Turkish Lira Climbs Against U.S. Dollar Despite Rate Cut

August 23 2016 - 4:10AM

RTTF2

The Turkish Lira erased early losses against the U.S. dollar and

climbed back in European trading on Tuesday, even as the Turkish

central bank slashed its key lending rate by a quarter point to

8.50 percent.

The Monetary Policy Committee of the Turkish central bank

lowered the Marginal Funding Rate by 25 basis points to 8.50

percent. This was the sixth consecutive reduction in rate.

The bank had reduced the funding rate by 25 basis points in

March, 50 basis points in April, May and June, and another quarter

point in July.

The overnight borrowing rate was left unchanged at 7.25 percent

and the one-week repo rate at 7.50 percent. The outcome of the

meeting came in line with expectations.

The Lira climbed to 2.9296 per greenback, off its early low of

2.9436. If the Lira extends rise, it may find resistance around the

2.88 mark.

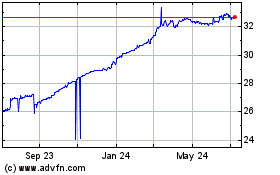

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Apr 2023 to Apr 2024