Euro Slides On ECB Policymakers' Rate Cut Comment

March 28 2024 - 10:56PM

RTTF2

The euro weakened against other major currencies in the Asian

session on Friday, as traders bet on the European Central Bank's

interest rate cut in the month of June in the wake of dovish

comments from the ECB policymaker Francois Villeroy de Galhau.

While speaking at Paris Dauphine University on Thursday, the ECB

policymaker and the Bank of France Governor Francois Villeroy de

Galhau said that the ECB's first rate cut will likely be a moderate

one and that it is of no "existential" importance if it occurs

either in April or in June.

Villeroy said, "Since monetary policy takes effect with a lag,

we run the risk of falling behind the curve if we wait too

long."

He added that if the ECB achieves an inflation target of 2

percent for a sustained period, then the central bank is at caution

about escalating downside risks if the ECB hesitates to implement

rate cuts.

Moreover, the ECB executive board member Fabio Panetta said on

Thursday, "The conditions to start easing monetary policy are

materializing."

"Restrictive policy is dampening demand and contributing to a

rapid fall in inflation," she added.

The European currency started falling against the U.S. dollar

and the pound from March 26th. Against the yen and the Swiss franc,

the euro started dropping from March 27th.

In the Asian trading now, the euro fell to an 8-day low of

0.8535 against the pound, a 4-day low of 0.9720 against the Swiss

franc and nearly a 2-week low of 162.94 against the yen from early

highs of 0.8550, 0.9736 and 163.55, respectively. If the euro

extends its downtrend, it may find support around 0.84 against the

pound, 0.96 against the franc, and 160.00 against the yen.

Against the U.S., the Australia and the Canadian dollars, the

euro slid to nearly a 6-week low of 1.0774, a 1-week low of 1.6529

and a 5-week low of 1.4585 from early highs of 1.0792, 1.6563 and

1.4611 respectively. The euro may test support near 1.06 against

the greenback, 1.63 against the aussie, and 1.44 against the

loonie.

Moving away from an early high of 1.8066 against the NZ dollar,

the euro edged down to 1.8031. On the downside, 1.77 is seen as the

next support level for the euro.

Looking ahead, U.S. PCE price index, personal income and

spending data and wholesale inventories, all for February, are

slated for release in the New York session.

At 11:20 am ET, Federal Reserve Chair Jerome Powell and Federal

Reserve Bank of San Francisco President Mary Daly will participate

in the Federal Reserve Bank of San Francisco Macroeconomics and

Monetary Policy Conference, in San Francisco, U.S.

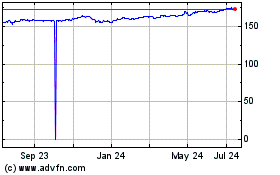

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

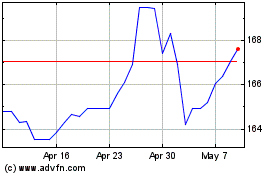

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024