Canadian Dollar Weakens Against Majors

April 09 2024 - 9:13AM

RTTF2

The Canadian dollar dropped against its major counterparts in

the New York session on Tuesday, as investors looked ahead to

crucial U.S. inflation data, the minutes of the Fed's March policy

meeting and the ECB rate decision for directional cues.

The U.S. Labour Department is scheduled to release its reports

on consumer and producer inflation for March on Wednesday and

Thursday, respectively.

Doubts crept in about a possible Fed rate cut this year after

Lorie Logan, president of the Federal Reserve Bank of Dallas,

warned that it's premature to consider lowering interest rates.

Fed Governor Michelle Bowman also echoed concerns about

potential upside risks to inflation, while Chicago Fed President

Austan Goolsbee said the U.S. central bank must weigh how long it

can maintain the policy restrictive without damaging the

economy.

Minneapolis counterpart Neel Kashkari said the Fed cannot 'stop

short' on the inflation fight as oil prices creep higher.

However, former Federal Reserve Bank of St. Louis President

James Bullard said in an interview with Bloomberg TV that he's

expecting three interest-rate cuts this year and that's the base

case.

According to CME Group data, the prospect of a first 25 basis

point cut in June currently stands at 49 percent, down from 57

percent a week ago.

The loonie weakened to 1.3598 against the greenback and 111.47

against the yen, from an early 4-day high of 1.3547 and a 5-day

high of 111.98, respectively. The currency may locate support

around 1.38 against the greenback and 108.00 against the yen.

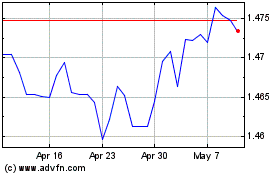

The loonie fell to more than a 3-month low of 0.9007 against the

aussie and near a 3-week low of 1.4764 against the euro, off its

early highs of 0.8960 and 1.4727, respectively. The currency is

seen finding support around 0.92 against the aussie and 1.49

against the euro.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024