Commodity Currencies Slide Amid Risk Aversion

April 15 2024 - 11:30PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Tuesday amid risk aversion, as bond yields spiked

after a report showed a much stronger than expected U.S. retail

sales growth in March. The data led to renewed concerns the U.S.

Fed will hold off on lowering interest rates in June. Traders also

remained concerned about geopolitical tensions in the middle

east.

Following the latest data, CME Group's FedWatch Tool is

currently indicating just a 21.6 percent chance of a quarter point

rate cut in June.

Also, losses across most sectors led by gold miners and

technology stocks led to the downturn of investor sentiment.

Crude oil prices fell amid slightly easing concerns about supply

disruptions after Iran's drone and missile attack on Israel did not

cause any big damage. Concerns about the outlook for oil demand in

China and a strong U.S. dollar also weighed on oil prices. West

Texas Intermediate Crude futures for May ended lower by $0.25 at

$85.41 a barrel.

In economic news, data from the National Bureau of Statistics

showed that China's gross domestic product gained 5.3 percent on

year in the first quarter of 2024, exceeding expectations for an

increase of 4.8 percent and up from 5.2 percent in the previous

three months.

On a seasonally adjusted quarterly basis, GDP was up 1.6 percent

- accelerating from 1.0 percent in the three months prior.

The bureau also said that industrial production rose 4.5 percent

on year in March, shy of forecasts for a gain of 5.4 percent and

down from 7.0 percent in February.

Retail sales were up 3.1 percent in March, missing expectations

for 5.1 percent and down from 5.5 percent in the previous

month.

House prices slipped 2.2 percent on year in March after sinking

1.4 percent in February.

The jobless rate came in at 5.2 percent, in line with

expectations and down from 5.3 percent in the previous month.

In the Asian trading now, the Australian dollar fell to a

5-month low of 0.6408 against the U.S. dollar, from yesterday's

closing value of 0.6441. The aussie may test support around the

0.62 region.

Against the euro and the Canadian dollar, the aussie slid to

near 2-week lows of 1.6557 and 0.8847 from Monday's closing quotes

of 1.6484 and 0.8880, respectively. If the aussie extends its

downtrend, it is likely to find support around 1.67 against the

euro and 0.86 against the loonie.

Against the yen and the NZ dollar, the aussie edged down to

98.92 and 1.0892 from yesterday's closing quotes of 99.36 and

1.0908, respectively. The next support level for the aussie are

seen around 97.00 against the yen and 1.07 against the kiwi.

The NZ dollar fell to a 5-month low of 0.5874 against the U.S.

dollar and nearly a 2-week low of 90.65 against the yen, from

Monday's closing quotes of 0.5903 and 91.08, respectively. If the

kiwi extends its downtrend, it is likely to find support around

0.57 against the greenback and 89.00 against the yen.

Against the euro, the kiwi slid to an 8-day low of 1.8063 from

yesterday's closing value of 1.7988. On the downside, 1.81 is seen

as the next support level for the kiwi.

The Canadian dollar fell to a 5-month low of 1.3814 against the

U.S. dollar, from Monday's closing value of 1.3786. The loonie may

test support near the 1.39 region.

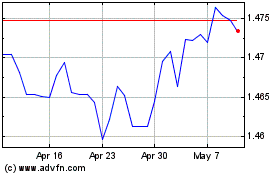

Against the yen and the euro, the loonie edged down to 111.72

and 1.4656 from yesterday's closing quotes of 111.86 and 1.4643,

respectively. If the loonie extends its downtrend, it is likely to

find support around 110.00 against the yen and 1.48 against the

euro.

Meanwhile, the safe-haven currency or the U.S. dollar

strengthened against its major rivals amid risk aversion.

The U.S. dollar strengthened against other major currencies in

the Asian session on Tuesday.

The U.S. dollar rose to a 5-1/2-month high of 1.0605 against the

euro and a 5-month high of 1.2416 against the pound, from

yesterday's closing quotes of 1.0622 and 1.2444, respectively. If

the greenback extends its uptrend, it is likely to find resistance

around 1.05 against the euro and 1.23 against the pound.

Against the Swiss franc and the yen, the greenback edged up to

0.9138 and 154.43 from Monday's closing quotes of 0.9114 and

154.27, respectively. The greenback may test resistance near 0.92

against the franc and 155.00 against the yen.

Looking ahead, Germany's ZEW economic confidence survey results

for April and Eurozone foreign trade data for February are due to

be released at 5:00 am ET in the European session.

In the New York session, U.S. building permits and housing

starts for March, Canada CPI for March and U.S. industrial

production for March are slated for release.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024