of $[***] per unit,

which is equal to the closing price of our common stock on the Nasdaq Capital Market on [***], we would sell [***] units to receive

gross proceeds of approximately $[***] million. Each Common Warrant will have an exercise price of $[***] per share of common at

an assumed public offering price of $[***] per unit. Each unit consists of one share of common stock and one Common Warrant to purchase

one share of common stock.

We are also offering to each purchaser, with

respect to the purchase of units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of

our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase one Pre-Funded

Warrant in lieu of one share of common stock. A holder of Pre-Funded Warrants will not have the right to exercise any portion of

its Pre-Funded Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election

of the holder, such limit may be increased to up to 9.99%) of the number of shares of common stock outstanding immediately after

giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock. The purchase price per

Pre-Funded Warrant will be equal to the price per share of common stock, minus $0.0001, and the exercise price of each Pre-Funded

Warrant will equal $0.0001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership

cap) and may be exercised at any time in perpetuity until all of the Pre-Funded Warrants are exercised in full. The units will

not be certificated or issued in stand-alone form. The shares of common stock, and/or Pre-Funded Warrants, and the Common Warrants

comprising the units are immediately separable upon issuance and will be issued separately in this offering. |

| |

|

| Common stock to be outstanding prior to this offering |

[***] shares |

| |

|

| Common stock to be outstanding after this offering |

[***] shares |

| |

|

| Assumed public offering price per unit |

$[***] per unit |

| |

|

Description of Common Warrants:

|

The Common Warrants will

be immediately exercisable on the date of issuance and expire on the five-year anniversary of the date of issuance at an assumed

initial exercise price per share equal to $[***] (equal to 100% of the public offering price of each unit sold in this offering),

subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications,

reorganizations or similar events affecting our common stock. The terms of the Common Warrants will be governed by a Warrant Agency

Agreement, dated as of the closing date of this offering, that we expect to be entered into between us and Computershare Investor

Services or its affiliate (the “Warrant Agent”). This prospectus also relates to the offering of the shares of common

stock issuable upon exercise of the Common Warrants. For more information regarding the Common Warrants, you should carefully read

the section titled “Description

of Securities We Are Offering” in this

prospectus. |

| |

|

| Placement Agent’s Warrants |

Upon the closing of this

offering, we have agreed to issue to the placement agent warrants exercisable for a period of five years from the commencement of

sales in this offering entitling the placement agent to purchase [***]% of the number of shares of common stock included in the units

sold in this offering (including the shares of common stock underlying the Pre-Funded Warrants, but excluding the shares of common

stock underlying the Common Warrants), at an exercise price equal to [***]% of the public offering price per Unit. The warrants will

not be exercisable for a period of six months from the date of effectiveness of the registration statement. For additional information

regarding our arrangement with the placement agent, please see “Plan

of Distribution.” |

| |

|

| |

|

| Use of Proceeds |

Assuming the maximum number of Units are sold

in this offering, we expect to receive net proceeds from this offering of approximately $[***] million, based upon an assumed offering

price of $[***] per share, the last reported sale price of our common stock on the Nasdaq Capital Market on [***], 2024, after deducting

the placement agent discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering,

together with our existing cash for general and administration expenses and other general corporate purposes. See “Use

of Proceeds.” |

| |

|

| Nasdaq Capital Market Symbol |

Common Stock “ASTI”. |

| |

|

| Risk Factors |

Investing in our securities

involves a high degree of risk. See “Risk

Factors” beginning on page 8 of this prospectus

for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| |

|

| Best Efforts Offering |

We have agreed to offer

and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy

or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit

offers to purchase the securities offered by this prospectus. See “Plan

of Distribution” on page 52 of this prospectus. |

| |

|

| Lock-up |

We, each of our officers,

directors, and certain of our stockholders of our common stock have agreed, subject to certain exceptions, not to sell, offer, agree

to sell, contract to sell, hypothecate, pledge, grant any option to purchase, make any short sale of, or otherwise dispose of or

hedge, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable

for shares of capital stock, for a period of six months after the date of this prospectus, without the prior written consent of Dawson

James Securities Inc. See “Shares

Eligible for Future Sale” and “Plan

of Distribution” for additional information. |

| |

|

The number of shares outstanding after this offering

is based on [***] shares of our common stock outstanding as of [***], 2024, and excludes:

| |

|

|

| |

· |

[***] shares of our common

stock reserved for issuance under outstanding restricted stock units (“RSUs”) granted as employment inducement award

to our CEO, |

| |

· |

5,596,232 shares of common

stock reserved for issuance upon the exercise of outstanding common stock warrants, which warrants will increase to [***] shares

following a full ratchet adjustment to such warrants upon the consummation of this offering (based upon an assumed offering price

of $[***] per share, the last reported sale price of our common stock on the Nasdaq Capital Market on [***], 2024), |

| |

· |

3,572,635 shares of common

stock reserved for issuance upon the exercise of outstanding common stock warrants, at an exercise price of $2.88 per share, |

| |

· |

715,111 shares of common

stock reserved for issuance upon the exercise of outstanding prefunded warrants, at an exercise price of $0.0001 per share, |

| |

· |

107,179 shares of common

stock reserved for issuance upon the exercise of outstanding common stock warrants, at an exercise price of $3.60 per share, |

| |

· |

7,076 shares of common

stock reserved for issuance upon the exercise of outstanding common stock warrants, at an exercise price of $1,060 per share, |

| |

· |

[***] shares reserved for

issuance upon the conversion of our outstanding senior secured convertible notes and conversions payable related to the senior secured

convertible notes, |

| |

· |

525,000 shares of common

stock reserved for issuance under our new 2023 Equity Incentive Plan, |

| |

· |

[***]

shares of common stock reserved for issuance upon the exercise of the placement agent’s warrants issued in connection with

this offering. |

RISK FACTORS

Investing in our securities involves a high degree

of risk. You should carefully consider the risks and uncertainties described below, together with the other information contained in

this prospectus, before making a decision to invest in our securities. If any of the following events occur, our business, financial

condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline,

and you could lose all or part of your investment. The risks included here are not exhaustive or exclusive. Other sections of this prospectus

may include additional factors which could adversely affect our business, results of operations and financial performance. We operate

in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for management

to predict all such risk factors, nor can it assess the impact of all such risk factors on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Risks

Relating to Our Business

Our continuing operations will require additional

capital which we may not be able to obtain on favorable terms, if at all, or without dilution to our stockholders. Since inception,

we have incurred significant losses. We expect to continue to incur net losses in the near term. For the year ended December 31, 2022,

our cash used in operations was approximately $10.5 million. At December 31, 2022, we had cash and equivalents on hand of approximately

$11.5 million. For the nine months ended September 30, 2023, our cash used in operations was approximately $7.3 million.

Although we have commenced production at our manufacturing

facility, we do not expect that sales revenue and cash flows will be sufficient to support operations and cash requirements until we

have fully implemented our new strategy of focusing on high value PV products. Product revenues did not result in a positive cash flow

for the 2022 year, and are not anticipated to result in a positive cash flow for the next twelve months.

During 2022, we entered into multiple financing agreements

to fund operations, raising approximately $16 million in net proceeds. We do not expect that sales revenue and cash flows will be sufficient

to support operations and cash requirements for the foreseeable future, and we will depend on raising additional capital to maintain

operations until we become profitable. There is no assurance that we will be able to raise additional capital on acceptable terms or

at all. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our existing

stockholders could be significantly diluted, and these newly issued securities may have rights, preferences or privileges senior to those

of existing stockholders. If we raise additional funds through debt financing, which may involve restrictive covenants, our ability to

operate our business may be restricted. If adequate funds are not available or are not available on acceptable terms, if and when needed,

our ability to fund our operations, take advantage of unanticipated opportunities, develop or enhance our products, expand capacity or

otherwise respond to competitive pressures could be significantly limited, and our business, results of operations and financial condition

could be materially and adversely affected.

We currently have limited committed sources of capital

and we have limited liquidity. Our cash and cash equivalents as of September 30, 2023 was $2.2 million. We expect our current cash and

cash equivalents will be sufficient to fund our operations into March 2024. Therefore, we will require substantial future capital in

order to continue operations.

Following the receipt of $[***] million in net proceeds

from this offering, we believe our cash resources would be sufficient to fund our current operating plans into the third quarter of 2024.

We have based these estimates, however, on assumptions that may prove to be wrong, and we could spend our available financial resources

much faster than we currently expect and need to raise additional funds sooner than we anticipate. If we are unable to raise additional

capital when needed or on acceptable terms, we would be forced to delay, reduce, or eliminate our technology development and commercialization

efforts.

Our auditors have expressed substantial doubt

about our ability to continue as a going concern. Our auditors’ report on our December 31, 2022 financial statements expresses

an opinion that our capital resources as of the date of their audit report were not sufficient to sustain operations or complete our

planned activities for the year 2023 unless we raised additional funds. Additionally, as a result of the Company’s recurring losses

from operations, and the need for additional financing to fund its operating and capital requirements, there is uncertainty regarding

the Company’s ability to maintain liquidity sufficient to operate its business effectively, which raises doubt as to the Company’s

ability to continue as a going concern. Management cannot provide any assurances that the Company will be successful in accomplishing

any of its plans. Our December 31, 2022 financial statements do not include any adjustments that might be necessary should the Company

be unable to continue as a going concern.

We have a limited history of operations, have

not generated significant revenue from operations and have had limited production of our products. We have a limited operating history

and have generated limited revenue from operations. Currently we are producing products in quantities necessary to meet current demand.

Under our current business plan, we expect losses to continue until annual revenues and gross margins reach a high enough level to cover

operating expenses. Our ability to achieve our business, commercialization and expansion objectives will depend on a number of factors,

including whether:

| |

· |

We can generate customer

acceptance of and demand for our products; |

| |

· |

We successfully ramp up

commercial production on the equipment installed; |

| |

· |

Our products are successfully

and timely certified for use in our target markets; |

| |

· |

We successfully operate

production tools to achieve the efficiencies, throughput and yield necessary to reach our cost targets; |

| |

· |

The products we design

are saleable at a price sufficient to generate profits; |

| |

· |

We raise sufficient capital

to enable us to reach a level of sales sufficient to achieve profitability on terms favorable to us; |

| |

· |

We are able to successfully

design, manufacture, market, distribute and sell our products; |

| |

· |

We effectively manage the

planned ramp up of our operations; |

| |

· |

We successfully develop

and maintain strategic relationships with key partners, including OEMs, system integrators and distributors, who deal directly with

end users in our target markets; |

| |

· |

Our ability to maintain

the listing of our common stock on the Nasdaq Capital Market; |

| |

· |

Our ability to achieve

projected operational performance and cost metrics; |

| |

· |

Our ability to enter into

commercially viable licensing, joint venture, or other commercial arrangements; and |

| |

· |

The availability of raw

materials. |

Each of these factors is critical to our success

and accomplishing each of these tasks may take longer or cost more than expected or may never be accomplished. It also is likely that

problems we cannot now anticipate will arise. If we cannot overcome these problems, our business, results of operations and financial

condition could be materially and adversely affected.

We have to date incurred net losses and may be

unable to generate sufficient sales in the future to become profitable. We incurred a net loss of approximately $19.75 million for

the year ended December 31, 2022 and reported an accumulated deficit of approximately $447.5 million as of December 31, 2022. We expect

to incur net losses in the near term. Our ability to achieve profitability depends on a number of factors, including market acceptance

of our specialty PV products at competitive prices. If we are unable to raise additional capital and generate sufficient revenue to achieve

profitability and positive cash flows, we may be unable to satisfy our commitments and may have to discontinue operations.

Our business is based on a new technology, and

if our PV modules or processes fail to achieve the performance and cost metrics that we expect, then we may be unable to develop demand

for our PV modules and generate sufficient revenue to support our operations. Our CIGS on flexible plastic substrate technology is

a relatively new technology. Our business plan and strategies assume that we will be able to achieve certain milestones and metrics in

terms of throughput, uniformity of cell efficiencies, yield, encapsulation, packaging, cost and other production parameters. We cannot

assure you that our technology will prove to be commercially viable in accordance with our plan and strategies. Further, we or our strategic

partners and licensees may experience operational problems with such technology after its commercial introduction that could delay or

defeat the ability of such technology to generate revenue or operating profits. If we are unable to achieve our targets on time and within

our planned budget, then we may not be able to develop adequate demand for our PV modules, and our business, results of operations and

financial condition could be materially and adversely affected.

Our failure to further refine our technology and

develop and introduce improved PV products could render our PV modules uncompetitive or obsolete and reduce our net sales and market

share. Our success requires us to invest significant financial resources in research and development to keep pace with technological

advances in the solar energy industry. However, research and development activities are inherently uncertain, and we could encounter

practical difficulties in commercializing our research results. Our expenditures on research and development may not be sufficient to

produce the desired technological advances, or they may not produce corresponding benefits. Our PV modules may be rendered obsolete by

the technological advances of our competitors, which could harm our results of operations and adversely impact our net sales and market

share.

Failure to expand our manufacturing capability

successfully at our facilities would adversely impact our ability to sell our products into our target markets and would materially and

adversely affect our business, results of operations and financial condition. Our growth plan calls for production and operations

at our facility. Successful operations will require substantial engineering and manufacturing resources and are subject to significant

risks, including risks of cost overruns, delays and other risks, such as geopolitical unrest that may cause us not to be able to successfully

operate in other countries. Furthermore, we may never be able to operate our production processes in high volume or at the volumes projected,

make planned process and equipment improvements, attain projected manufacturing yields or desired annual capacity, obtain timely delivery

of components, or hire and train the additional employees and management needed to scale our operations. Failure to meet these objectives

on time and within our planned budget could materially and adversely affect our business, results of operations and financial condition.

We may be unable to manage the expansion of our

operations and strategic alliances effectively. We will need to significantly expand our operations and form beneficial strategic

alliances in order to reduce manufacturing costs through economies of scale and partnerships, secure contracts of commercially material

amounts with reputable customers and capture a meaningful share of our target markets. To date, we have not successfully formed such

strategic alliances and can give no assurances that we will be able to do so. To manage the expansion of our operations and alliances,

we will be required to improve our operational and financial systems, oversight, procedures and controls and expand, train and manage

our growing employee base. Our management team will also be required to maintain and cultivate our relationships with partners, customers,

suppliers and other third parties and attract new partners, customers and suppliers. In addition, our current and planned operations,

personnel, facility size and configuration, systems and internal procedures and controls, even when augmented through strategic alliances,

might be inadequate or insufficient to support our future growth. If we cannot manage our growth effectively, we may be unable to take

advantage of market opportunities, execute our business strategies or respond to competitive pressures, resulting in a material and adverse

effect to our business, results of operations and financial condition.

We depend on a limited number of third-party suppliers

for key raw materials, and their failure to perform could cause manufacturing delays and impair our ability to deliver PV modules to

customers in the required quality and quantity and at a price that is profitable to us. Our failure to obtain raw materials and components

that meet our quality, quantity and cost requirements in a timely manner could interrupt or impair our ability to manufacture our products

or increase our manufacturing cost. Most of our key raw materials are either sole sourced or sourced by a limited number of third-party

suppliers. As a result, the failure of any of our suppliers to perform could disrupt our supply chain and impair our operations. Many

of our suppliers are small companies that may be unable to supply our increasing demand for raw materials as we implement our planned

expansion. We may be unable to identify new suppliers in a timely manner or on commercially reasonable terms. Raw materials from new

suppliers may also be less suited for our technology and yield PV modules with lower conversion efficiencies, higher failure rates and

higher rates of degradation than PV modules manufactured with the raw materials from our current suppliers.

Our products may never gain sufficient market

acceptance, in which case we would be unable to sell our products or achieve profitability. Demand for our products may never develop

sufficiently, and our products may never gain market acceptance, if we fail to produce products that compare favorably against competing

products on the basis of cost, quality, weight, efficiency and performance. Demand for our products also will depend on our ability to

develop and maintain successful relationships with key partners, including distributors, retailers, OEMs, system integrators and value-added

resellers. If our products fail to gain market acceptance as quickly as we envision or at all, our business, results of operations and

financial condition could be materially and adversely affected.

We are targeting emerging markets for a significant

portion of our planned product sales. These markets are new and may not develop as rapidly as we expect or may not develop at all.

Our target markets include agrivoltaics, space and near space markets. Although certain areas of these markets have started to develop,

some of them are in their infancy. We believe these markets have significant long-term potential; however, some or all of these markets

may not develop and emerge as we expect. If the markets do develop as expected, there may be other products that could provide a superior

product or a comparable product at lower prices than our products. If these markets do not develop as we expect, or if competitors are

better able to capitalize on these markets our revenues and product margins may be negatively affected.

Failure to consummate strategic relationships

with key partners in our various target market segments, such as space and near space and agrivoltaics, and the respective implementations

of the right strategic partnerships to enter these various specified markets, could adversely affect our projected sales, growth and

revenues. We intend to sell thin-film PV modules for use in agrivoltaics, space and near space solar panel applications. Our marketing

and distribution strategy is to form strategic relationships with distributors, value added resellers and e-commerce to provide a foothold

in these target markets. If we are unable to successfully establish working relationships with such market participants or if, due to

cost, technical or other factors, our products prove unsuitable for use in such applications; our projected revenues and operating results

could be adversely affected.

If sufficient demand for our products does not

develop or takes longer to develop than we anticipate, we may be unable to grow our business, generate sufficient revenue to attain profitability

or continue operations. The solar energy industry is currently dominated by the rigid crystalline silicon based technology. The extent

to which our flexible thin film PV modules will be widely adopted is uncertain. Many factors, of which several are outside of our control,

may affect the viability of widespread adoption and demand for our flexible PV modules.

We face intense competition from other manufacturers

of thin-film PV modules and other companies in the solar energy industry. The solar energy and renewable energy industries are both

highly competitive and continually evolving as participants strive to distinguish themselves within their markets and compete with the

larger electric power industry. We believe our main sources of competition are other thin film PV manufacturers and companies developing

other solar solutions, such as solar thermal and concentrated PV technologies.

Many of our existing and potential competitors have

substantially greater financial, technical, manufacturing and other resources than we do. A competitor’s greater size provides

them with a competitive advantage because they often can realize economies of scale and purchase certain raw materials at lower prices.

Many of our competitors also have greater brand name recognition, established distribution networks and large customer bases. In addition,

many of our competitors have well-established relationships with our current and potential partners and distributors and have extensive

knowledge of our target markets. As a result of their greater size, these competitors may be able to devote more resources to the research,

development, promotion and sale of their products or respond more quickly to evolving industry standards and changes in market conditions

than we can. Our failure to adapt to changing market conditions and to compete successfully with existing or future competitors could

materially and adversely affect our business, results of operations and financial condition.

Problems with product quality or performance may

cause us to incur warranty expenses, damage our market reputation and prevent us from maintaining or increasing our market share. If

our products fail to perform as expected while under warranty, or if we are unable to support the warranties, sales of our products may

be adversely affected or our costs may increase, and our business, results of operations and financial condition could be materially

and adversely affected.

We may also be subject to warranty or product liability

claims against us that are not covered by insurance or are in excess of our available insurance limits. In addition, quality issues can

have various other ramifications, including delays in the recognition of revenue, loss of revenue, loss of future sales opportunities,

increased costs associated with repairing or replacing products, and a negative impact on our goodwill and reputation. The possibility

of future product failures could cause us to incur substantial expenses to repair or replace defective products. Furthermore, widespread

product failures may damage our market reputation and reduce our market share causing sales to decline.

Currency translation risk may negatively affect

our net sales, cost of equipment, cost of sales, gross margin or profitability and could result in exchange losses. Although our

reporting currency is the U.S. dollar, we may conduct business and incur costs in the local currencies of other countries in which we

operate, make sales or buy equipment or materials. As a result, we are subject to currency translation risk. Our future contracts and

obligations may be exposed to fluctuations in currency exchange rates, and, as a result, our capital expenditures or other costs may

exceed what we have budgeted. Further, changes in exchange rates between foreign currencies and the U.S. dollar could affect our net

sales and cost of sales and could result in exchange losses. We cannot accurately predict future exchange rates or the overall impact

of future exchange rate fluctuations on our business, results of operations and financial condition.

A significant increase in the price of our raw

materials could lead to higher overall costs of production, which would negatively affect our planned product margins, or make our products

uncompetitive in the PV market. Our raw materials include high temperature plastics and various metals. Significant increases in

the costs of these raw materials may impact our ability to compete in our target markets at a price sufficient to produce a profit.

Our

intellectual property rights or our means of enforcing those rights may be inadequate to protect our business, which may result in the

unauthorized use

of our products or reduced sales or otherwise reduce our ability to compete. Our business and competitive position depends upon our

ability to protect our intellectual property rights and proprietary technology, including any PV modules that we develop. We attempt

to protect our intellectual property rights, primarily in the United States, through a combination of patent, trade secret and other

intellectual property laws, as well as licensing agreements and third-party nondisclosure and assignment agreements. Because of the differences

in foreign patent and other laws concerning intellectual property rights, our intellectual property rights may not receive the same degree

of protection in foreign countries as they would in the United States. Our failure to obtain or maintain adequate protection of our intellectual

property rights, for any reason, could have a materially adverse effect on our business, results of operations and financial condition.

Further, any patents issued in connection with our efforts to develop new technology for PV modules may not be broad enough to protect

all of the potential uses of our technology.

We also rely on unpatented proprietary technology.

It is possible others will independently develop the same or similar technology or otherwise obtain access to our unpatented technology.

To protect our trade secrets and other proprietary information, we require our employees, consultants and advisors to execute proprietary

information and invention assignment agreements when they begin working for us. We cannot assure these agreements will provide meaningful

protection of our trade secrets, unauthorized use, misappropriation or disclosure of trade secrets, know how or other proprietary information.

Despite our efforts to protect this information, unauthorized parties may attempt to obtain and use information that we regard as proprietary.

If we are unable to maintain the proprietary nature of our technologies, we could be materially adversely affected.

In addition, when others control the prosecution,

maintenance and enforcement of certain important intellectual property, such as technology licensed to us, the protection and enforcement

of the intellectual property rights may be outside of our control. If the entity that controls intellectual property rights that are