Antipodean Currencies, Euro Strengthens Amid Risk Appetite

April 03 2024 - 11:10PM

RTTF2

The antipodean currencies such as the Australia and the New

Zealand dollars, and the euro strengthened against their major

counterparts in the Asian session on Thursday, as Asian stock

markets traded higher, as traders reacted to the latest remarks

from U.S. Fed officials that helped ease recent concerns about the

outlook for interest rates. Fed Chair Jerome Powell reiterated

during remarks at Stanford University that the central bank is not

in a hurry to begin lowering interest rates, but reaffirmed his

view that they will likely cut interest rates this year.

Gains in gold miners, technology and financial stocks, also

improved the investor sentiment.

Crude oil prices climbed higher after OPEC ended its meeting

without making any changes to its production policy. West Texas

Intermediate Crude oil futures for May ended higher by $0.28 or

0.33 percent at $85.43 a barrel.

In economic news, the services sector in Australia continued to

expand in March, and at a faster pace, the latest survey from Judo

Bank revealed on Thursday with a services PMI score of 54.4. That's

up from 53.1 in February, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

Meanwhile, the total number of building approvals issued in

Australia was down a seasonally adjusted 1.9 percent on month in

February, the Australian Bureau of Statistics said on Thursday -

coming in at 12,520. That missed expectations for an increase of

3.0 percent following the 1.0 percent drop in January. On a yearly

basis, overall approvals fell 5.8 percent. The value of total

building approved fell 16.5 percent, following a 14.5 percent

January increase.

Data from Statistics New Zealand showed that the total number of

building permits issued in New Zealand was up a seasonally adjusted

14,9 percent on month in February, coming in at 2,795. That follows

the 8.6 percent decline in January.

In the Asian trading today, the Australian dollar rose to nearly

a 4-week high of 1.6462 against the euro and a 9-day high of 0.8902

against the Canadian dollar, from yesterday's closing quotes of

1.6505 and 0.8877, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 1.63 against the euro and

0.90 against the loonie.

Against the U.S. dollar and the yen, the aussie advanced to

2-week highs of 0.6588 and 99.92 from yesterday's closing quotes of

0.6563 and 99.55, respectively. The aussie may test resistance near

0.66 against the greenback and 100.00 against the yen.

The aussie edged up to 1.0928 against the NZ dollar, from

Wednesday's closing value of 1.0918. On the upside, 1.10 is seen as

the next resistance level for the aussie.

The NZ dollar rose to nearly a 2-week high of 1.7965 against the

euro, from yesterday's closing value of 1.8025. The kiwi is likely

to find its next support level around the 1.76 region.

Against the U.S. dollar and the yen, the kiwi advanced to near

2-week highs of 0.6038 and 91.55 from Wednesday's closing quotes of

0.6007 and 91.11, respectively. If the kiwi extends its uptrend, it

is likely to find resistance around 0.61 against the greenback and

93.00 against the yen.

The euro rose to a 9-day high of 1.0848 against the U.S. dollar

and an 8-day high of 164.53 against the yen, from yesterday's

closing quotes of 1.0835 and 164.35, respectively. If the euro

extends its uptrend, it is likely to find resistance around 1.10

against the greenback and 166.00 against the yen.

Against the pound and the Swiss franc, the euro edged up to

0.8572 and 0.9801 from Wednesday's closing quotes of 0.8562 and

0.9783, respectively. The euro may test resistance near 0.86

against the pound and 0.99 against the franc.

Looking ahead, PMI reports from various European economies and

U.K. for March, Eurozone PPI for February, are due to be released

in the European session.

At 7:30 am ET, the ECB is set to publish the account of the

monetary policy meeting of the Governing Council held on March 6

and 7.

In the New York session, U.S. weekly jobless data and U.S. and

Canada trade data for February are slated for release.

At 12:15 pm ET, Federal Reserve Bank of Richmond President

Thomas Barkin will give a new speech on the economic outlook before

the Home Building Association of Richmond, in Richmond, U.S.

Half-an-hour later, Federal Reserve Bank of Chicago President

Austan Goolsbee will participate in a moderated question-and-answer

session before the Multi-Chamber Economic Outlook Luncheon and Expo

, in Oak Brook, U.S.

At 2:00 pm ET, Federal Reserve Bank of Cleveland President

Loretta Mester will participate in a conversation on the economic

outlook before virtual Global Interdependence Center Executive

Briefing, in Cleveland, U.S.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

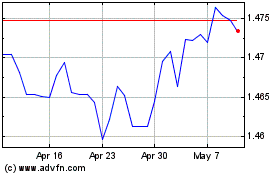

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024