Current Report Filing (8-k)

January 19 2021 - 11:16AM

Edgar (US Regulatory)

0001362468falseLas VegasNV00013624682021-01-152021-01-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 15, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allegiant Travel Company

|

|

|

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada

|

|

001-33166

|

|

20-4745737

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1201 North Town Center Drive

|

|

|

|

|

|

|

Las Vegas, NV

|

|

89144

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

Registrant’s telephone number, including area code: (702) 851-7300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common stock, par value $.001

|

|

ALGT

|

|

NASDAQ Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

ITEM 1.01.

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

On January 15, 2021, Allegiant Travel Company (the “Company”) through its airline operating subsidiary Allegiant Air, LLC entered into a Payroll Support Program Extension Agreement (the “PSP2”) with the U.S. Department of the Treasury (the “Treasury”) for the first installment of an award Allegiant Air is to receive under Subtitle A of Title IV of Division N of the Consolidated Appropriations Act, 2021. The total amount expected to be allocated to Allegiant Air under the Payroll Support Extension Program is approximately $91.8 million. Under the PSP2, Allegiant Air has received a grant of $45.9 million and the proceeds must be used exclusively for wages, salaries and benefits.

If additional funds are allocated by the Treasury under the PSP2 such that the amount received by the Company exceeds $100.0 million, then Allegiant Air will issue a note for 30% of the funds received under the PSP2 in excess of $100.0 million and the Company will issue to Treasury warrants to purchase a number of shares of common stock of the Company (based on 10% of the amount of Note issued) at a price of $179.23 per share (based on the closing price of the Company’s common stock on The Nasdaq Global Select Market on December 24, 2020).

In connection with the PSP2, the Company will be required to comply with the relevant provisions of the Coronavirus Aid, Relief, and Economic Security Act (the ”CARES Act”) for a longer period of time, including those prohibiting the repurchase of common stock and the payment of common stock dividends until March 31, 2022, as well as those restricting the payment of certain executive compensation for periods through October 1, 2022.

Forward-Looking Statements: Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in this Report that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements may include, among others, future funding of the PSP2 and the effect of restrictions and obligations thereunder. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," "anticipate," "intend," "plan," "estimate," “project”, “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports and registration statements filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, the severity and duration of business disruption caused by the Covid-19 pandemic among other disclosed risks which may impact our operations.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Allegiant Travel Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 19, 2021

|

ALLEGIANT TRAVEL COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gregory C. Anderson

|

|

|

|

Name:

|

Gregory C. Anderson

|

|

|

|

Title:

|

Chief Financial Officer

|

|

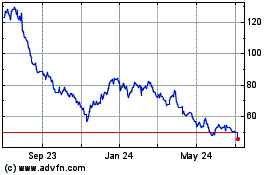

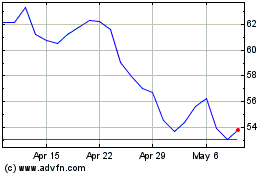

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Apr 2023 to Apr 2024